Lang tax plan would push top overall tax rate for small businesses to over 50% in Illinois

Lang’s progressive-tax proposal would hit successful small businesses, which account for 72 percent of all small-business income in Illinois.

Illinois could become one of only four states where small businesses would face an overall top tax rate of over 50 percent – a major disincentive to expanding or starting up in Illinois – if politicians vote to enact state Rep. Lou Lang’s progressive-tax plan.

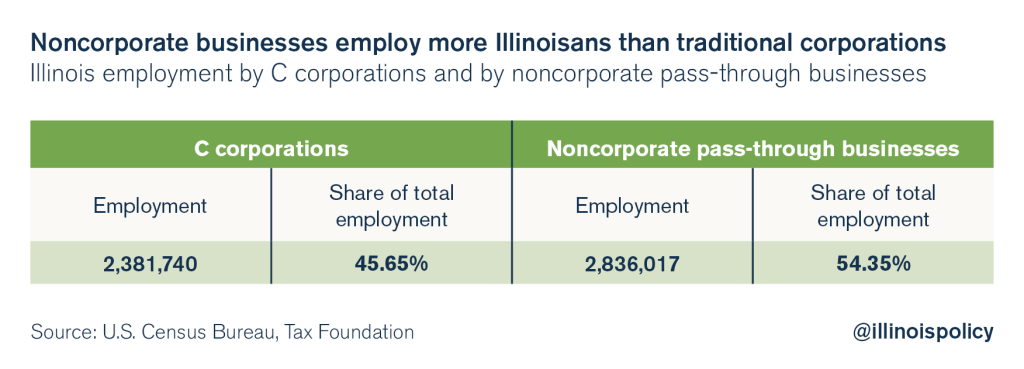

Noncorporate businesses, often simply referred to as small businesses, provide a majority of employment in Illinois, according to data from the U.S. Census Bureau, as compiled by the Tax Foundation. While traditional C corporations employed 46 percent of Illinois workers in 2011, noncorporate “pass-through” businesses employed 54 percent of Illinois workers.

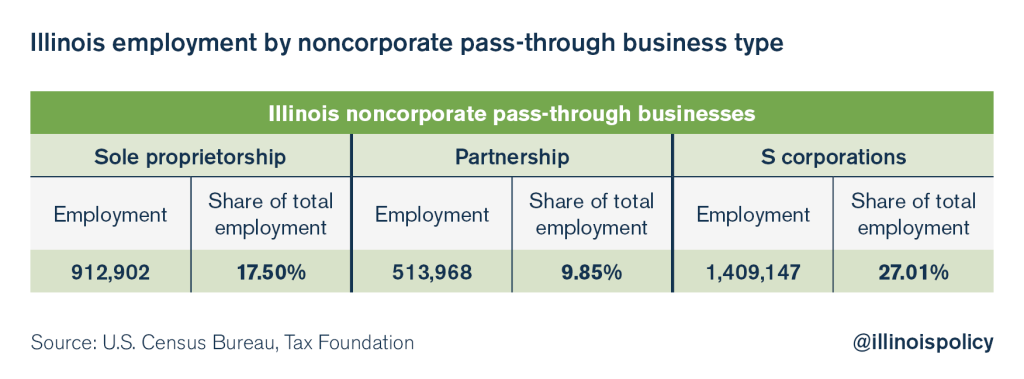

Viewed from the federal level, noncorporate businesses are composed of sole proprietorships, partnerships and S corporations. All limited liability companies (commonly referred to as LLCs), which are state-level creations, fall into one of these categories. These are called “pass-through” businesses because the income they earn passes through to the individual owners, who then pay taxes on it. These businesses create the majority of Illinois jobs.

