Illinois’ symbolic first step – cut LLC fees

Small businesses and innovators are the lifeblood of any economy, and Illinois needs reform to encourage them to locate in Illinois. Small businesses are responsible for two-thirds of all new jobs created in the last 20 years. The disincentives for entrepreneurs to locate in Illinois are systemic, and thus require systemic solutions. An agenda for...

Small businesses and innovators are the lifeblood of any economy, and Illinois needs reform to encourage them to locate in Illinois. Small businesses are responsible for two-thirds of all new jobs created in the last 20 years.

The disincentives for entrepreneurs to locate in Illinois are systemic, and thus require systemic solutions. An agenda for structural reform, which can begin next year, will promote entrepreneurship in Illinois.

Not all reforms serve the same purpose. In fact, slashing Limited Liability Company startup fees accomplishes two important goals, and costs the state very little in lost revenue.

- Cutting LLC fees can save Illinois small businesses as much as $70 million per year, with much of that savings at the critical point of starting-up.

- This reform would be symbolically powerful by showing that the state wants to create a great environment for entrepreneurs.

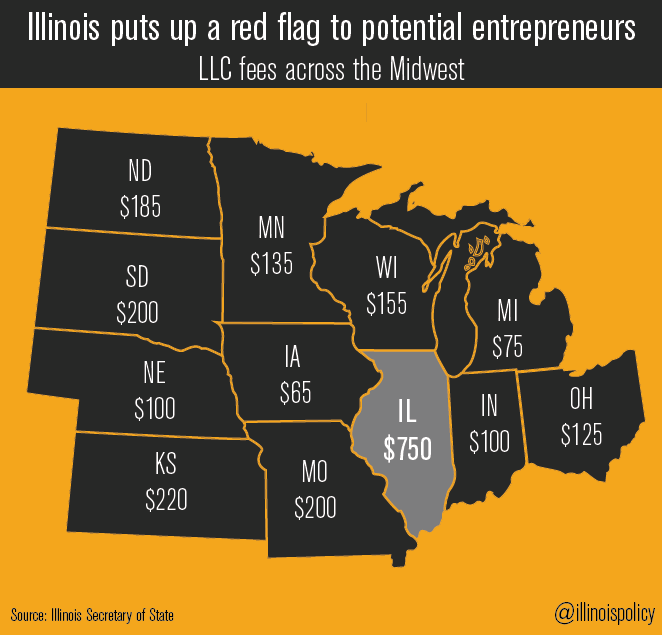

The current cost to start an LLC in Illinois is $500, plus another $250 in annual fees. This is the second-highest fee schedule in the country.

The symbolism of such a high fee is powerful, especially for an entrepreneur who wants to gauge a state’s friendliness to startups. Right off the top, Illinois government wants a cut of a small business’ cash. This is not the signal that Illinois wants to send.

Across the Midwest, Illinois is the only state to put up such an obvious red flag, essentially warning away would-be job creators.

Illinois needs to take down the warning flags and welcome new businesses. Cutting the LLC fee by 90 percent is a great place to start. It would cost the state little in lost revenue, which could be more than made up by cutting crony spending elsewhere. And it would make Illinois the most competitive in the Midwest for startup costs.

Another symbolic lesson Illinois should learn about startup fees comes from neighboring Missouri. Just as Phoenix has made itself a 24-hour city, Missouri has made itself a 24-hour state. Online LLC filings in Missouri cost only $50, and are completed in one day.

Following Missouri’s lead would send a powerful message to businesses: Illinois officials want government to provide an efficient business environment, and it’s only going to cost you $50 – instead of half a week’s of pay.