It’s time for a true balanced-budget requirement for Illinois

For years Illinois politicians have used borrowing and budgeting gimmicks to give the false appearance of balanced budget.

Despite a constitutional requirement to do so, Illinois politicians have not passed a balanced budget since 2001.

The wording in the Illinois Constitution seems clear: “Proposed expenditures shall not exceed funds estimated to be available for the fiscal year as shown in the budget.”

But for years, Illinois lawmakers have skirted around the requirement with borrowing and bad accounting.

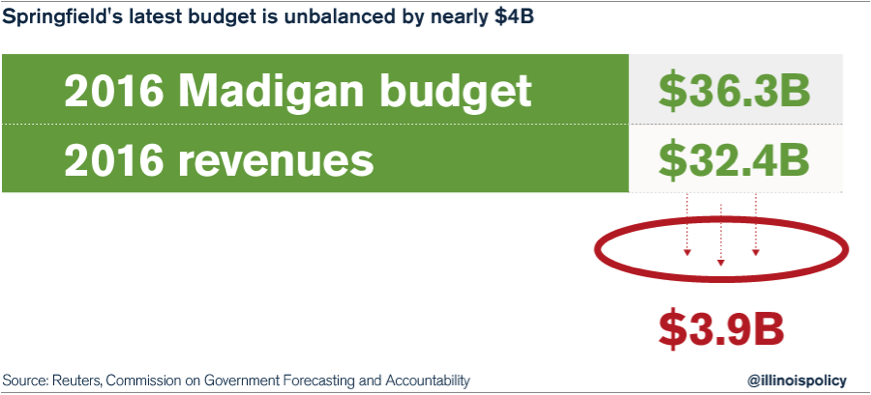

House Speaker Mike Madigan attempted to continue this trend in fiscal year 2016, passing a budget through the Illinois General Assembly that would have the state spend nearly $4 billion more than it takes in. Gov. Bruce Rauner vetoed this budget on June 26.

Illinois politicians have constantly used borrowing and budgeting gimmicks to present the false appearance of balance. For example:

- In May 2011, less than six months after the General Assembly enacted a 67 percent state income-tax increase, lawmakers passed what they called a balanced budget. In reality, this budget used an accounting gimmick to push more than $1 billion in unpaid bills to the next fiscal year.

- In fiscal year 2010, then-Gov. Pat Quinn borrowed $3.5 billion to fund the state’s pension systems. In fiscal year 2011, Quinn borrowed another $3.7 billion for the same reason.

Unbalanced budgets, gimmicks and deficit spending have been business as usual for far too long in Illinois. What good is a balanced budget requirement if politicians can just skirt around it? The state needs a real balanced-budget requirement – one that includes the following:

- Deficits cannot be carried forward.

- Borrowing, fund sweeps and refinancing debt cannot be counted as revenues.

- The comptroller must complete an independent certification of revenue estimates.

- The comptroller must verify and endorse planned expenditures as less than or equal to revenues estimates.

- The governor must submit the balanced budget and the legislature must approve the budget.

A strong balanced budget requirement means that spending is paid for and promises are kept. Operating within a common-sense fiscal framework would pay huge dividends to the state’s fiscal future.