Motivated math: Pritzker ‘fair tax’ numbers don’t add up

Gov. J.B. Pritzker’s proposed progressive income tax won’t raise the revenue he claims, and will lead to future tax hikes on the middle class.

Illinois Gov. J.B. Pritzker is pushing for the removal of the Illinois Constitution’s flat tax protection in order to install a graduated, or progressive, income tax structure. Pritzker claims the progressive tax rates he proposed March 7, which he dubbed the “fair tax,” will generate $3.4 billion in new revenue.

But Pritzker’s revenue projections overstate by nearly $2 billion the amount a progressive income tax hike would actually bring in.

Why? Tax changes affect behavior. The administration’s failure to recognize responses to a progressive income tax hike means the tax will not deliver the revenue the governor anticipates. And even without taking into account the economic effects of taxation – an analysis called “static” scoring – Pritzker’s estimates fall short by nearly $1 billion.

Dynamic vs. static scoring of tax changes

Government agencies are often charged with estimating tax revenues. Traditional revenue estimation, called static scoring, assumes no feedback from taxes to aggregate income. The other extreme suggests that tax cuts can generate so much economic growth that they completely (or even more than completely) pay for themselves.

Most economists are skeptical of both polar cases because reality lies somewhere in the middle.

In 2003, the U.S. House of Representatives adopted a rule that requires the staff of the Joint Committee on Taxation, or JCT, to analyze the macroeconomic impact of any major tax bill before the House can consider the proposed legislation. The JCT estimates include many behavioral effects that economists anticipate would result from changes to taxation.

The evidence suggests there are large feedback effects of policy changes on economic behavior. Cuts in personal income taxes lead to a fall in tax revenues, while corporate income tax cuts on average have little impact on tax revenues. Cuts in average personal income tax rates raise employment, consumption and investment. Cuts in average corporate income tax rates boost investment and do not affect or even lower private consumption. The opposite is also true: tax increases have a large negative effect on investment.

Scoring Pritzker’s tax increase

Using the most recent available data from the Illinois Department of Revenue and from the Internal Revenue Service’s “Statistics of Income,” the Illinois Policy Institute analyzed Pritzker’s progressive income tax increase under both a static revenue estimation and a dynamic revenue estimation.

The simplest way to estimate changes in tax revenues are static revenue calculations. These straightforward calculations are the best-case scenario for a state government wishing to raise more tax revenue, because static estimates assume that tax increases have no effect on production or employment, and thus income.

