Land of 1,000 shrinking communities

Illinois’ lost people problem spreads to more than 1,000 communities in 2018

Illinoisans already knew the state shrank for the fifth consecutive year, then they learned all the large metro areas shrank – but now come estimates for all communities showing 80% lost people.

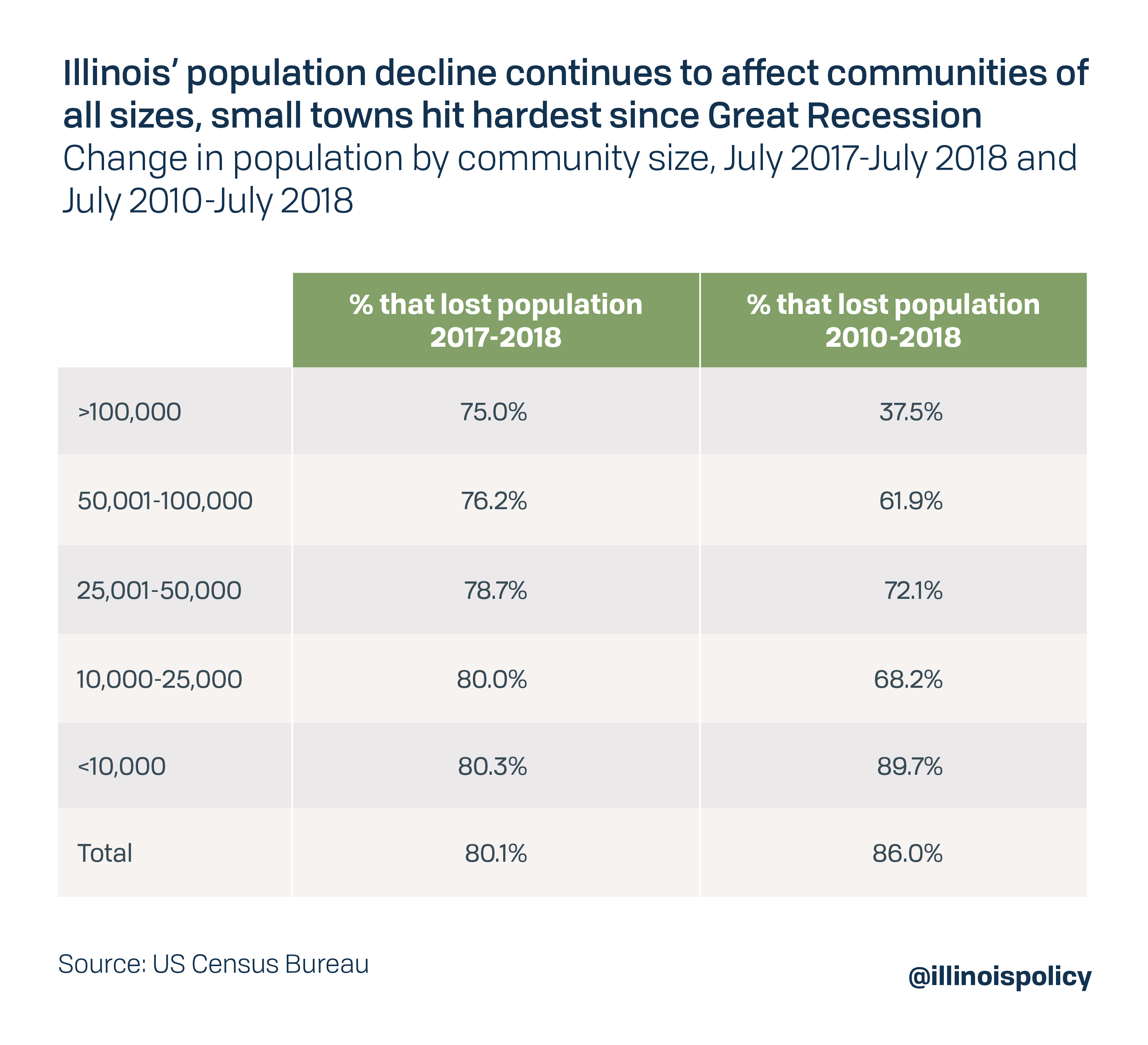

Data released on May 23 by the U.S. Census Bureau show 1,040 Illinois communities shrank from July 2017 to July 2018, with population decline affecting communities of all sizes relatively equally during the year.

