More than half of joint filers in Winnetka, Northfield would see income tax hike if voters approve Pritzker’s ‘fair tax’

Voters statewide will decide whether 2,740 Winnetka and Northfield taxpayers should send $119 million in additional income taxes to Springfield.

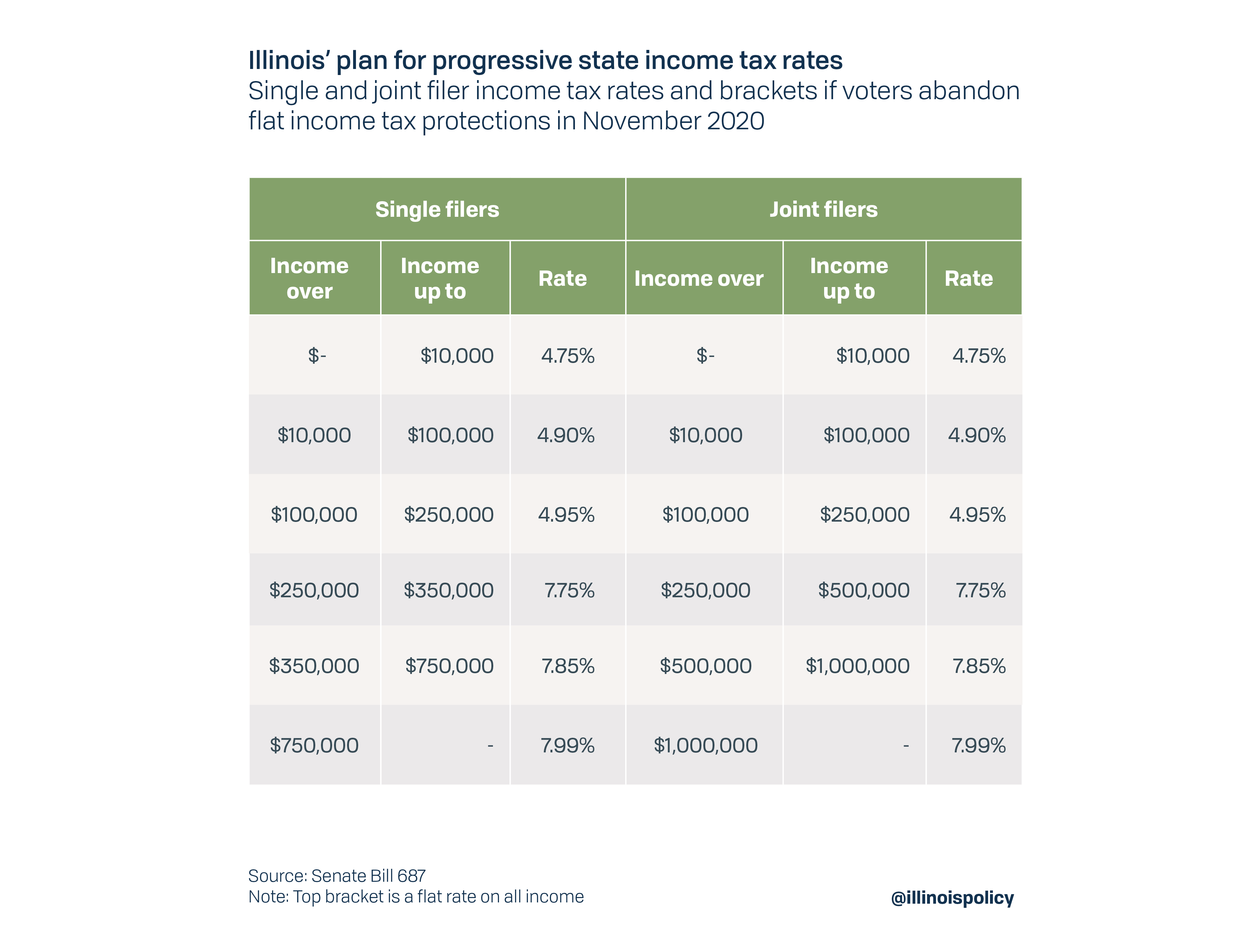

Gov. J.B. Pritzker claims 97% of Illinois taxpayers will see their tax bills stay the same or decline under his progressive income tax ballot measure.

But that picture changes significantly at the community level.

Take Illinoisans living in the 60093 ZIP code for example, which covers Winnetka and Northfield. Nearly a third of all taxpayers there, 29%, will see higher income taxes if voters approve Pritzker’s progressive income tax amendment at the ballot box in November 2020. Springfield would take an additional $119 million from those taxpayers, in total.

A staggering 53% of joint filers in Winnetka and Northfield would be hit with a tax increase, according to IRS data:

- 1,009 fall into the $250,001 to $500,000 tax bracket

- 707 fall into the $500,001 to $1 million bracket

- 791 fall into the more than $1 million bracket

Additionally, 233 Winnetka and Northfield single filers would experience a tax increase:

- 75 fall into the $250,001 to $350,000 tax bracket

- 89 fall into the $350,001 to $750,000 bracket

- 69 fall into the $750,001 or more bracket

Under Pritzker’s plan, a joint filer making $400,000 would see a $4,135 tax hike. Currently this family pays $19,000 in state income taxes, an effective tax rate of 4.95%. Under Pritzker’s tax plan, they would pay $23,935 in state income taxes, an effective tax rate of 5.98%.

Notably, these tax hike figures assume Pritzker’s introductory progressive income tax rates and brackets never change. In the only state that switched to a progressive income tax structure in the last 30 years, Connecticut in 1996, an introductory “tax on the rich” ended up bringing middle class tax hikes as well. Progressive income tax systems allow lawmakers to change rates and brackets more easily than Illinois’ current flat income tax system.

Some Winnetka and Northfield residents may not mind paying more in income taxes to fund enhanced social services, education, parks programming or other benefits to Illinois communities.

But additional money from the progressive income tax will be disproportionately eaten up by the state’s broken pension system. When lawmakers passed a $31 billion income tax hike in 2011, nearly 90 cents of every new dollar in revenue went into the state pension systems, yet Illinois’ pension debt still grew by $25 billion.

Today, the revenue Pritzker estimates his progressive income tax would generate is enough to cover Illinois’ pension costs for less than four months.

Illinois’ large unfunded pension liabilities have also been a major driver in property tax increases over the last 20 years. For every dollar increase in property taxes, less than 50 cents goes toward services. The pension burden is so large that it eats up additional funding. In the same way, additional levies from the progressive income tax will be consumed by the pension crisis. Pritzker has refused to endorse putting a pension constitutional amendment on the ballot.

In November 2020, voters will decide whether they see Pritzker’s tax hike as a solution or simply a blank check for Springfield.

Winnetka and Northfield residents will be awaiting their choice.