Lake County homeowners: Where do your property taxes go?

In 2017 alone, Lake County billed homeowners $1.8 billion in property taxes. Owners of a median-valued home in Lake Forest received a $13,600 property tax bill.

Illinoisans shoulder some of the heaviest state and local tax burdens in the country. And increasingly, property taxes are weighing down this massive load. Between 2008 and 2015, for example, property tax bills grew six times faster than household incomes.

But homeowners in Chicago’s collar counties get hit especially hard. The highest median property tax rates in the state can be found in these counties. But no one has felt the squeeze like Lake County households, whose property tax bills rank highest in Illinois – and among the highest in the nation.

Property tax bills totaling $1.8 billion were issued to Lake County homeowners in 2017. Although the Lake County treasurer collects and processes these property tax bills, most of the revenue doesn’t remain with the county, but is distributed among multiple other taxing bodies within the county.

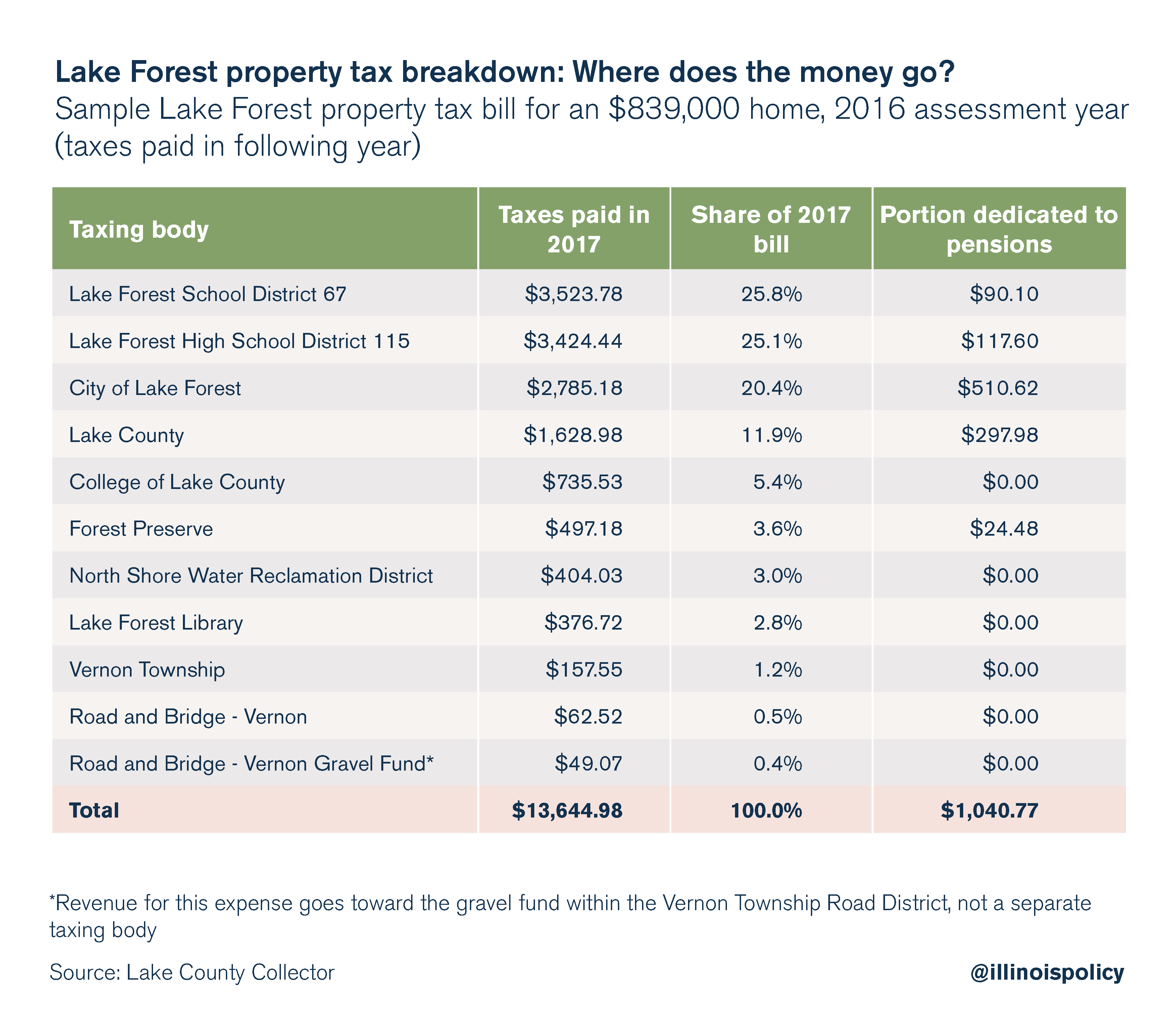

A property tax bill for a Lake Forest home in Lake County offers a look at where these tax dollars go.

