Jeremiah made it, but 2 Illinois education reforms could help others

Illinois has too much school district administration. It has too much education pension debt. There are ways to solve those problems to help students facing challenges and taxpayers facing ever-increasing demands.

Jeremiah Griffin was different from his classmates. Surviving open-heart surgery at age 4 was only the start of it.

“Around kindergarten, I realized learning was a bit harder for me than other kids. When I took my spelling tests, the words would be right but the first letter would be switched around so instead of ‘dog’ I would write ‘bog’ – those type of mistakes,” he said.

“My grades weren’t where they needed to be for my class, and my teachers told my mom I probably wouldn’t make it to high school. My fourth-grade teacher, Miss Tompkins, was pretty much the only one that said she saw progress, and I just had to focus on that. But outside of her, in elementary school I know a lot of my other teachers believed that I wouldn’t graduate, or even pass the sixth grade.”

Jeremiah and his mother believed he had dyslexia and requested special education classes for reading and math. His specific needs might have been identified sooner had resources been focused on supporting students with intellectual or social-emotional challenges.

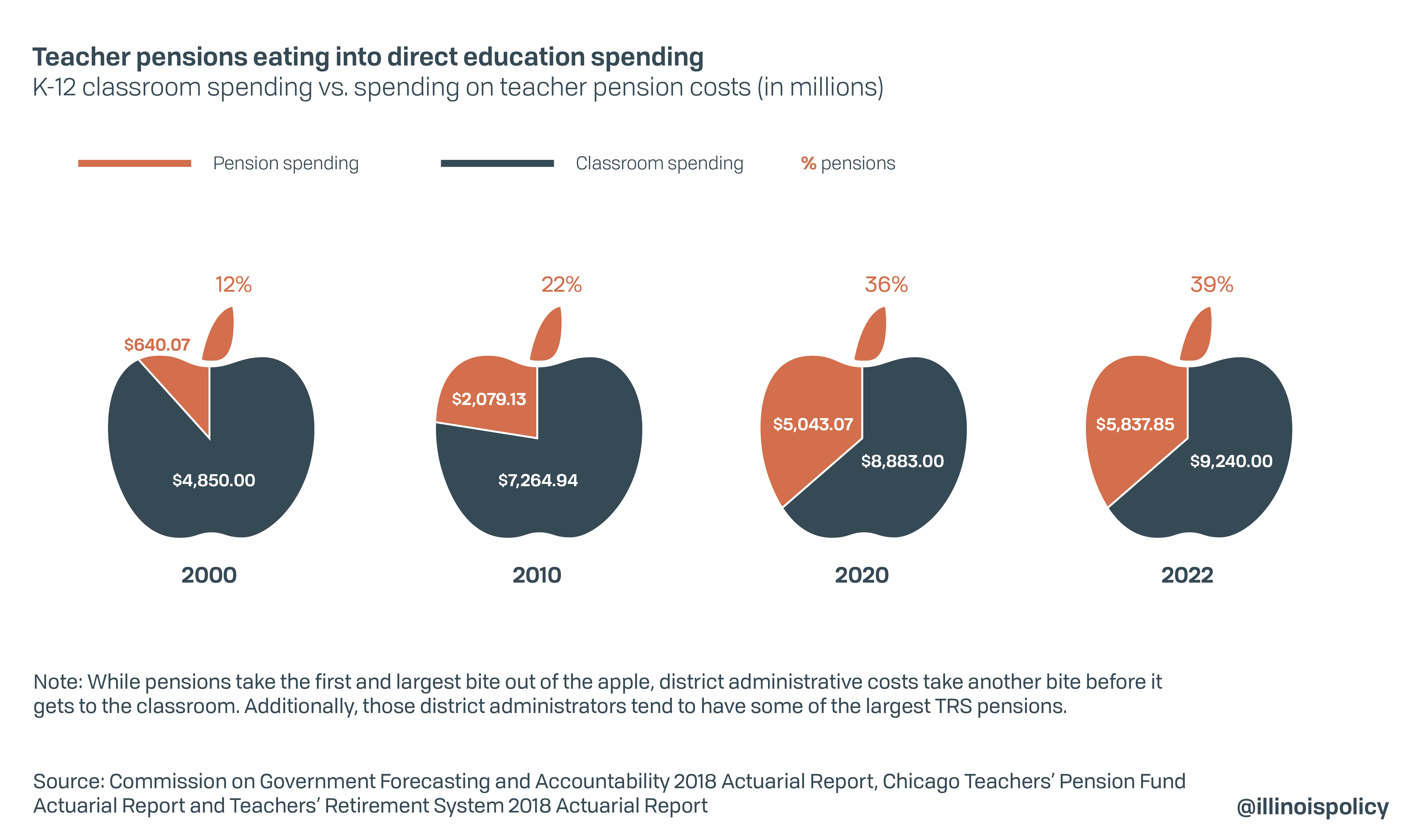

But Illinois instead prioritizes administration and pension spending to the detriment of students. Illinois spends more than two and a half times the national average on district-level administration. It spends nearly 40% of education dollars on pensions.

Jeremiah’s hometown of Zion, in the far northeast corner of Illinois, sees both issues impact its schools.

