Illinois population loss worsens for 5th straight year

The Land of Lincoln is losing 313 residents per day to other states.

Illinois’ people problem is worsening. And it’s driven by residents leaving for greener pastures.

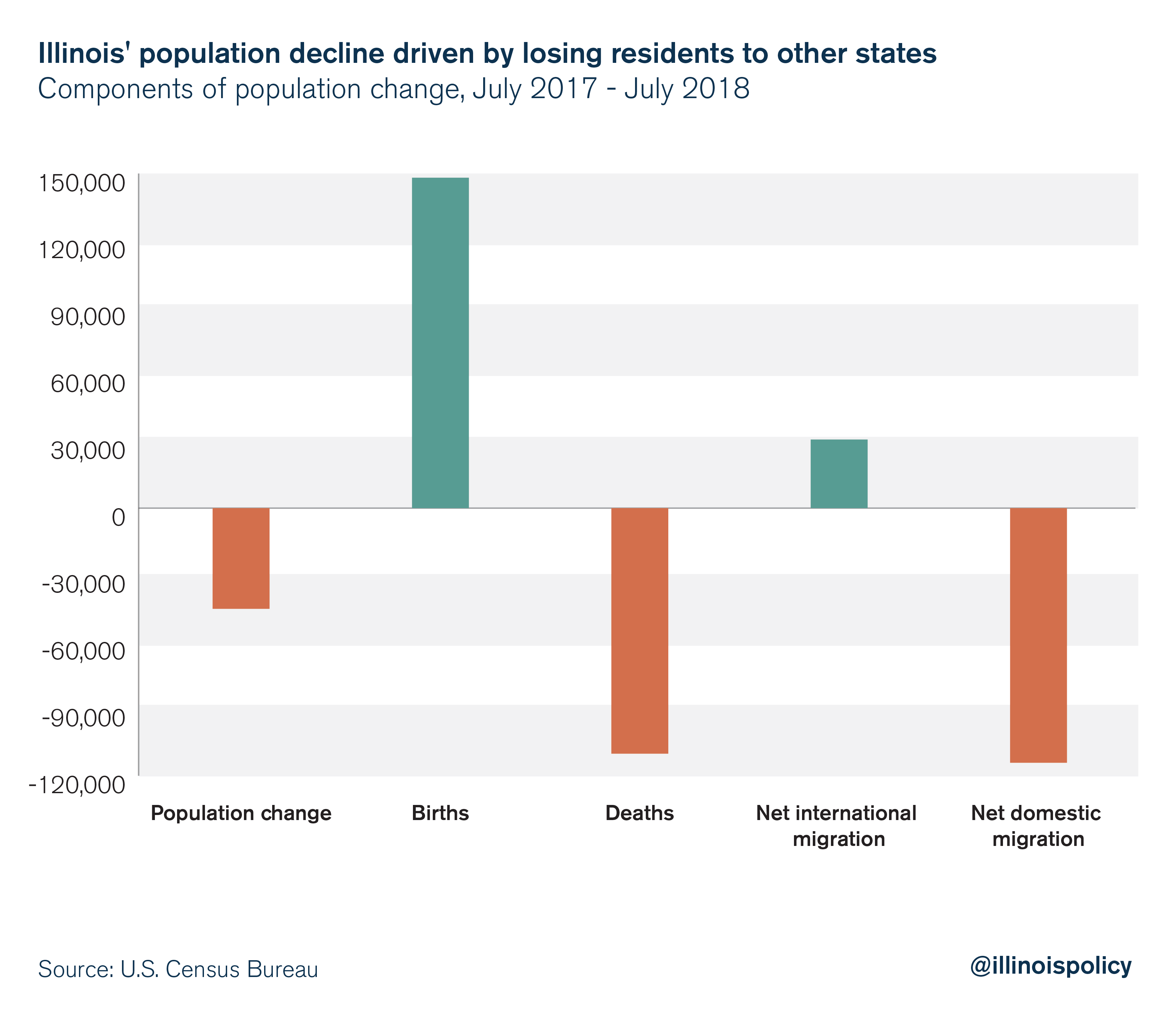

From July 2017 to July 2018, Illinois’ population shrank by more than 45,000 people, behind only New York for the worst raw population decline in the nation, according to data released Dec. 19 by the U.S. Census Bureau.

