Investigation: Madigan firm the biggest player in commercial property tax appeals

A new investigation by the Chicago Tribune and ProPublica Illinois reveals the mismanagement of the Cook County property tax system, and the politically connected firms who profit from it.

Mike Madigan is best known as the longest-serving state House speaker in American history. He’s been Illinois’ House speaker for all but two years since 1983. But Madigan doesn’t make most of his money in the speaker’s chair. He makes it through his business – lowering property tax bills on some of Cook County’s most valuable buildings.

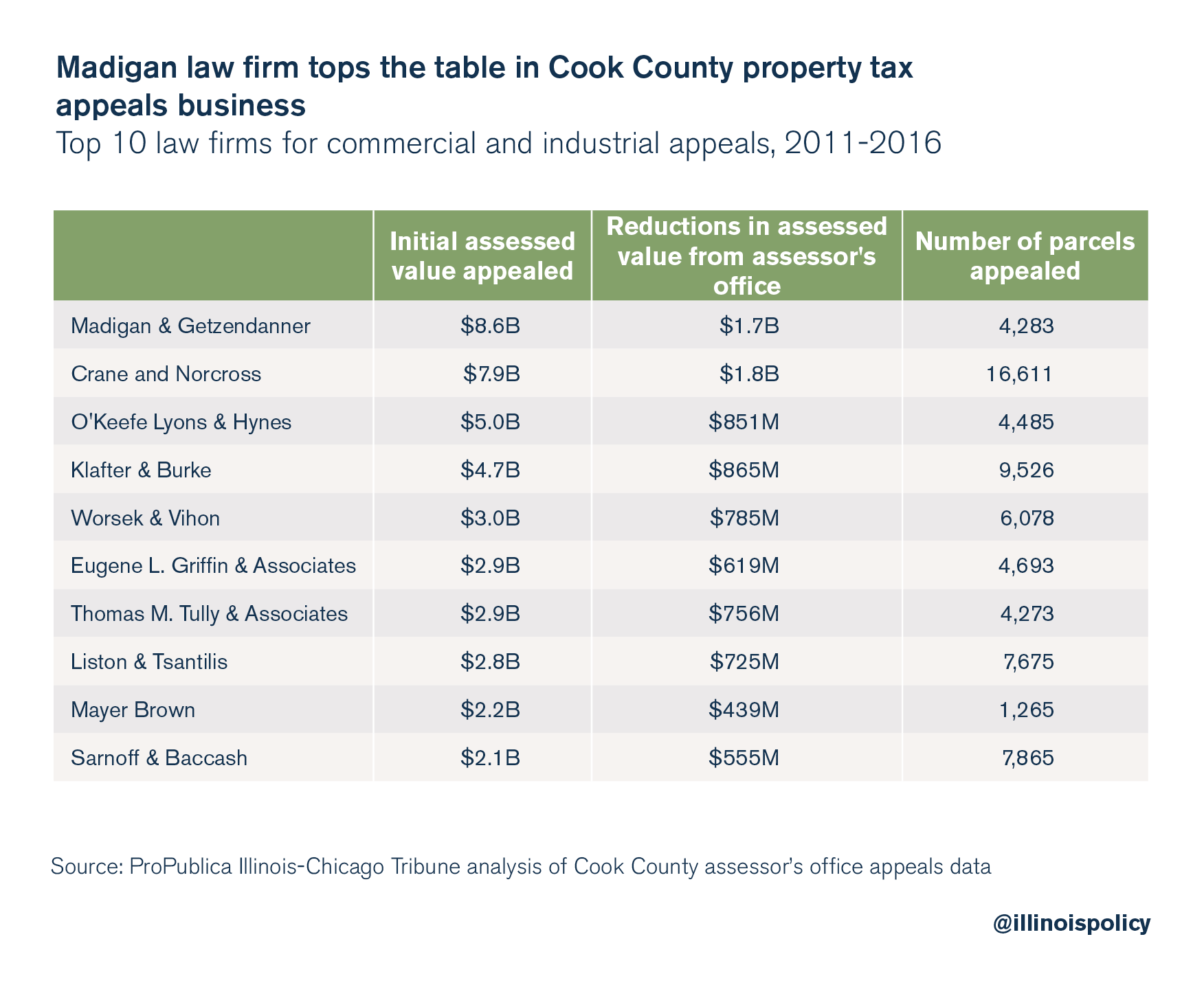

A joint investigation released Dec. 7 by the Chicago Tribune and ProPublica Illinois reveals the extent to which Madigan & Getzendanner, a law firm Madigan founded in 1972, dominates the property tax appeals business.