For a home in Lake Forest worth $839,000 in 2016, or around the Lake Forest median, the homeowner’s 2017 tax bill would have been just over $13,600. (Property tax bills are issued based on the previous year’s value assessments.) The county collects the payments and then distributes the revenues to the county and to other local taxing bodies. The biggest recipients of this household’s property tax payments were Lake Forest School District 67, Lake Forest High School District 115 and the city of Lake Forest.

Some $1,040, or roughly 7.6 percent, of these property tax dollars went toward government employees’ pensions. The growing cost of government-worker pension obligations has played a key role in driving up property tax bills. In the city of Lake Forest, police and fire pensions have recently put pressure on local lawmakers due to growing liabilities. According to a 2017 Illinois Department of Insurance report, as of April 2016, the Lake Forest fire pension fund has less than 72 cents on hand for every dollar owed in future benefits. While this fund is healthier than that of some other municipalities in Illinois, the report shows its funding level is lower now than it was in 2012, and in every year since then. The Lake Forest police fund has fared worse, having roughly 54 cents for each dollar owed.

As salaries rise, so too do government workers’ pensions. And Lake County has some of the most highly compensated public officials in the state. City Manager Robert Kiely, Illinois’ second-highest earning city manager, is projected to collect nearly $250,000 in fiscal year 2018. As of 2016, the highest-paid state governor in the U.S. earns $190,800 in contrast, according to the Council of State Governments.

But the largest percentage of property tax revenue from this bill went to Lake Forest school districts. Combined, District 67 and District 115 consumed approximately 50 percent of this property tax bill. In the 2015-2016 school year, property tax funds were both school districts’ largest revenue source, accounting for roughly 87 percent of each district’s total revenues, according to Illinois State Board of Education data.

District 67 and District 115, along with the city of Lake Forest, raised property taxes in 2015. Both school districts increased property tax levies by 0.8 percent, while the city imposed a 2.93 percent levy hike, according to the Daily North Shore.

A 2015 Illinois Policy Institute study found Lake County’s property tax burden climbed by more than 44 percent between 2000 and an average of the years 2009-2013.

That one household is subject to taxation by so many separate units of local government is striking on its own. But when one considers the number of taxing bodies across Illinois, the state’s notorious property tax burden is less mysterious. The Land of Lincoln is tangled in nearly 7,000 units of government – more than any other state in the country. With so many government units imposing property taxes – and often hiking levies – Illinois taxpayers are struggling under ever-heavier burdens.

And in addition to the numerous layers of government and accompanying government worker salaries they must fund through their property taxes, Illinois homeowners foot the bill for expensive unfunded mandates, inequitable collective bargaining laws and excessive government-worker compensation.

With the highest property taxes in the state, it’s no wonder that Lake County is losing residents through outmigration. Since 2010, Lake County lost nearly 39,200 residents on net to other counties, according to U.S. Census Bureau data. Collectively, net domestic outmigration from the collar counties to other counties has totaled 122,100 residents since 2010.

And as local property taxes take a bigger and bigger bite out of Lake County household budgets, state lawmakers threaten to make matters even worse. Several Illinois politicians have recently floated the idea of a graduated, or progressive, income tax to solve the state’s fiscal woes. However, based on one such proposal currently floating through Springfield, a median-income family in Lake County would pay nearly $1,000 more annually under such a plan.

Taxpayers should urge their representatives in Springfield to advance reforms that rein in the cost of government and offer relief to taxpayers. A smart spending cap that ties state expenditures to economic growth would force the state to spend within its means. And real reforms to collective bargaining, unfunded mandates and pensions are needed to bring the cost of local and state government down to a level Illinoisans can afford.

Absent reforms like these, Lake County residents can count on further hikes to their already outsized tax burden.