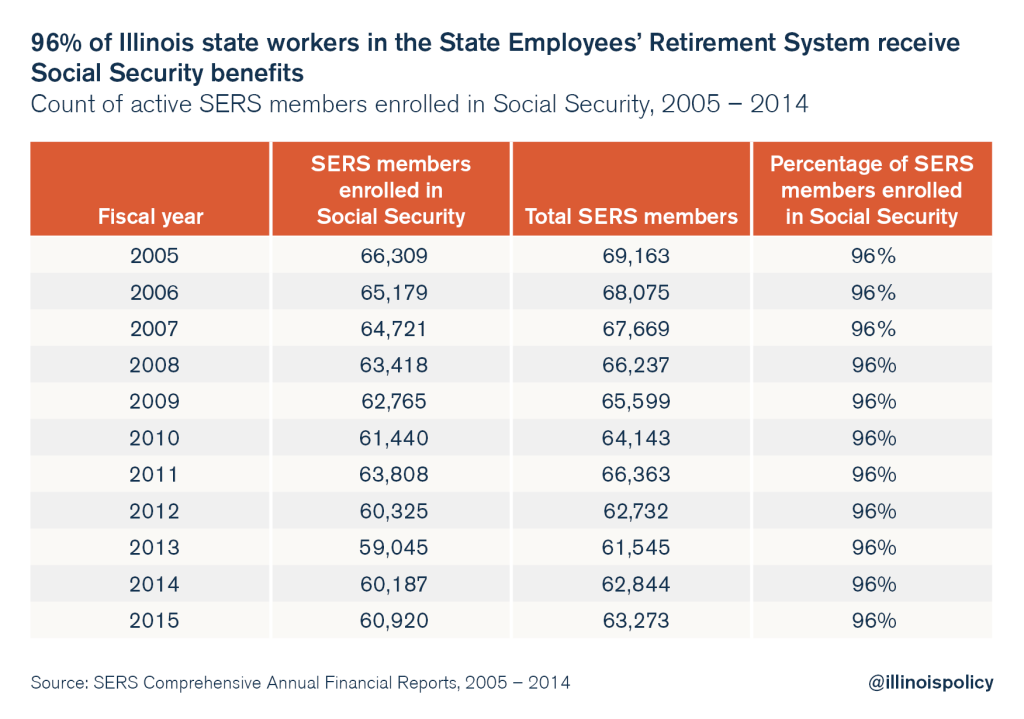

More than 60,000 Illinois state workers participate in Social Security

Recently retired career state workers receive an average annual pension of $63,000. On top of this, more than 60,000 workers in Illinois’ State Employees’ Retirement System participate in Social Security.

A common misconception government unions like to promote is that none of Illinois’ state workers are eligible for Social Security benefits.

Many union officials then use this claim to justify state workers’ forced participation in Illinois’ broken and unaffordable pension systems.

But when it comes to government employees who participate in the State Employees’ Retirement System, or SERS, that argument is far from the truth.

In fact, 96 percent of the 63,273 active members who are enrolled in SERS also participate in Social Security. That group represents more than 20 percent of the 267,000 active members in Illinois’ five state retirement systems.

The unions’ complaint about not receiving Social Security implies that it’s acceptable to set pension benefit levels in line with Social Security benefits. If Illinois were to do that, taxpayers would be thrilled – this would save taxpayers billions and set government workers and the private sector on equal footing.

The average 2016 Social Security benefit for a retired worker is $16,100, and the maximum benefit for those at the full retirement age of 67 is $32,000. Government unions argue that not receiving these benefits in some way justifies the million-dollar retirement packages that career government employees in Illinois receive today.

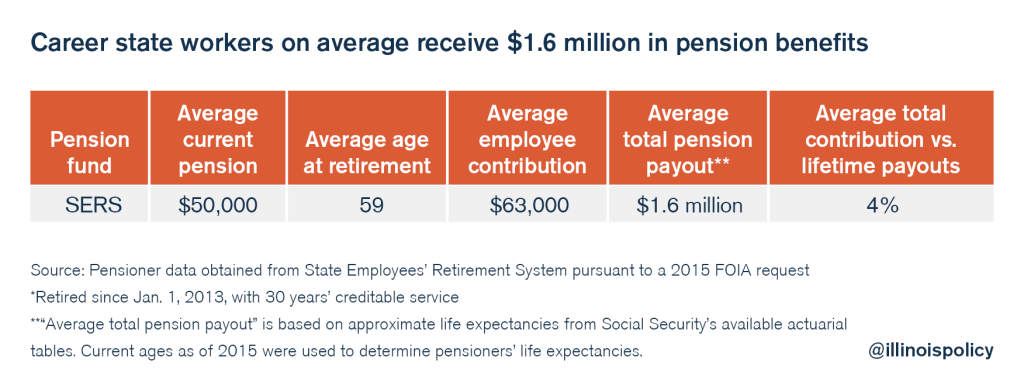

Not only do a majority of SERS members retire in their 50s, but recently retired career state workers also receive an average pension of $63,000 a year, and will average $1.6 million in total benefits over the course of their retirements.

Those benefits will come on top of whatever the more than 60,000 eligible state workers receive from Social Security.

In addition, state workers receive heavily taxpayer-subsidized health care benefits that the vast majority of private-sector workers can only dream of.

Government-worker unions should stop complaining about the private sector’s Social Security benefits.

Instead, they should focus on getting their members out of the broken, politician-controlled pension systems and into worker-controlled 401(k)-style plans.

That, along with a suite of other retirement reforms, will benefit taxpayers and government workers alike.