That domination comes within a Cook County property tax system found to disproportionately harm lower-income residents, due in part to the appeals process.

The game

From 2011 to 2016, Madigan’s firm appealed property taxes for more than 4,200 parcels totaling more than $8.6 billion in assessed value. No other firm handled more value in commercial and industrial properties over that time.

On those parcels, Madigan & Getzendanner won $1.7 billion in assessed value reductions from the Cook County assessor, a 20 percent reduction overall.

Madigan spokesman Steve Brown disputed the appeals analysis, saying Madigan’s firm won a mere $1 billion in assessed value reductions, but did not provide any supporting data, according to the Tribune. No. 4 on the list is Klafter & Burke, the property tax appeals law firm founded by Chicago Alderman Ed Burke. Burke has served as a Chicago alderman since 1969, and is the longtime chair of the city’s finance committee.

The man in charge of the property valuations so crucial to the businesses of Madigan and Burke is Joseph Berrios, the Cook County assessor (a position he attained in 2010 with the help of Madigan’s political workers). Berrios also serves as the Cook County Democratic Party chairman. Meanwhile, Madigan is the state party chairman. He is the only legislative leader in the nation to serve in such a position, according to the Illinois Campaign for Political Reform.

Flatlining

Over the course of its four-part investigation, the Tribune has presented data that suggest gross mismanagement on the part of Berrios’ office. In June, reporters detailed the fundamentally flawed assessment system, wherein high value properties were systematically undervalued – thus paying less in property taxes – and lower-value properties were systematically overvalued – thus paying more.

The most recent installment details the phenomenon of stagnant valuations of property, which benefit the likes of Madigan’s firm.

The assessor’s office is charged with reassessing property values once every three years in Cook County. The purpose of reassessment is to help ensure the property’s assessed value stays in line with its market value. In a booming market, assessed values are supposed to rise, and thus the owner pays more in property taxes. In a downturn, the opposite should happen.

But the Tribune analysis found those crucial adjustments weren’t happening for thousands of commercial and industrial properties across the city. The assessor’s office simply assigned identical assessed values to a given property over multiple years.

Reporters analyzed more than 40,000 unique parcels of property classified as commercial or industrial, which were assessed in 2009, 2012 and 2015. They found more than two-thirds were given identical first-pass values by the assessor’s office in consecutive assessment years. Under James Houlihan, the previous Cook County assessor, only 1.1 percent of commercial or industrial parcels had identical first pass values in consecutive assessment years.

“If your models are working correctly, the chances of values staying exactly the same are virtually impossible,” assessment expert Peter Davis told the Tribune.

A vast majority of owners who saw identical initial values appealed their assessments, according to the analysis, 74 percent of whom won reductions from the assessor, only to see the value jump back up to the same level in the next reassessment year.

“The repetitive process feeds a property tax appeal industry that provides the bulk of Berrios’ campaign contributions,” the report reads.

“Inaccurate assessments also help drive business to political allies who are property tax attorneys, including Illinois House Speaker Michael Madigan, the longest-serving state house speaker in U.S. history, and Ald. Edward Burke, the longtime chair of the Chicago City Council’s finance committee.”

Madigan’s millions

Every dollar Madigan earns back for his corporate clients makes someone else’s property tax bill go up. It falls on the shoulders of Cook County residents not savvy enough to hire a politically connected law firm to appeal their property taxes, or who refuse to play the game altogether.

Madigan has never fully disclosed his sources of income, but the House speaker gave a clue regarding his earnings in 2015, when a reporter asked him whether he’d be subject to a proposed millionaire’s tax.

“Do I make a million dollars in a year? … In a good year I would be subject to this [tax],” he said.

As one of the most powerful state lawmakers in Illinois history, Madigan should be fighting for reforms to address one of the most pressing issues for Illinois’ middle class – the highest property taxes in the nation.

Passing a property tax freeze on homeowners’ actual bills (not just the levies of local governments), and requiring voter approval for property tax hikes are two powerful reforms that would go a long way for families struggling to pay higher property taxes as their own incomes stagnate.

Instead, the speaker continues to cash in on an unfair system.

Sign the petition

VOTE MIKE MADIGAN OUT AS HOUSE SPEAKER

Sign the petition today to demand an end to Michael Madigan's speakership.

Learn More >