Michigan has reversed the flow of interstate migration with Illinois

Illinois used to gain net population from Michigan, but data for recent years indicate that Michigan now gains more residents on net from Illinois.

Illinois once enjoyed an annual population boost from Michigan. But in Illinois’ downward economic spiral, migration between Illinois and Michigan has tipped to favor the faster-growing Wolverine State.

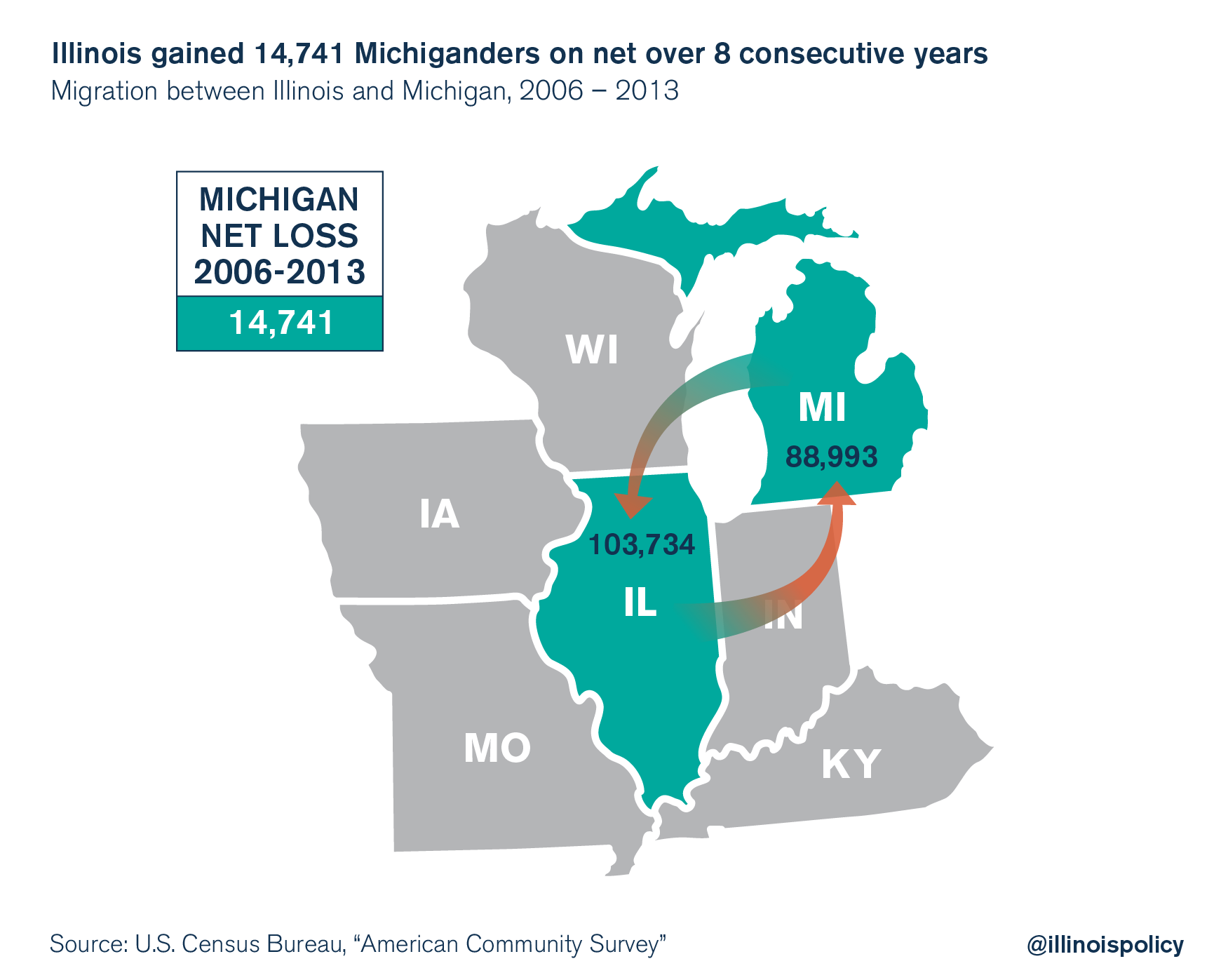

For eight of the past 10 years, Illinois gained population from Michigan, adding nearly 15,000 Michiganders, on net, from 2006 through 2013, according to data from the U.S. Census Bureau. The gains over those years largely coincided with the 2008 meltdown of the automotive industry during the Great Recession and Michigan’s ensuing economic crisis. This 15,000 net gain for Illinois – comparable to the population of Dixon – was a modest but valuable source of new residents at a time when the Land of Lincoln was losing population to most surrounding states.

