Madigan’s plan: Reduce wages and standard of living for Illinois’ middle class

Madigan’s stated concern for the middle class rings hollow given that his own plan to boost the state’s fiscal health consists solely of income-tax increases, which would directly reduce the wages and standard of living for Illinoisans.

Illinois House Speaker Mike Madigan, D-Chicago, has repeatedly claimed that he opposes regulatory reforms and spending reforms because he says they would “drive down middle-class wages and the standard of living.” The first problem with Madigan’s statement is that it is directly refuted by evidence: States that have enacted similar regulatory and spending reforms, such as Indiana and Michigan, have since seen stronger jobs growth and better income growth than Illinois has experienced. Second, and more importantly, Madigan’s stated concern for the middle class rings hollow given that his own plan would directly reduce the wages and standard of living for Illinoisans by raising their taxes.

Madigan most clearly summarized his economic policy position in a speech before the City Club of Chicago in December 2015. In his remarks, Madigan proposed raising income taxes to pay for increased government spending. After overseeing terrible jobs growth and massive out-migration from Illinois for decades as House speaker, the only fix Madigan has come up with is to raise taxes.

Contrary to what Madigan claims, tax hikes are the primary way Illinois politicians have been driving down wages and the standard of living for Illinois’ middle class. That’s because the most direct way the government can reduce the take-home wages and the standard of living of the middle class is to increase taxes on this group.

When the government takes an additional $1,000 in annual taxes from a family’s pocketbook – as happened to the median Illinois household after the 2011 income-tax hike – that family’s annual wages and standard of living are reduced by $1,000 per year. And when property taxes grow more than three times faster than household income, as they have in Illinois since 1990, this further erodes the middle class’ standard of living.

And that’s only considering the most direct effects of tax hikes. According to economic research, tax hikes decrease the economic growth that would otherwise occur. Specifically, the work of Christina Romer, President Barack Obama’s former chair of the Council of Economic Advisers, shows that tax hikes have “strongly significant, highly robust” dampening effects on economic growth because of the negative effect taxes have on investment.

So Illinois families would be hurt twice by Madigan’s plan:

- First, their take-home wages and standard of living would be reduced by the amount of the tax increase.

- Second, Illinoisans would find fewer job opportunities available in Illinois because of reduced economic growth.

And here’s Madigan’s proposal: a massive tax hike with no economic reforms to foster jobs growth or government spending reforms. Madigan’s plan would reduce the wages and standard of living for all Illinois taxpayers by cutting their take-home salaries and reducing economic growth in Illinois. The Madigan approach wouldn’t even offset that tax pain with regulatory reforms to improve economic growth, or with the responsible spending plan Illinoisans need for a brighter future.

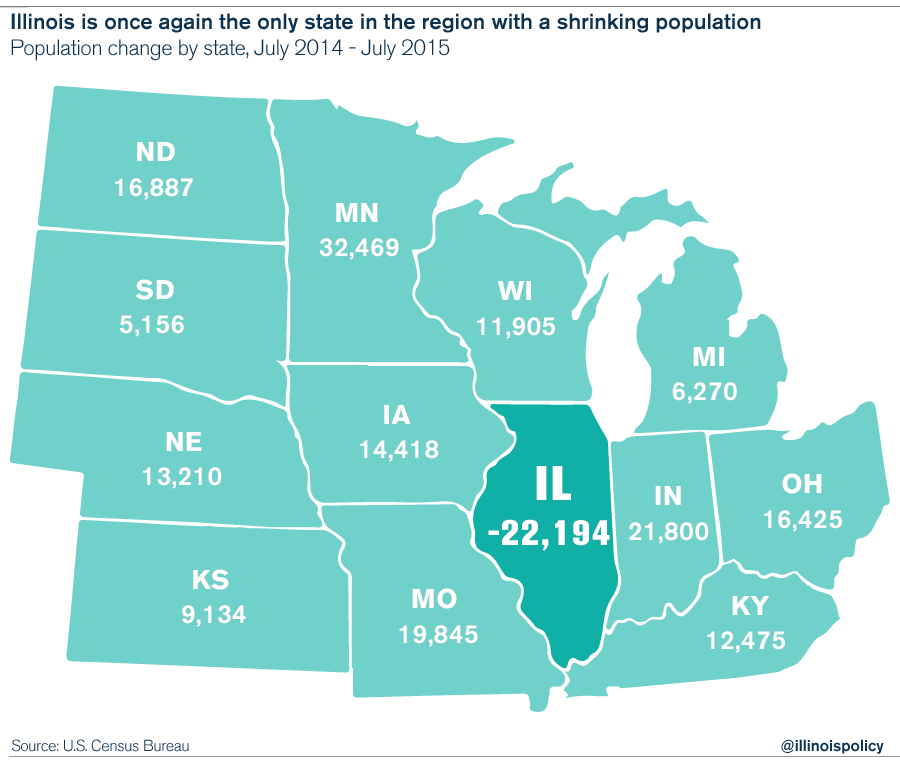

Employers and investors have long steered clear of Illinois due to the state’s precarious finances and mountains of regulatory red tape. Those job creators would continue to avoid Illinois, and companies currently in Illinois would have even more reasons to pick up and move elsewhere. It’s already underway. Illinois’ out-migration is currently at record levels – the Land of Lincoln loses more than 100,000 residents to other states each year, on net, leaving Illinois as the only state in the Midwest with a shrinking population.

Madigan appears to believe the higher taxes that result in less economic growth will help raise the standard of living for Illinois’ middle class. And Madigan thinks that lower taxes, which lead to more economic growth, would reduce the wages and standard of living for Illinois’ middle class.

Madigan has it exactly backward.

After decades as speaker of the House of Representatives, Madigan himself described Illinois’ situation:

“Put it all together and Illinois is awash in debt.”

One could add “with terrible jobs growth, a declining standard of living, and a middle class that is fleeing the state” to get the full picture of the accumulated effects of decades of Madigan’s favored policies.

Illinois politicians should realize that every time they raise taxes, they are reducing the wages and standard of living of Illinoisans. The 2011 income-tax hike was a direct attack on Illinois’ middle class. Chicago’s massive property-tax hike and Cook County’s huge sales-tax hike inflict still more damage on the middle class in the most populous area of the state. A 2017 income-tax hike would be the same thing – more economic pain, less take-home pay, and a lower standard of living for all Illinoisans.

At a minimum, Illinoisans should be able to expect their political leaders to enact substantial reforms both to contain government spending and to encourage jobs growth so that residents can look forward to a better standard of living and a more prosperous future.