Illinois Senate’s spending “cap” doesn’t protect taxpayers, core services

The Senate’s “grand bargain” contains a one-year spending “cap” that won’t improve fiscal responsibility. A real cap must come with structural spending reforms to return spending to a level that taxpayers can afford.

Politicians want to help sell the Illinois Senate’s “grand bargain” budget deal by including what they call a one-year spending “cap.” It’s a desperate attempt to appear fiscally responsible to fed-up taxpayers.

Calling a one-year, $37.9 billion limit a “cap” on spending – especially when the Senate deal calls for a nearly $7 billion tax hike – is disingenuous.

After just one year, lawmakers will be free to spend under the same old rules and policies that allowed them to create the budget crisis in the first place.

If Illinois politicians really wanted to bring fiscal discipline to Illinois, their spending cap would extend for multiple years or be permanent. And it would limit spending growth to the rate of inflation and changes in population.

But most importantly, it would be paired with real spending reforms – something the “grand bargain” lacks.

The Senate deal relies on raising taxes by nearly $7 billion to balance the budget because it offers virtually nothing in the way of real spending reforms.

That’s a problem because unless lawmakers enact comprehensive spending reforms, a spending cap will only ensure that pensions, state worker health care and Medicaid – costs that have grown uncontrollably over the past two decades – continue to crowd out state spending on social services and other core programs.

A spending cap without reforms solves nothing

State politicians have prioritized spending on pensions and state worker health care costs over almost everything else over the past two decades. A spending cap alone won’t stop those costs from growing.

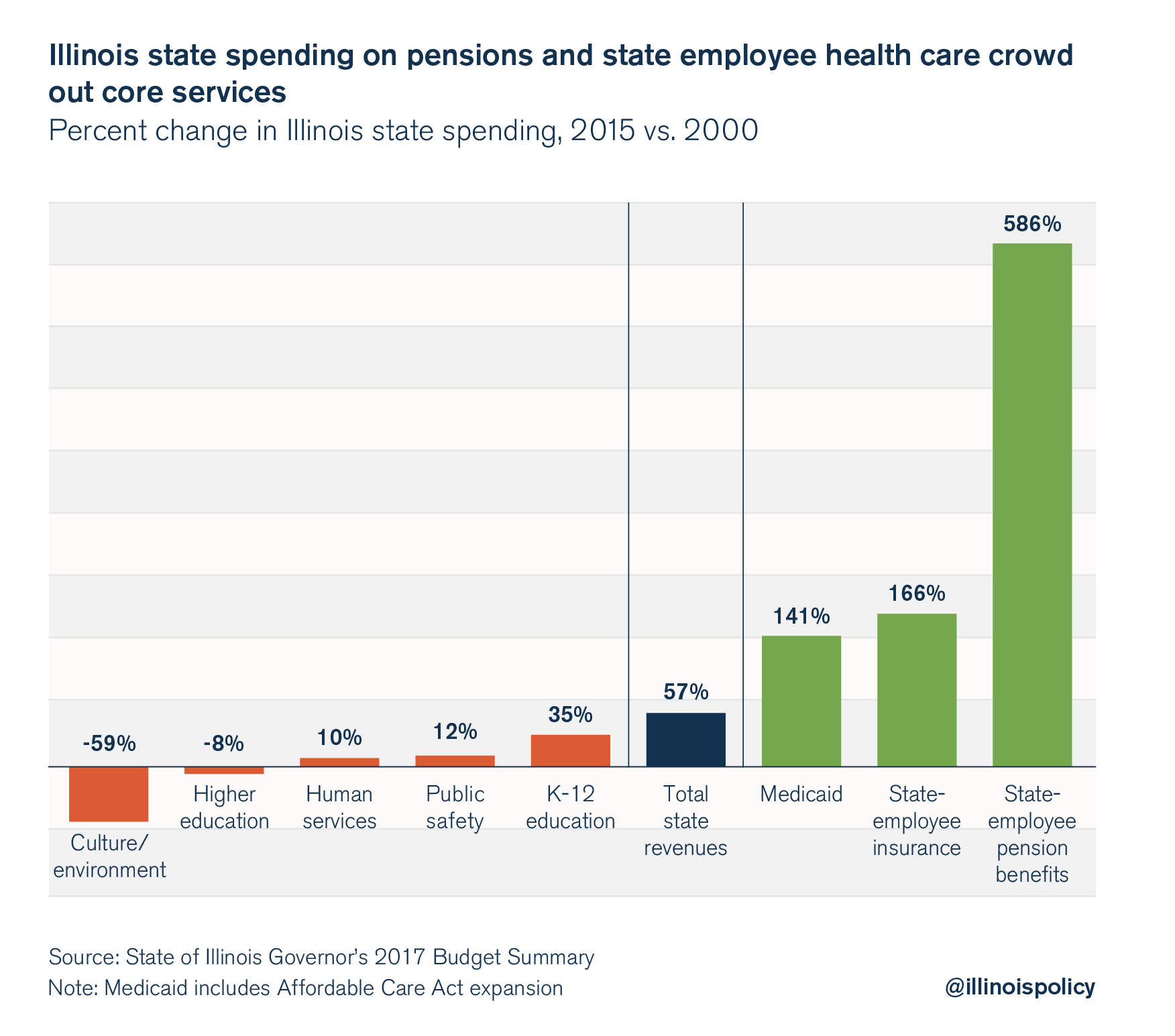

A look at the growth in state spending over the past 15 years reveals how pensions and state employee health care costs have outpaced other budget items, crowding out state spending on services such as education and public safety.

