Jackson County residents see state spending grow far faster than local incomes

Growth in state spending per capita outpaced per capita personal income growth by nearly 40 percent in Jackson County.

Illinois lawmakers have been on a spending spree. And it’s outpacing residents’ ability to pay.

In Jackson County, for example, per capita personal income grew by an average of 2.8 percent each year from 2005-2015. But state lawmakers grew per capita state spending by 3.9 percent each year over the same time – nearly 40 percent faster than the growth in local pocketbooks.

Statewide, personal income per capita grew by an average of just over 3.1 percent per year, meaning state spending outpaced that growth by 25 percent.

Illinois’ growth in state spending is unsustainable. And it injects uncertainty into the lives of Illinoisans.

When government spending grows faster than residents’ ability to pay, politicians are left with two choices: hike taxes or borrow money.

Illinois lawmakers have been eager to do both. Even with last summer’s $5 billion tax hike passed by the General Assembly, the budget is still out of balance by more than $1 billion. And state debt continues to climb.

Hiking taxes to make up for out-of-control spending hurts the state’s economy. A recent study from the Illinois Policy Institute found Illinois’ 2011 tax hike cost the state 9,300 jobs and nearly $56 billion in economic activity from 2012-2016. The most recent 2017 tax hike is expected to inflict similar damage.

But it’s not just at the state level where Jackson County residents have their tax burdens grow. Property taxes continue to take a larger and larger chunk out of household budgets.

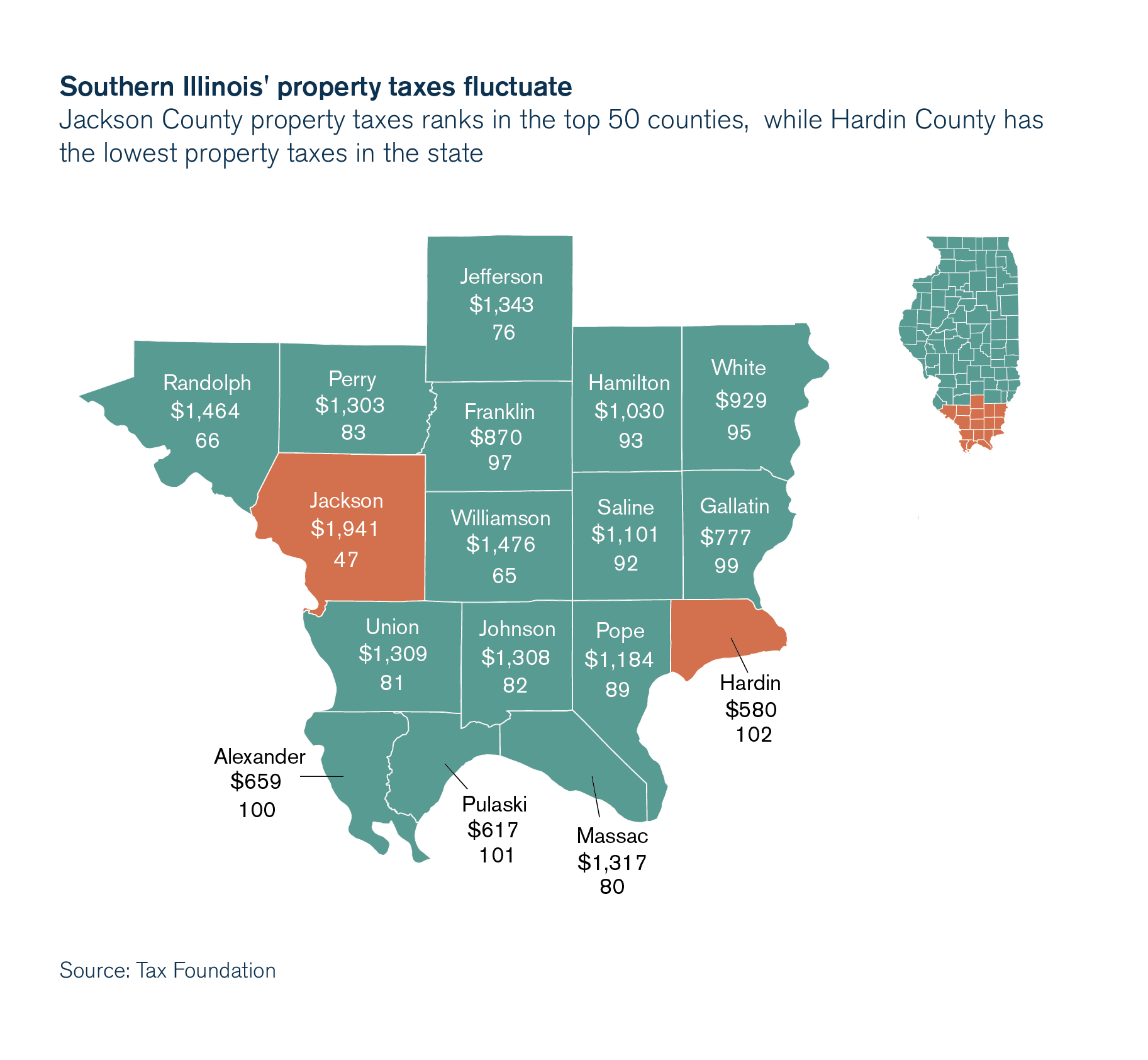

Jackson County has the highest property taxes among the southernmost counties in Illinois, with nearly $2,000 a year in annual median property taxes paid, according to data from the Tax Foundation. Statewide, Jackson County is in the top 50 for median property taxes paid, ranking 47 out of Illinois’ 102 counties.

An analysis of all 102 counties in the state found that between 2000 and an average of years 2009-2013, Jackson County residents saw their property tax burdens increase by more than 27 percent.

Leaders at the state and local levels have proven unable to rein in spending. That’s meant uncertainty for residents, who are unable to predict what government will be costing them five, 10 or 15 years down the line.

Smart growth

In a healthy economy, Illinois’ government spending should grow. But that growth shouldn’t exceed residents’ ability to pay.

A smart spending cap that ties government spending growth to the state’s economic growth – 2.89 percent per year since 2000 – would gift greater certainty to residents in Jackson County and across the state.

And at the local level, a property tax freeze is an essential first step toward reducing the burden of property taxes on homeowners – offering them greater certainty in the future value of their homes. To work toward real property tax relief, addressing cost-drivers for local governments is key. Lawmakers should also take aim at government consolidation, collective bargaining reform, prevailing wage reform and more.

Until state and local lawmakers get serious about reining in spending, Jackson County residents will continue to see government spending outpace the growth in their own pocketbooks.