This comes after census data in April revealed for the first time all of Illinois’ metropolitan areas experienced population decline, driven almost entirely by Illinoisans moving to other states. The start of the bad news was in late 2018, with data showing Illinois’ population shrank for the fifth consecutive year between 2017 and 2018.

With a declining population and Gov. J.B. Pritzker lobbying for nearly $7 billion in new taxes and fees, Illinoisans can expect to see a decline in private demand, fewer investments and fewer work opportunities. Economic growth in Illinois is sure to stall.

This is also bad for the state’s finances, because lawmakers are anticipating increased revenues to finance more spending, even though a slowing economy and shrinking population will likely result in lower revenue than projected.

Proponents of a progressive income tax – whose rates have not been passed – are projecting it will bring in more than $3 billion in new revenue. But those estimates rely on strong economic growth and population remaining at the 2016 level, though the state has continued shrinking since then.

Illinois cities are losing population

Since 2010, large cities have been bleeding residents at a slower rate than smaller communities. That trend is disappearing.

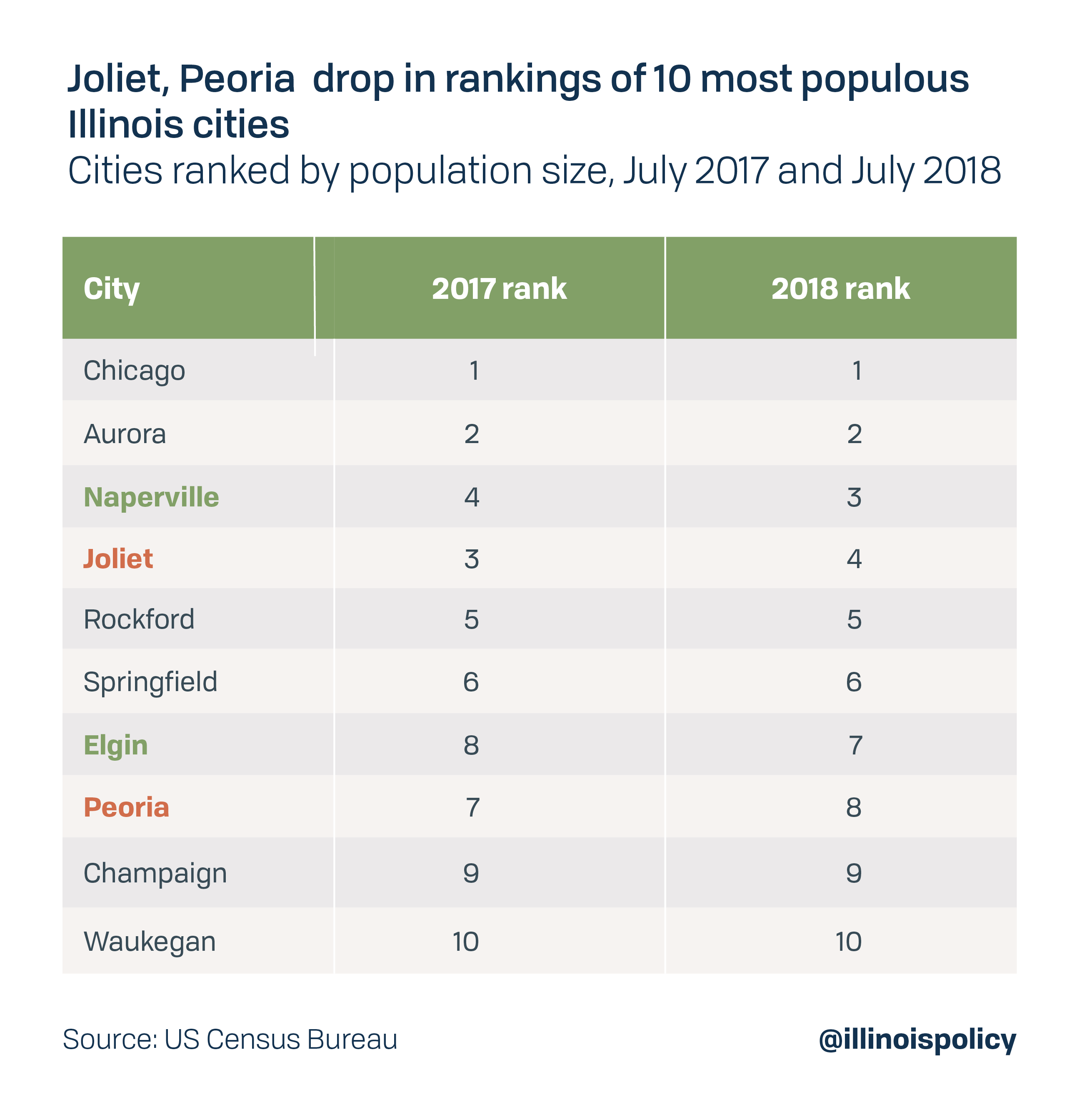

Population decline also caused some changes in the rankings of Illinois’ largest communities.

Joliet slipped from 3rd to 4th in 2018, being overtaken by Naperville. Peoria dropped from 7th to 8th in 2018, being overtaken by Elgin. While the change in Joliet and Naperville’s rankings came from growth in Naperville outpacing Joliet, the change with Peoria and Elgin was the result of a greater population decline in Peoria than Elgin.

