Illinois to issue $500M in bonds, continues to pay highest borrowing rate of all 50 states

Illinois’ monthslong budget gridlock, $111 billion in government-worker pension debt, and more than a decade of unbalanced budgets have resulted in credit downgrades for Illinois and the highest borrowing costs of any state in the nation.

Illinois plans to issue nearly $500 million in long-term bonds to fund the state’s infrastructure needs.

As the state of Illinois prepares to tap the bond market for the first time in nearly two years, bond investors are set to punish the state for its continued failure to fix its fiscal problems.

Bond investors have demanded ever-higher rates from the state of Illinois over the past seven years, as the government’s fiscal position has eroded due to a lack of balanced budgets, a failure to pass spending and pension reforms, and its poor governance record. Expect investors to demand even higher rates this time around.

Illinois now pays the highest borrowing rate of any state in the nation, and the penalty it pays –the premium it must pay to borrow when compared with what AAA-rated states such as Indiana pay – is likely to go up as long as Illinois continues to operate without a budget.

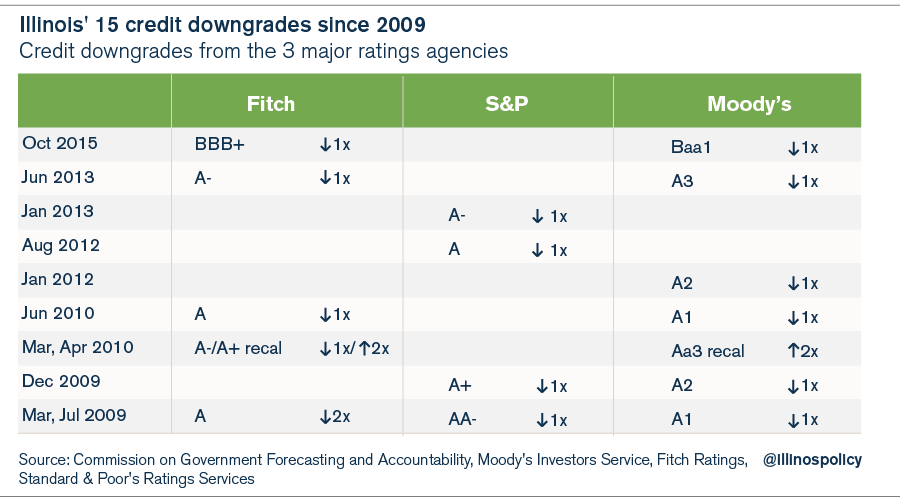

Illinois’ problems did not start with this fiscal year’s budget gridlock. Rather, since 2009, Illinois has suffered 15 credit downgrades from the three main rating agencies – Moody’s Investors Service, Standard & Poor’s Rating Services and Fitch Ratings. Thirteen of those downgrades occurred under former Gov. Pat Quinn’s tenure.

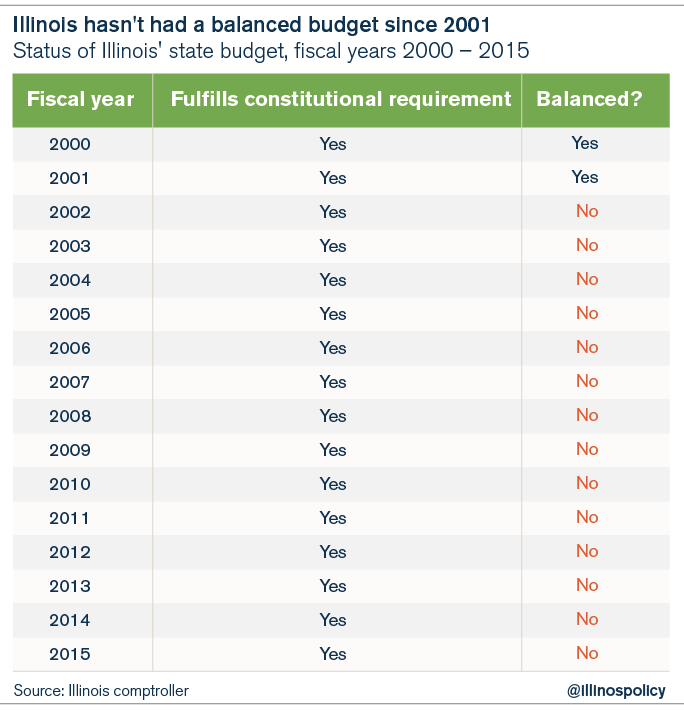

The drivers of those downgrades were the continued absence of balanced budgets, combined with skyrocketing debt. Illinois has not had a balanced budget since 2001.

