Illinois Senate proposes income tax hike in the face of record out-migration and wealth flight

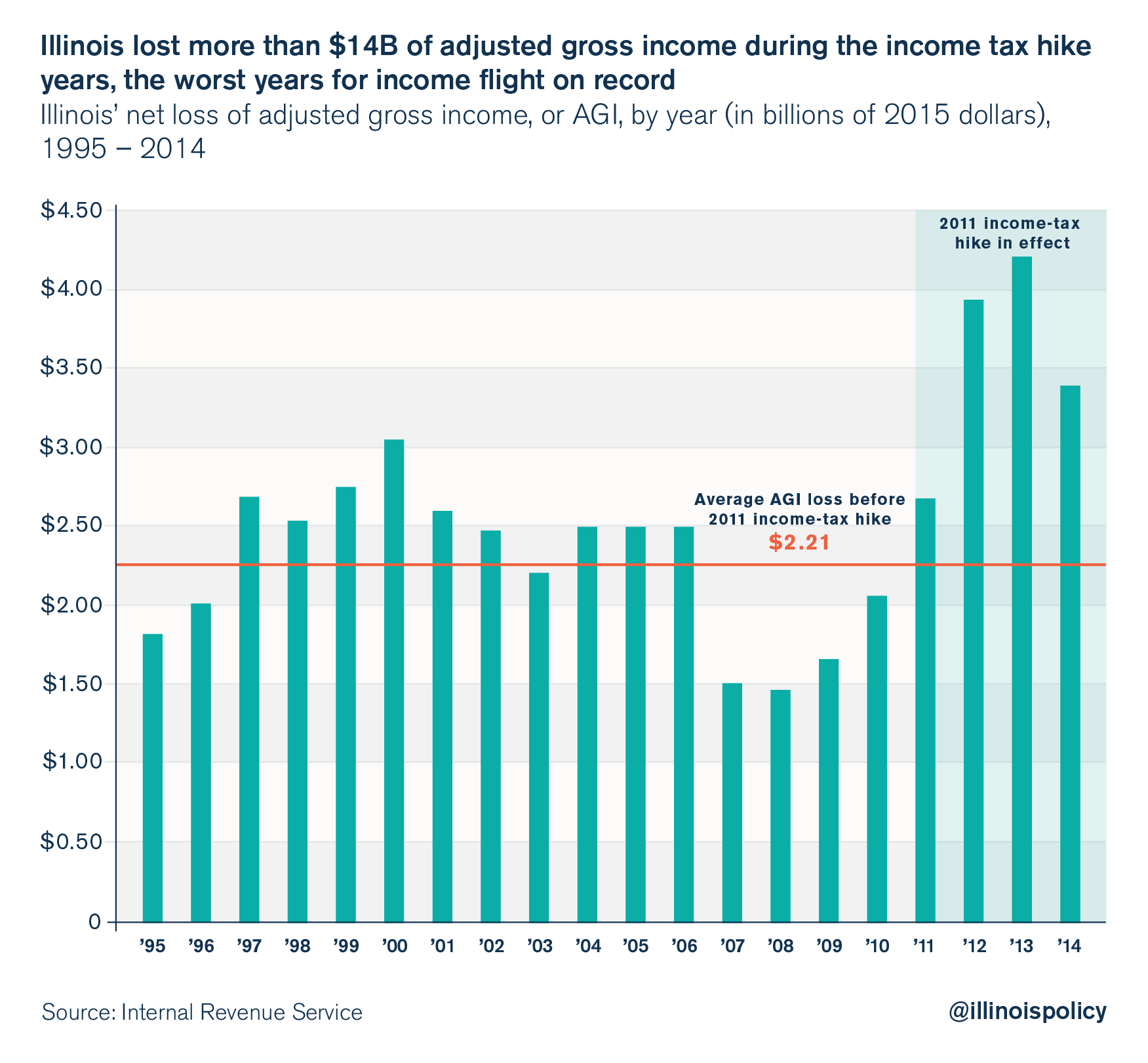

The Illinois Senate’s proposed budget plan would raise the personal income tax rate to at least 4.95 percent with no real reforms to address the state’s skyrocketing debt and unsustainable spending. This proposal comes despite Illinois’ loss of $14 billion in annual income and hundreds of thousands of people in the wake of the 2011 income tax hike.

Illinois taxpayers are leaving in droves, and Senate leaders are pushing a budget plan that will drive out still more people from the state.

