LaHood files Taxpayer Protection Act to stop blank-check bailouts of mismanaged states, fix Illinois’ pension crisis

U.S. Rep. Darin LaHood filed legislation in the U.S. House to ensure federal money supports essential government services during the COVID-19 pandemic – not mountains of pre-existing state and local debt and financial mismanagement.

U.S. Rep. Darin LaHood, the Republican representative from Illinois’ 18th Congressional District, introduced the Taxpayer Protection Act in the U.S. House of Representatives on Sept. 24. The bill would create a “Taxpayer Protection Program” to prevent blank-check bailouts of state and local governments.

Similar to the Paycheck Protection Program — which required businesses to use the funds to maintain their workforce in order to receive forgiveness on federal loans — the Taxpayer Protection Program authorizes state and local governments to seek forgivable loans from the federal government, with loan forgiveness available only to states with sound pensions, truly balanced budgets and sufficient rainy-day funds. Both programs implement basic financial safeguards to ensure federal aid is used to support those in need.

States with unsustainable pension debt and a history of fiscal mismanagement would be required to implement reforms to protect their residents and ensure federal money achieves its intended purpose of supporting essential government services during the COVID-19 pandemic.

The requirements for loan forgiveness are:

- Sound pensions: States and counties with populations of 500,000 or more and local governments with populations of 250,000 or more must be able to eliminate 100% of pension debt over no more than 25 years, using best practices for funding schedules and realistic accounting assumptions. States such as Illinois and New Jersey with unsustainable levels of pension debt must reduce pension debt to the level they can truly afford, without increasing taxpayer costs.

- Truly balanced budgets: States would be required to have a constitutional or statutory requirement for “end of year” balanced budgets. Only actual revenue, such as from taxes and fees, would count toward the balancing requirement. States would not be able to count borrowing or money swept from other government accounts toward the requirement, preventing the budget gimmicks that have allowed Illinois politicians to avoid balancing the budget for 20 years.

- Sufficient rainy-day funds: States would be required to save for emergencies and recessions on their own going forward, holding 5-10% of their annual revenue in a rainy-day fund. Rainy-day funds allow states to cover revenue shortfalls without resorting to essential service cuts or tax hikes. The average state held 8% of its budget in reserve before the COVID-19 pandemic, but Illinois had virtually nothing saved.

The bill prohibits states from using federal money to bail out legacy debt and deficits that are unrelated to the COVID-19 pandemic. The bill also guarantees no state or local government would receive more revenue than they actually lost as a result of the pandemic, limiting quarterly payments to the difference between current own-source revenue collections and collections during the same period in fiscal year 2019. It allows for up to $186 billion in federal and state aid, with $100 billion for states, $75 billion for local governments, $8 billion for tribal governments and $3 billion for the District of Columbia and U.S. territories.

States that fail to achieve the conditions for sound finances will need to repay the loans with an interest rate that goes up as a state’s credit rating goes down. Illinois, which holds the worst credit rating in the nation, would face a “spread” or interest rate penalty of 3.3% compared to 1% for top-rated states.

On Sept. 16, Illinois Gov. J.B. Pritzker wrote a letter to members of Illinois’ Congressional delegation urging them “to come together in a bipartisan fashion to provide critical support to states and local governments facing disastrous budgetary consequences stemming from unanticipated revenue losses due to the COVID-19 pandemic.”

Since April, the governor has pushed for an “unencumbered” bailout from the federal government, meaning he wants grants that do not have to be repaid and come with no strings attached. Similarly, Illinois Senate President Don Harmon in April requested a federal bailout of $44.2 billion, including $10 billion for Illinois’ pension systems.

Pritzker in June signed a budget that increased spending by $2.4 billion over last year despite significantly lower expected revenues resulting from the pandemic. He refused to even discuss canceling pay raises for state workers that cost taxpayers $261 million. That budget has a $6 billion deficit and relies on $5 billion from a non-existent federal bailout or additional borrowing. Under the Taxpayer Protection Program, Illinois would initially be eligible for an estimated maximum of just under $3.1 billion during the next two budget years.

Pritzker’s letter does state his support for “new solutions” and “addressing inefficiencies” in state government. The Taxpayer Protection Program would provide the governor a path to some financial aid while also helping secure new solutions and efficiencies. Illinois has no bigger inefficiency than its overspending on pensions.

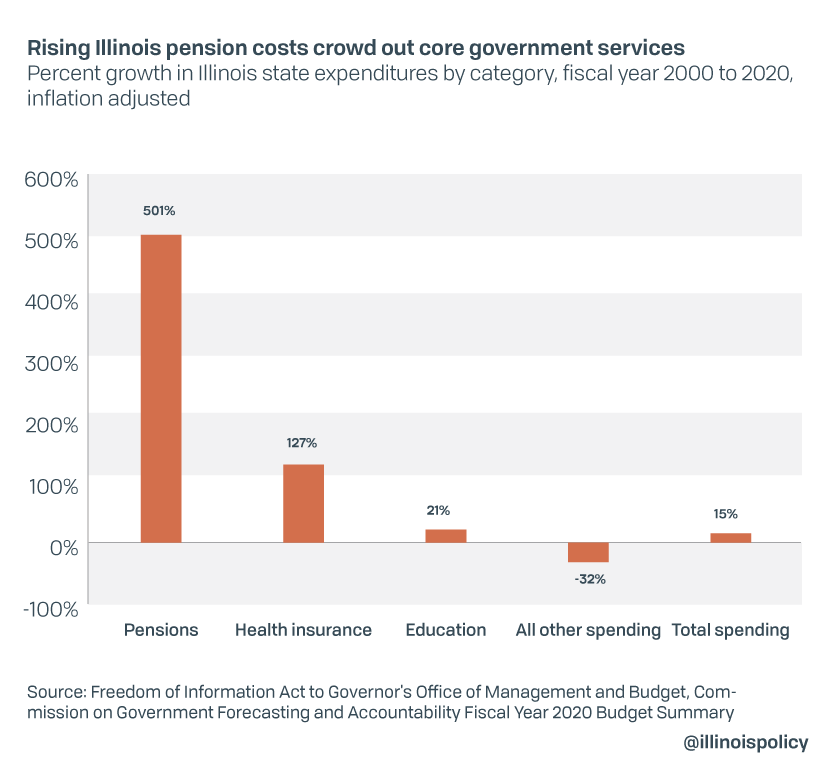

Spending on pensions in Illinois has increased more than 500% during the past 20 years, after adjusting for inflation, causing spending on the poor and disadvantaged to fall by nearly one-third during that same time period.

Illinois’ pension crisis is the most severe public policy issue facing the state. Pension debt can be directly linked to high taxes, reductions in government services, low home values, cuts to public services that weaken the social safety net and lagging economic growth. Market volatility linked to COVID-19 will exacerbate these problems and, by exposing the risk of total pension collapse, should be seen as an opportunity to build consensus for needed reforms.

Without pension reform, a federal bailout would simply prop up historic mismanagement and force residents struggling with unprecedented economic challenges to continue living under a failed system.

Rather than just throwing more money into a black hole of pension debt and deficits, the Taxpayer Protection Program would offer overburdened Illinois taxpayers a path to declining debt, lower taxes, more effective state government and a more sustainable recovery.