Illinois pension plans 39% funded, taxpayers on the hook for $105 billion in liabilities: It will get worse

Numerous U.S. pension plans are in deep, deep trouble, and Illinois is at the top of the list. Plan assumptions cannot and will not be met.

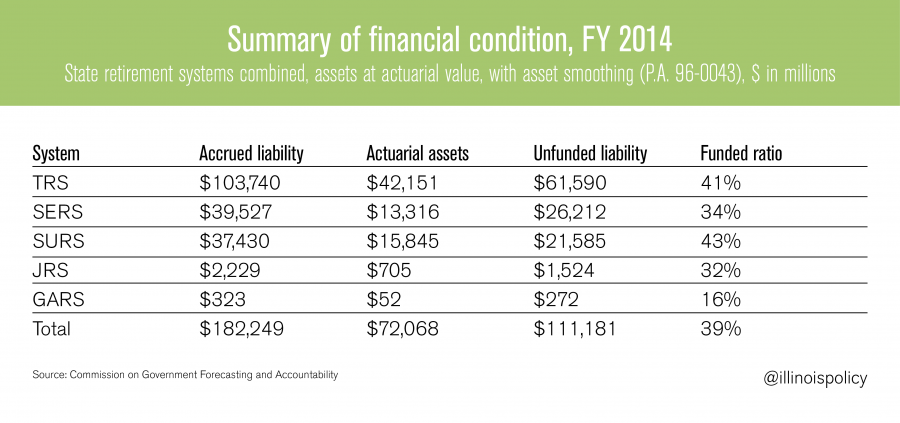

A “Special Pension Briefing” from the Commission on Government Forecasting and Accountability last November shows Illinois’ state retirement systems are in dismal shape.

Unfunded liabilities

- Teachers’ Retirement System (TRS): $61.6 billion

- State Retirement Systems (SERS): $61.6 billion

- State Universities Retirement System (SURS): $21.6 billion

- Judicial Retirement System (JRS): $1.5 billion

- General Assembly Retirement System (GARS): $0.3 billion

The above numbers show actuarial (smoothed) asset valuations, as does the following chart.

Congratulations go to the Illinois General Assembly Retirement System for having one of the worst, (if not the worst) pension plans in the entire nation. It is 16 percent funded.

No doubt, that increases the pressure of the General Assembly to put the burden of bailing out the system on the backs of Illinois taxpayers.

Smoothed returns

The above chart shows “smoothed returns” that even out the 2007-2009 dip as well as the 2010-2014 blast higher. Illinois resorted to using smoothed returns to minimize the effect of the 2007-2009 dip. But now, with the rally, Illinois wants to use actual market returns.

On a non-smoothed (market) basis the numbers are slightly better. Non-smoothed, the total deficit is $105 billion instead of $111 billion.

Liabilities per household

Let’s be generous and assume the lower $105 billion number. The U.S. Census Bureau shows there are 4,772,723 Illinois households.

The potential taxpayer burden to make up the deficit is $22,000 per household. That’s not even the worst of it, as the following chart shows.

In spite of the massive stock-market rally, Illinois liabilities have increased every year since 2011.

0% chance of success

It’s bad enough that Illinois is $105 billion to $111 billion in the hole and liabilities have increased in spite of a massive rally in both stocks and bonds.

Illinois’ plan expectations are icing on the cake.

I discussed this at length in my post, “Beggar Thy Taxpayer: Currency Wars, QE Strain Life Insurers and Pension Plans; Negative Returns With 4-7% Promises.”

Europe vs. U.S.

In Europe, pension plans and retirement funds have promised 4 percent returns. Future promises in Germany are now down to 1.25 percent. However, yields on 10-year German bonds are 0.35 percent.

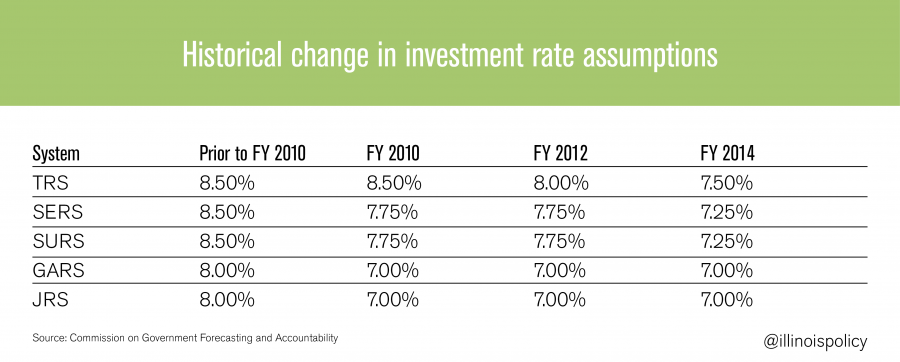

In Illinois, the plan assumption for TRS, the biggest system with the biggest unfunded liability, is 7.5 percent. There has been no meaningful reduction in plan promises over the years.

7.0% to 7.5% assumptions will not happen for two reasons

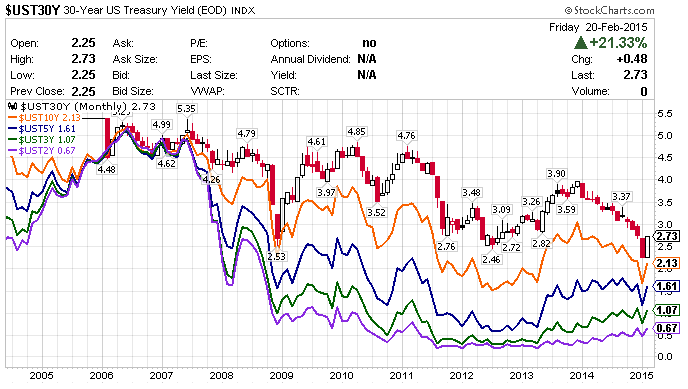

- U.S. treasury yield curve

- Stock market valuations

U.S. promises

In the U.S., pension funds have not made 1.25 percent promises or even 4 percent promises, but rather promises in excess of 7 percent with the 10-year bond yielding 2.13 percent. Annuities promise 6 percent or so.

