Moody’s report: Illinois pension debt reaches record-high $317 billion

Illinois worst-in-the-nation public pension debt grew 19% year over year. It will continue hurting the state economy and job growth, driving more people out of Illinois, unless there are reforms.

Illinois’ pension debt reached an all-time high of $317 billion as of June 30, 2020, according to credit rating agency Moody’s Investors Service – more than double the state’s official estimate. The need for a constitutional amendment to allow for structural pension reforms has never been greater to fix state finances that are dragging down the state’s economy.

Illinois’ pension crisis has been rated the worst in the nation, measured by pension debt relative to state gross domestic product, since fiscal year 2014. Pension debt increased 19% from $261 billion at the end of fiscal year 2019.

Official reporting of pension debt by the state of Illinois puts the debt at less than half of Moody’s estimate, $144.4 billion at the end of fiscal year 2020. State estimates use much more optimistic, and less realistic, assumptions about investment returns.

Because the state systemically underestimates its pension debt, it also underestimates the taxpayer contributions necessary to keep the debt from growing each year. During the past decade, officially-reported growth in pension debt outpaced the state’s initial projections by $24 billion. Growth in annual taxpayer contributions exceeded state estimates by about 15% per year on average, causing taxpayers to contribute $7.6 billion more than projected during the decade. Still, that extra money has not slowed a mushrooming pension debt. The state’s regular upward revisions demonstrate Moody’s method, which is more in line with private sector standards, is more accurate.

Because employee contributions to the pension funds and benefits paid out are both fixed by state law, taxpayers must make up for any shortfall caused when investment returns miss rosy targets. For example, the largest of Illinois’ five state pension systems, the Teachers’ Retirement System, reported a 0.52% return on investment in fiscal year 2020, which included the first four months of the COVID-19 pandemic. That was far short of the TRS’s 7% return target and helped grow the debt.

In addition to underestimating the debt, the state’s current funding policy violates best practices for public pension plans by targeting 90% funding rather than 100%.

Generous pension benefits allow many government workers in the five state systems to retire in their 50’s with multi-million dollar pensions, after having contributed only about 4-6% of expected payouts. Combined with the state’s poor accounting and funding practices, this explains why Illinois spends more of its tax revenue on pensions than any other state, but still has the largest gap between current payments and what would be required to pay down the debt without reforms.

The Illinois Policy Institute previously estimated it would require a 50% increase in the state’s flat income tax – taking over $1,800 from a median family’s income – to eliminate the debt without reform.