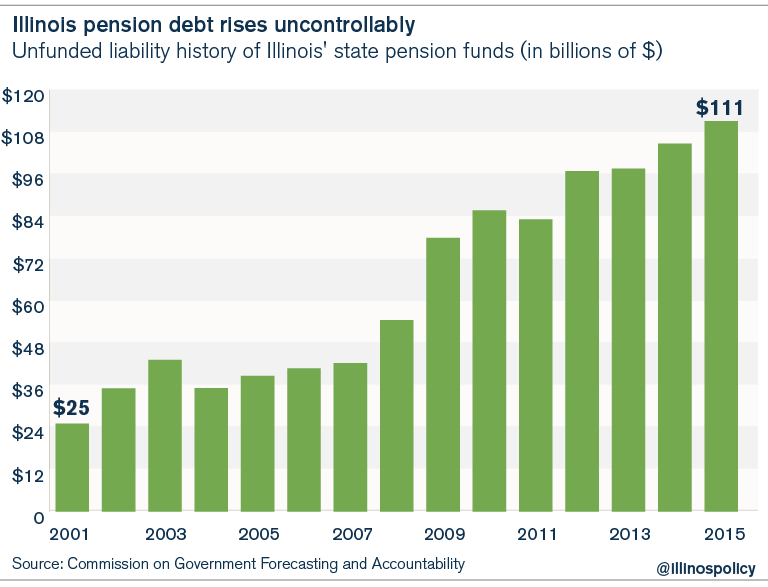

Meanwhile, Illinois’ pension debt, based on asset market values, surpassed the $110 billion mark in 2015, double the shortfall at the end of fiscal year 2008.

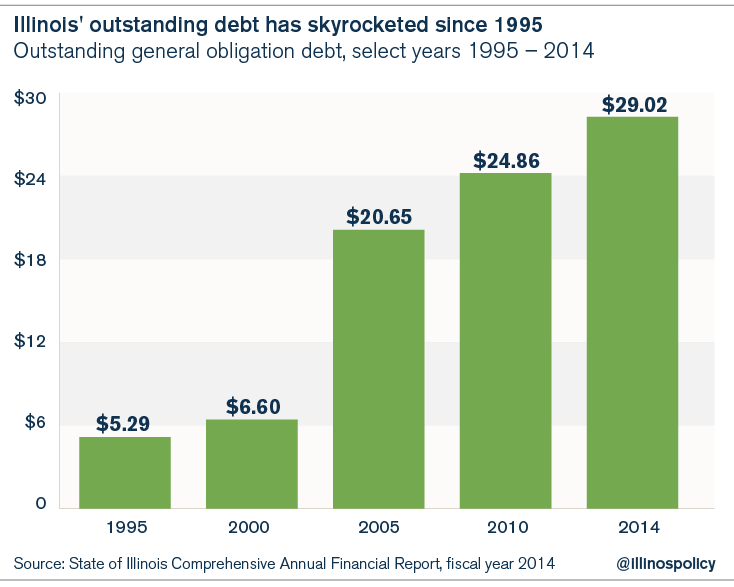

And bonded debt also jumped as former Govs. Pat Quinn and Rod Blagojevich issued more than $17 billion in pension obligation bonds to paper over the pension crisis. Total bonded debt now totals nearly $30 billion.

The most recent credit downgrades came in October 2015, when both Moody’s and Fitch reacted to the failure of the Illinois General Assembly to pass a budget.

Illinois is also under scrutiny for how it communicates its fiscal problems to bond holders. In 2013, the Securities and Exchange Commission charged Illinois with securities fraud for failing to fully inform investors of the state’s fiscal condition. The SEC said:

“Illinois failed to inform investors about the impact of problems with its pension funding schedule as the state offered and sold more than $2.2 billion worth of municipal bonds from 2005 to early 2009. Illinois failed to disclose that its statutory plan significantly underfunded the state’s pension obligations and increased the risk to its overall financial condition. The state also misled investors about the effect of changes to its statutory plan.”

This time around, the state’s offering statement is more cautious and warns of the potential risks to investors:

“Particular attention should be given to the investment considerations described below which, among other things, could affect the financial condition of the state and therefore result in a repayment risk for investors, and could also affect the liquidity/market value of the bonds after they are issued.”

Among those risks investors face is a budget that fails to rein in spending.

Many investors continue to look for increased revenues in the form of higher taxes as the solution to Illinois’ fiscal and rating problems. But Illinois hiked personal income taxes by a record 67 percent in 2011, along with a 46 percent corporate income tax increase – generating more than $30 billion in additional revenues over a four-year period – and that did nothing to improve Illinois’ fiscal standing.

On the contrary, Illinois’ fiscal situation worsened during those four years. That’s because Illinois’ General Assembly, flush with cash to spend, avoided virtually all the key reforms needed to fix Illinois. As a consequence, the state’s pension debt grew by more than $20 billion, it has the same amount of unpaid bills it had four years ago, and the state experienced the worst post-recession economic recovery of any state in the nation. In fact, Illinois received five more credit downgrades from the three rating agencies during those four years.

Another risk to investors is the failure of the state to begin enacting real pension reform. That can be done by moving all new government employees to 401(k)-style accounts and by giving existing workers the option to choose self-managed accounts.

To move forward, Illinois can’t pass just any budget to get beyond its crisis. With today’s fiscal stress, a bad budget is worse than no budget. A budget without major spending and pension reforms will only allow Illinois’ debt to continue to spiral, putting investors – and subsequently, Illinois residents – at risk.

Illinois has the worst credit rating in the nation and sits just three notches away from a junk rating.

While the $500 million in additional debt isn’t material when compared to Illinois’ overall bond and government-worker pension debt, investors should begin to wonder: Just how much will it take to break the camel’s back?