Nearly 100 Lake County municipal retirees are pension millionaires

Lake County residents pay some of the highest property taxes in the nation – a burden driven by the growth in pension costs over the last 20 years.

Lake County families are seeing rising property taxes chip away at one of their biggest retirement investments – their homes. Meanwhile, those tax bills are funding retirement benefits for former local government workers practically unheard of in the private sector.

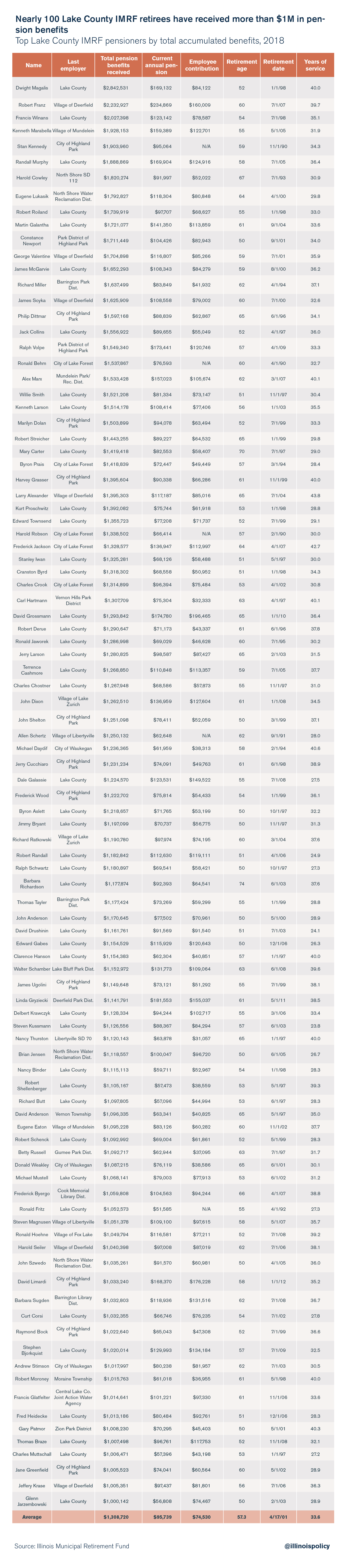

Documents from the Illinois Municipal Retirement Fund, or IMRF, show 97 current retirees from Lake County local governments have taken home more than $1 million in pension benefits over the course of their retirements.

On average, those top-earning Lake County pensioners retired at age 57, receive a current annual pension of more than $95,700 and contributed just $74,500 to the pension fund over the course of their careers.

This dataset does not include workers enrolled exclusively in pension funds for teachers, police officers, firefighters or state workers. Rather, most of these retirees worked for Lake County government, village and city governments, park districts, water districts and library districts.

The top local IMRF pensioner is former Lake County administrator Dwight Magalis, whose current $169,100 annual pension is more than double what he contributed to the fund over the course of his career. Magalis has received more than $2.8 million in pension benefits since retiring at age 52 in 1998.

