Illinois treasurer says ‘fair tax’ makes retirement tax more likely

Illinois Treasurer Michael Frerichs said a progressive state income tax will open the door to taxing retirement income.

Illinois state Treasurer Michael Frerichs confirmed what many believe would be a new possibility in Illinois if voters pass the progressive income tax amendment: taxing retirees.

“One thing a progressive tax would do is make clear you can have graduated rates when you are taxing retirement income,” he said while speaking at an event hosted by the Des Plaines Chamber of Commerce. “And, I think that’s something that’s worth discussion.”

According to the Daily Herald, Frerichs said he knows people who receive annual pensions over $100,000 but pay no state income taxes. He said under the flat tax there is no way to differentiate between retirees who take home hundreds of thousands from those who get little.

Illinois voters on Nov. 3 will decide whether to remove the Illinois Constitution’s flat tax protections and give state lawmakers greater power to set tax rates.

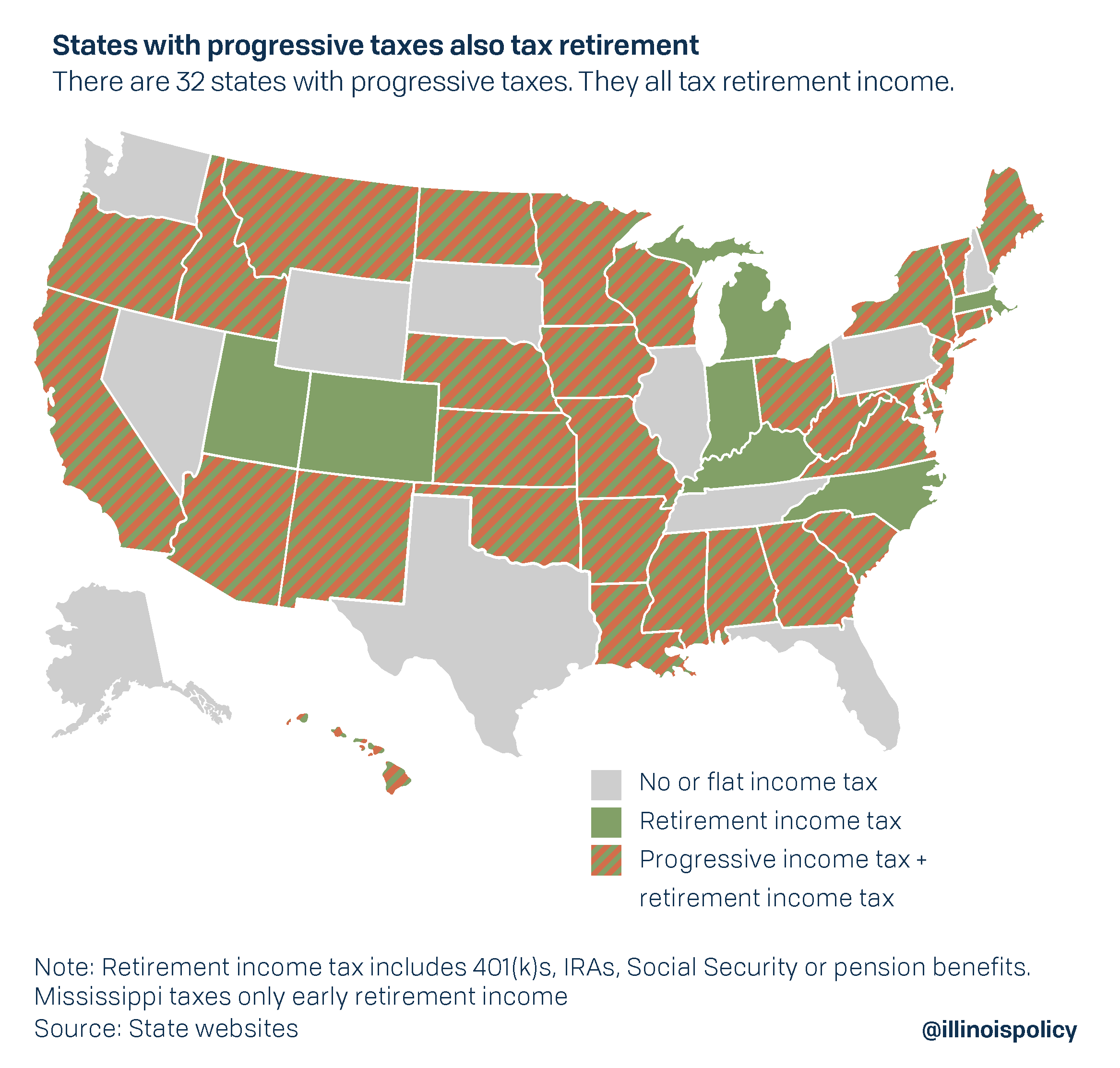

All 32 states with a progressive income tax impose some sort of tax on retirement income from 401(k)s, IRAs, Social Security and pension benefits. Mississippi limits its retirement taxes to the income of those who retire before age 59.5.

The constitution’s drafters in 1970 included a flat tax guarantee in order to ease voters’ fears that the state’s first income tax – which went into effect in 1969 – could be raised easily in Springfield. Flat taxes treat everyone the same and make it harder for lawmakers to raise rates on everyone because voters can hold them responsible. A graduated tax allows politicians to decide who should be taxed how much and allows them to gradually increase taxes on smaller segments of the population, eventually hitting the middle class where most taxable income resides.

