Lightfoot can’t fix Chicago’s finances without pension reform

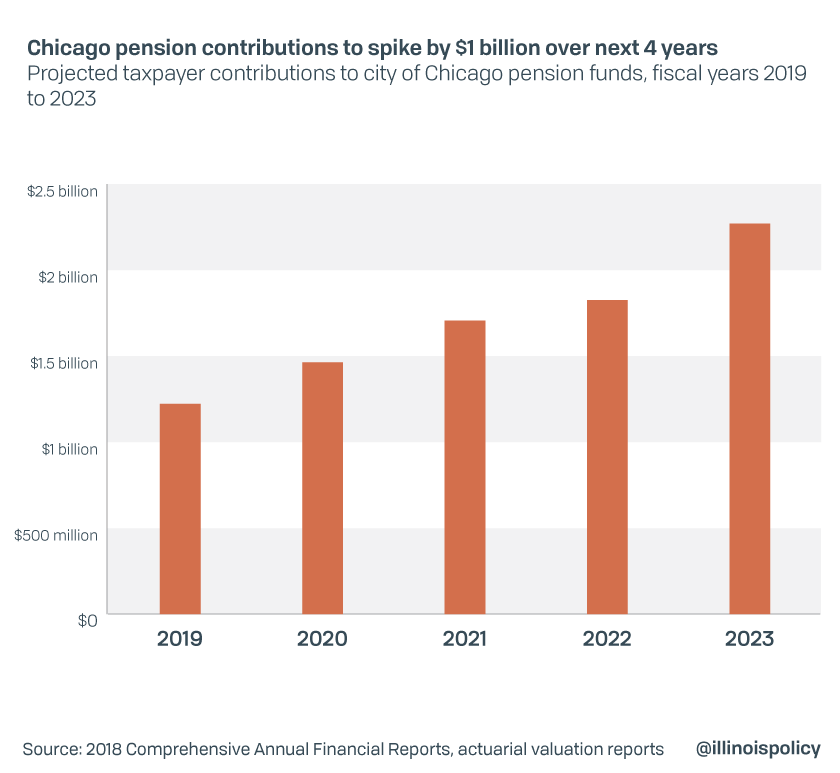

City pension contributions are set to spike by $1 billion over just four years. Taxpayers cannot afford the entire burden of fixing city finances.

Chicago Mayor Lori Lightfoot is looking down an $838 million budget hole, with no easy options to fill it in her first year in office. While her predecessor also stared down massive fiscal problems, former Mayor Rahm Emanuel embraced the right solution as he headed out the door: a constitutional amendment to enable structural pension reform.

So far, Lightfoot has focused mostly on asking Springfield for authority to hike various taxes and fees to raise revenue. She has also released plans to raise additional revenue through taxes and fees she can raise on her own. Examples of new revenue proposals include tripling ride-sharing fees into or out of downtown Chicago, increasing taxes on certain commercial real estate sales and a publicly owned casino.

Lightfoot has said she is willing to look for ways to control spending as well, although options are limited. Debt service, personnel costs and pensions account for most of Chicago’s budget, and it would be nearly impossible to achieve significant savings without confronting them.

The mayor is looking at expensive perks in labor agreements and at letting some staffing positions go unfilled, according to the Chicago Sun-Times. She should also follow Emanuel and push to amend the Illinois Constitution to allow structural pension reform.

Research from the Illinois Policy Institute shows how an amendment that protects pension benefits already earned but allows changes to the future growth rate of benefits can enable thoughtful and balanced pension reform. Public pension systems can be fixed in a way that protects both retirees and taxpayers.