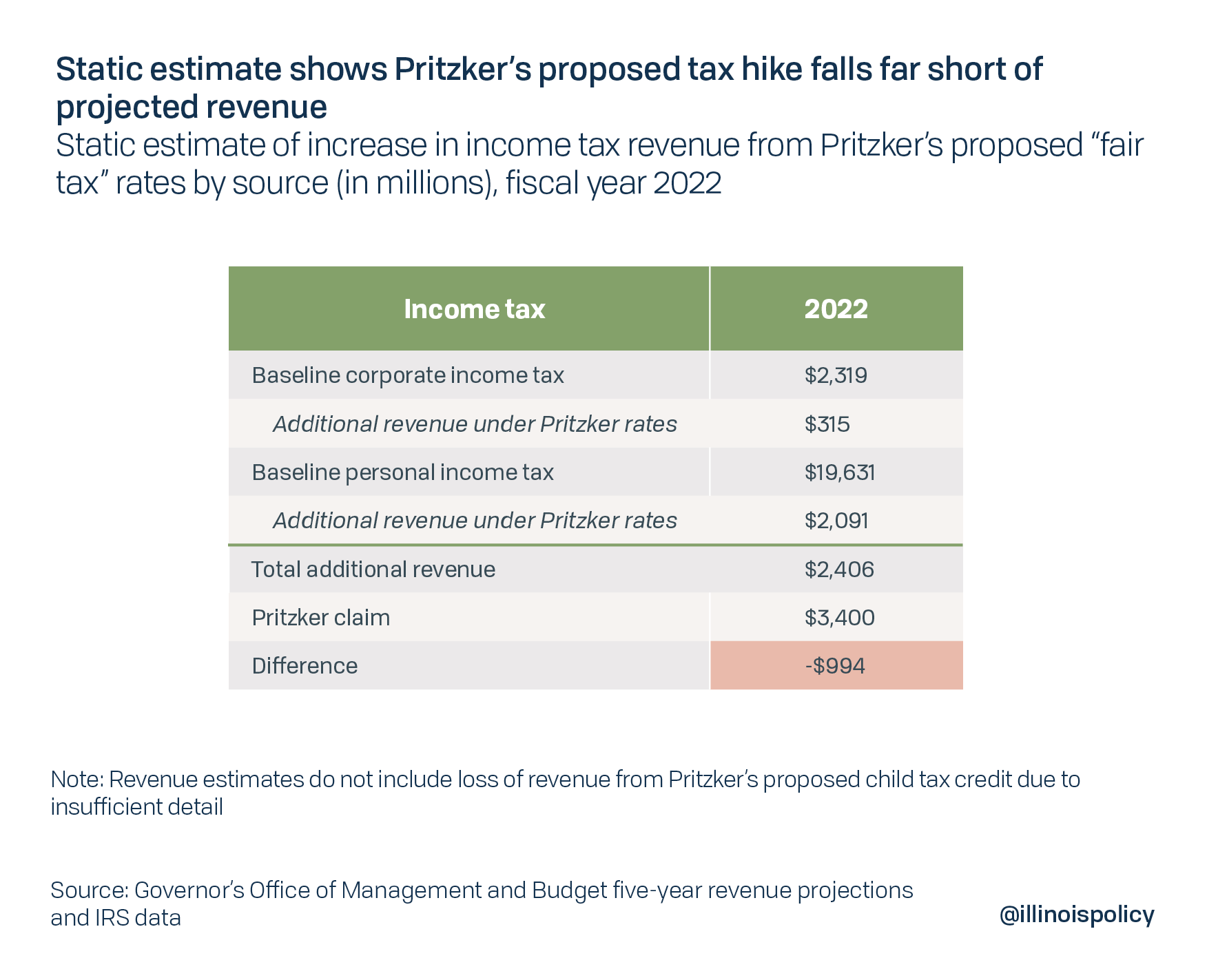

A static revenue estimate – which doesn’t take into account the economic effects of a tax hike – reveal that Pritzker’s graduated income tax rates would fall $1 billion short of his claims.

