Illinois sees stagnant jobs growth, declining labor force in January

Despite healthy jobs growth nationally, Illinoisans are desperate for work.

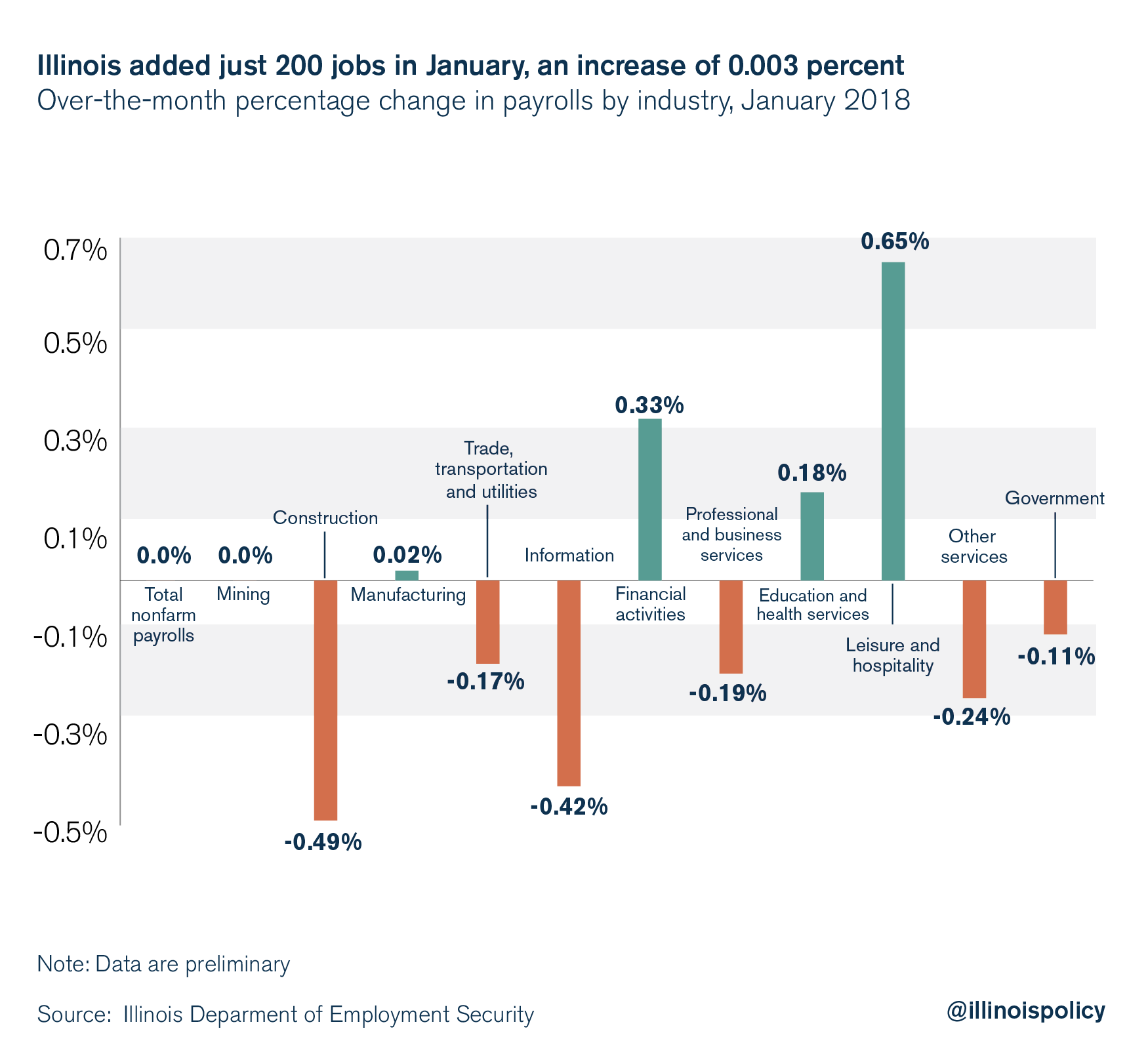

Nonfarm payrolls in Illinois remained virtually flat over the month of January, with the state adding only 200 jobs, an increase of 0.003 percent.

