Moody’s: Chicago laggard in economic growth

A new report by Moody’s Investors Service details Chicago’s weak economic growth and increasing government-worker pension obligations.

Moody’s Investors Service’s Nov. 10 Chicago pension report foreshadows even more tax hikes for residents of the Windy City – over and above the record property-tax hike passed in October.

The rating agency found that under four different scenarios, Chicago’s statutory payment to its government-worker pension plans in 2030 will be three to nearly six times higher than its 2015 payment of $500 million. Without real pension and spending reforms, the City Council will continue to count on Chicagoans to fork over more of their incomes.

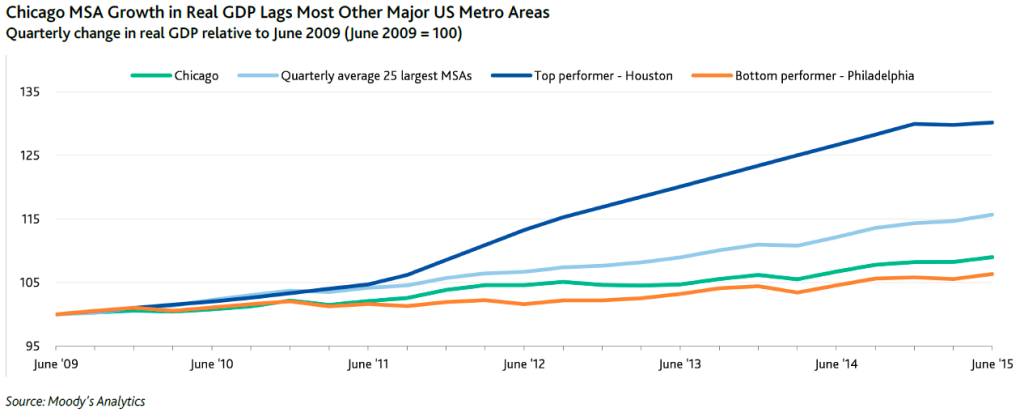

The report also contained more ominous news for Chicagoans. Chicago’s economic performance has significantly lagged those of its peers since the end of the Great Recession. That means fewer job opportunities and slower income growth for Chicago residents.

The Chicago Metropolitan Statistical Area’s, or MSA’s, real growth rate is up by just 9 percent since June 2009, below the 15 percent average real growth rate experienced by the country’s 25 largest MSAs.

Houston, the top performer in the nation, grew nearly 30 percent during that same time period. By contrast, Chicago only outperformed three regions – Philadelphia, St. Louis and Washington, D.C.

Chicago’s competitiveness will only worsen under the burden of the record tax hike that will draw more than $700 million a year from the private sector once the plan is fully rolled out by 2018.

And that’s what should really worry city officials. What happens when this economic growth cycle – as anemic as it may be – comes to an end? Chicago already lost 7 percent of its population from 2000 to 2010. More tax hikes and a weak economy will only accelerate the exodus to the suburbs and neighboring Indiana.

Instead of passing massive tax hikes, it’s time the city focused on real reforms that can help fix the pension crisis in the long run.

Positive reforms for the city include moving all new city employees into 401(k)-style plans, offering optional 401(k)-style plans to current workers, and freezing city employee salaries to shrink the growth in accrued pension benefits.

In addition, Chicago should end pension “pickups” for Chicago Public Schools, or CPS, teachers, under which CPS pays for a majority of its teachers’ required employee pension contributions as a special benefit.

And if all these reforms ultimately prove unsuccessful in slowing the growth of Chicago’s pension liabilities, the city should be given the option to declare bankruptcy.