When comparing spending in 2015 with that in 2000, spending on state worker pensions was 586 percent higher, or $6.6 billion higher. Spending on state employee health insurance increased 166 percent, up by more than $1 billion.

By contrast, spending on human services went up only 10 percent, or $498 million, and spending on higher education fell by 8 percent, or $175 million.

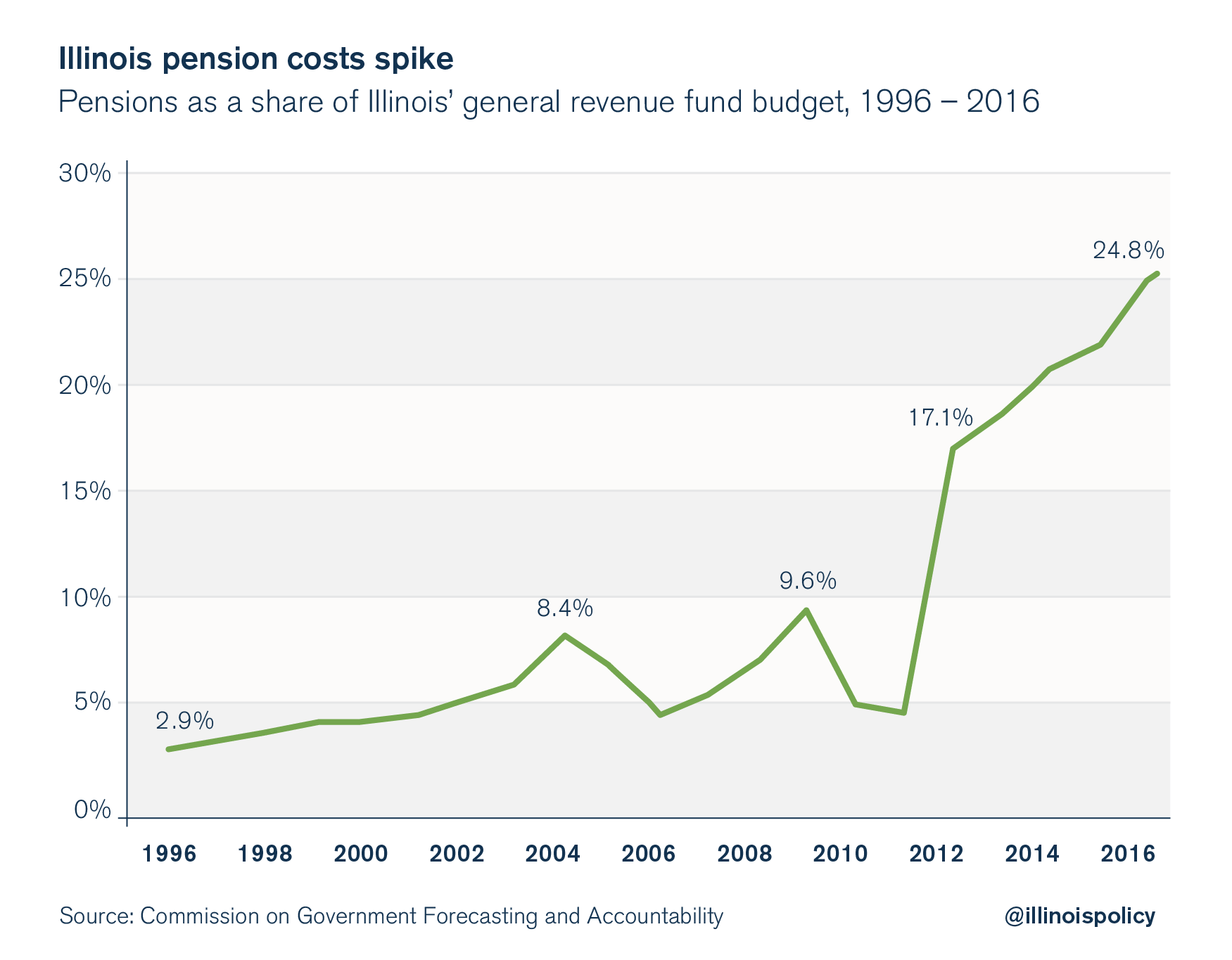

Pensions alone already consume 25 percent of the state’s budget. Putting a cap on state spending without reforming pensions will only allow pensions’ share of the budget to rise further.

Pass comprehensive reforms with a spending cap

A spending cap is an important tool in bringing the state’s budget back to a level Illinoisans can afford.

A real spending cap would be permanent, limit spending to $33.4 billion – the total revenue estimated by the governor’s budget team in 2018 – and would only grow at the rate of inflation and population growth.

However, a cap alone won’t be enough to fix Illinois’ problems. Lawmakers must enact structural reforms to pensions and health care to prevent those costs from eclipsing the rest of the budget.

The Illinois Policy Institute has laid out the reforms Illinois needs in Budget Solutions 2018. The plan fills Illinois’ budget hole, provides tax relief to struggling homeowners through a comprehensive property tax reform package, implements pension reforms that begin an end to the state’s pension crisis, and enacts major reforms to state spending on Medicaid and state worker health care benefits.