New census data tell the tale of Quad Cities

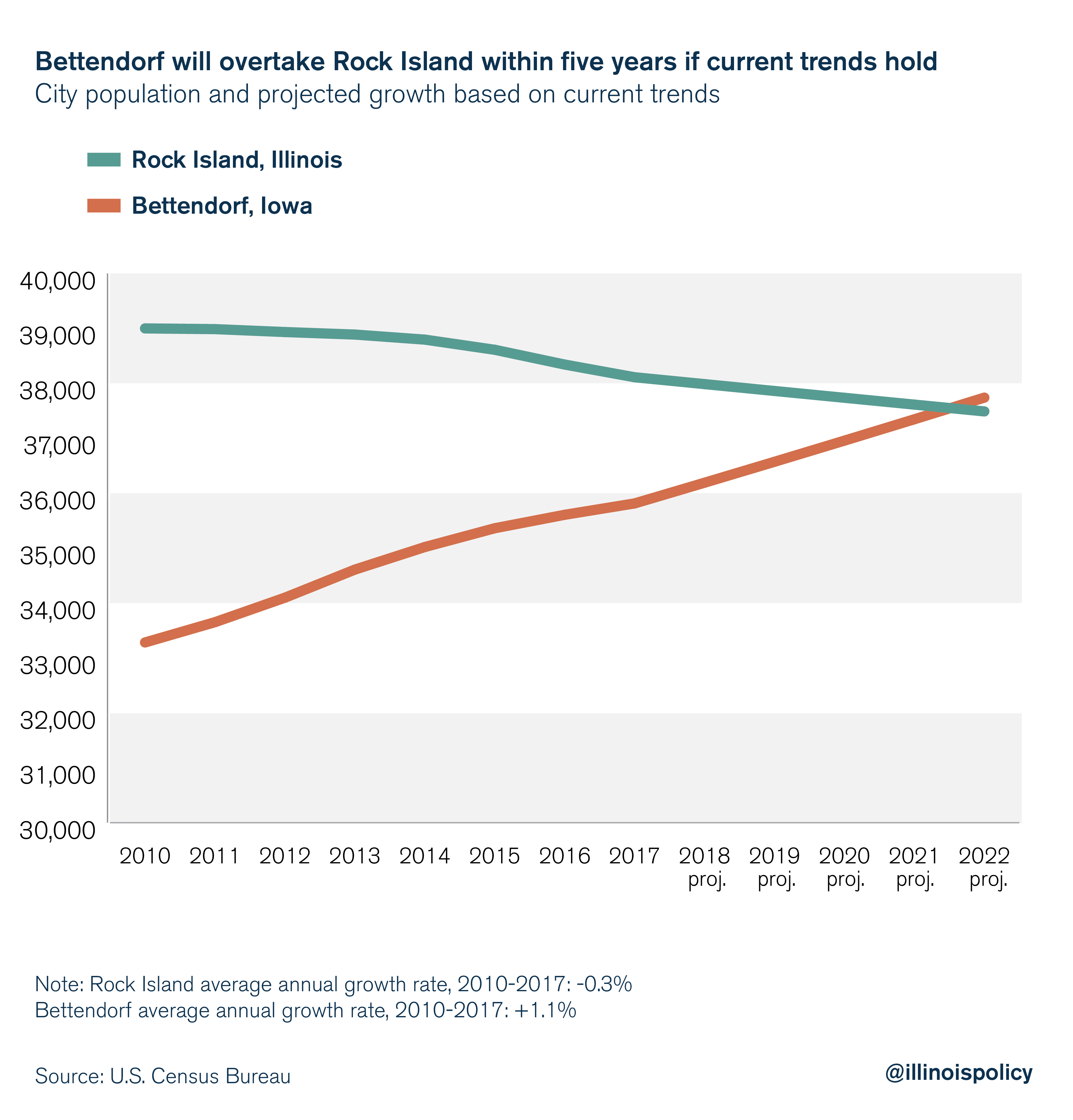

If current population trends hold, Rock Island, Illinois, will take a back seat to Bettendorf, Iowa, within five years.

Border battles for new families and investment continue to play out across Illinois, but new data released by the U.S. Census Bureau May 24 shed light on one particularly concerning front: the Quad Cities.

While the Land of Lincoln continues to lose people on its side of the Mississippi River in the region, the Iowa side of the border has been growing.