That’s according to the Illinois Department of Employment Security, which released its monthly report on changes in the Illinois labor market March 12, in conjunction with the Bureau of Labor Statistics.

The industries that saw growth in employment were: leisure and hospitality, up 0.65 percent (+4,000 jobs); financial activities, up 0.33 percent (+1,300 jobs); education and health services, up 0.18 percent (+1,700 jobs); and manufacturing, up 0.02 percent (+100 jobs).

Meanwhile, the other six major industries saw payrolls decline. The industry sectors with payroll declines were: construction, down 0.49 percent (-1,100 jobs); information, down 0.42 percent (-400 jobs), other services, down 0.24 percent (-600 jobs); trade, transportation, and utilities, down 0.17 percent (-2,100 jobs); professional and business services, down 0.19 percent (-1,800 jobs); and government, down 0.11 percent (-900 jobs).

Lagging the nation

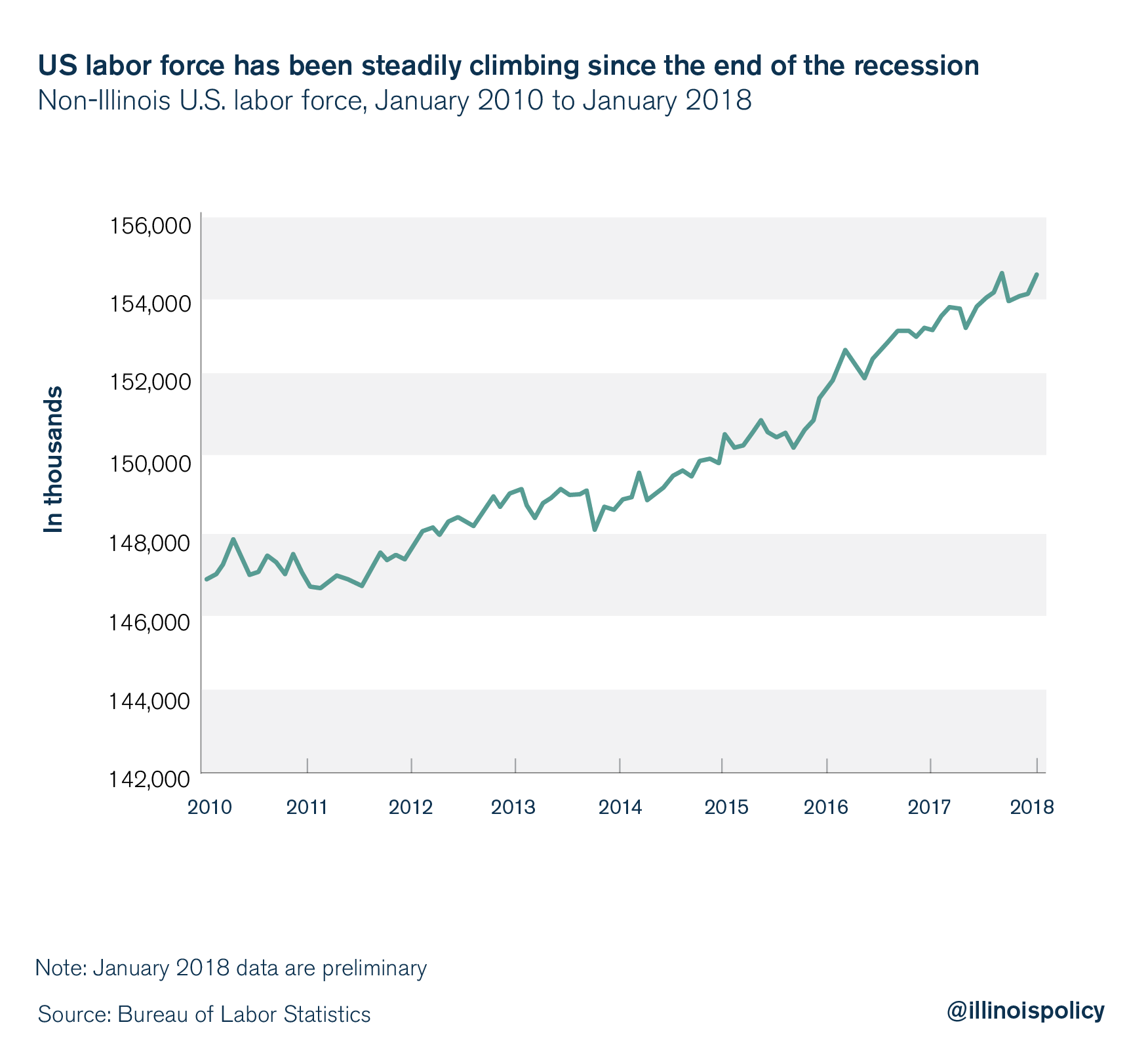

Sluggish jobs growth continues to plague Illinois, which once again lagged the rest of the nation in January. Although Illinois employment remained stagnant, the rest of the United States added 409,000 jobs in January (+0.27 percent).