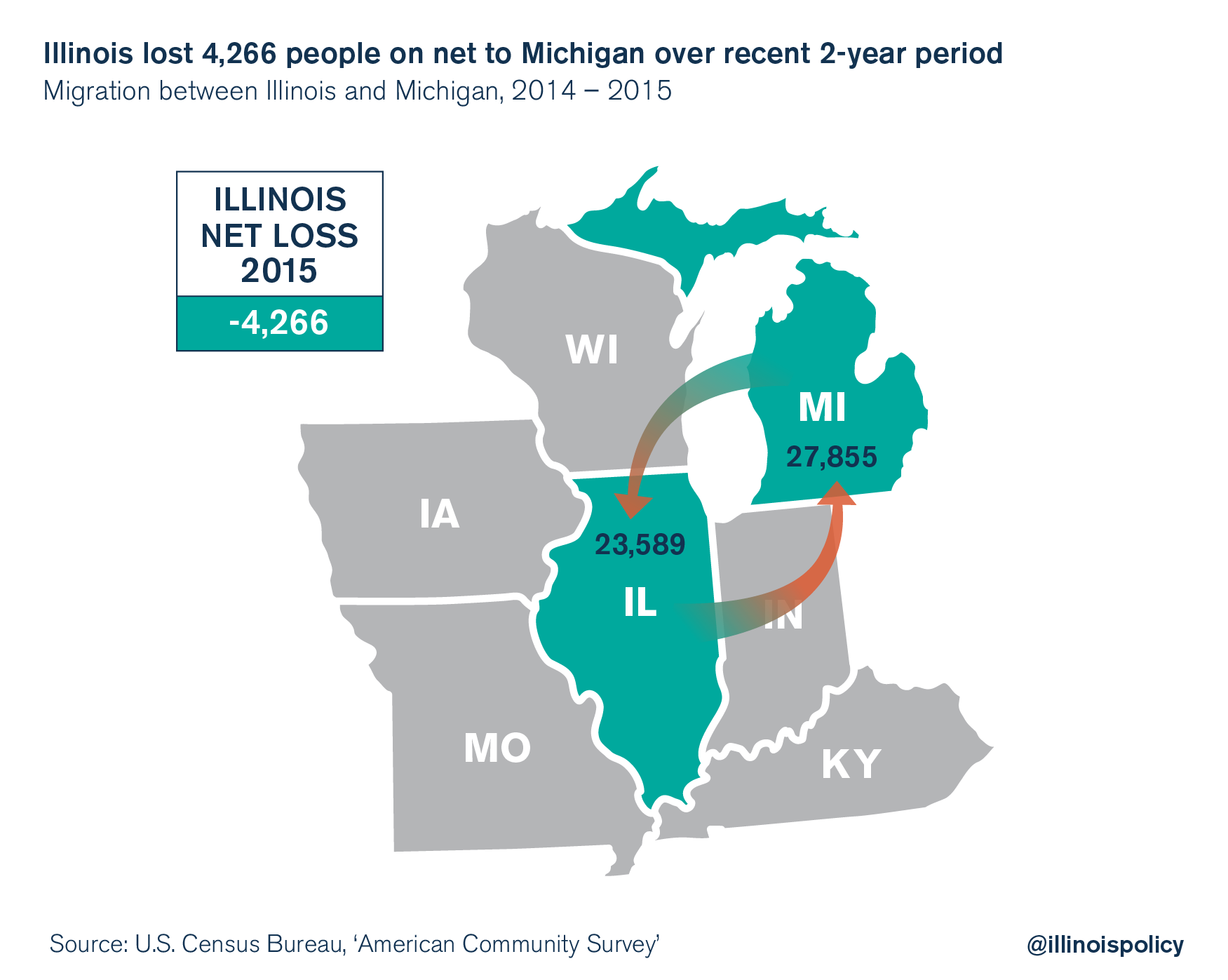

Foolish policy decisions in the Land of Lincoln and smart ones in the Wolverine State have in recent years helped reverse the flow of Illinois-Michigan interstate migration. Altogether, in 2014 and 2015, Illinois lost more than 4,000 residents, on net, to Michigan. This reversal is not a one-sided phenomenon: It’s the result of both fewer Michigan residents moving into Illinois and more Illinois residents moving into Michigan.

What explains this change? In general, Michigan has offered more opportunities and lower costs for families seeking work while Illinois’ economy has sputtered.

Michigan is more pro-growth and less expensive than Illinois

Michigan is seeing enhanced economic opportunity, which can drive new investment in the state. Michigan’s economic growth correlates both with the revival of the auto industry and with smart policy changes in the Wolverine State. Since enacting Right to Work in March 2013, for instance, Michigan has seen faster jobs and income growth than Illinois, which lacks Right-to-Work legislation. According to a 2016 Chief Executive Magazine survey, nine of the 10 best states for business had Right-to-Work laws.

Michigan is also beating Illinois in the competition for manufacturing jobs. That’s partly because Illinois’ highest-in-the-region workers’ compensation costs deter manufacturing investment. Workers’ compensation represents a major expense for manufacturers, so it’s in their interest to operate in states with lower costs. Compared with Illinois, Michigan’s workers’ compensation premium rates are roughly 30 percent lower.

A relatively lighter tax burden in Michigan also benefits both businesses and residents. Compared with Illinois, Michigan’s property taxes and corporate income taxes are each approximately 23 percent lower, and the state’s sales tax is about 31 percent lower than Illinois’ average combined sales tax rate. And while Illinois currently imposes a lower personal income tax than Michigan, the Illinois Senate is fighting to raise both corporate and personal income taxes to levels above Michigan’s rates.