The largest driver of Illinois’ population decline? More people are leaving for other states than arriving from other states. Over the year, Illinois lost 114,000 people on net to other states, or roughly 313 residents per day.

Clearly, state lawmakers’ passing a record-breaking permanent income tax hike in July 2017 hasn’t helped matters. This policy has deterred new investment and job creation, making Illinois a less promising state in which to find opportunity.

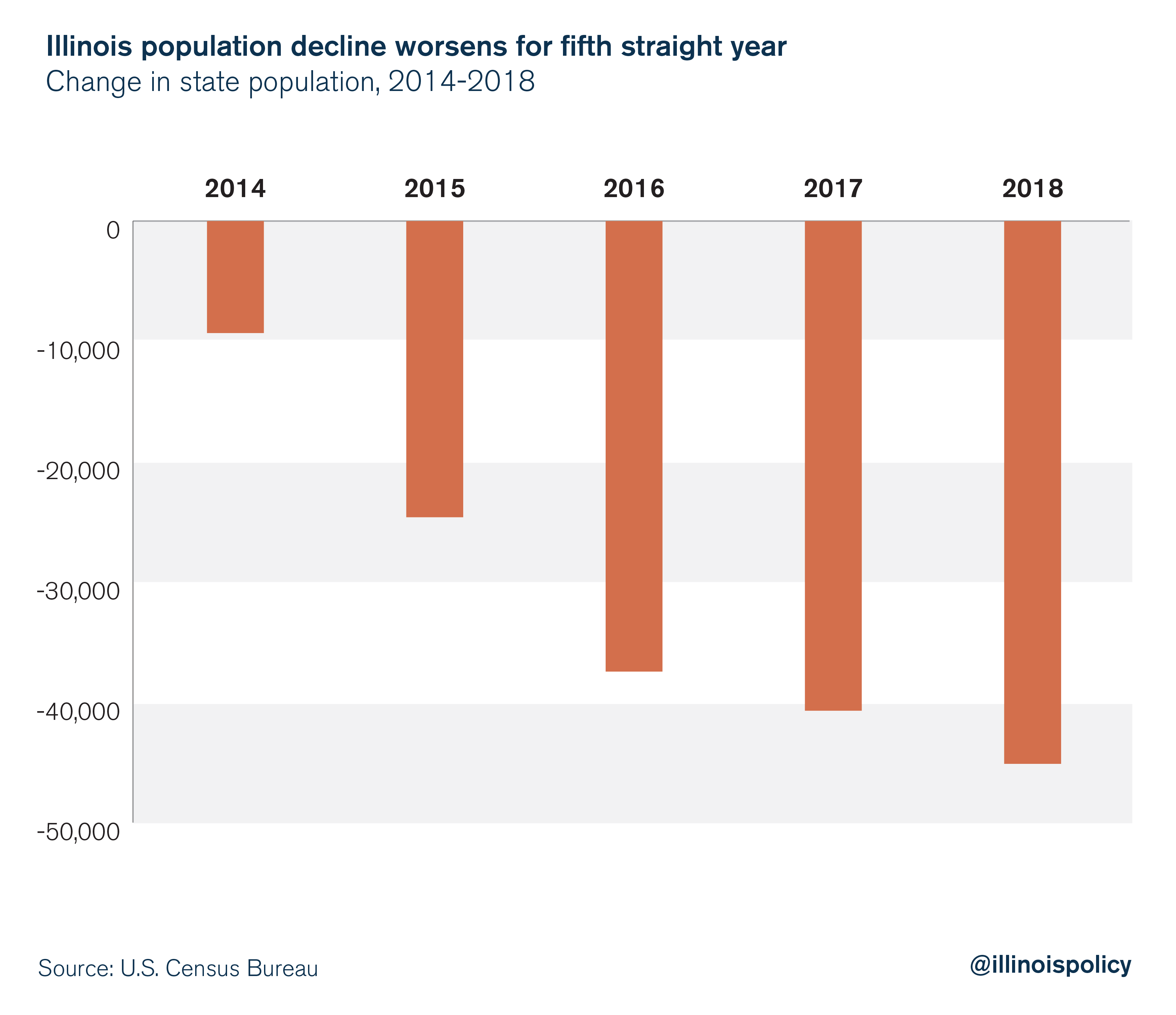

This was Illinois’ fifth straight year of worsening population decline. Among all 50 states, only West Virginia has seen more consecutive years of population decline, with six.