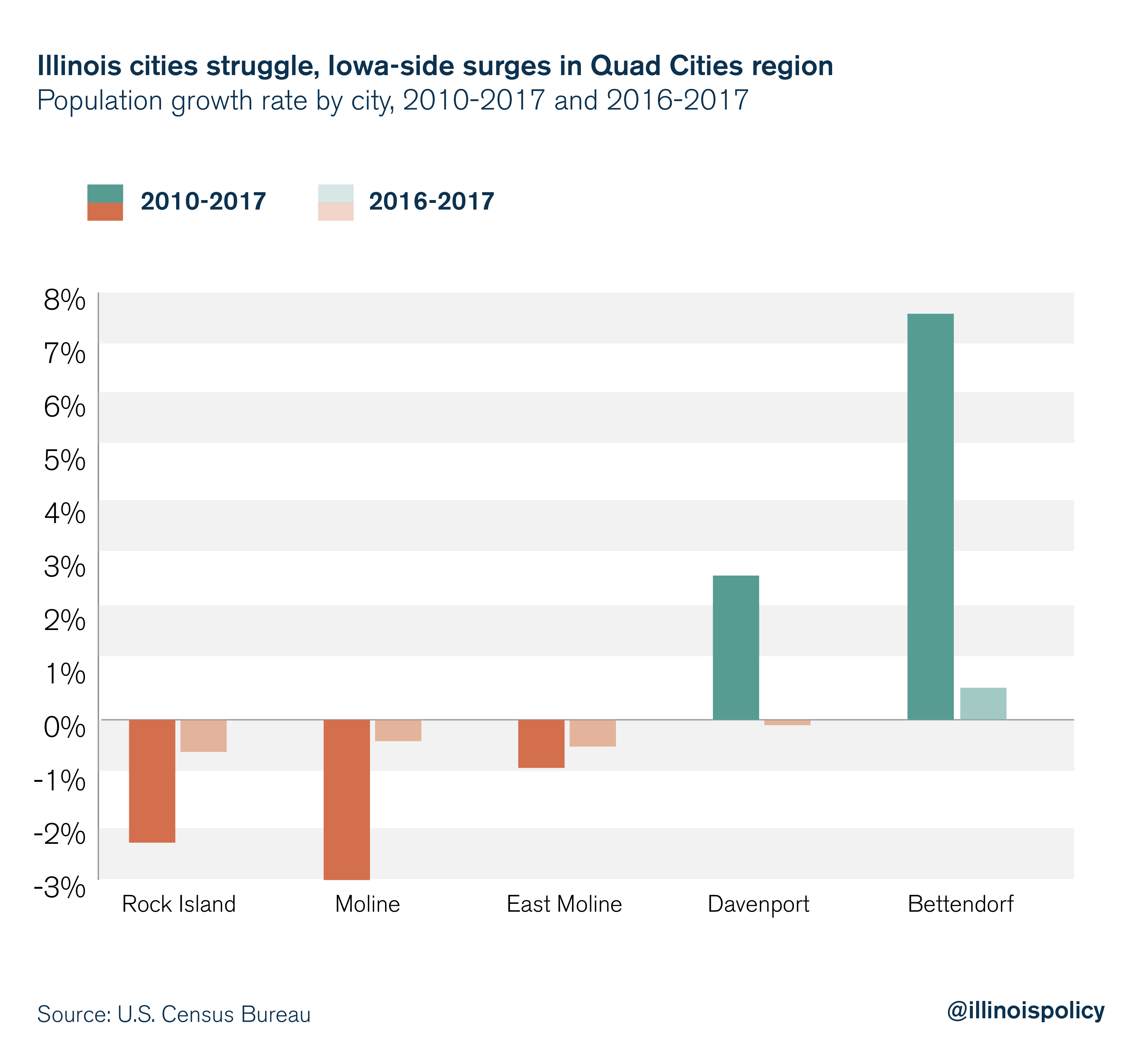

The Quad Cities include Rock Island, Moline and East Moline on the Illinois side of the river, and Davenport on the Iowa side. The greater metropolitan region also includes the Iowa city of Bettendorf. From 2010 to 2017, Davenport and Bettendorf saw their populations grow by nearly 5,200 people combined. Meanwhile, Rock Island, Moline and East Moline lost nearly 2,400 residents combined.

The divergence is clear.

Over the year, Davenport saw a small drop in population according to the Census Bureau, losing 65 people. But Bettendorf continued to gain population, as it has every year this decade – growing by close to 8 percent since 2010.

In fact, put against Rock Island’s slow decline, Bettendorf could soon take the title of the third largest city in the region, behind Moline and Davenport. If population trends hold, Bettendorf will become larger than Rock Island by 2022.

The big question: What’s driving these trends?