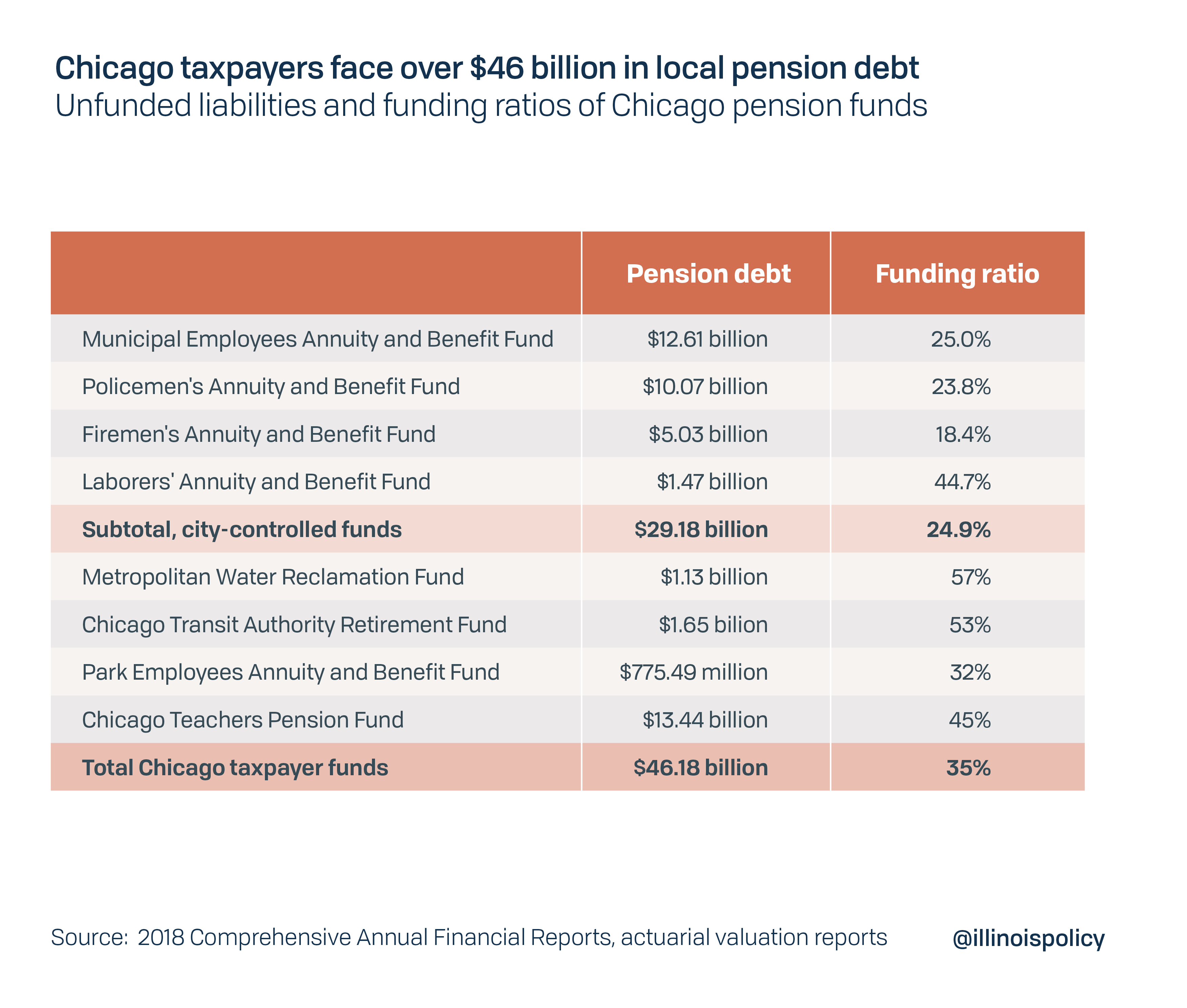

Pension debt is the single biggest financial issue facing the city of Chicago and its taxpayers. In fact, Chicago has more total pension debt than 44 U.S. states at over $46 billion.

Cumulatively, Chicago pension systems have a funding ratio of just 35%. In other words, if benefits continue to grow as projected, funds financed by Chicago taxpayers will only have 35 cents on the dollar to fund promised benefits. Experts generally recognize that a funding ratio of less than 60% means a plan is “deeply troubled,” while 40% may be a point of no return after which funds might never be able to pay off their debts without structural changes. If the pension funds ever do become insolvent, city leaders could face the difficult choice of further cutting services to pay pensions or seeing pensioners get less than they’re owed.

The mayor has previously acknowledged that as much as one-third of this year’s budget deficit is due to increases in pension contributions. But the problem goes far beyond a single year deficit. Even if Lightfoot were able to close this year’s deficit mostly with tax and fee increases, pensions would continue to blow holes in city budgets every year for her initial term in office. In fact, during the next four years, contributions are set to increase sharply each year so that by fiscal year 2023, pension payments will be more than $1 billion higher than they are today.

Fixing the pension crisis is essential to closing Chicago’s multi-year structural budget deficit. Without pension reform, city leaders are likely to continue to look for more taxes to raise on a tax base that cannot afford it.

Chicago taxpayers were recently subjected to $864 million in annual tax hikes during Emanuel’s administration. Included in that were $543 million in property tax hikes, $174.1 million in higher water and sewage taxes, and $147.1 million from an increase in the emergency 911 call fee. While these tax hikes were sold largely as a fix to the pension system, they have failed to solve the underlying problem of pension benefits that are more expensive than taxpayers can sustain.

This high tax burden has contributed to four straight years of population loss for the city. Illinois already has one of the most punishing total tax burdens in the country, and this is the No. 1 reason residents cite for wanting to leave the state.

While Lightfoot has said she would rather not raise property taxes again, she has also said it could be her only option without help from Springfield, according to the Sun-Times. But help from Springfield should not just come in the form of more taxing authority.

Previously, Emanuel successfully lobbied Springfield for modest pension reforms to the municipal and labor systems. Unfortunately, these reforms – as well as reform to the park district pension system that does not directly affect the city budget – were struck down as unconstitutional by the Illinois Supreme Court.

The interpretation of Illinois’ pension clause by the high court prevents any pension reform for existing employees and retirees, either for benefits already earned or to the future growth rate of unearned benefits.

Currently, employees in the municipal and laborers systems hired before 2011 receive 3% compounding annual increases. While often described as cost of living adjustments, these increases are more appropriately called permanent benefit increases because they are not tied to inflation. Police officers and firefighters both receive lower non-compounding annual adjustments.

To fix city finances without more harmful tax hikes, Lightfoot should endorse and lobby for a constitutional amendment to allow changes to future, not-yet-earned benefits. Reforms that could be implemented as a result include modifying automatic annual increases so they are pegged to inflation, increasing retirement ages for younger workers, placing a cap on the maximum pensionable salary and suspending annual cost of living increases in certain years for some employees to allow inflation to catch up to past benefit growth.

Lightfoot ran as a reform candidate willing to challenge business as usual. To fully live up to that promise, she must be willing to tackle the city’s biggest public policy problem. Without major structural changes to the pension systems, city taxpayers face a future in which they are asked to pay ever more in taxes while city services are crowded out by the growing burden of a broken, unsustainable pension system.