Illinois’ wealth flight explained in 4 graphics

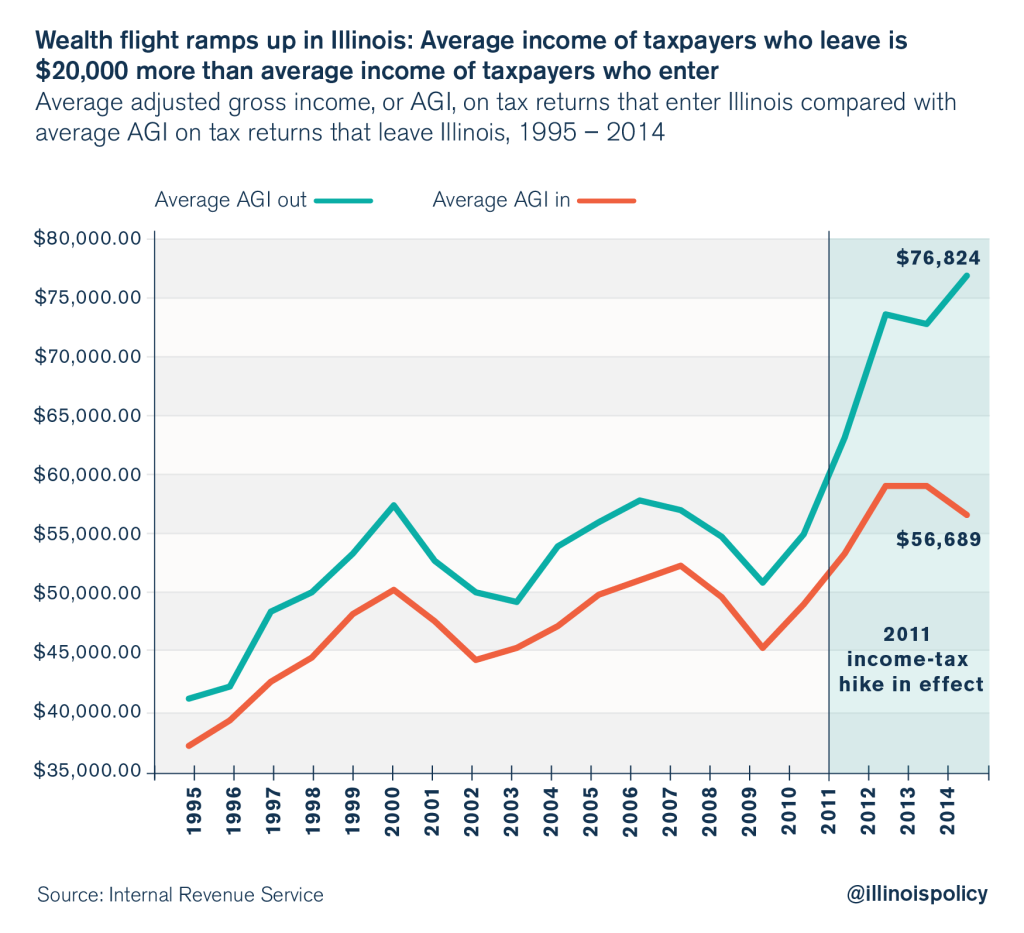

IRS data show the average income of taxpayers leaving Illinois surpassed the average income of taxpayers entering the state by $20,000 in 2014, a record loss for Illinois in the wake of the 2011 income-tax hike.

Politicians enacted Illinois’ 2011 income-tax hike during a late-night legislative session in January 2011 and raised the state’s personal income-tax rate to 5 percent from 3 percent. This 67 percent income-tax hike lasted for four years, during which time Illinois experienced record wealth flight.

IRS data reveal what happens when politicians choose short-term tax revenue gains over long-term stability. The short-term increase in tax revenue gained from higher tax rates is offset by the long-term loss of substantial portions of Illinois’ tax base.

The average income of taxpayers leaving Illinois rose to $77,000 per year in 2014, according to new income migration data released by the IRS. Meanwhile, the average income of people entering Illinois was only $57,000. 2014’s $20,000 difference in average income between people who left Illinois and people who entered the state is the highest on record. And this divergence between out-migrating and in-migrating income began widening significantly in the wake of the 2011 tax hikes.