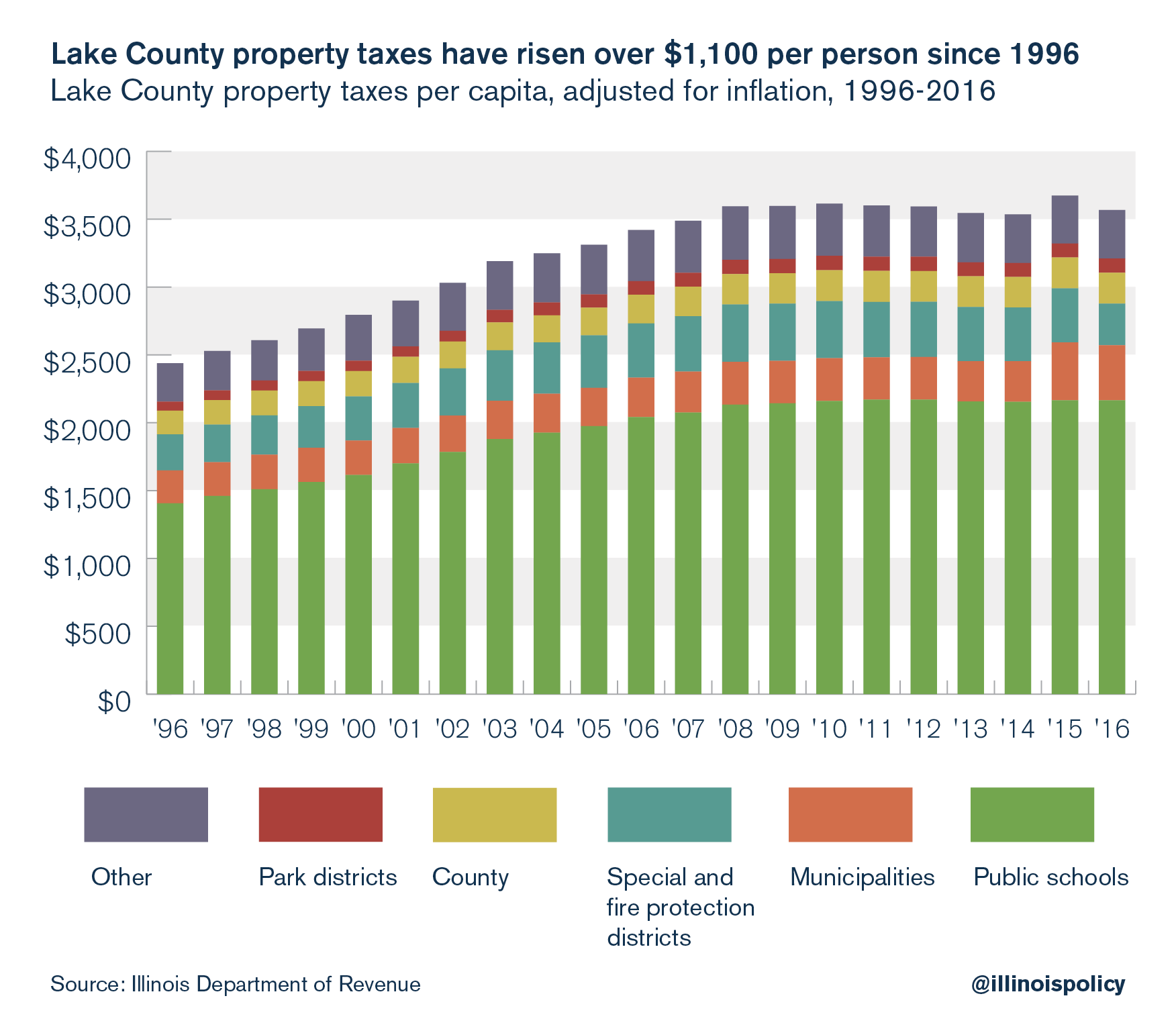

Lake County homeowners have seen their property taxes rise by more than $1,100 per person since 1996 after adjusting for inflation.