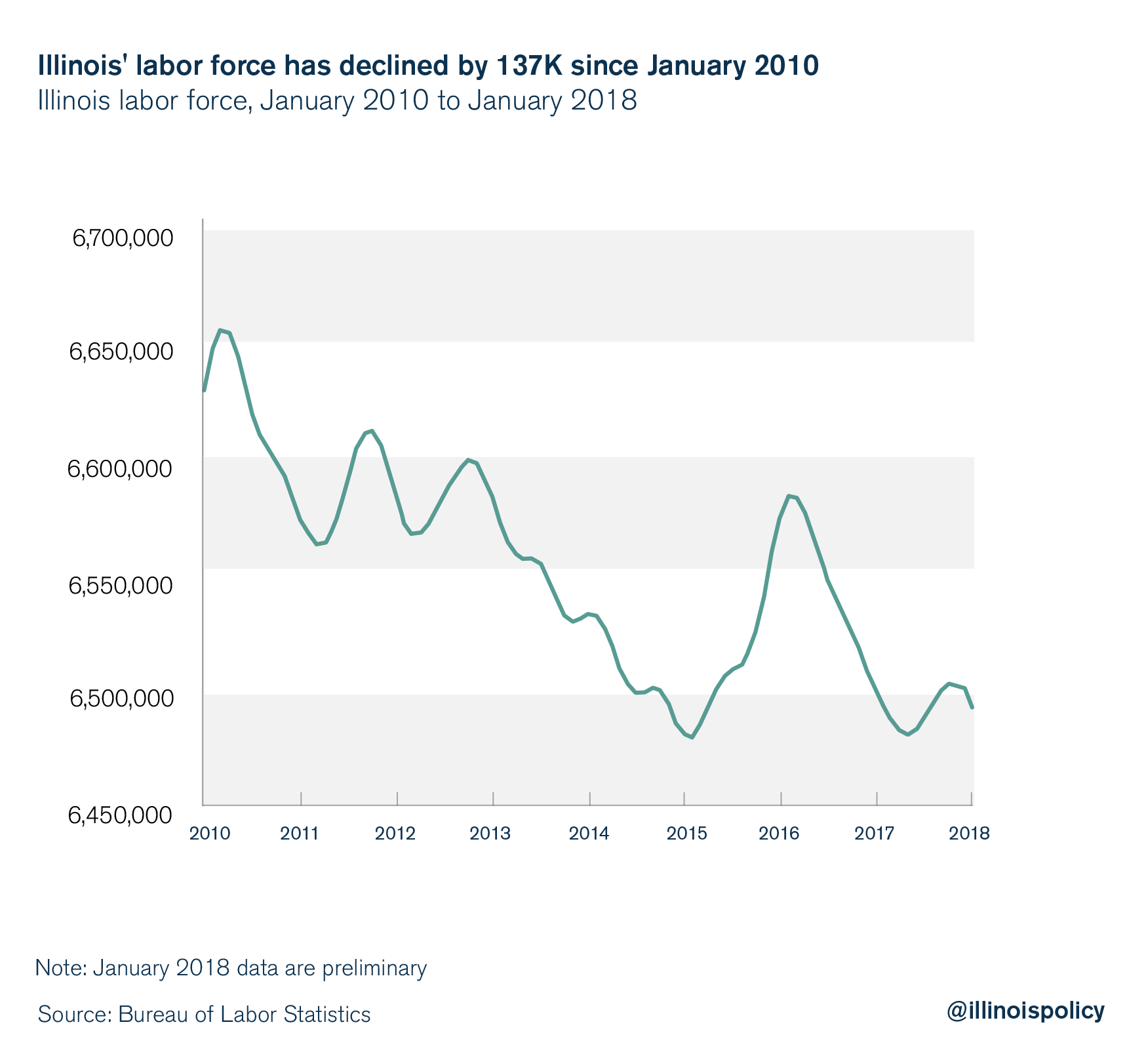

Additionally, the labor forces of Illinois and the rest of the U.S. continue to be on opposite trajectories.

Since the end of the recession, Illinois’ labor force has declined by more than 137,000 individuals, a drop of 2.1 percent. Meanwhile, the rest of the U.S. labor force has been growing during its slow, steady recovery from the recession. The rest of the nation’s labor force grew by more than 7.7 million over the same time, an increase of 5.3 percent.

Although Illinois has created relatively few employment opportunities, the unemployment rate continues to fall, dropping to 4.8 percent from 4.9 percent over the month of January. In most states, employment growth outpaced labor force growth, which caused falling unemployment rates. But in Illinois, the number of job seekers has been declining due to a shrinking labor force.

Good news, bad news

In spite of several lingering issues within Illinois’ labor market, this month’s jobs report did have a piece of good news, which came from the Bureau of Labor Statistics revising previous estimations to new benchmarks. The updated data reflect more positive but still-sluggish employment growth over the past two years in Illinois.

The December 2015 to December 2016 numbers were revised to show 0.6 percent growth (up from 0.3 percent) and the revised December 2016 to December 2017 growth was revised up to 0.7 percent from 0.5 percent.

Despite these favorable revisions, Illinois still stands in stark contrast to the rest of the U.S. economy.

Changing course

If Illinois is to reverse its current trajectory, the state needs policies that will incentivize investment and growth, and inspire confidence in job seekers to stay in the labor market.

This does not include considering yet another income tax hike. Elected officials and gubernatorial candidates alike have been touting their support for enacting a progressive income tax system in Illinois. Given what Illinoisans know about the rates put forth in House Bill 3522, a progressive income tax would constitute a tax hike of 21 percent, and increase tax bills for Illinoisans earning as little as $17,300.

Meanwhile, the 2017 income tax hike is still being felt throughout the state’s economy, and is expected to shrink the state’s economy. A progressive income tax hike can be expected to have similarly harmful effects. This progressive income tax proposal would likely drag down the state’s economy down even further, resulting in declining investment and fewer opportunities available to families who are trying to make ends meet.

Instead of saddling taxpayers with a higher income tax burden, lawmakers need to rein in the growth of government spending with a spending cap. State Sen. Tom Cullerton, D-Villa Park, and state Rep. Allen Skillicorn, R-East Dundee, have both filed constitutional amendments tying growth in state spending to growth in the state’s economy: SJRCA 21 and HJRCA 38.

Adopting these proposals will provide certainty for businesses while averting the need for future tax hikes, thus putting the state on a path toward healthier economic growth.