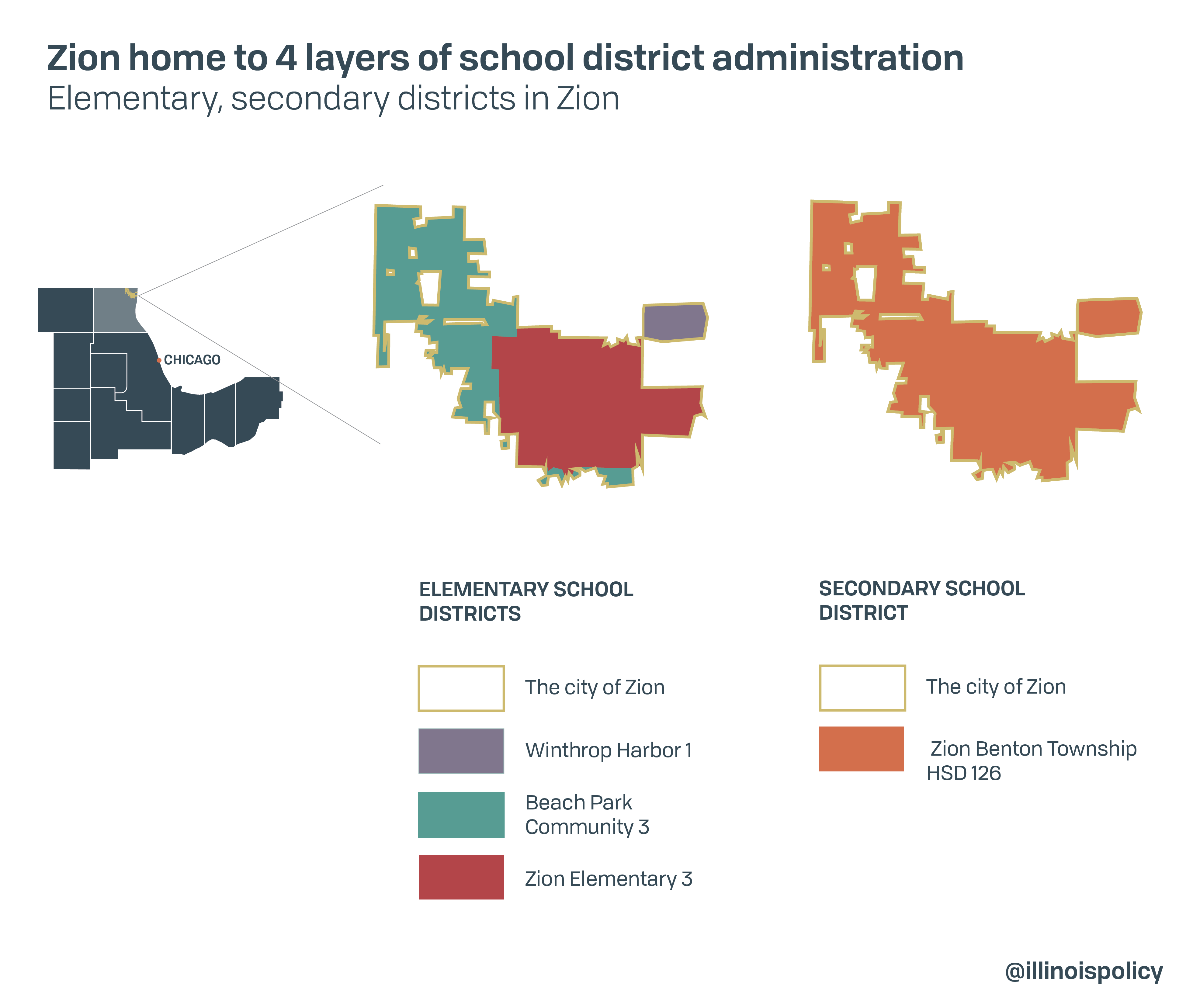

Zion is divided by Zion Elementary School District 6, Winthrop Harbor School District 1, and Beach Park Consolidated School District 3. All three schools feeds into Zion-Benton High School District 126.

Zion District 126 administrator salaries were 7.5% above the state average, and teacher salaries were 7.7% lower. Government shows its priorities by how it spends money.

Add high salaries from too much administrative overhead to vast pension debt – $83.3 billion is owed just for educators in Illinois – and the two soak up funds that could provide services needed by students such as Jeremiah. They also drive up property taxes.

Families in Zion could save $696 annually on their property tax bills just by consolidating the four separate school districts they help support, according to an analysis by the Illinois Policy Institute.

One solution almost passed the Illinois General Assembly last spring – until teachers unions derailed it. The idea is still viable, though.

The Classrooms First Act would create a School District Efficiency Commission aimed at consolidating Illinois’ 852 school districts by 25%. In Zion, $22.5 million annually could be freed up to be spent on education services or property tax relief by consolidating district administration.

No schools would go away but were administration of the separate grade school district and high school district consolidated there would be efficiencies. Money from those efficiencies could help improve classroom instruction by providing additional resources for teachers and students, or give taxpayers a break.

Zion students could use the help because they perform below the state averages.

In 2017, Jeremiah’s graduation year, only 80% of seniors graduated from Zion High School in four years, 7 percentage points lower than the state average, according to the Illinois State Board of Education data. That dropped to 75% for students identifying as black and 69.4% for children with Individualized Education Plans.