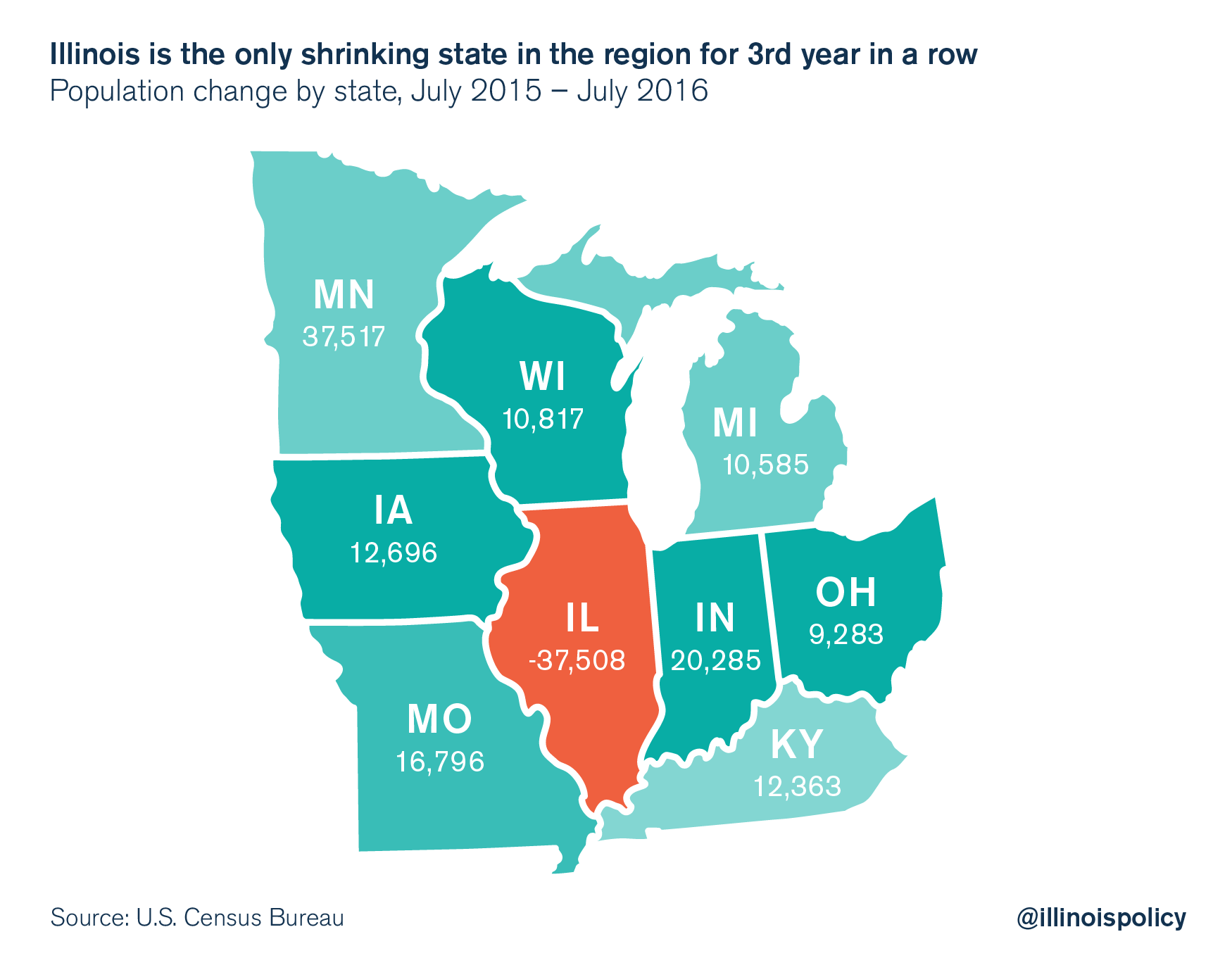

Illinois’ population is shrinking. The Land of Lincoln lost one Peoria’s worth of people to other states in just the past year. People with higher incomes are leaving for other states, and Chicago is experiencing a millionaire flight that is happening nowhere else in the United States.

And Illinois Senate leaders are proposing to make all of this worse. Their original plan was to raise the personal income tax rate by 32 percent. Now reports note that the rate could go even higher, with as much as a 40 percent income tax hike on the table. With no meaningful spending reforms in the discussion, Illinois’ personal income tax rate could hit an all-time high of 5.25 percent.