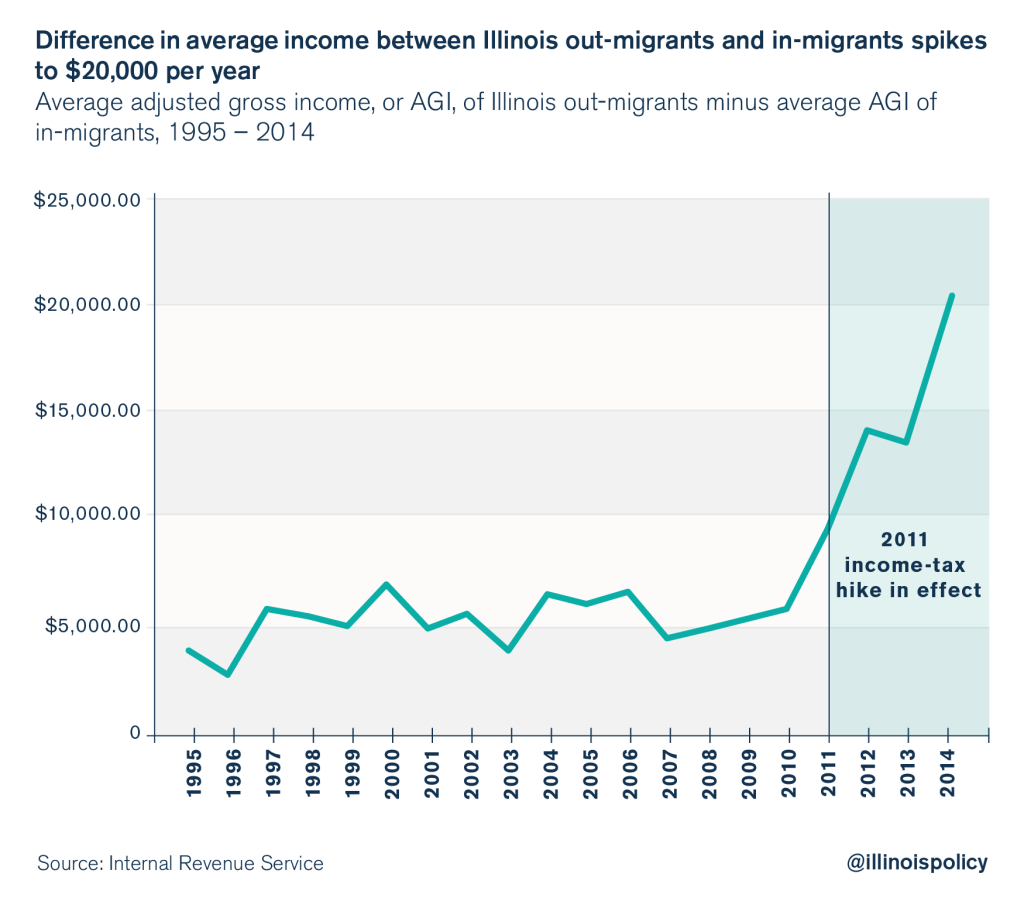

The IRS income migration data span back to 1995, and show how the migration of earning power out of Illinois has changed over time. From 1995 to 2010, the difference between the earning power of Illinoisans who moved out and people who moved in was $5,350. This spread dipped to $3,000 in tax year 1996, then climbed to $7,000 in tax year 2000.

But that income differential increased dramatically after the 2011 tax hikes. In tax year 2010, the last year before the tax hike, the differential was $5,900. The difference jumped to $9,700 in 2011; $14,300 in 2012; $13,700 in 2013; and $20,100 in 2014.