Moreover, unlike in Illinois, Michigan policymakers have succeeded in reducing the strain of cost drivers – such as public pensions for policymakers and their staffs – on the state’s budget, which minimizes the need to raise taxes while making the state more sustainable in the long term.

Although Michigan’s economy would stand to gain even more from additional policy improvements, it is still faring far better than Illinois’. In fact, from December 2012 through December 2016, Michigan experienced the strongest jobs growth in the region at 7.4 percent, compared with Illinois’ 3.9 percent, the worst in the region. Michigan also added 2,500 manufacturing jobs in 2016, while Illinois lost 11,000.

Making Illinois more competitive

Illinois is accustomed to losing net population to its neighboring states, but it hasn’t always lost to Michigan. This about-face should sound the alarm for Illinois policymakers, who must admit that structural, pro-growth reforms are needed to improve the state’s economy and prevent its descent into insolvency.

Commonsense policy changes, such as reforming workers’ compensation to bring costs more in line with those in other states and enacting Right to Work, would make Illinois more fertile for jobs growth. Similarly, lawmakers should make Illinois a more affordable place to call home by implementing a property-tax freeze to protect home values and boost the housing market, as well as fixing cost drivers – such as government-union collective bargaining and pensions – that trigger perennial calls for tax hikes.

Illinois is clearly on the losing end of the ongoing “border wars” for industry and population, and state policymakers shouldn’t stand idly by as the state digs itself deeper into obsolescence.