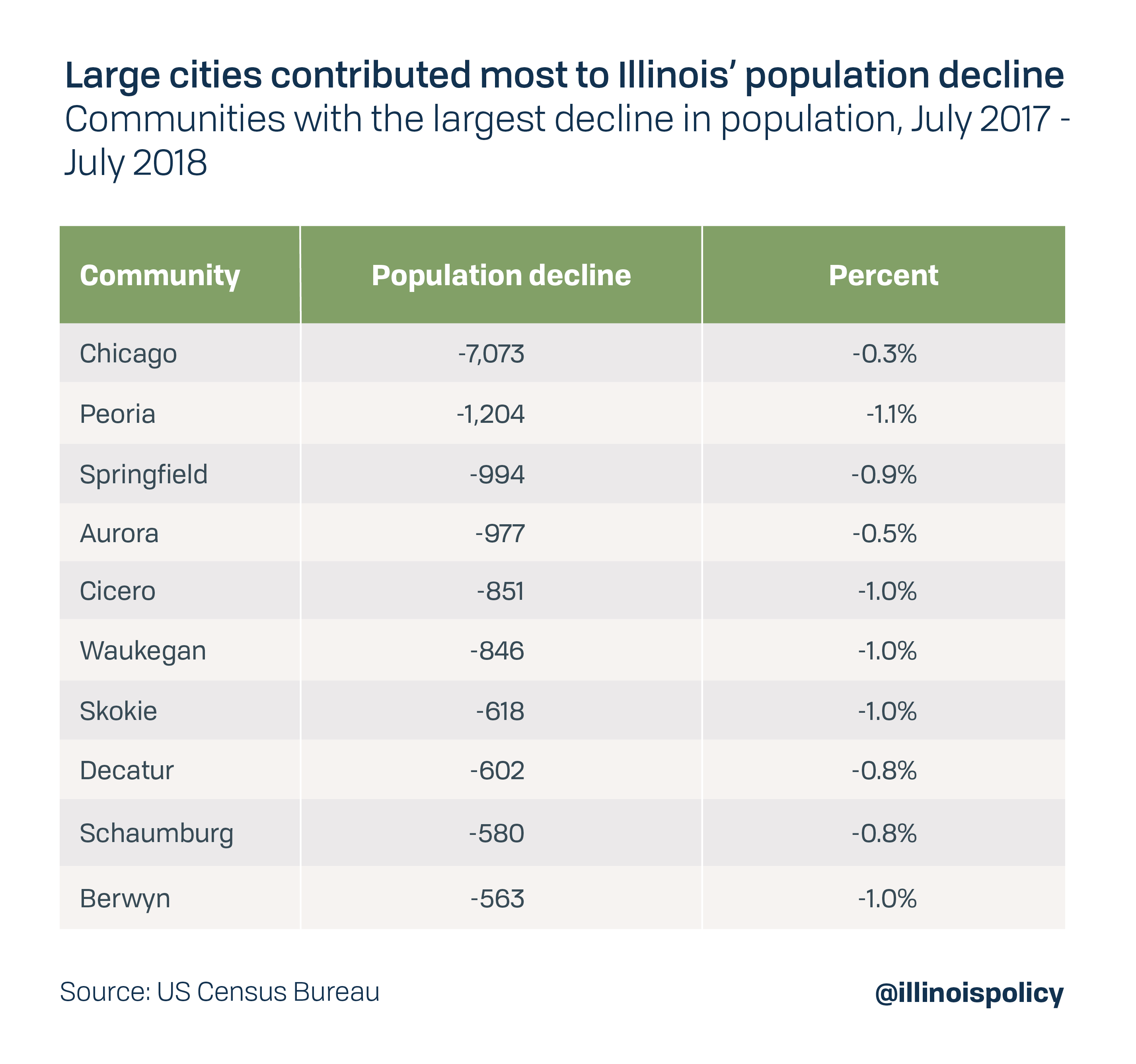

Illinois’ largest cities were also some of the biggest population losers in 2018.

Chicago experienced the largest population decline in the state, losing more than 7,000 residents on net, followed by Peoria, Springfield and Aurora, all of which lost about 1,000 residents.