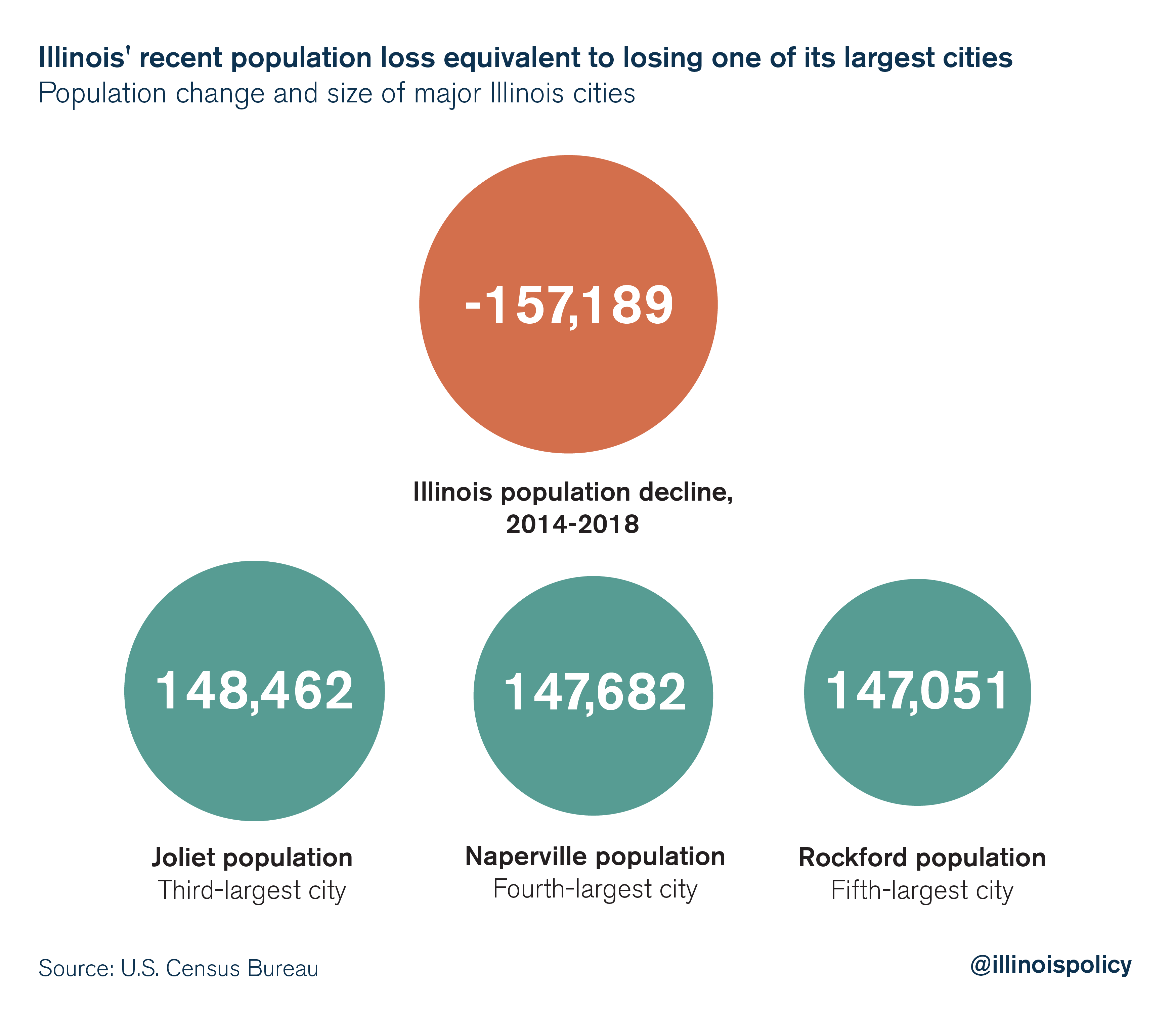

Since Illinois’ population decline began in 2014, the state has shrunk by more than 157,000 people. That’s equivalent to losing the entire city of Joliet, Naperville or Rockford. Those are the third-, fourth- and fifth- largest cities in the state, respectively. Illinois’ change in population since 2010 is the worst of any state in the nation, in raw terms.