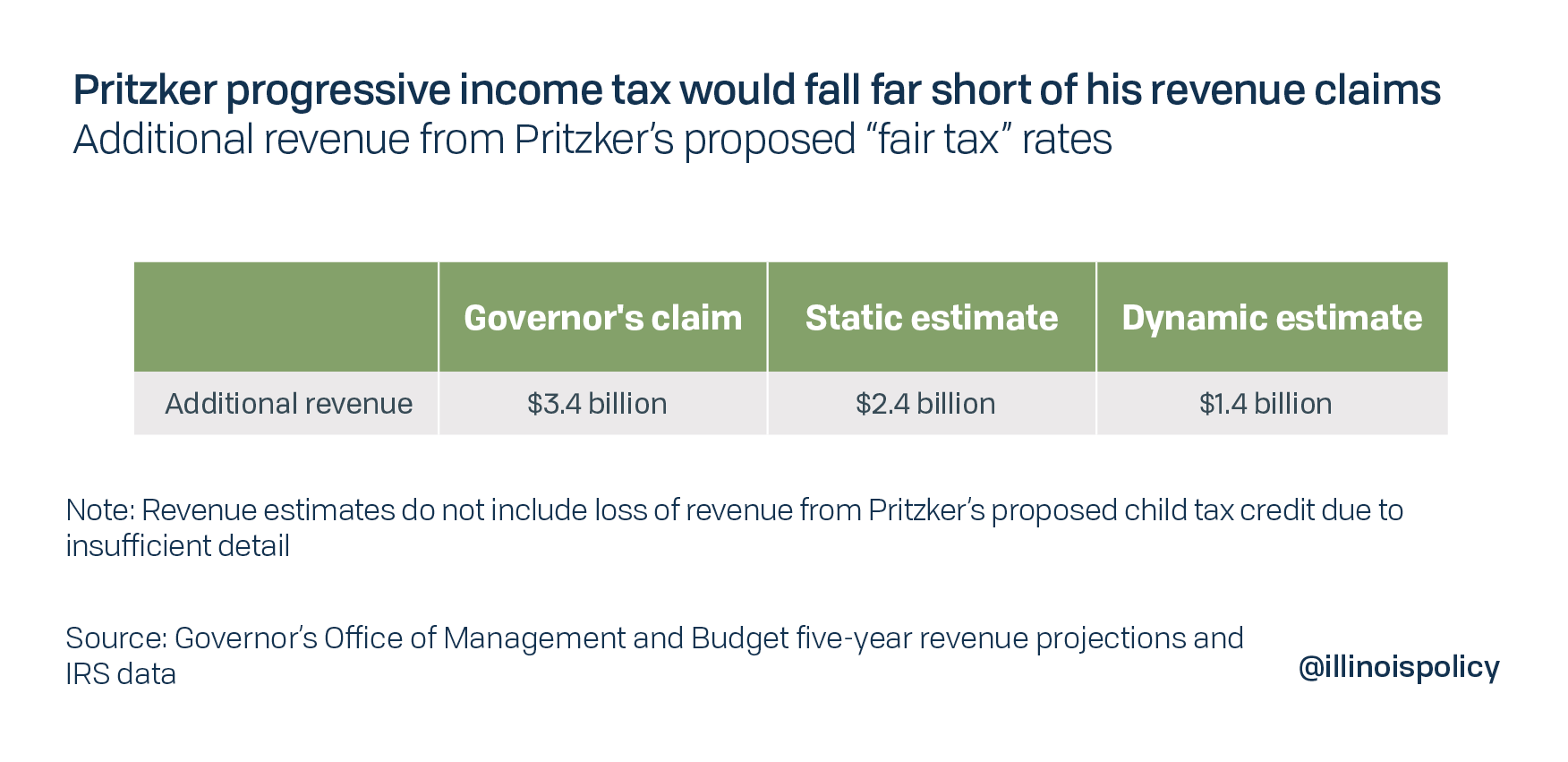

Under the governor’s plan, total personal income tax revenues are expected to increase by 11.2 percent according to the distribution of tax returns reported in IRS income tax return data, while corporate income tax revenues are scheduled to increase by 13.6 percent. Assuming Pritzker’s tax hikes have no impact on economic behavior, his proposed rates should yield an additional $2.4 billion in tax revenue in the first full fiscal year after the new tax rates are in effect, after accounting for his proposed $100 million increase in property tax credits.

In reality, the governor’s proposal will bring in far less revenue than the amount predicted by a static estimation, because the economy is negatively affected by personal income tax increases. The Illinois Policy Institute’s dynamic estimate suggests the tax change will bring in 41.2 percent of the governor’s expected additional revenue. A detailed description of the Illinois Policy Institute’s dynamic analysis, similar to Prescott (2004) and Mankiw and Weinzierl (2006) can be found in Appendix B here.

Progressive income taxes deter investment more than revenue-neutral flat taxes. This is because top earners, who have a higher propensity to invest, are even more responsive to tax policy changes than lower income earners.

It is unrealistic to expect a 61 percent tax increase on one group of individuals – as Pritzker’s income tax proposal would impose on Illinoisans earning over $1 million – to result in a 61 percent increase in the tax collected from that group of taxpayers. This is why a revenue estimate that considers the effects of the governor’s tax proposal shows the increase will yield significantly less revenue than what is projected by the governor’s team.

It is ultimately unclear why the administration’s revenue estimates differ so much from both the Illinois Policy Institute’s static and dynamic estimates. The Pritzker administration has so far refused to release its methodology and assumptions for the $3.4 billion revenue estimate.

Illinois policymakers are too often motivated to reach certain revenue estimates that support their policy preferences. Regardless, if the administration has tax data that aren’t yet available to the public, it should release this information before asking Illinoisans to support billions of dollars in tax hikes.

