New bill would outlaw Cook County soda tax

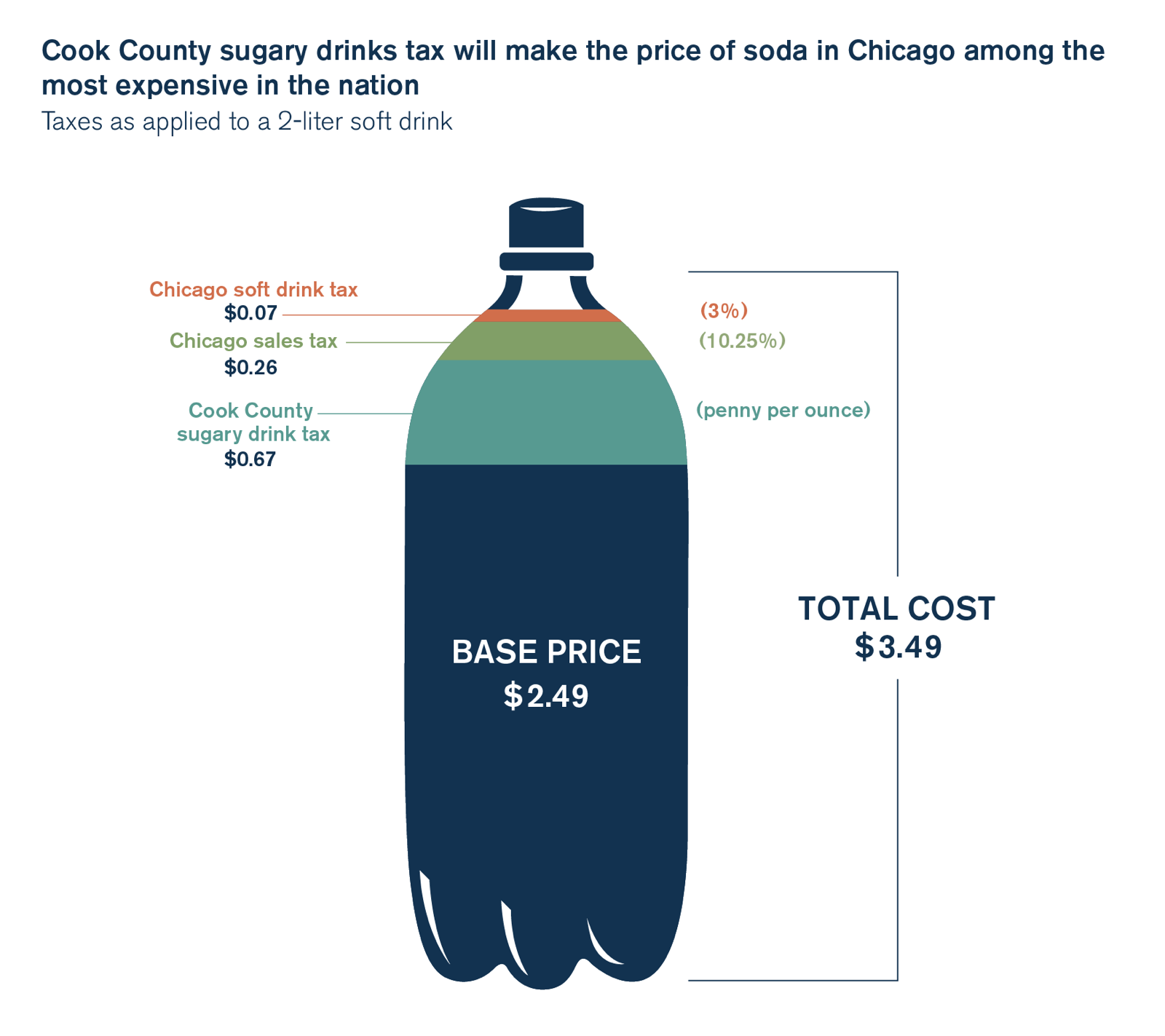

House Bill 4082 would ban Illinois home rule counties from levying taxes on sweetened drinks by volume sold.

A new proposal in the Illinois House of Representatives would do away with Cook County’s controversial sweetened beverage tax.

House Bill 4082 would prohibit any home rule county from taxing sweetened beverages by volume sold. The bill would also nullify any such tax currently in existence.

HB 4082 was filed by state Rep. Michael A. McAuliffe, R-Chicago. The Cook County Republican was also joined by the following co-sponsors: state Reps. Grant Wehrli, R-Naperville; Keith Wheeler, R-Oswego; Peter Breen, R-Lombard; and Christine Winger, R-Bloomingdale.

The proposal is yet another indicator of the vehement opposition and problems the sweetened beverage tax has fostered. Polling commissioned by the Illinois Manufacturers’ Association shows 87 percent of Cook County residents disapprove of the tax, according to Crain’s Chicago Business. The same poll also shows 80 percent of Cook County residents believe the county has imposed the tax to gain revenue and not to improve public health.

Days after the tax went into effect, consumers filed lawsuits against 7-Eleven, Walgreens and McDonald’s, alleging the companies improperly applied the sweetened beverage tax. The plaintiff agreed to the dismissal of his lawsuit against McDonald’s Aug. 15, according to the Chicago Tribune.

The Cook County tax may also have statewide implications, as the U.S. Department of Agriculture has indicated it may withhold $87 million in funding from Illinois over the way Cook County is handling the sweetened beverage tax for consumers in the Supplemental Nutrition Assistance Program.

It’s not just state lawmakers who are trying to get rid of the unpopular tax.

A bipartisan group of Cook County commissioners led by Commissioner Sean Morrison, R-Palos Park, is trying to repeal the tax at the county level. Morrison said that due to the tax’s widespread unpopularity and implementation problems, commissioners who originally voted for it might feel differently now.

The Cook County sweetened beverage tax took effect Aug. 2, after a court battle between the Cook County Board and the Illinois Retail Merchants Association, or IRMA. The tax was originally supposed to go into effect July 1, but a Cook County Circuit Court judge issued a temporary restraining order delaying the implementation of the tax while the case was being litigated.

After the court upheld the tax, Cook County Board President Toni Preckwinkle filed a lawsuit against IRMA seeking $17 million in damages for money the county lost while IRMA challenged the tax in court. Days later, Preckwinkle withdrew the lawsuit.