Illinois’ unfunded pension liability has increased by $13 million per day since 1996

The main driver? A defined-benefit system.

Illinois’ unfunded pension liability has grown by more than $90 billion since 1996, to $111 billion in 2014 from $20 billion. That’s an average increase of $13 million per day every day for the last 19 years.

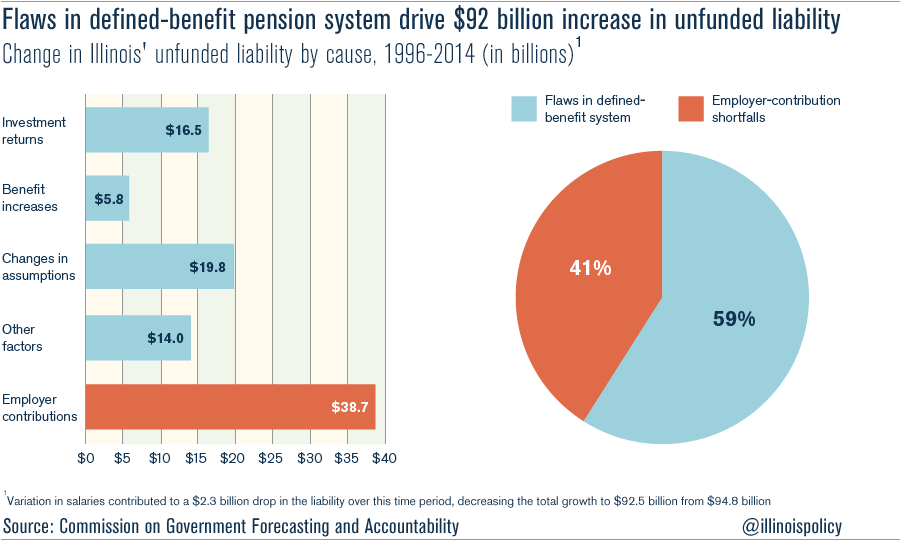

A lot of factors contributed to that increase, including underfunding of the pension systems by the state, but the biggest driver of the growing debt is the nature of the defined-benefit system itself.

In total, 59 percent of the growth in the unfunded liability stems from issues with the defined-benefit pension plan. Changes in actuarial assumptions increased the unfunded liability by nearly $20 billion. That’s partially due to the fact that people are living longer and collecting more benefits than originally planned for. Benefit increases added another $6 billion to the unfunded liability. And failing to meet the assumed rate of return on investments increased the unfunded liability by more than $16 billion.

The remaining 41 percent of the growth in the unfunded liability was the result of underfunding. Employer-contribution shortfalls contributed nearly $39 billion to the growth in the unfunded liability.

The problem is the amount taxpayers are supposed to contribute to the system is a moving target. Taxpayers contributed $16 billion more into the system from 1996-2014 than they were supposed to under the original repayment ramp. But the contributions have also been actuarially insufficient – leading to system underfunding.

According to the state’s estimates, Illinois’ unfunded liability will continue to grow every year for the next 16 years – topping out at $128 billion in 2030. That’s assuming, of course, that everything goes as planned.