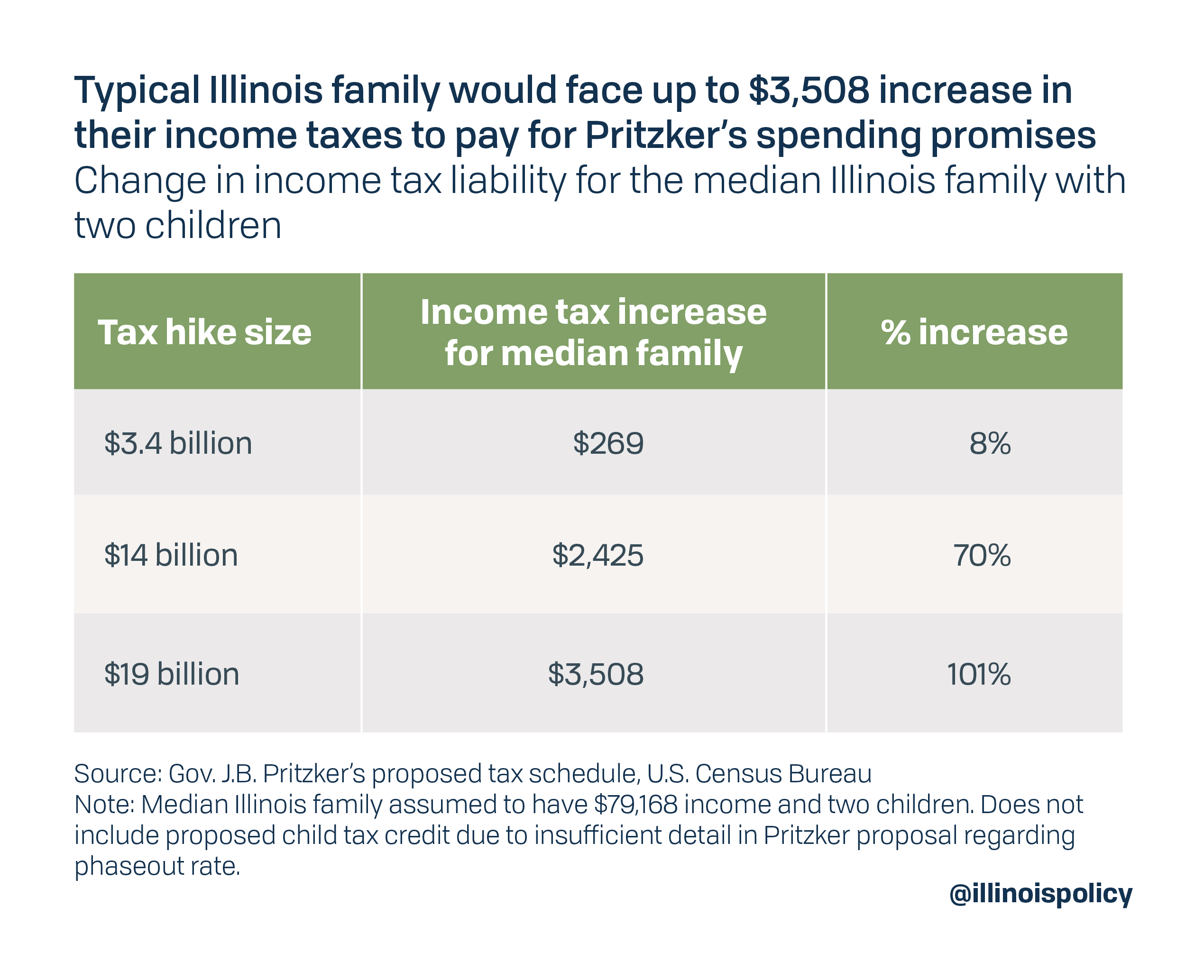

Unfortunately, realistic revenue estimates suggest Pritzker’s tax rates would be temporary and that Illinois politicians will soon be asking hardworking Illinois families for more of their paychecks. The typical family would see a $3,500 income tax hike under Pritzker’s proposed progressive tax structure in order to finance the governor’s spending promises.

Pritzker should abandon his plans for a progressive tax hike to finance billions of dollars in unaffordable new spending. Instead, the governor should look to structurally reform the cost drivers of Illinois’ budget and debt problems: rising costs of pensions and government worker health insurance. The Illinois Policy Institute recently released Budget Solutions 2020, a plan to balance Illinois’ budget immediately and pay off its debt in less than five years – without raising taxes.