Job prospects contributing to population decline

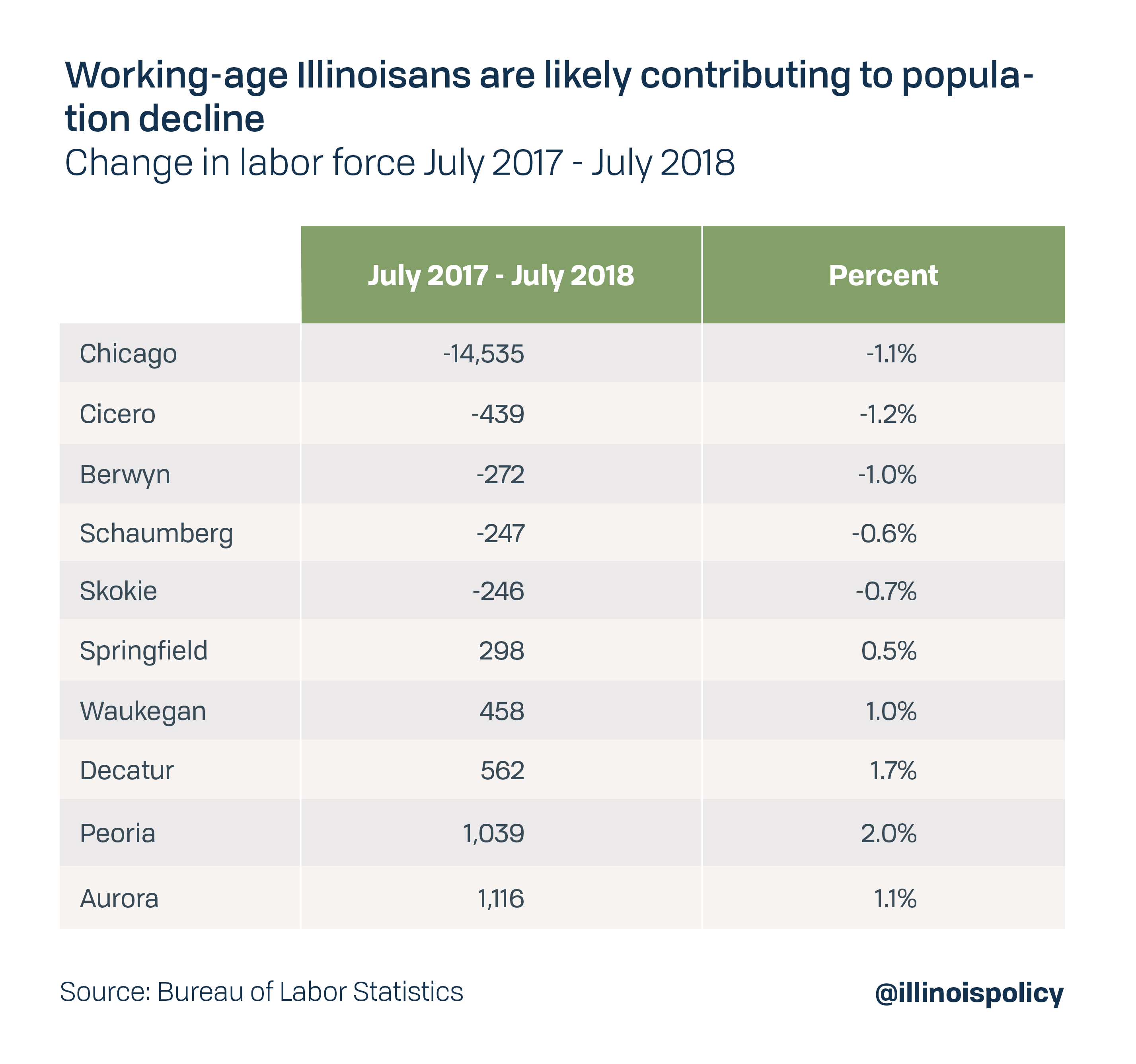

IRS data shows the primary driver of outmigration, and thus population decline, has been Illinois’ lagging labor market.

In the cities experiencing the largest population decline in Illinois, working-age individuals appear to be the ones headed for the exits, as the labor force is often also shrinking.