If the proposal is structured like the income tax hike legislation introduced earlier in January, the law will be retroactive to the beginning of 2017. Anyone with plans to leave Illinois this spring would effectively pay a border tax of hundreds or thousands of dollars on the way out the door.

Here’s a review of what happened in the years following 2011, the last time Illinois raised its income tax rate without reforming any structural spending drivers.

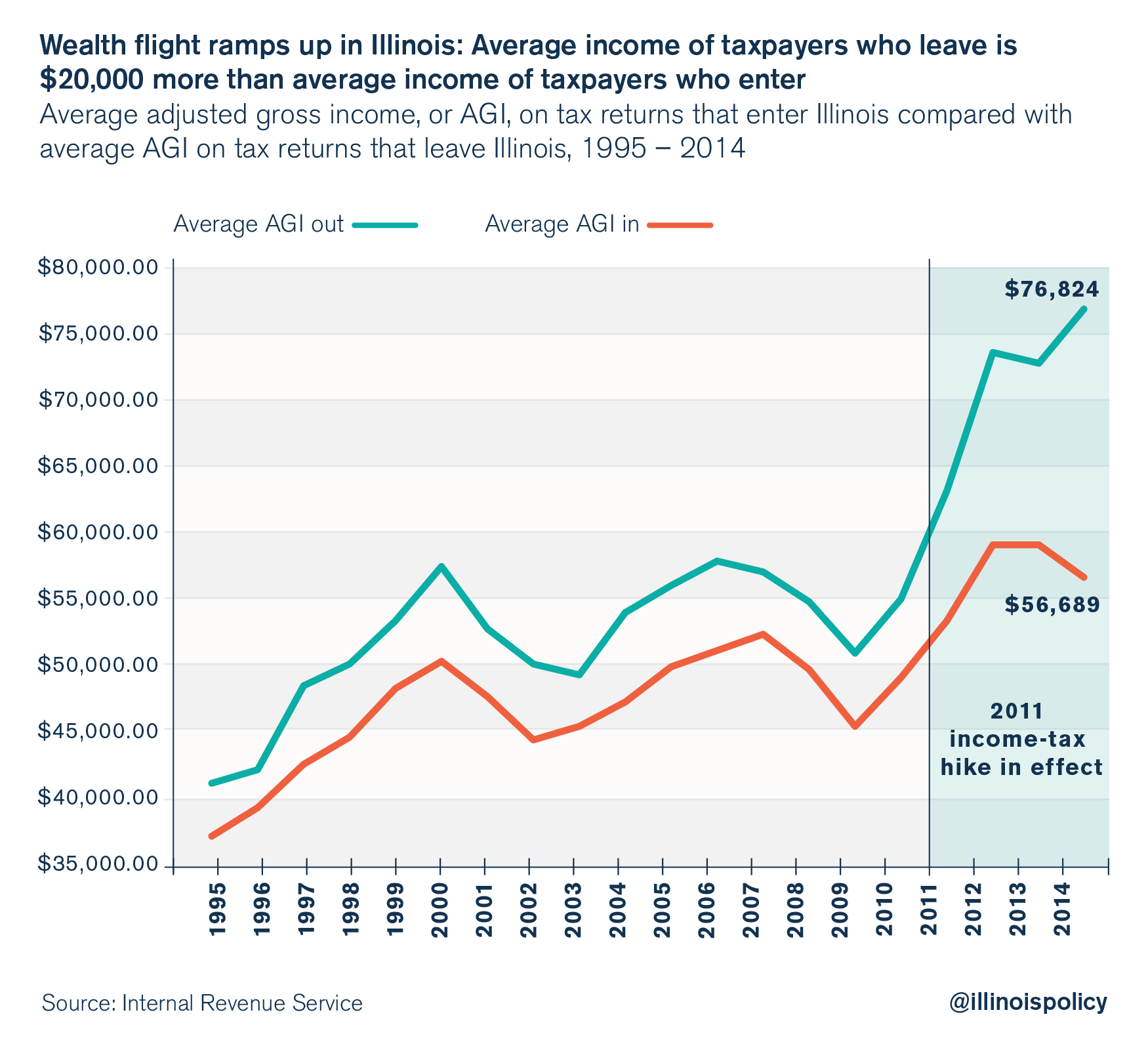

First, the average income of people leaving Illinois shot up. As of tax year 2014, the most recent year of data, the average income of people leaving the state was $77,000, while the average income of people entering the state was $57,000. This income differential of $20,000 between out-migrants and in-migrants is the worst in the United States.