For minority students in a similar situation as Jeremiah with education plans, less than 5% of those tested met or exceeded proficiency in English and mathematics, according to ISBE. Not only did students with special needs have a lower chance of graduating on time, they also are not receiving adequate education in core basics.

Another important fix to make sure Illinois focuses education spending on classrooms is pension reform. Illinois spends nearly 40% of its education dollars on pensions, and still there is a massive gap between dollars available and dollars promised to school retirees.

Pensions eat more and more of Illinois’ education dollars, taking away from the number of teachers and their pay. The state has made a 200% increase in spending on teacher pensions since 2000, compared with a mere 20% increase on classroom spending during that period.

A “hold harmless” pension reform plan developed by the Illinois Policy Institute for the five statewide pension systems could save roughly $2.4 billion for the state budget the first year and more than $50 billion through 2045. The plan would also totally eliminate the state’s pension debt during that time, rather than the 90% funding target state leaders hope for. It accomplishes all of that while preserving every dollar of pension benefits promised to public workers for work already performed.

In a town where 17.4% of the population lives below the poverty line, each dollar allocated towards students or saved in property taxes goes even farther in helping families provide for their basic needs and investing in their youngsters and futures.

“I graduated in four years, I finished in spite of my learning challenges and teachers who said I wouldn’t even make it to high school. At the moment, I want to be a chef. One day, while messing around in the kitchen, I discovered that I can make some delicious sauces. I shared them with family and friends, and they were a big hit. Now, I’m working on launching my sauce business.”

Jeremiah is making it despite the odds. Some students didn’t and won’t.

Streamlining school administration and reforming public pensions could change that. Make those changes and Illinois schools could offer property tax relief and create more student success stories.