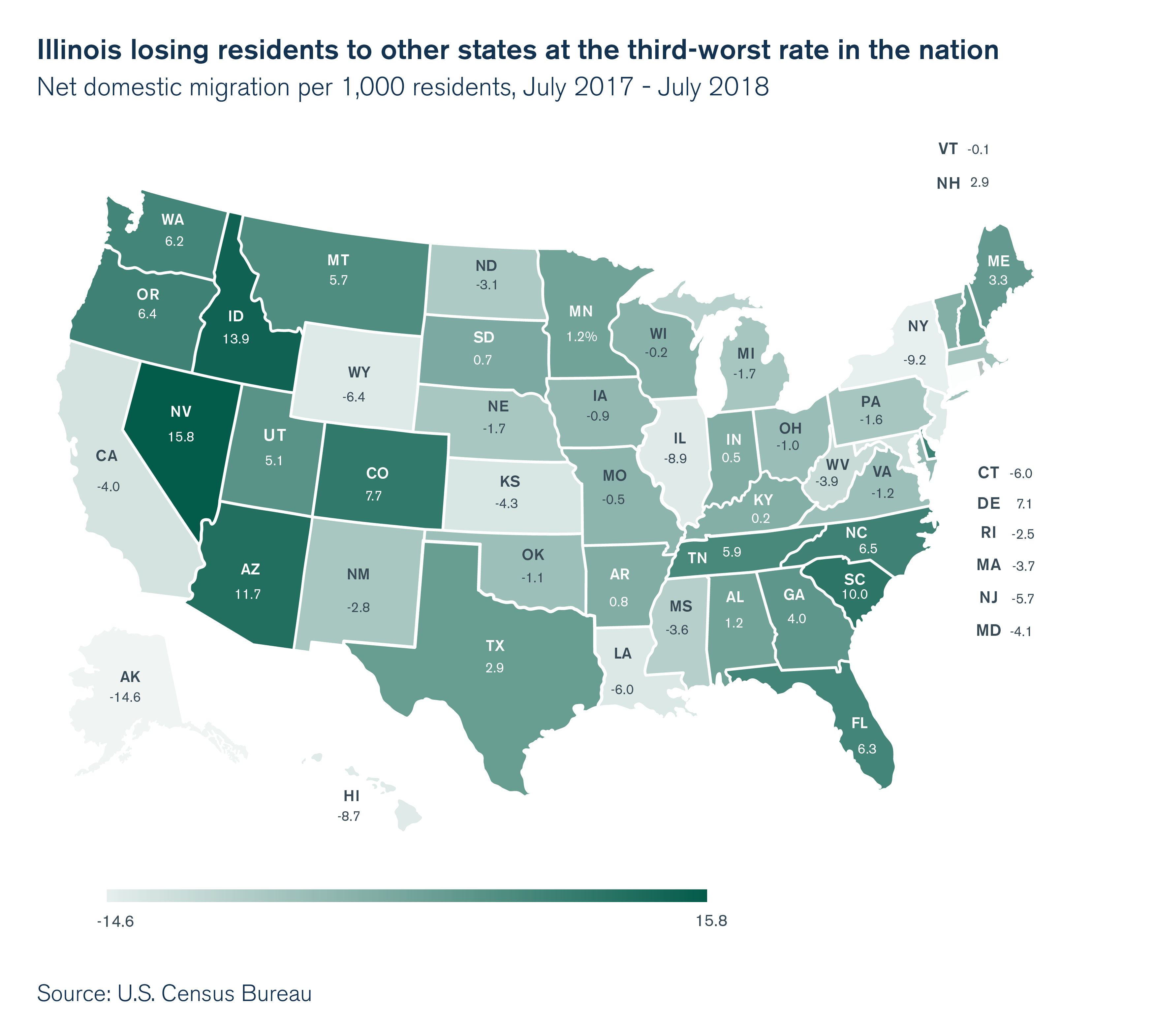

Unfortunately, Illinois lost residents to other states at the third-fastest rate in the nation over the year.