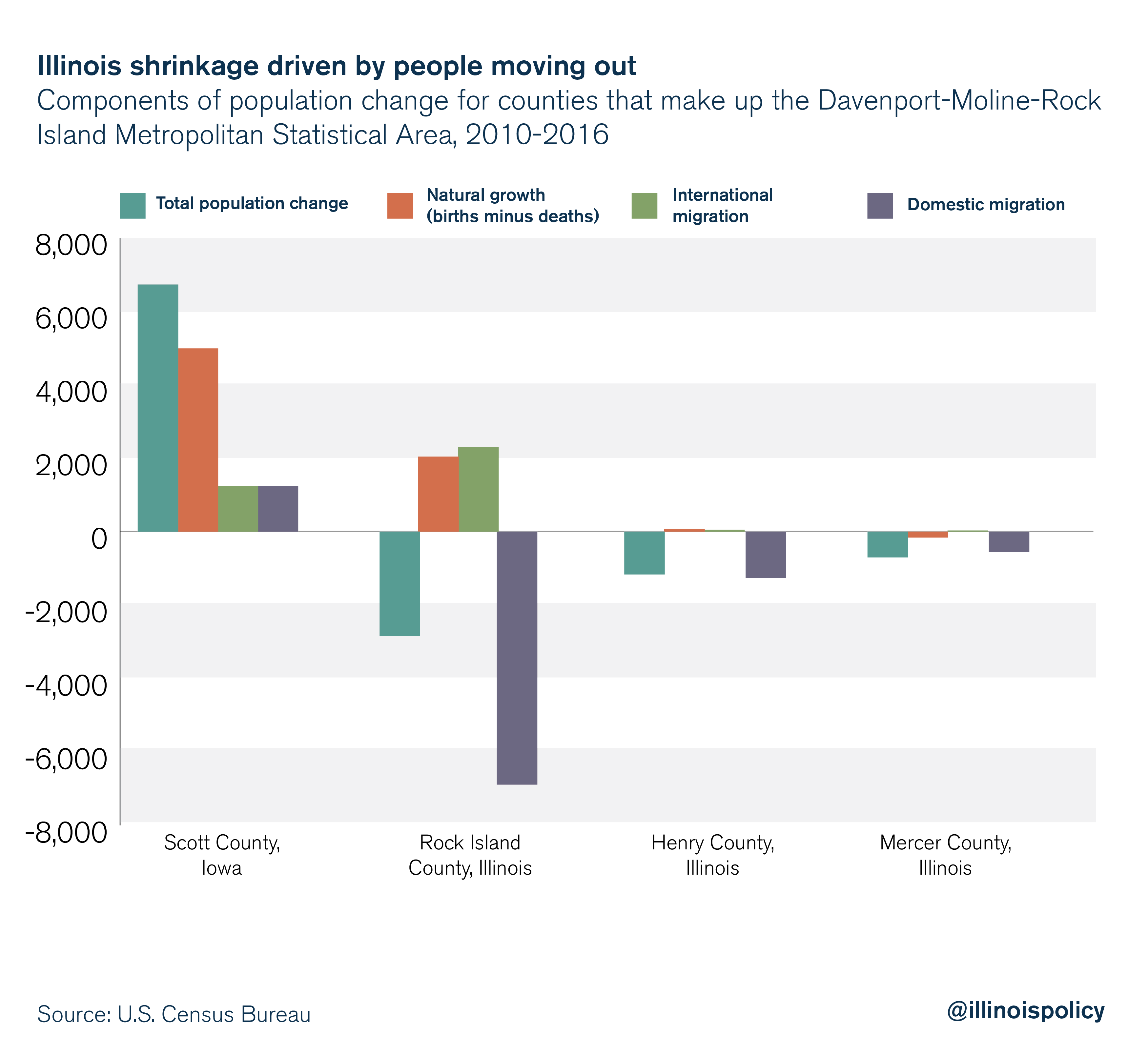

While city-level data don’t show where population growth is coming from, county-level data can shed some light. The reason for the Illinois decline is straightforward: more people are leaving than coming in.

