Moody’s warning of an “inflection point” in Illinois signals need for spending reforms

Illinois lawmakers should heed Moody’s Investors Service’s warnings about the state’s precarious economic health and dire fiscal situation and enact major structural spending reforms to balance the budget.

Moody’s Investors Service warned Illinois politicians on March 30 that the state has reached an “inflection point.” Previously, the credit rating agency’s analysis indicated that Illinois’ economic deterioration is pushing the state toward an economic death spiral.

The message to Illinois politicians should be clear: The state needs structural spending reforms.

Moody’s said in its March 30 announcement that the state has to choose between “further credit deterioration and drift without compromise” and the “potential for stabilization.” That’s Moody’s way of saying Illinois needs a balanced budget.

But Moody’s commentary on Illinois’ precarious economic health says that not just any budget will do. The credit rating agency has warned Illinois may be entering a vicious cycle in which increasing population losses lead to an intractable economic crisis. That means the state’s weak economic growth and fleeing population – sparked by higher taxes – could reinforce each other and lead to a collapse of the economy and the state’s finances:

“[P]opulation loss can be a cause, as well as an effect, of economic deterioration. A self-reinforcing cycle of population loss and economic stagnation could greatly complicate Illinois’ efforts to stabilize its finances.”

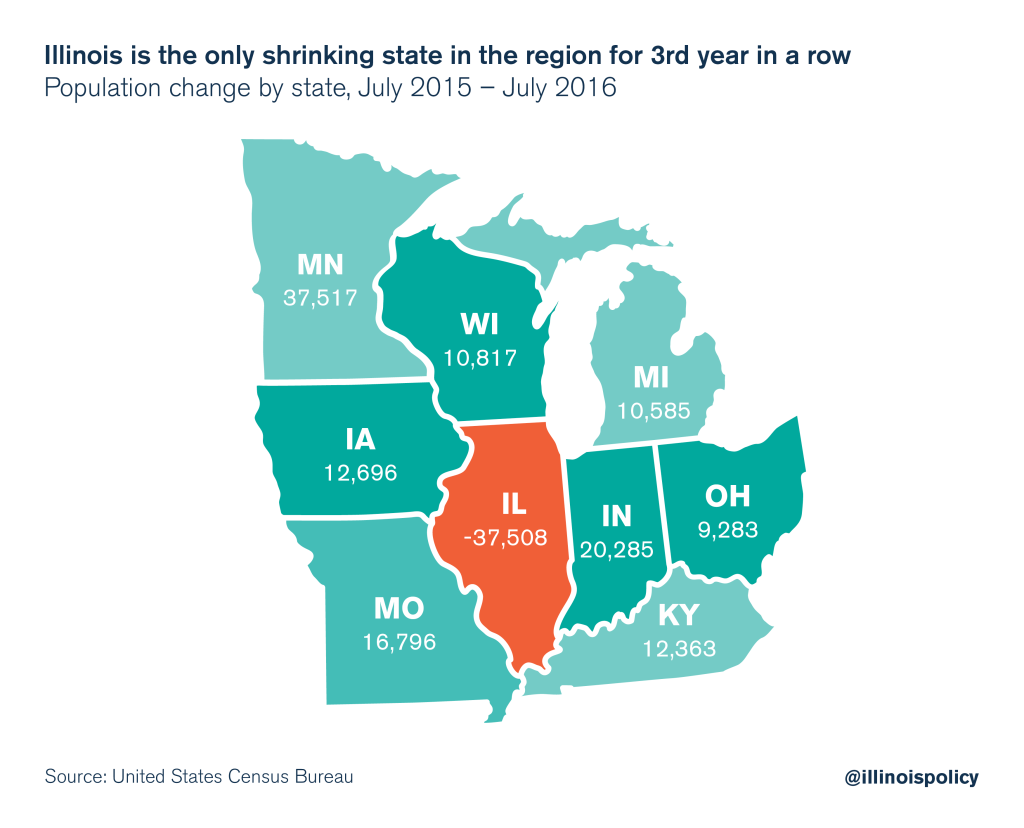

Illinois lost a record 114,000 residents due to domestic out-migration from July 2015 to July 2016. All those fleeing residents resulted in a contraction of the state’s population by 37,500 – making Illinois the only state in the region with a shrinking population for the third year in a row.

Why are so many are leaving? Taxes. A Paul Simon Public Policy Institute poll released in October 2016 found that nearly half of Illinoisans polled said they wanted to leave Illinois, and taxes were the No. 1 reason.

And a 2017 poll of Illinois voters conducted by Fabrizio, Lee & Associates and commissioned by the Illinois Policy Institute found that 60 percent of respondents said state taxes are too high. A full 70 percent said their property taxes in particular were too high.

And nearly 80 percent of those polled agreed that “Illinois state lawmakers should pass major structural reforms before passing any tax increase.”

The above facts indicate a simple point: Illinoisans are fed up with the state’s high-tax environment. They’ll leave if politicians attempt to hike taxes on them again instead of enacting the reform Illinois needs.

Any compromise budget – such as the Illinois Senate’s “grand bargain” – that increases the burden on Illinoisans or perpetuates the state’s broken pension system will only hasten the state along the path of Moody’s forewarned downward economic spiral.

That’s why the Illinois Policy Institute has provided the road map for a balanced budget that’s based on structural spending reforms, not tax hikes.

The plan fills Illinois’ budget hole, provides tax relief to struggling homeowners through a comprehensive property tax reform package, implements pension reforms that begin an end to the state’s pension crisis, and enacts major reforms to state spending on Medicaid and state worker compensation.