Illinois’ promises range from 7.0 percent to 7.5 percent. How do you get 7.5 percent in a 2 percent world?

The correct answer is: you don’t. But insurers and pension plans try, by taking risks. And the more risk they take, the higher and higher into bubble territory go stock-market and junk-bond valuations.

This is well understood and established behavior. And it’s precisely what the Fed has sponsored. At the end of 2012, even mainstream media recognized what was happening, as shown by the following from the CNBC article “How the Fed Is Pushing Investors to Buy Junk Bonds”:

“‘The market is thirsting for yield and the Fed is pushing people to do things like this [buy junk],’ said Lawrence G. McDonald, who as head of LGM Group specializes in junk-bond trading. ‘So big asset managers are reaching, reaching, reaching and companies know this and are issuing, issuing, issuing all this crap.’”

We have seen that effect in Illinois pension plans as well. The Illinois Policy Institute report, “401(k)s are better than politician-run pensions,” noted that pension funds often invest in riskier assets to try and boost their returns. From the report:

“A look at the Illinois Teachers’ Retirement System, or TRS, portfolio, for example, reveals a portfolio of investments in junk bonds, real estate, derivatives and private equity. TRS has more than $1 billion invested in bonds that Moody’s Investors Service or S&P Ratings Services rate as junk.”

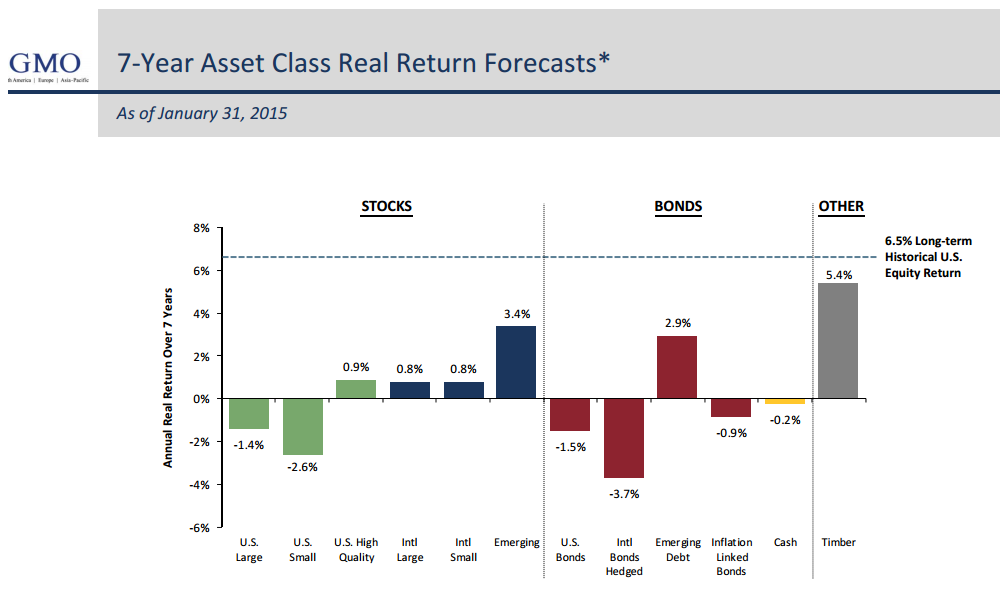

7-year negative returns

As of Jan. 31, 2015, stock and bond prices are so stretched that GMO’s “7-Year Asset Class Real Return Forecast” shows negative real returns for seven years in U.S. equities and bonds.

From GMO:

“The chart represents real return forecasts for several asset classes and not for any GMO fund or strategy. These forecasts are forward‐looking statements based upon the reasonable beliefs of GMO and are not a guarantee of future performance. Forward‐looking statements speak only as of the date they are made, and GMO assumes no duty to and does not undertake to update forward‐looking statements. Forward‐looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results may differ materially from those anticipated in forward‐looking statements. U.S. inflation is assumed to mean revert to long‐term inflation of 2.2% over 15 years.”

As of Dec. 31, 2014, GMO managed $116 billion in assets.

Broken model

In the U.S., pension plans have aggressively shifted from investing in AAA-rated bonds to equities and junk bonds because yields in U.S. treasuries and AAA-rated corporates are not high enough.

Denial that this has happened is nearly everywhere one looks. Of course the Fed, and most others, cannot and will not see a bubble until it bursts wide open.

Even if the air is let out slowly – something that has never happened in practice – negative real returns, and perhaps zero nominal returns for seven years are the only other plausible outcomes unless one expects an even bigger bubble coupled with even longer negative returns in the future.

Simply put, numerous U.S. pension plans are in deep, deep trouble. Illinois is at the top of the list. Plan assumptions cannot and will not be met. It’s far too late for token improvements.

Honest discussion needed

Not even massive tax hikes can save the system at this point. Businesses and taxpayers would flee. And Illinois is already struggling with corporate and individual flight.

The Illinois pension system is totally broken. It’s time to have a truly honest discussion of what to do about it.