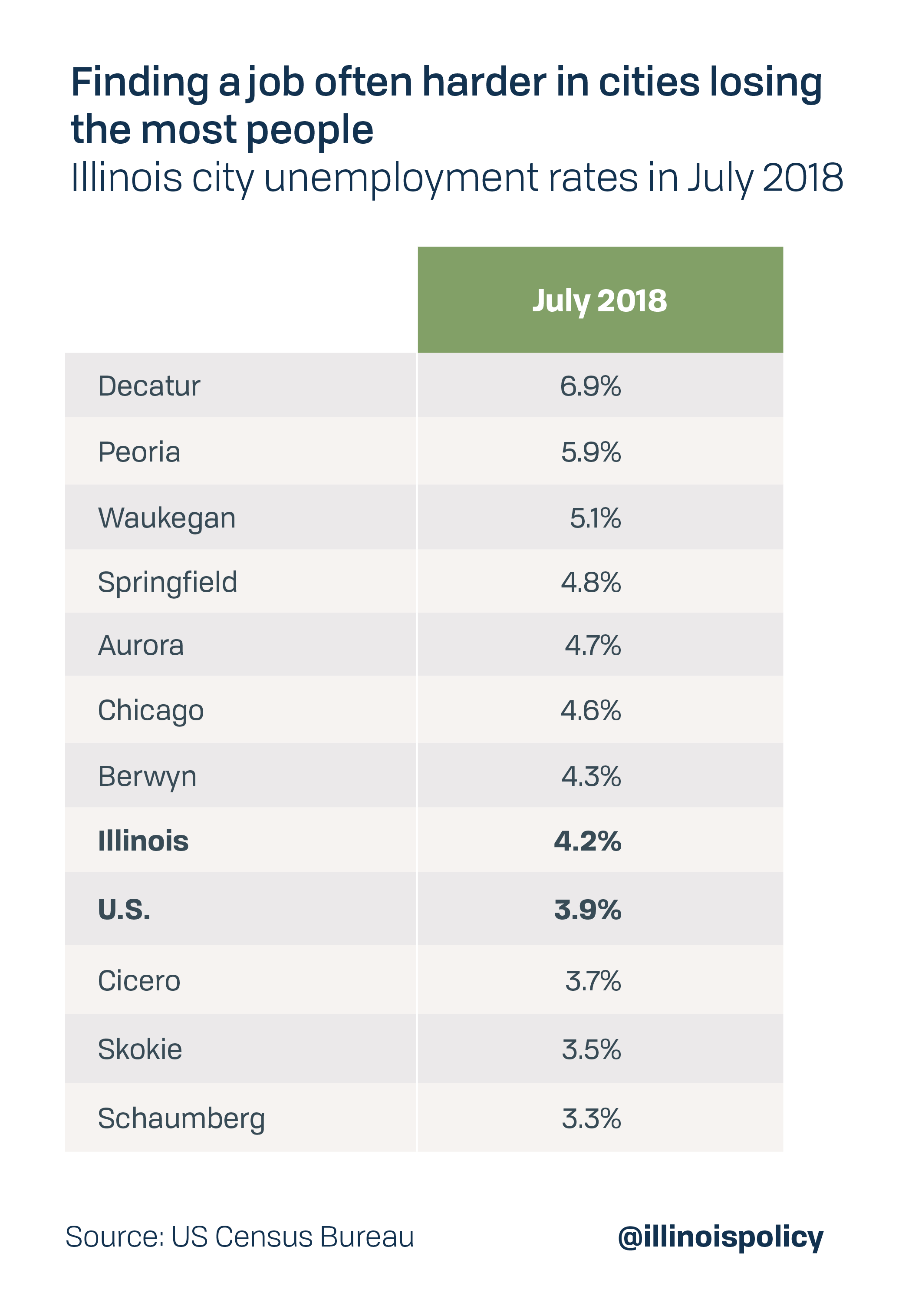

With a shrinking population and declining labor force, it is unlikely many businesses will have much incentive to invest or create jobs in these communities. It is unsurprising that many of these cities experience greater unemployment rates than the state or national averages.

Unfortunately, the state’s shrinkage may get even worse, as the 2017 tax hike will continue to hurt the Illinois economy. By costing the state thousands of jobs and billions of dollars in economic activity, the recent tax hike made the state less attractive for families looking to plant roots. State lawmakers cannot continue to rely on tax hikes if they want families to choose Illinois.

Reversing the trend: Illinois should rein in spending while protecting core services, not hike taxes

Illinois state lawmakers have the opportunity to give residents a more prosperous future through policy reform. But what kind of reform should a shrinking state pursue?

One clear mistake, given the state’s people problem, would be scrapping Illinois’ constitutionally protected flat income tax.

Americans are fleeing high-tax, progressive income tax states for more competitive tax environments. These states have also been the most successful at creating jobs, which has been a sore spot for the Illinois economy.

A progressive income tax will only aggravate Illinois’ outmigration crisis. Illinoisans – and particularly those on whom Pritzker wants to raise taxes – are already leaving at a record pace.

The tax hike approach was already tried: first in 2011 with a temporary income tax hike; again in 2017 with a permanent tax hike. Both failed to address growing deficits and increasing pension debt. Now with Pritzker’s progressive income tax proposal, the state is considering raising taxes on small businesses, subjecting them to one of the highest tax rates in the nation. The tax would make it even harder for struggling Illinoisans to find a job. Then it won’t just be the wealthy who head for the exit: middle-class job-seekers will continue their exodus, too.