This glaring problem raises three crucial questions for state lawmakers: Who’s leaving? Why are they leaving? And what can leaders do to fix it?

Who’s leaving?

The primary driver of Illinois’ outmigration crisis is prime working-age residents (ages 25-54) seeking opportunity.

An analysis of the most recent government data reveal migrants tend to be more highly educated than non-migrants, and that the state’s people problem has led to a shrinking of both the skilled and unskilled population in the state. This is a bad sign for Illinois’ already weak labor market.

Those college-educated migrants who leave the state tend to make 14 percent more in wages and salaries than non-migrants and 18 percent more than the migrants moving into the state. This signals that Illinois is continuing to experience significant wealth flight.

The data also reveal Illinois is shedding migrants who are in the labor force and seeking a job, while attracting migrants who are less likely to be labor force participants.

Why are they leaving?

When analyzing Illinois’ people problem, it’s important to understand why people move.

Yes, warmer states have been attracting more people, especially retirees, as America’s population continues aging. But people also move because of taxes and labor market conditions. And Illinois’ population decline is driven primarily by prime working-age Illinoisans, not retirees.

The most important factor in Illinois’ migration problem is the labor market, which has been crushed by the state’s unfriendly tax policy and business climate.

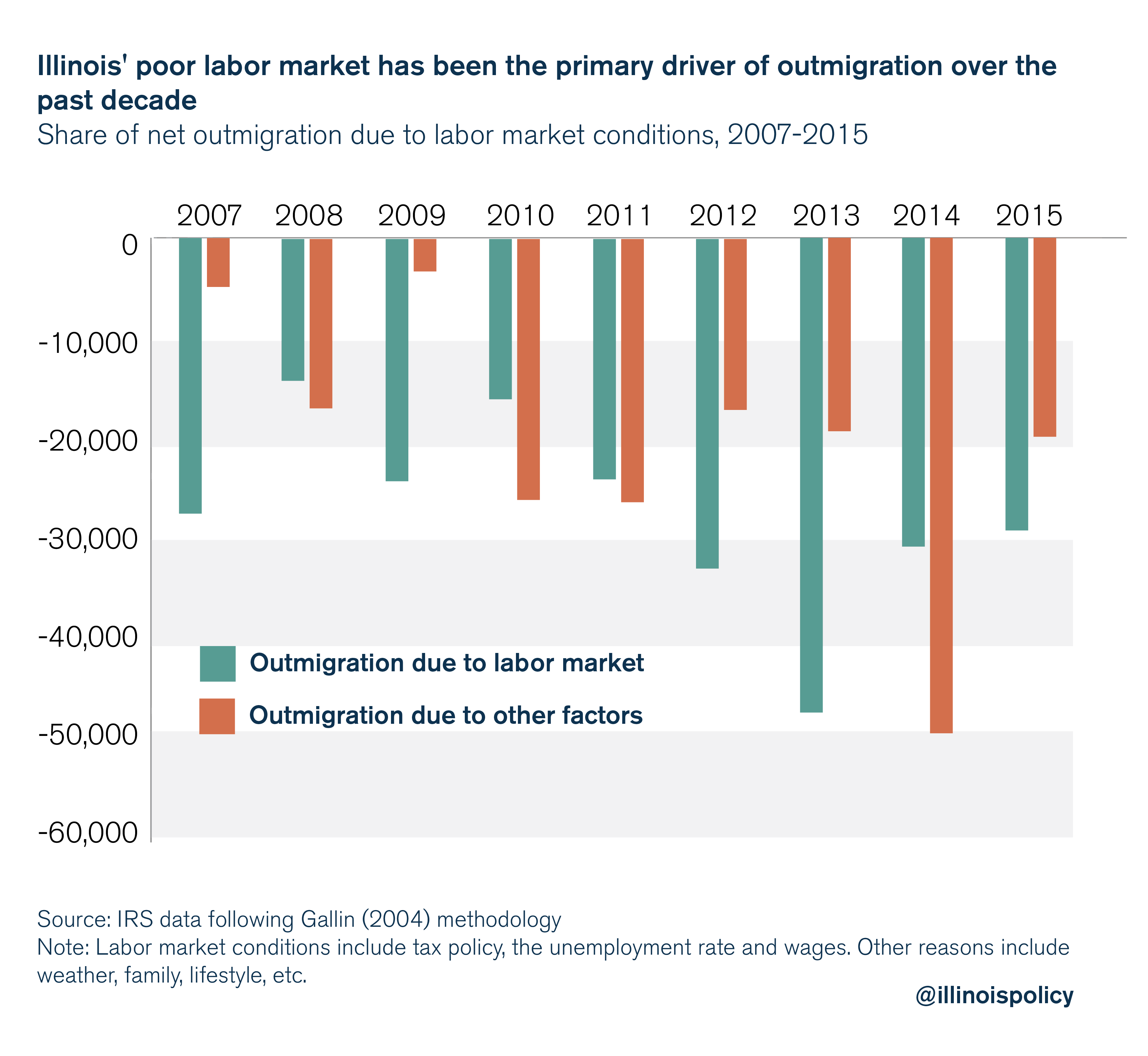

Following the methods of Federal Reserve economist Joshua Gallin (2004), which take into account the effects of climate, age and labor market conditions on migration decisions, IRS data reveal Illinois’ poor labor market has been the primary driver of outmigration since 2006, accounting for 57 percent of Illinois’ net migration losses to other states (see Appendix A).

The state’s lackluster economy is directly responsible for the loss of most migrants in the past decade. In other words, had the state fostered a healthy labor market, Illinois’ population would have continued to grow in 2014 and 2015 instead of experiencing persistent declines.

The state’s lackluster economy is directly responsible for the loss of most migrants in the past decade. In other words, had the state fostered a healthy labor market, Illinois’ population would have continued to grow in 2014 and 2015 instead of experiencing persistent declines.

Unfortunately, the state’s shrinking may get even worse, as the 2017 tax hike will continue to have harmful effects on the Illinois economy. By costing the state thousands of jobs and billions of dollars in economic activity, the recent tax hike made the state less attractive for families looking to plant roots. State lawmakers cannot continue to rely on tax hikes if they want families to bet on Illinois.

Reversing the trend

Illinois state lawmakers have the opportunity to put the state on a path toward a more prosperous future through policy reform. But what kind of reform should a shrinking state pursue?

