Judge halts Cook County sugary drinks tax

The Cook County sugary drinks tax was set to go into effect July 1, but a circuit court judge has temporarily blocked the implementation of the tax in response to a lawsuit opposing it.

A Cook County circuit court judge on June 30 halted the implementation of Cook County’s penny-per-ounce tax on sugary drinks, according to the Chicago Tribune. The ruling comes days after a lawsuit by Illinois retailers and grocers.

The Illinois Retail Merchants Association and several grocers filed a lawsuit against Cook County June 27 in an effort to stop the penny-per-ounce tax on sugary beverages. Retailers claim the tax is unconstitutionally vague and not uniform in what it taxes.

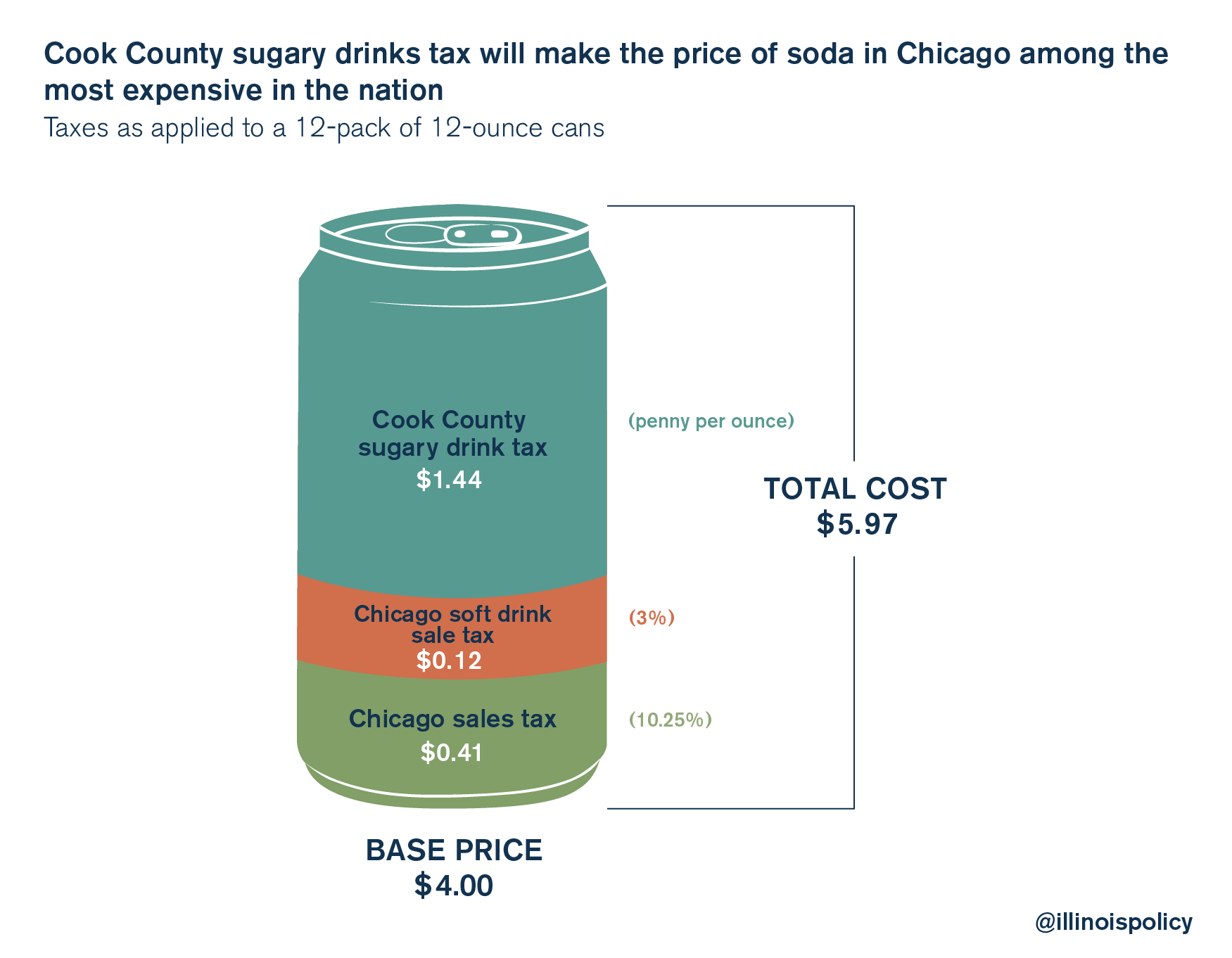

The tax would apply to sweetened beverages sold in Cook County, including in Chicago, which already has a 10.25 percent combined sales tax and a 3 percent beverage tax – which together could make soda costs in the city among the highest in the nation.

The tax’s uncertain application has confused many retailers, grocers and consumers.

One issue, the Daily Herald reported June 29, is ice displacement in a cup. The tax is applied per ounce, but since ice takes up space within a cup, the amount of soda might not exactly match the amount of ounces the cup is supposed to hold. The county hasn’t provided a clear answer on how to navigate that, either. A spokesman for Cook County Board President Toni Preckwinkle told the Daily Herald, “How [restaurants] fill up the cup is an issue between them and their customers.” The same question would apply to free refills offered by restaurants.

But if restaurant owners wanted to eat the cost of the tax themselves instead of passing it on to consumers, they don’t have the option. The law specifically states: “The tax must be passed on to the consumer.” Consumers won’t be able to skirt the tax by ordering soda online, either, as any soda shipped into Cook County is subjected to the tax, according to NBC 5 Chicago. The tax also includes any syrups or powders restaurants purchase to make soda, which are taxed by the amount of ounces of sugary drinks the syrups or powders will make.

The county has estimated it will generate over $200 million in revenue from the sugary drink tax in fiscal year 2018.

The vague and confusing nature of the tax may be a headache for retailers, but what is clear is that the tax will hit consumers’ pocketbooks, in a county that already has imposed numerous tax hikes on its residents in just the past two years. Cook County residents shouldn’t have to bail out politicians’ financial recklessness. The penny-per-ounce sugary drinks tax is a way to do just that, and the tax’s ambiguity creates a hassle for businesses that only aggravates the injury.