That is what happened in Connecticut, the only state in the past 30 years to impose a progressive tax. Middle class taxes rose 13%, property taxes spiked 35%, poverty increased by 50%, more than 360,000 jobs were lost and the state economy took a $10 billion hit. All that, and the state still failed to balance its budget.

Gov. J.B. Pritzker has billed a progressive income tax as a way to increase taxes on the rich without also increasing taxes on the poor and middle class. But for a low-income resident making $12,400 a year, the tax would save them $6 while they are still taxed $1,800 a year.

The bigger problem is the tax’s impact on small businesses, which are just starting the economic recovery from Pritzker’s COVID-19 lockdown orders. A progressive tax would mean up to a 47% tax increase on over 100,000 small businesses, the state’s most prolific jobs creators.

Taxing retirement is not a new idea in Illinois. Former Chicago Mayor Rahm Emanuel proposed taxing retirees with incomes over $100,000 last year, while the Civic Committee of the Commercial Club of Chicago proposed taxing retirement income over $15,000 per year.

The Chicago Sun-Times editorial board even tied the two together, writing “Pritzker’s progressive income tax plan can set the stage for far greater tax fairness. Next, that tax should be expanded to include the highest retirement incomes.”

Former Democratic gubernatorial candidate and former state Sen. Daniel Biss also agreed with Frerichs’ position that a progressive tax is needed in order for Illinois to tax retirement income.

While government leaders argue for more taxation, Illinoisans want to move in the opposite direction. A 2019 poll by the Paul Simon Public Policy Institute found 73% are against taxing retirement incomes, while just 23% believe it is a good idea. Illinois is one of three states that does not tax retirement income.