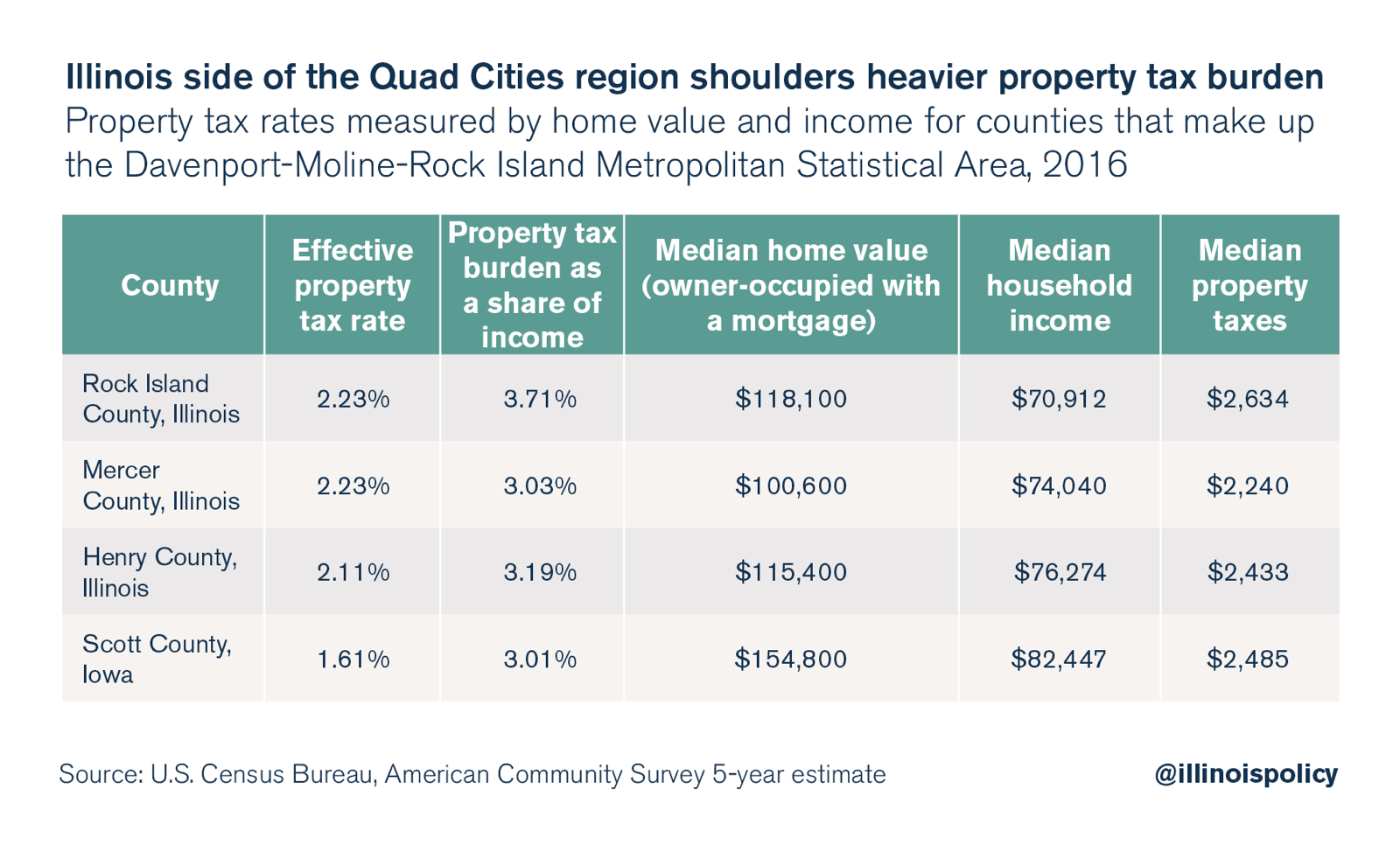

One policy choice that puts the Illinois side of the border at a disadvantage is residents’ high property tax burden. The difference between Rock Island County and Scott County is particularly noticeable.

While the median home value in Scott County is 31 percent higher than the median home value in Rock Island County, the median property tax bill is 6 percent lower. Measured as a share of residents’ income, Rock Island County’s property tax burden is 39 percent higher than Scott County’s.

Unfortunately, efforts to address the cost-drivers of those property tax bills have too often been “hijacked” by those opposed to reform. In Henry County, for example, calls to study potential cost-saving measures among the dozens of different local governments across the county have been muzzled repeatedly.

And the Illinois General Assembly has been unwilling to tackle a number of substantial reforms to reduce property tax bills.

Meanwhile, the Hawkeye State is moving ahead with reforms to poach more Illinoisans. For example, Iowa changed its rules for government union collective bargaining in 2017. This will help Iowa control taxpayer costs and keep down their property tax burden, while Illinois property taxes continue to spin out of control.

Further, the Iowa legislature is looking to cut income taxes, while Illinois lawmakers passed the largest permanent income tax hike in the state’s history last summer.

Until Springfield takes smart steps toward making the Land of Lincoln more attractive for families and businesses, Illinoisans in the Quad Cities and elsewhere shouldn’t expect to win out against neighboring states.