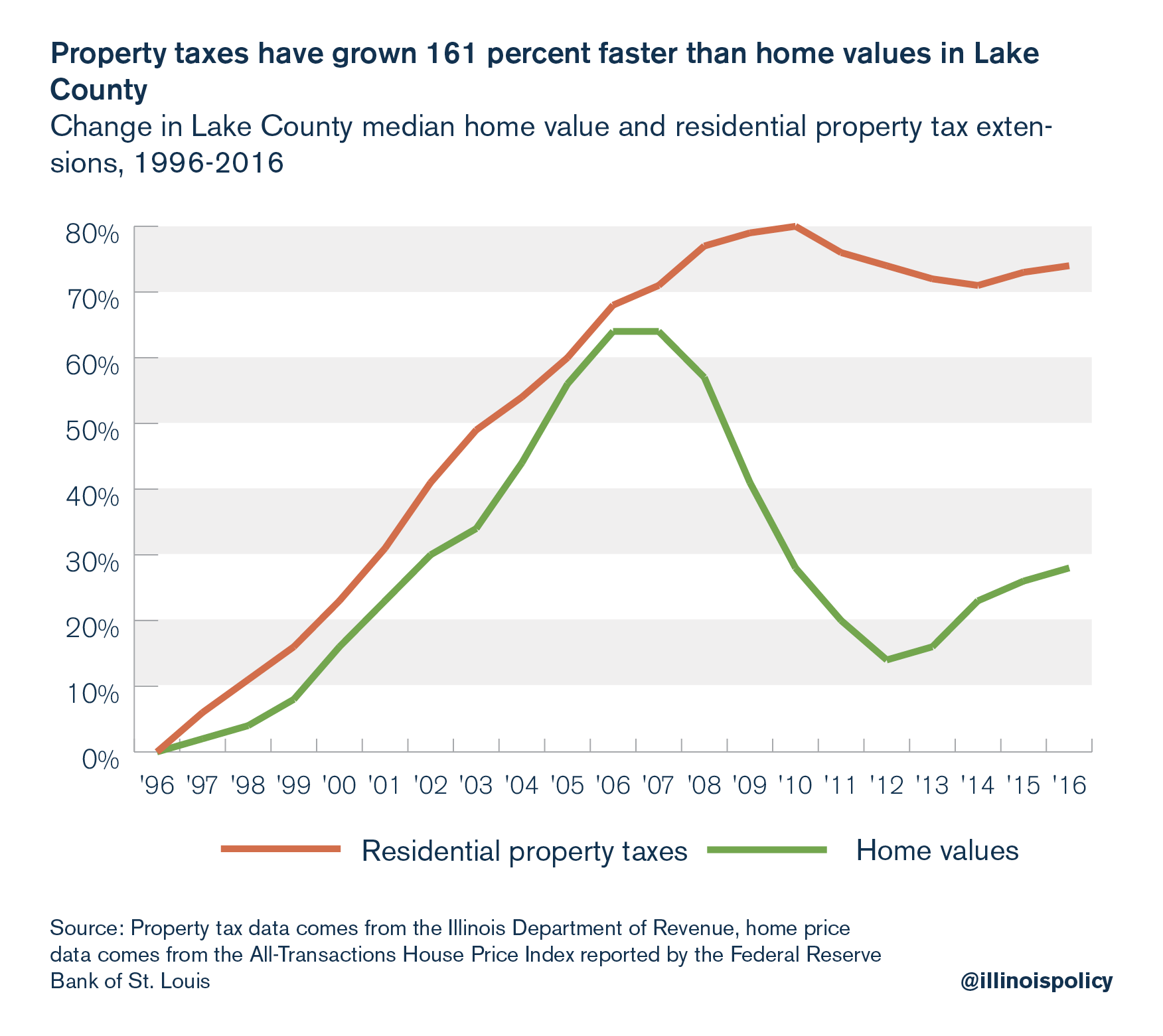

In theory, homeowners could benefit from higher property taxes through higher home values, if those property tax dollars were going toward improving the delivery of valued services. That doesn’t seem to be the case in Lake County, where residential property tax bills grew more than 160 percent faster than home values from 1996 to 2016.