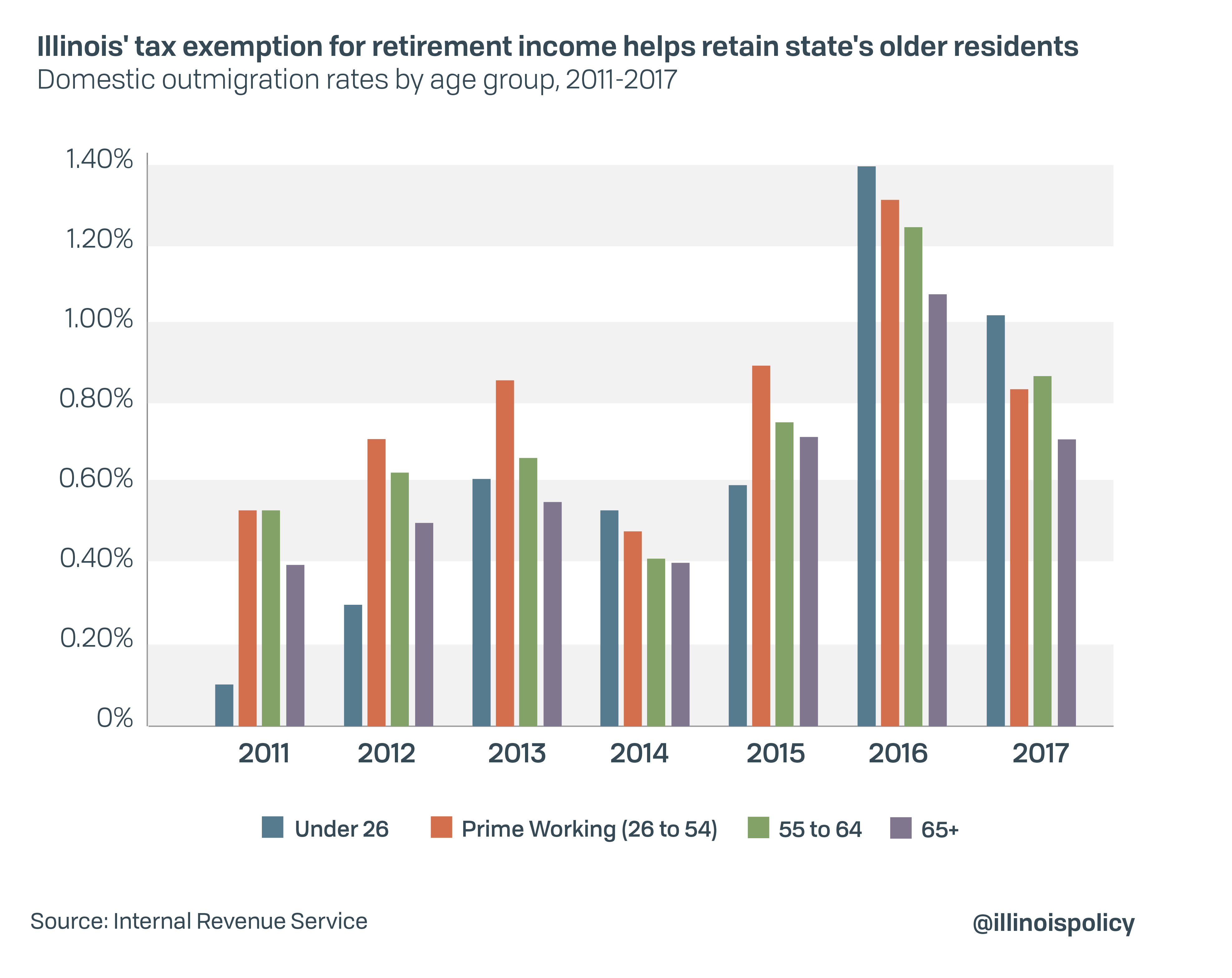

With no retirement tax, Illinois can more easily retain retired workers without losing them to more tax-friendly states. Since 2013, Illinoisans over age 65 have been the least likely to move out.

Connecticut’s progressive income tax hits single filers on $50,000 and joint filers on $60,000 of retirement income. Unsurprisingly, Connecticut loses retired residents at a faster rate than Illinois.

If the Land of Lincoln changes tax structures and imposes a progressive income tax that taxes retired workers on their income, these trends can easily change. More Illinoisans over 65 will pack and move to states with better climates and lower tax rates.

Illinois leaders who want to ensure fairness and economic recovery should protect the current tax structure. Progressive taxation and taxing retirement income will not fix the state’s spending problem, but will send more jobs and retirees to other states.