In total, Illinois lost record amounts of income-earning power to other states during the years of the income tax increase. More than $14 billion of annual adjusted gross income, or AGI, left the state during the four years of the tax hike, far worse than any other period in Illinois’ past.

The loss of more than $14 billion of annual AGI is equivalent to permanently losing all the nonmigrant AGI earning power of Kane County, the state’s fifth-largest county by AGI. Put another way, the loss is like losing all the AGI of Kendall, Rock Island, LaSalle, Macon and Kankakee counties, permanently. The $14 billion of annual AGI Illinois lost due to out-migration while the 2011 tax hike was in effect is also equal to all the nonmigrant AGI of Illinois’ 50 smallest counties combined. Of course, it will only get harder for the state to make budgets work if tax dollars keep flowing out the door.

But Illinois hasn’t just lost income since the 2011 tax hike. Illinois has lost record numbers of people, too. In the most recent year of data, from 2015 to 2016, Illinois lost 114,000 people on net to other states, the worst level of out-migration the state has ever experienced. And that happened even after the income tax hike partially sunset to 3.75 percent in 2015. Residents are clearly voting with their feet after seeing the results of decades of failure from their political leaders.

On top of all this, Illinoisans are struggling under the burden of property taxes that continue to climb in many parts of the state. Add to that the state’s pension debt, which soared during the tax hike years. Just in the past year, Illinois’ pension liability shot up to $130 billion from $111 billion. Tens of billions more in Other Postemployment Benefits, or OPEB, debts sit uncounted and unfunded.

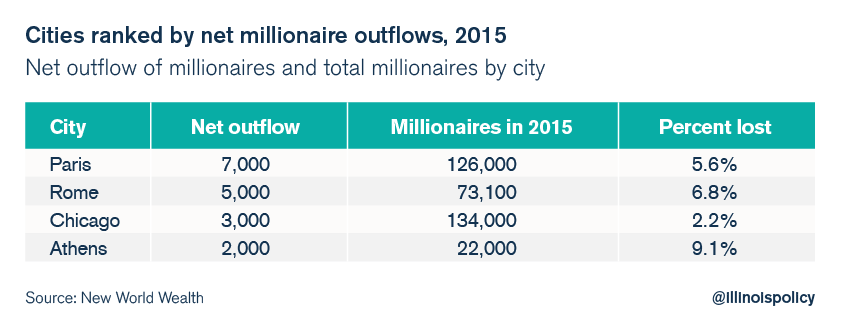

Residents of Illinois’ largest city, Chicago, have seen both property taxes and crime surge simultaneously. Many lower-income Chicagoans are stuck – with rising taxes, diminishing opportunities and few resources with which to leave. Meanwhile, wealthy Chicagoans are in flight. Research from a South African wealth migration firm shows that in 2015, Chicago was the only American city with recorded net millionaire flight – more than every city except Rome and Paris.

Analysts at Moody’s Investors Service have warned that Illinois might be facing what could be described as a financial death spiral because so many people are leaving the state as Illinois’ debt surges. But instead of cutting spending, the state Senate has proposed raising taxes.

The State of Illinois Economic Forecast for 2017 says that four Illinois metro areas are already in recession, with four more in danger of falling into recession. The report lists Bloomington, Carbondale, Peoria and the Quad Cities as already in recession, with Elgin, Danville, Decatur and Kankakee at risk of sliding out of their economic recoveries.

The Illinois Senate plan is the equivalent of a failing cable company that is raising service rates on a fleeing customer base right before the company goes bankrupt. Instead of providing better services at a lower cost to constituents, the Senate proposal would raise rates on its remaining “customer base,” undoubtedly driving more of them out of the state, and ultimately deepening Illinois’ crisis.

The primary financial problems Illinois faces are massive retirement debt and operating expenses for government workers. The pension and OPEB debts could be addressed if the General Assembly would put an amendment to the Illinois Constitution on the ballot for Illinois voters to consider, as should have happened years ago. And the state’s unsustainable spending on union contracts for government workers could be reined in if the General Assembly changed the laws to reduce the extraordinary power government-worker unions have in the collective bargaining process.

Finally, Illinois desperately needs economic growth. The state should adopt policies to attract more businesses, such as cutting the reams of red tape that strangle businesses and stifle innovation, and minimizing the tax burden.