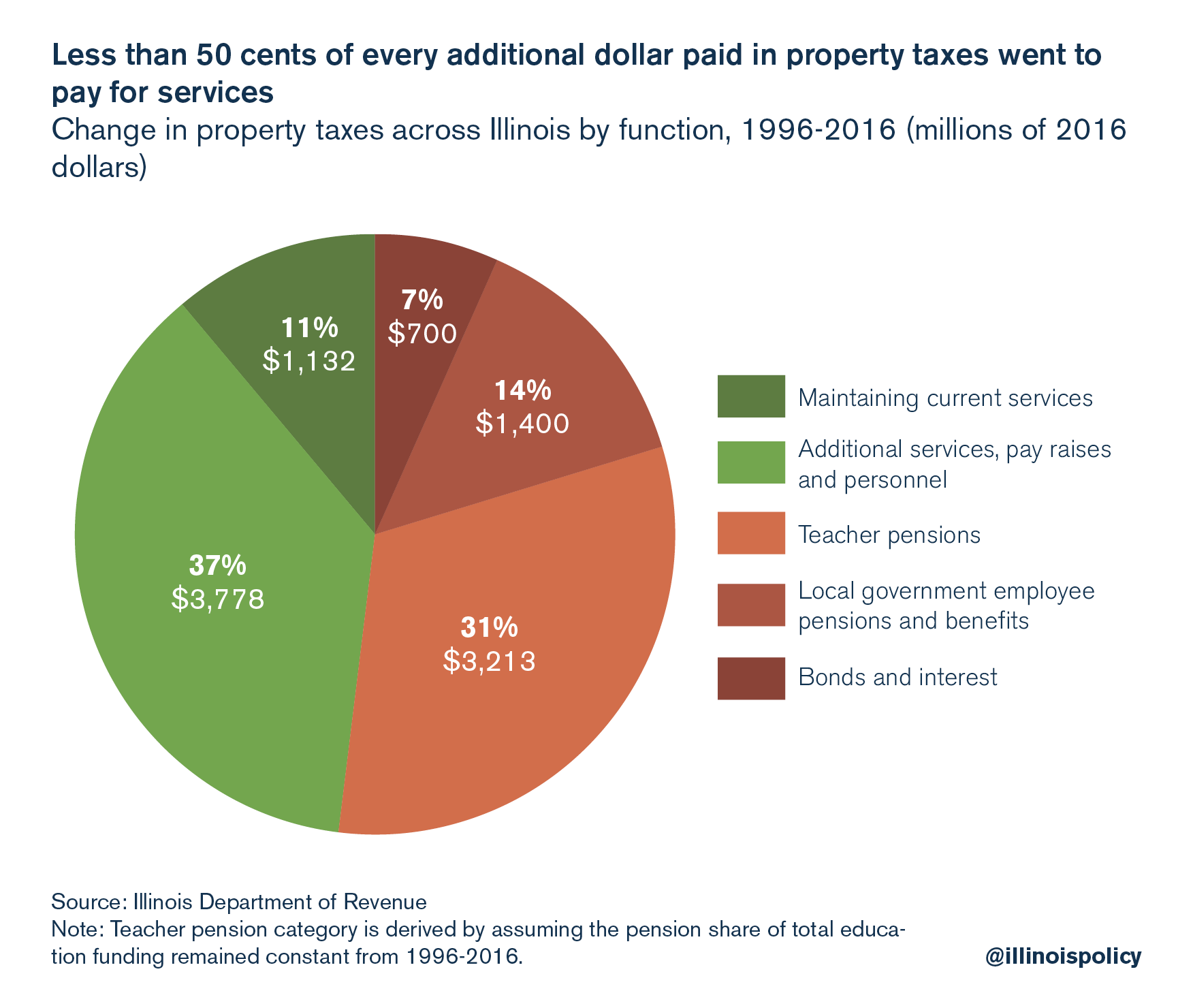

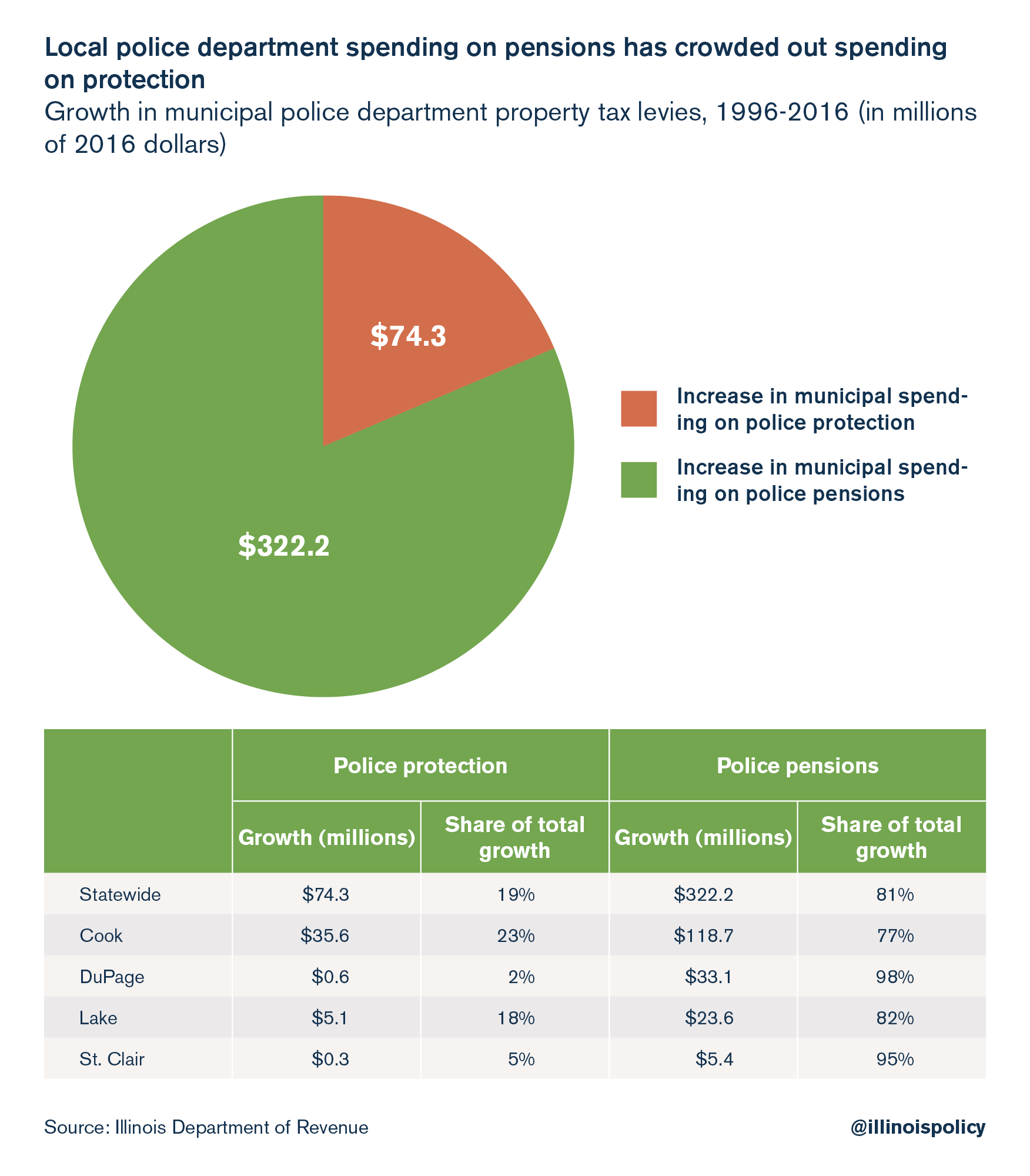

Sadly, this phenomenon is not surprising nor unique to Lake County. Less than 50 cents of every additional property tax dollar levied in Illinois since 1996 has gone to services. Rather, the single largest driver of the increase in property taxes over that 20-year period was pension costs.

Sadly, this phenomenon is not surprising nor unique to Lake County. Less than 50 cents of every additional property tax dollar levied in Illinois since 1996 has gone to services. Rather, the single largest driver of the increase in property taxes over that 20-year period was pension costs.

Of every additional property tax dollar that went to municipal police departments in Lake County over that time, 82 cents went to pensions, not law enforcement. Homeowners are now seeing the vast majority of their property tax dollars for police flow to pension payments.