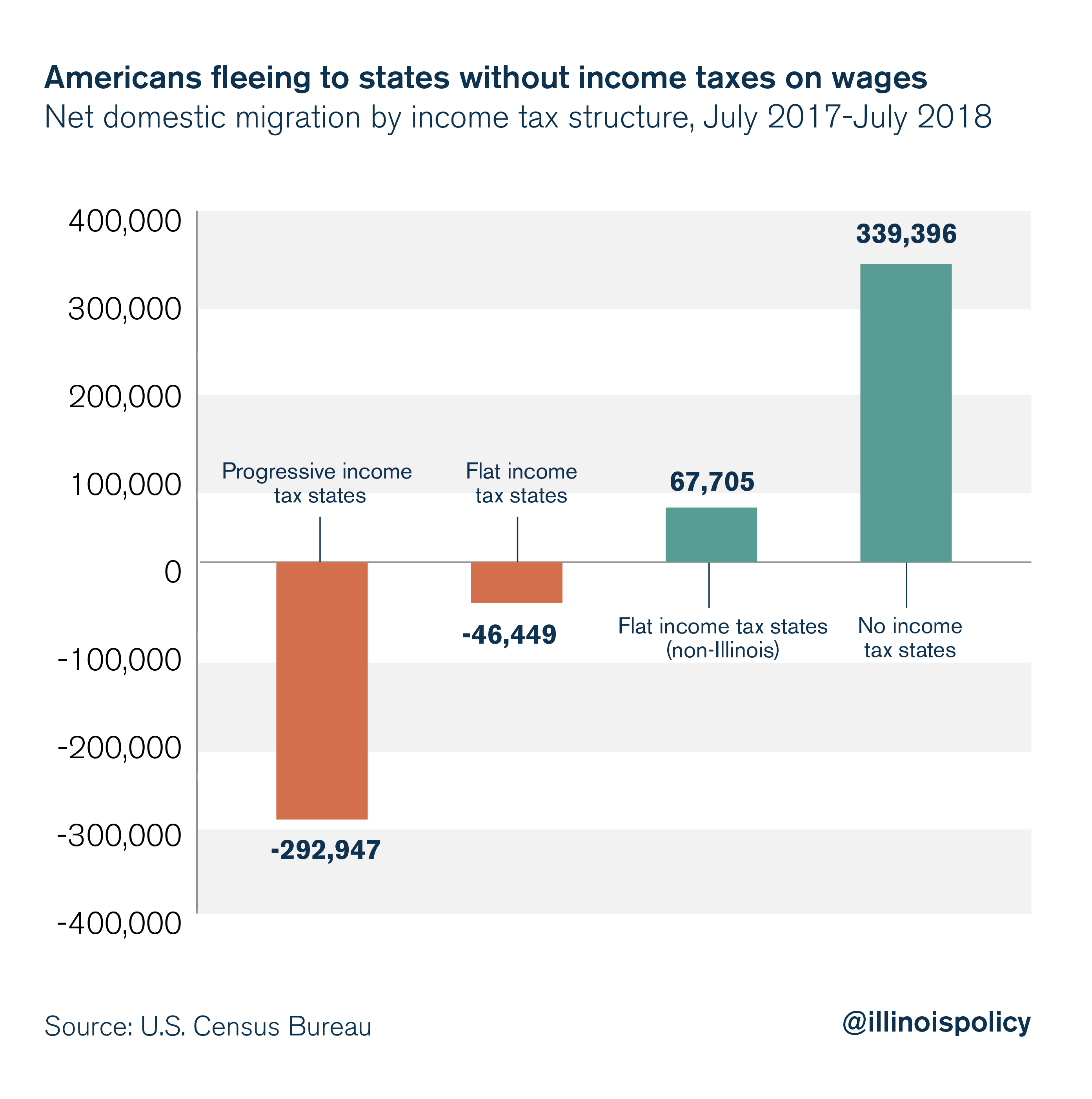

One clear mistake, given the state’s people problem, would be scrapping Illinois’ constitutionally protected flat income tax.

Progressive income tax states are hemorrhaging residents to more competitive tax environments, losing nearly 300,000 residents to other states over the past year as a group. Meanwhile, states with no income tax gained more than 300,000 residents. And taken together, flat income tax states excluding Illinois also gained residents from other states.

Instead of looking to a progressive income tax for increased revenue, Gov.-elect J.B. Pritzker should look at the true cost drivers of state government in 2019.

If Illinois is to reverse recent trends and foster population growth within the state, it must address the root causes of its migration problem: an unfriendly business environment that discourages investment and job creation, and punishes residents with high taxes.

Instead of continuously hiking taxes, state lawmakers need to free Illinoisans from their enormous tax burden. A lower tax burden would stimulate investment and job creation, making the state a more attractive place for families and businesses to plant roots.

The only way to get lower taxes – and more tax certainty – is to rein in government spending at the state and local levels. A spending cap could provide certainty about future government spending and help lawmakers avoid tax hikes to balance the budget.

Pension obligations are one of the largest cost drivers of government spending and now eat up more than a quarter of the state budget, meaning Illinoisans are paying more and getting less. Despite paying billions of dollars a year into the state retirement systems, these funds are becoming less solvent over time, as returns on investment are frequently below their projected targets and 3 percent compounding benefit increases outpace inflation.

An amendment to the Illinois Constitution that protects current earned benefits, but allows for a slower growth in accrual of future benefits – such as a true cost of living adjustment tied to inflation – would help to reduce the state’s $130 billion pension debt that taxpayers are on the hook for.

Without addressing the necessary spending reforms the state so desperately needs, Illinois will likely continue to shrink.

Appendix A: Estimating migration due to labor market conditions (Click to download)