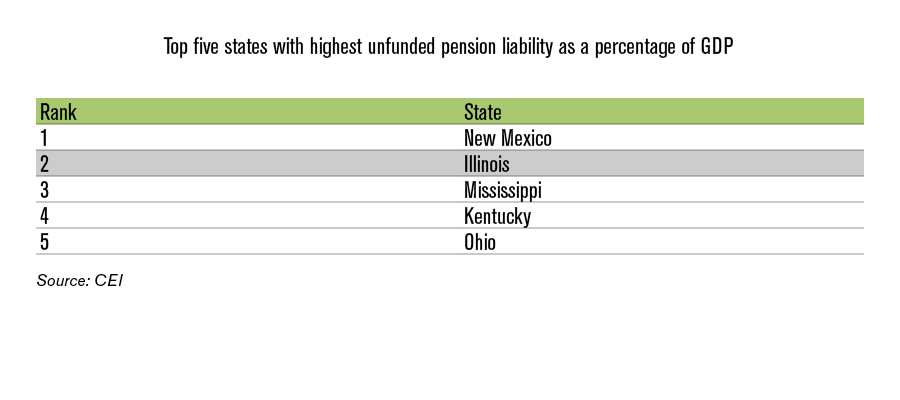

Illinois pension debt ranks second-worst in the nation

Illinois has once again earned the dubious honor of having one of the worst pension crises in the nation. This week, the Competitive Enterprise Institute, or CEI, released a report, “Understanding Public Pension Debt,” which combined the state rankings of several different pension debt studies, including reports by Moody’s Investors Service and the U.S. Census...

Illinois has once again earned the dubious honor of having one of the worst pension crises in the nation.

This week, the Competitive Enterprise Institute, or CEI, released a report, “Understanding Public Pension Debt,” which combined the state rankings of several different pension debt studies, including reports by Moody’s Investors Service and the U.S. Census Bureau.

Each study measured states’ unfunded pension liability as a percentage of their gross domestic product.

Unsurprisingly, Illinois had one of the worst scores in the country, behind only New Mexico.

The report goes on to explain why large pension debts negatively impact states:

The report goes on to explain why large pension debts negatively impact states:

“It is not just current tax burdens that matter. Moving a business or a household can be costly, as can altering one’s business practices or expenditures in light of policy changes. So location and other business decisions, as well as individuals’ residential choices, also depend on expectations of future changes in tax burdens and government-provided services.

Government debt can be a major driver of such expectations…The larger the debt, the larger the potential tax increases — and the greater the behavioral responses to them.”

Those advocating for higher taxes to pay down Illinois’ pension debt need to understand this point.

Illinois’ companies and residents know that every dollar from a new tax hike will go toward paying down pension debt – not providing services.

The same goes for companies or citizens outside of Illinois who are looking to relocate. Why would a company move to Illinois when the higher taxes it pays won’t provide government services, but will instead pay down the state’s massive pension debt?

Illinois can’t afford higher taxes if it wants to attract more businesses and residents. Real pension reform, starting with 401(k)-style plans for all new state workers, is the only way to fix the state’s fiscal crisis.