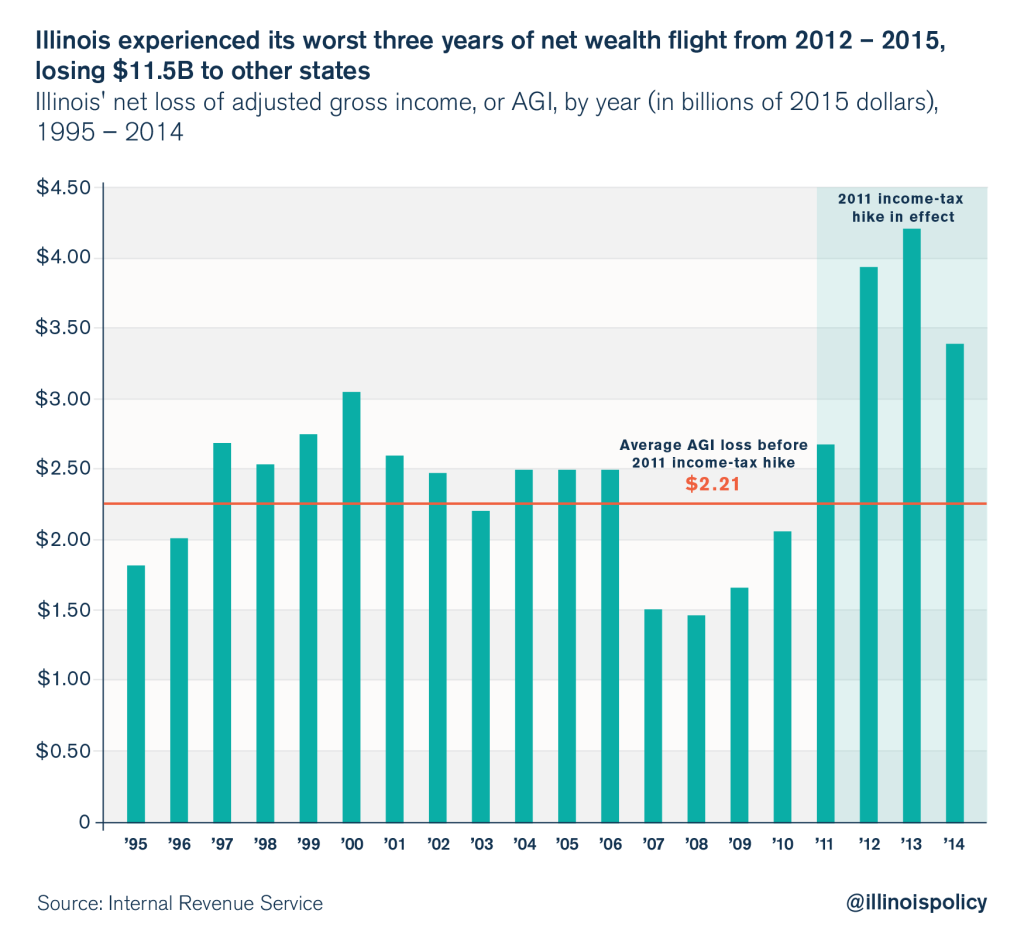

During the four years of the full income-tax hike, prior to its partial sunset in 2015, Illinois lost $14 billion in annual adjusted gross income, or AGI, to other states, on net. The out-migration of income cost Illinois $2.7 billion in 2011, $3.9 billion in 2012, $4.2 billion in 2013, and $3.4 billion in 2014. That compares with an average annual loss of $2.2 billion of AGI per year over the 16 years prior to the tax hike.

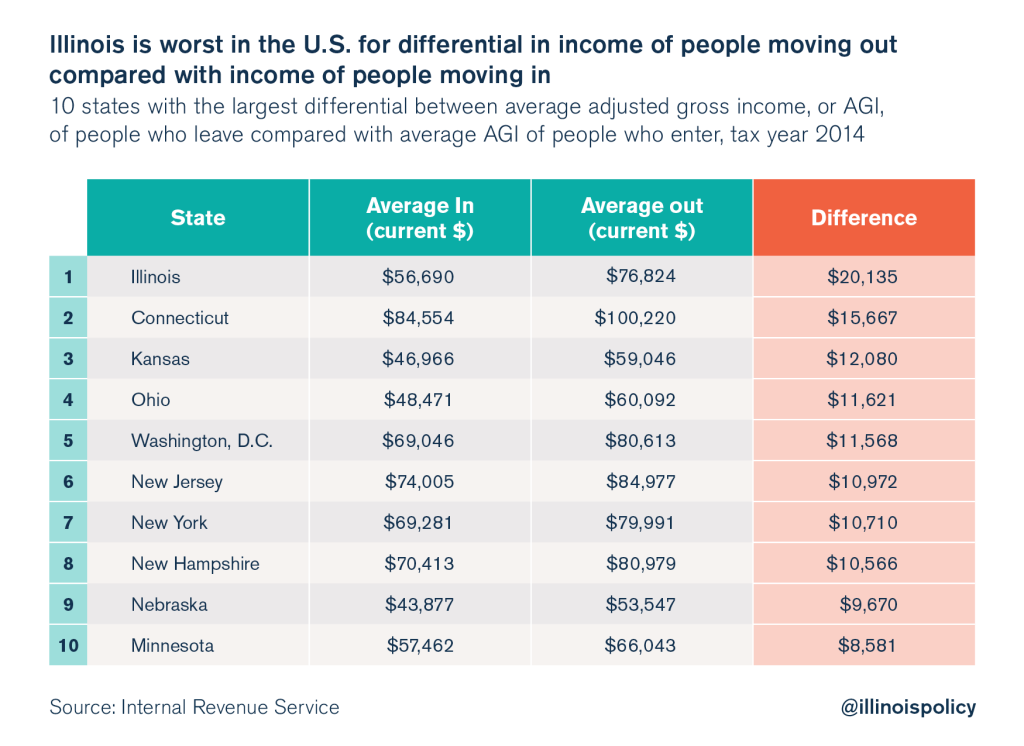

Illinois has America’s worst differential between the average income of people who leave the state and the average income of people who enter the state. Behind Illinois’ $20,000 income differential were Connecticut with a $16,000 income differential; Kansas at $12,000; and Ohio and Washington, D.C., each with an $11,600 income differential.

By contrast, the top five states with favorable income differentials were Florida, Wyoming, Nevada, South Carolina and Texas. Notably, 4 of 5 of these states have no income tax, and none of them have a death tax.

Illinois faces limitations in addressing its ongoing fiscal crisis in light of the fact that higher-income Illinoisans are opting out of Illinois residency. Further tax hikes will push these people out even faster. Rather, Illinois politicians have to rein in their spending habits.

And Illinois needs to remove the most obvious tax driver of high-income out-migration: the state’s death tax. If political leaders push through another income-tax hike as a temporary Band-Aid for the state’s fiscal crisis, they should also repeal the death tax as part of the process. The possibility of a repeal of the federal death tax and the increasing mobility of wealth and income across state borders will put even more pressure on states that still impose this tax.

Illinois policymakers need to confront the loss of wealth that followed the 2011 tax hike, which is likely still ongoing. Politicians must reckon with the fact that they have overspent and overpromised, and seek solutions that focus on reduced spending and more economic growth.