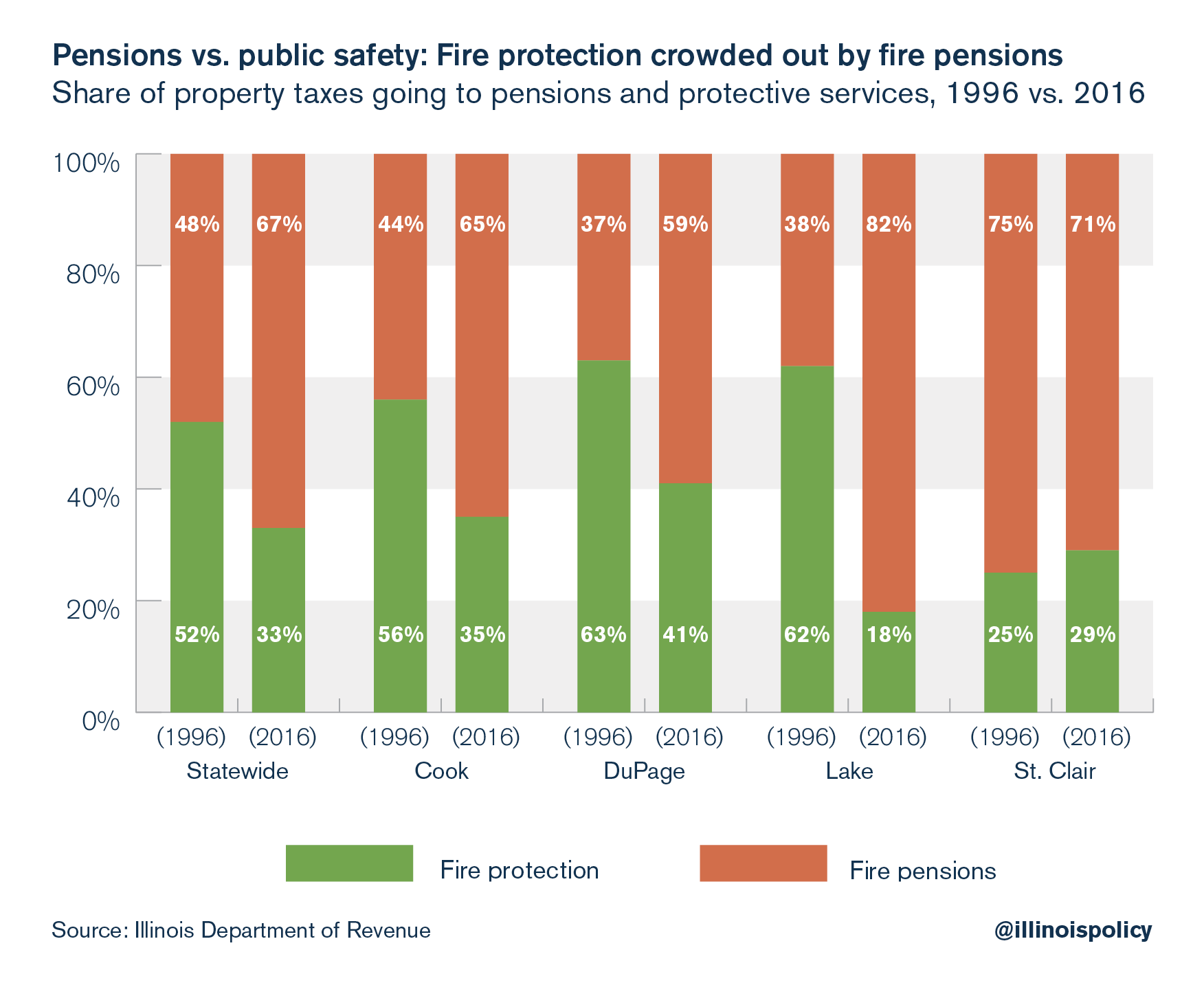

The pension problem is even worse for fire departments in Lake County. Residents saw a $3.6 million cut in property tax dollars flowing toward fire protection and a $12.6 million increase in property tax dollars flowing to pension costs for municipal fire departments in Lake County from 1996 to 2016.

In 1996, 62 cents of every property tax dollar for municipal fire departments went to fire protection in Lake County. But by 2016, only 18 cents of each dollar went to fire protection, with the rest going to pensions.

Until state lawmakers address this overwhelming rise in pension costs, Lake County residents will not see meaningful property tax relief, and government workers will continue to see their retirements put in jeopardy.

Until state lawmakers address this overwhelming rise in pension costs, Lake County residents will not see meaningful property tax relief, and government workers will continue to see their retirements put in jeopardy.

A short-term solution to this problem is enrolling every new government worker in a 401(k)-style retirement plan, similar to what more than 20,000 state university workers have opted into. A long-term solution must include a constitutional amendment to allow changes in future, unearned pension benefits for government workers. This would allow for reasonable changes such as ending automatic 3 percent annual benefit increases for retirees and bringing government worker retirement ages in line with the private sector.

Time is of the essence. Due to heavy outmigration, most of Lake County’s largest communities are shrinking, and it is the only collar county to have lost population since 2010.

In order to attract and retain residents, state lawmakers must avoid raising taxes and diminishing services to pay for unsustainable pension promises.