New Cook County soda tax upheld in court

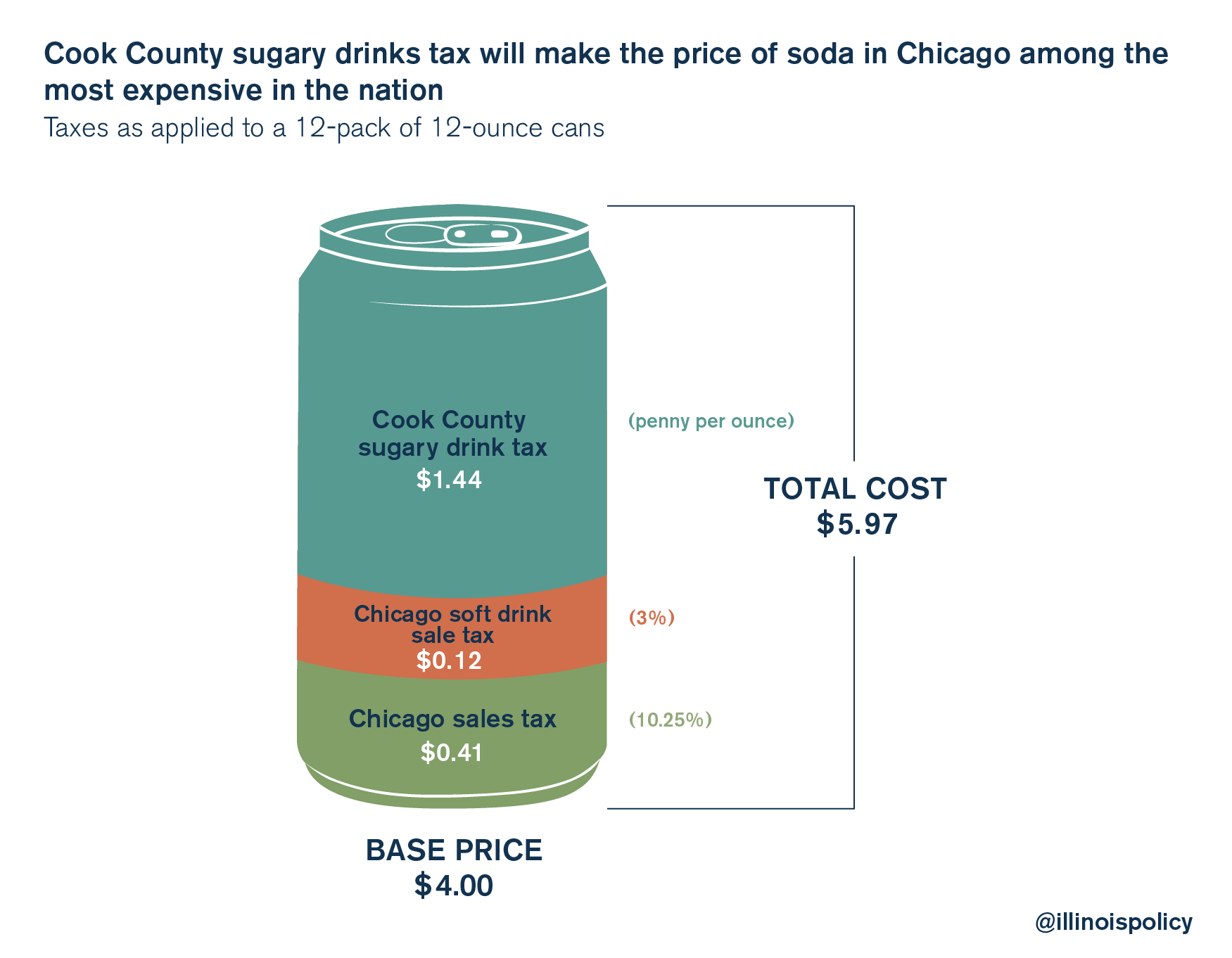

The tax makes soda sold in Chicago among the most expensive in the country.

Costs for Cook County soda drinkers are officially going up.

On July 28, Cook County Circuit Judge Daniel Kubasiak ruled against a lawsuit filed against the Cook County Department of Revenue for implementing a penny-per-ounce tax on sweetened beverages, according to The Associated Press.

The ruling adds yet another layer of taxes to Cook County residents. Chicago soda costs are now among the highest in the nation, thanks to the new tax along with Chicago’s tax on non-alcoholic beverages, and Chicago’s combined sales tax rate of 10.25 percent.

“The tax should be collected at the consumer level beginning on Aug 2,” Cook County Board President Toni Preckwinkle said in a statement.

The penny-per-ounce sweetened beverage tax was approved by the Cook County Board in November 2016 and set to be effective July 1, 2017, but the Illinois Retail Merchants Association, or IRMA filed a last-minute lawsuit against Cook County on June 27, claiming the tax was unconstitutional and too vague to be implemented. Judge Kubasiak issued a temporary restraining order to allow time for a permanent ruling to be given.

Retailers argued the tax was unconstitutional because it taxes the same items differently. Drinks made to order do not fall under the tax. The IRMA lawsuit noted that bottled Starbucks Frappuccinos sold at a grocery store will be taxed, but Frappuccinos made at a Starbucks coffee shop will not be taxed.

Additionally, retailers feared litigation problems arising from tax collection difficulties. Sweetened beverages bought with food stamps will not be taxed, but retailers feared their cash register systems may not let them make this distinction, meaning they might accidentally overtax consumers.

Under-taxation might also occur for retailers who sell fountain drinks in “non-pre-determined size containers,” especially if customers may receive refills. The necessary information for accurate taxation here, the retailers said, would be unavailable.

Even simple soft drink staples like ice are left unaddressed in the ordinance.

Cook County expected to receive $67.5 million in soda tax revenue for the remainder of 2017 and another $200 million in 2018. The county has claimed 1,100 government workers would be laid off and 600 vacant positions would be terminated if the tax were not implemented.