Illinois Senate passes legislation to slash start-up costs

Illinois currently has the highest start-up fees in the country, further burdening the already-unfriendly business climate in the state.

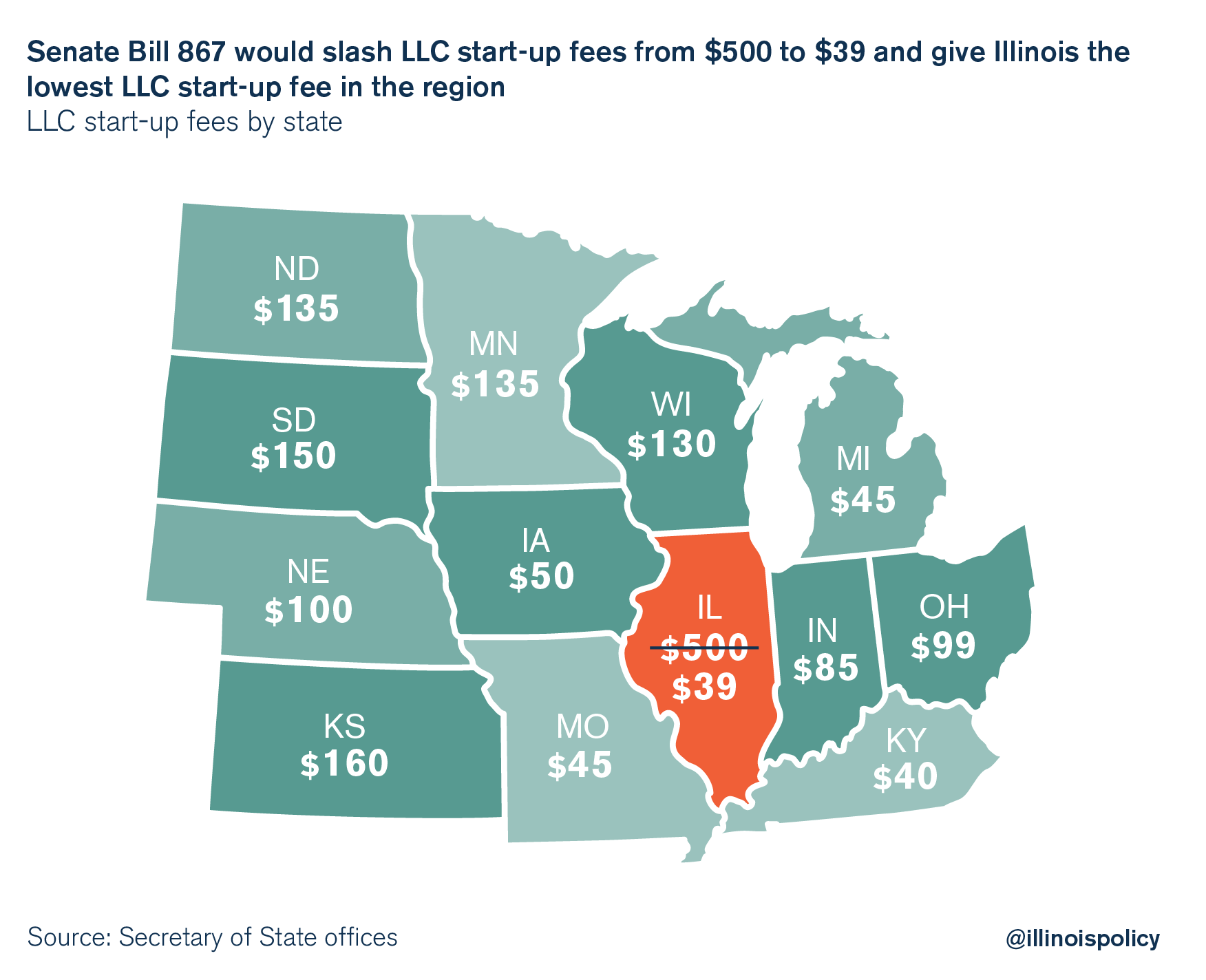

A bill that recently passed the Illinois Senate would lessen startup costs for entrepreneurs. Lawmakers from both sides of the aisle voted unanimously May 3 to pass Senate Bill 867, which will reduce the cost of starting a Limited Liability Company in Illinois from $500 to $39. State Sen. Tom Cullerton, D-Villa Park, was the bill’s chief sponsor.

Illinois currently has the highest start-up fee in the country for LLCs, tied with Massachusetts. Illinois entrepreneurs pay this $500 fee simply to file paperwork to organize a new business. Not only is the fee unnecessarily painful, it signals to entrepreneurs that Illinois sees businesses as entities to nickel and dime rather than as partners in producing economic growth.

Cutting the LLC start-up fee from $500 to $39 is a symbolic first step toward getting Illinois back on the right footing. SB 867 would give Illinois the lowest start-up fee in the region.

A lower start-up fee is a good way to begin signaling to businesses that Illinois wants to attract investment and economic growth. Everybody wins when the economy grows faster, and more rapid economic growth is necessary for Illinois to produce higher wages and a better standard of living.