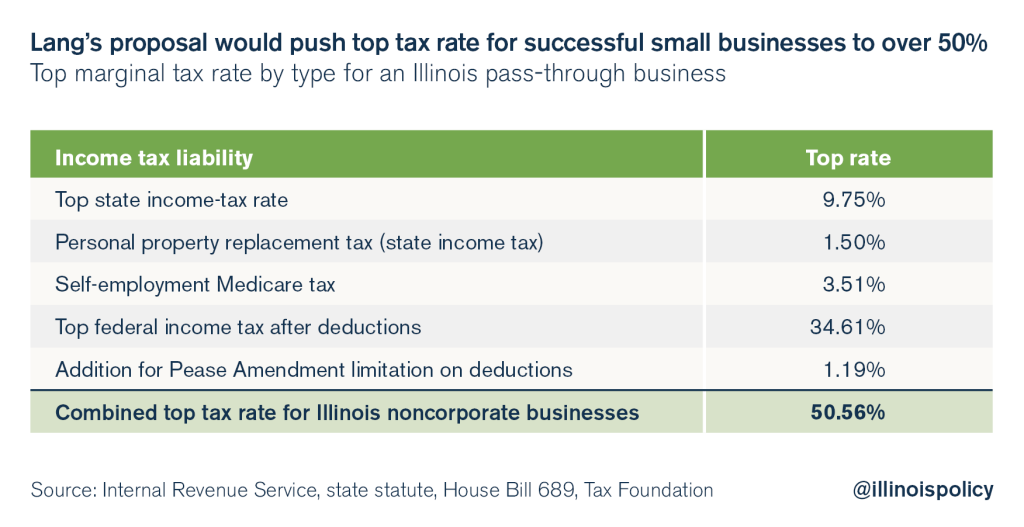

Lang’s proposal would raise the top overall tax rate faced by these businesses to 11.25 percent from a current level of 5.25 percent (3.75 percent individual income tax plus a 1.5 percent personal-property-replacement-tax, or PPRT, business tax). This would make Illinois one of only four jurisdictions in the U.S. where successful small businesses face income-tax rates as high as 50 percent.

The top tax burden under Lang’s plan would consist of:

- 11.25 percent at the state level (Lang’s 9.75 percent plus 1.5 percent PPRT)

- 3.51 percent Medicare tax

- 34.61 percent federal income tax (39.6 percent minus deductions for state and Medicare taxes)

- 1.19 percent addition due to Pease Amendment limitation on deductions

Illinois small businesses would face a top rate of 50.56 percent.

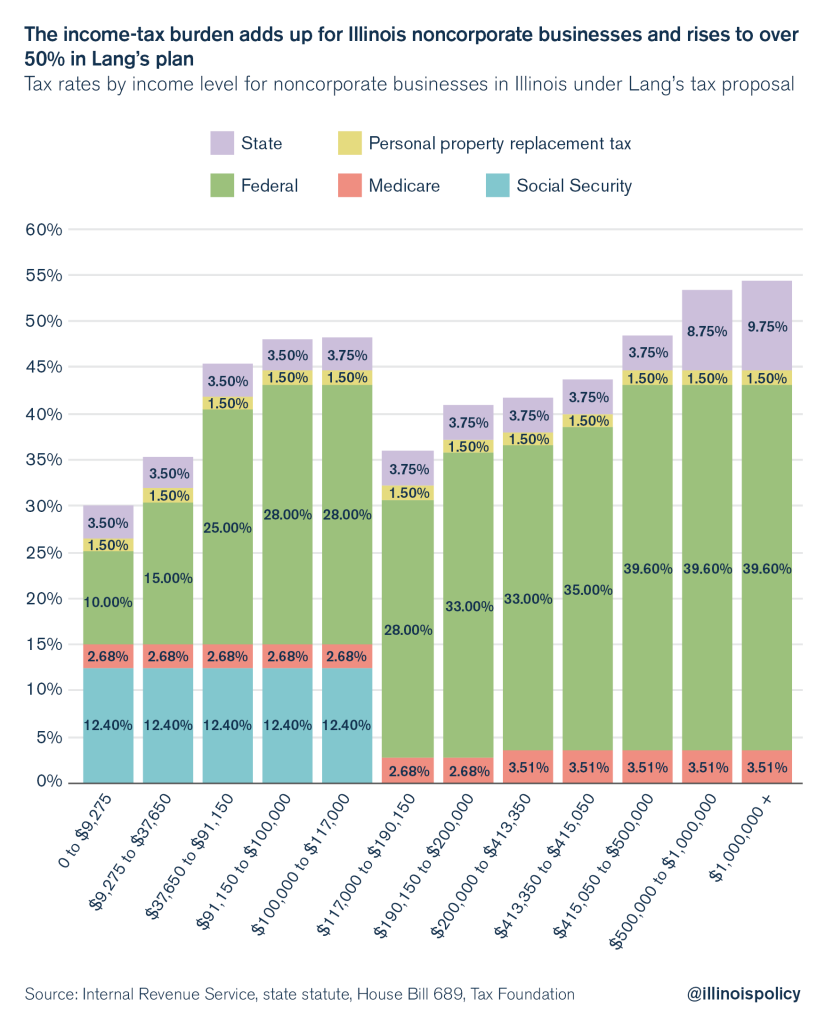

The combined state and federal income-tax burden is already heavy for noncorporate businesses, and if Lang’s proposed rates kick in the tax burden would break over 50 percent for a noncorporate business in Illinois.

(Note: The federal rates shown here are not reduced by state and Medicare tax deductions)

Noncorporate businesses that would pay these top rates are not just small contributors to the Illinois economy. Successful small businesses that would be hit by the Lang tax proposal account for 72 percent of all noncorporate business income in Illinois.

There are already more than enough disincentives that keep businesses from growing in Illinois, especially small businesses in the manufacturing and industrial sectors. Pushing the top tax rate to over 50 percent is one more mistake Illinois politicians shouldn’t make.