Instead, lawmakers should focus on the only solution that will create solvency for both taxpayers and the state pension systems: reining in government spending through a spending cap to provide certainty about future government spending and help avoid tax hikes as the only way to balance the budget. A spending cap constitutional amendment has already earned support from Senate Democrats this year.

Controlling pension costs is a critical component of holding down spending. Pension obligations, which state estimates put at $133 billion and independent analyses peg at as much as $250 billion, are one of the largest cost drivers of government spending and now eat up more than a quarter of the state budget. This means Illinoisans are paying more for government worker retirement costs, and fewer dollars are available for the services they expect. Despite paying billions of dollars a year into the state retirement systems, these funds are becoming less solvent over time, as returns on investment are frequently below their projected targets, and 3 percent compounding benefit increases outpace inflation.

An amendment to the Illinois Constitution that protects already-earned pension benefits, but allows for slower growth in accrual of future benefits – such as a true cost of living adjustment tied to inflation – would help to reduce the state’s pension debt and assure retirees that the pension they have been promised will always be there, without a reduction to current benefits. This amendment is part of the Illinois Policy Institute’s five-year plan to balance the state budget, pay down debt and provide a path to tax relief.

Instead of further tax hikes on Illinois families and businesses, as Pritzker is proposing, state lawmakers must bring spending down to a level taxpayers can afford. Only then can Illinois foster a friendlier business environment that encourages investment and job creation – making the state a place families want to move to instead of from.