State Rep. David McSweeney, R-Barrington Hills, is the chief sponsor of the bill in the House. If it sails through the House as easily as it went through the Senate, Illinois will have a better incentive structure to attract new business formation.

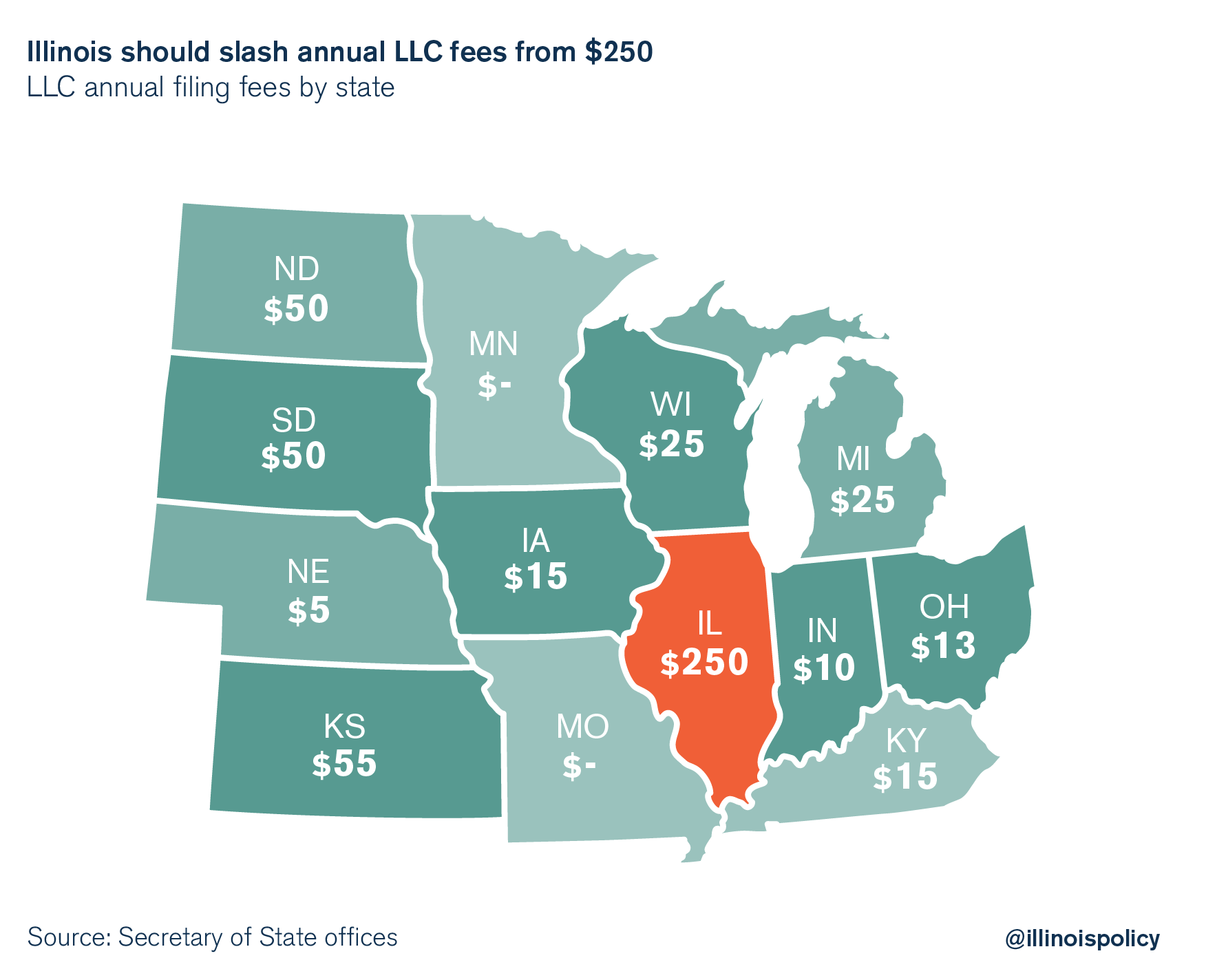

The state legislature can follow up on this cost-cutting measure by also reducing the LLC annual filing fee. Illinois’ $500 LLC start-up fee is punishing, and is backed up by an annual fee of $250 per year. SB 867 does not change the annual fee.

The annual fee is also far out of line with surrounding states, and hits every LLC in Illinois every year. Cutting the annual fee would keep a little more money in the pockets of small businesses.

Taxes, fees and regulations in Illinois create incentives for businesses to avoid the Land of Lincoln. Meanwhile, neighboring states have been rolling out the welcome mat for new business investments. For example, Kentucky has announced nearly $3 billion in new business investments since enacting Right-to-Work in early 2017.

These types of job-creating investments don’t come to Illinois. Instead, workers in neighboring states benefit from new capital and machinery, higher productivity and increasing wages. Workers in Illinois are too often stuck envying the job opportunities across the border.

SB 867 is a start to build upon. Lawmakers should pass SB 867 and string together a series of business reforms to make Illinois an attractive place to invest.