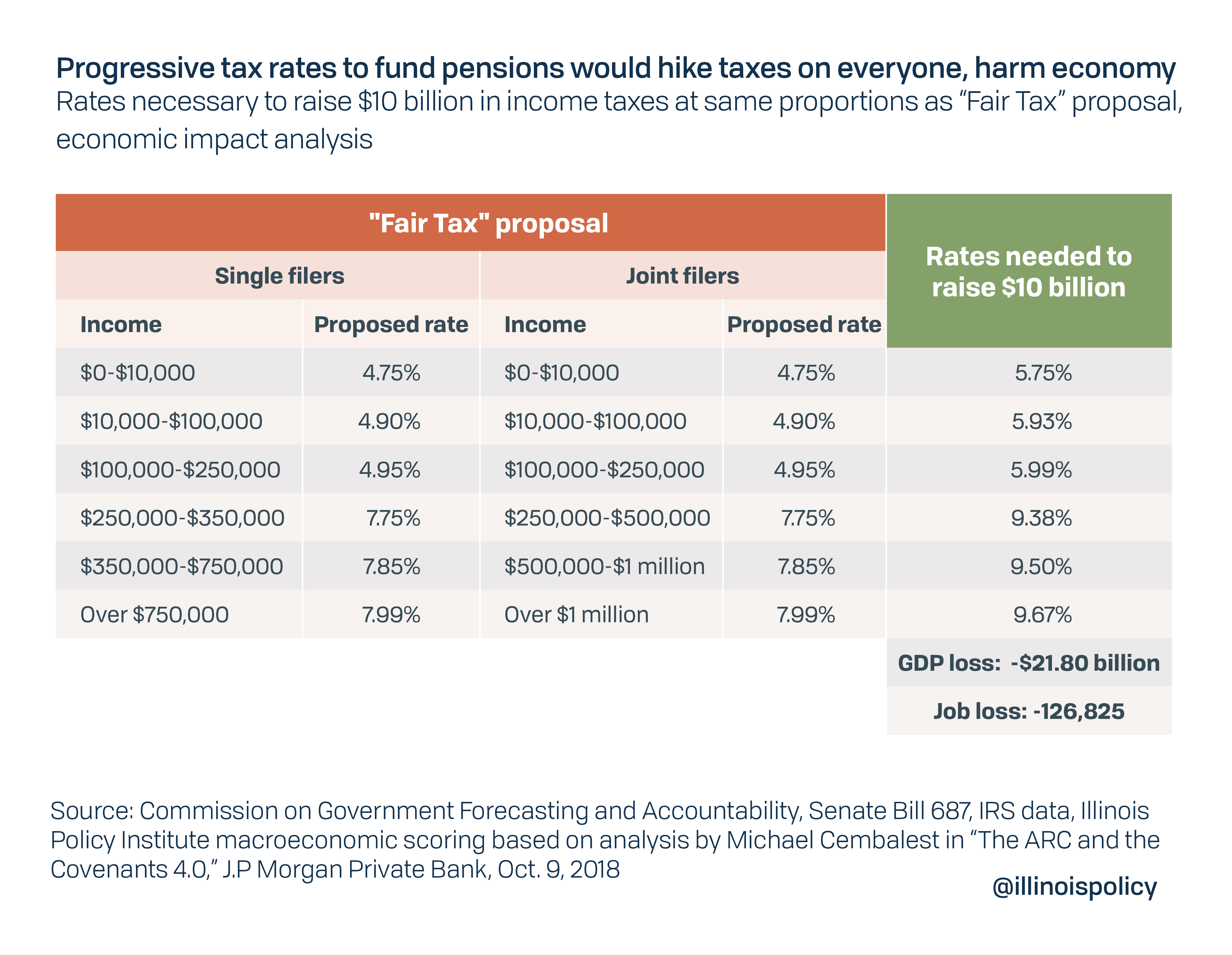

On Feb. 24, Illinois House Speaker Emanuel “Chris” Welch suggested another attempt at amending the state constitution to implement a progressive income tax, this time earmarked to pay for pensions. But paying down Illinois pension debt with a progressive income tax would require rates to be 21% higher on all taxpayers compared to the rates attached to the “fair tax” voters rejected in November 2020. This massive $10 billion tax increase would cost the state economy nearly 127,000 jobs and $21.8 billion in economic output.

Tax hikes cannot solve Illinois’ pension crisis, which has never been a problem of underspending. If lawmakers pursue further tax increases, they will only succeed in driving more businesses and residents out of state, impeding the state’s ability to economically recover from the COVID-19 pandemic.

Moody’s Analytics, a sister company to the ratings agency, underscored this point in a recent analysis for the state.

“Weak demographic trends and deep-rooted fiscal problems such as mounting pension obligations and a shrinking tax base represent the biggest hurdles to the longer-term outlook. The forecast anticipates that the state will grow a step behind the Midwest average and a few steps behind the nation over the extended forecast horizon. Over the next five years, employment in Illinois is forecast to increase 6.7%, below the 7.7% increase for the Midwest and 8.8% rise nationally.”

That translates into about 57,000 fewer jobs than if Illinois kept up with its Midwest peers, and about 120,000 fewer jobs than were it to keep pace with the nation.

The only viable solution to Illinois’ pension crisis starts with a constitutional amendment to allow for reductions in future benefit growth for current workers and retirees. A constitutional amendment filed in the General Assembly in 2020 – House Joint Resolution Constitutional Amendment 38 – would have done just that.

If passed, an amendment mirroring the expired HJRCA 38 would open the door for reforms such as the Illinois Policy Institute’s “hold harmless” pension reform plan, which would save the state roughly $2.4 billion the first year and more than $50 billion through 2045. The plan would also fully eliminate the state’s pension debt during that time.

Recent polling from the Paul Simon Public Policy Institute found 51% of Illinoisans support “an amendment to the Illinois Constitution that would preserve state retirement benefits already earned by public employees, but would also allow a reduction in the benefits earned in the future, whether by current or future employees.”

Pension reform that finally solves Illinois’ worst-in-the-nation crisis would benefit all Illinoisans by ensuring the state has as many good-paying jobs as possible for working families.