Lightfoot asks Springfield for progressive ‘exit tax’ on Chicago property sales

Chicago Mayor Lori Lightfoot wants state lawmakers to let her impose progressively higher real estate transfer tax rates to close a $838 million budget deficit. She faces a limited time window and resistance from state lawmakers.

Chicago Mayor Lori Lightfoot says she either needs authority from Springfield to impose a progressive “exit tax” on high-end home sales, or a property tax increase on all city residents could be underway.

She only has Nov. 12-14 to get that OK from state lawmakers before they adjourn for the year. Chicago Democrats are part of the opposition.

Chicago’s $11.65 billion budget has an $838 million deficit that Lightfoot is trying to fill with a host of new tax proposals: She plans to triple the tax on solo ride-share trips in downtown Chicago to generate $40 million, double the “restaurant tax” on dining out downtown to raise $20 million and impose a progressive real estate transfer tax, which is estimated to generate $50 million during 2020 and $100 million a year thereafter.

Chicago currently charges a 0.75% tax on real estate transfers, although the total rate is 1.2% by the time the state, county and transit authority add their own transfer taxes. Lightfoot’s plan would charge progressively higher city tax rates on real estate transfers:

- 0.55% for sales under $500,000

- 0.95% for sales between $500,000 and $1 million

- 1.5% for sales between $1 million and $3 million

- 2.55% for sales over $3 million

Democratic state representatives holding up Lightfoot’s plan in Springfield say they’d prefer to generate even more from the tax. They want to generate $86 million for affordable housing by applying the 1.5% rate to sales over $750,000 and charge 4% on sales over $10 million, according to Crain’s Chicago Business. Those rates would apply to both residential and commercial properties.

The Chicago area’s population has declined for each of the past four years. Rather than taxing the residents who decide to flee or raising property taxes on the homes of those who stay, Lightfoot should get at the foundation of the problem: unaffordable growth of public pension costs.

Her predecessor, former Mayor Rahm Emanuel, at the end of his term came out in support of constitutional pension reform.

A smart amendment to the Illinois Constitution’s pension clause would protect workers’ already-earned pension benefits but allow for changes in the growth of future benefit increases – such as replacing automatic 3% annual raises with a real cost-of-living adjustment tied to inflation. “There is nothing progressive about 3% compounded raises for retirees and furloughs for workers,” Emanuel said.

His backing came after he tried to fix city pensions in 2015 with the largest property tax hike in city history, a $543 million boost that was part of a total package of tax and fee hikes totaling $864 million a year. The plan didn’t work, and left Lightfoot with limited or unpopular options for taxing her way out of the current budget deficit.

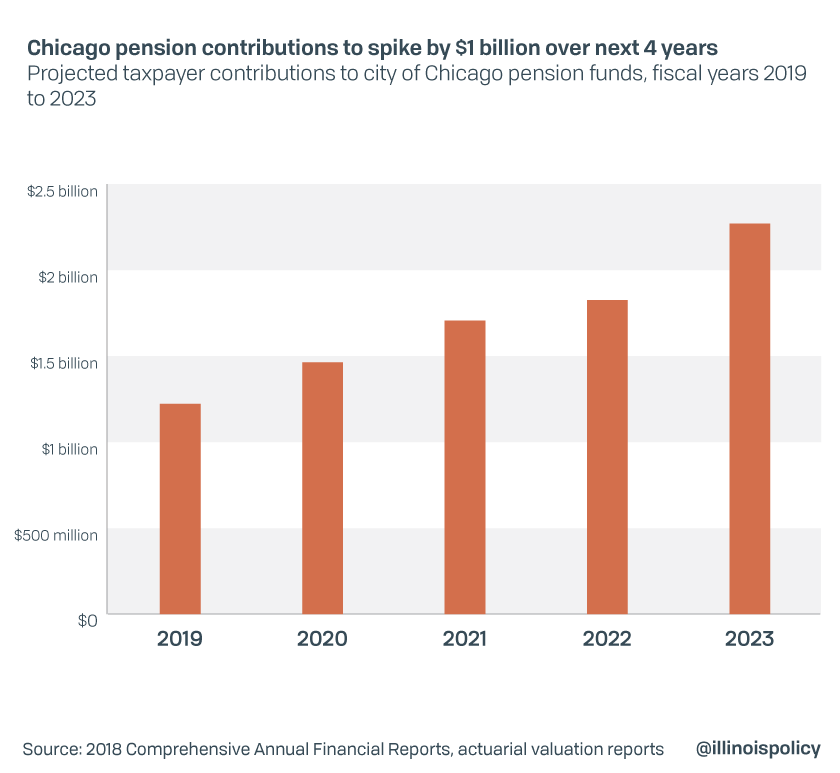

Lightfoot inherited four city pension funds that are over $29 billion in debt and are only 25% funded. In total, Chicago taxpayers are responsible for eight public pension systems that are $46 billion in debt, with payments expected to escalate by $1 billion during the next four years.

Emanuel couldn’t tax his way out of the pension hole. Lightfoot won’t be able to, either, especially with another $1 billion in future payments pressing down on her.

Rather than spending her time and political capital trying to get Springfield to let her tax Chicagoans’ exits, threatening higher property taxes or floating any other tax hike destined to fail, Lightfoot needs to reach the same epiphany that Emanuel did. She needs to ask state lawmakers to pursue a constitutional amendment that allows for control of future pension growth – a reform that would improve government finances in Chicago, in Springfield and in every corner of Illinois.