Illinois payrolls see largest monthly drop since Great Recession

State sheds 34,100 jobs during early stages of COVID-19 economic fallout.

Last week, the Illinois Department of Employment Security released data offering the first glimpse at the extent of job losses as a result of the coronavirus and measures taken to contain it.

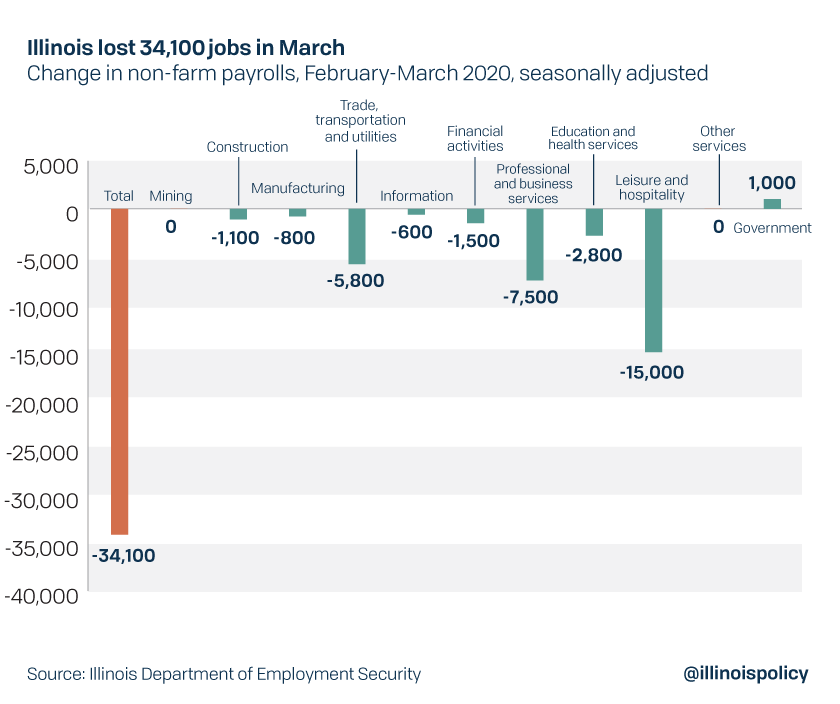

The data covers the last two weeks of February and first two weeks of March, so it excludes the final two weeks of March when initial unemployment claims in Illinois were hitting six figures each week. Still, the new data revealed Illinois lost 34,100 non-farm jobs during the period – the largest monthly decline since the Great Recession.

Leisure and hospitality was the sector with the most severe losses as payrolls declined 15,000 (-2.4%) during the period, which the state reports as “March.” The sudden decline in jobs was the most for the industry in over 20 years and came as the state began taking precautions to prevent the spread of COVID-19 and closed businesses deemed “non-essential.”

The only area of the economy that did not experience payroll declines was the government sector, which added 1,000 jobs. Two hundred of those jobs came at the federal level, while state and local government each added 400 positions during the month.

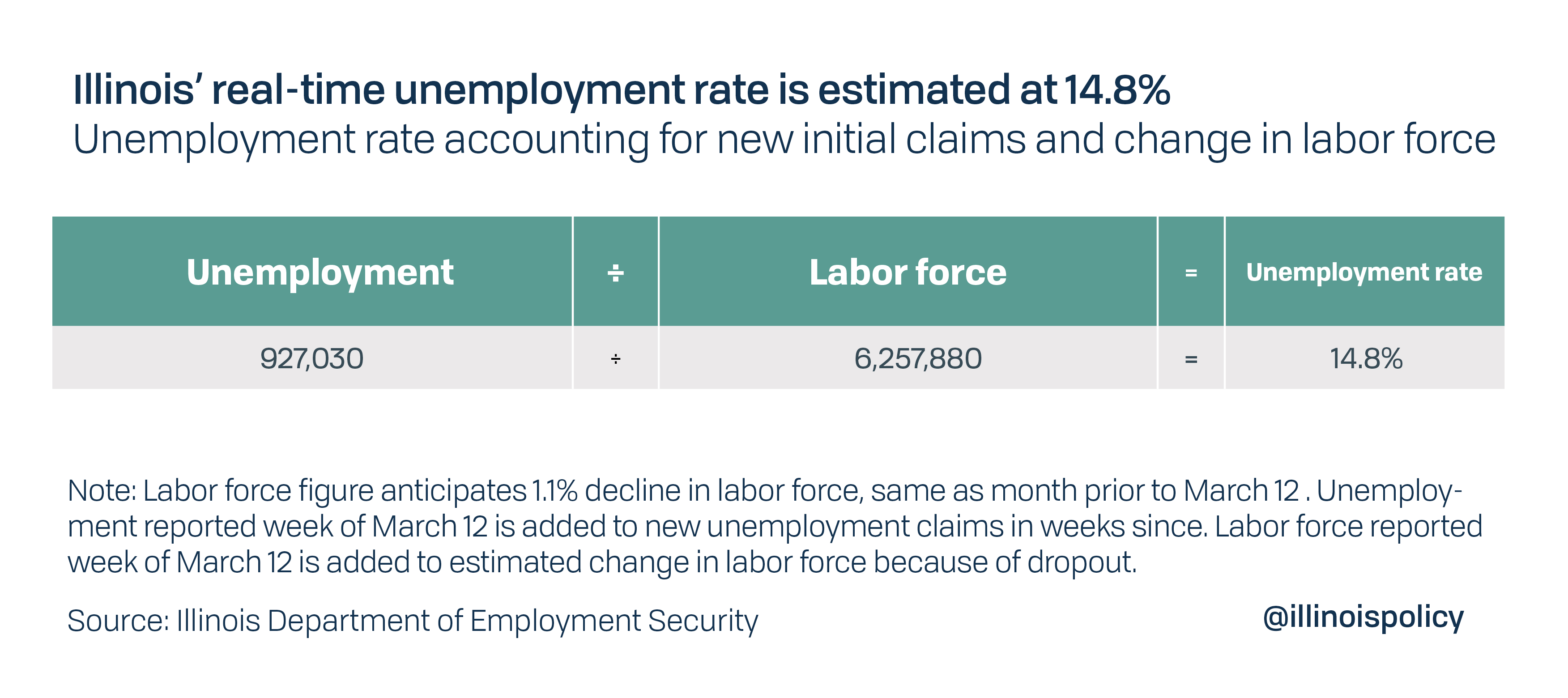

Large declines in payrolls have also resulted in skyrocketing unemployment claims. As of mid-March, the state’s non-seasonally adjusted unemployment rate had jumped by 26%, going to 4.4% from 3.5%. In the weeks since then, an additional 635,000 Illinoisans have made initial unemployment claims. This would bring the state’s estimated real-time unemployment rate closer to 14.8%.

Even the real-time estimate is likely an underestimate. Many Illinoisans are dropping out of the labor force entirely right now, and many have still been unable to register for unemployment insurance with the state.

Allowing for a robust recovery

As record numbers of Illinoisans find themselves suddenly out of a job, and no word yet from government leaders on when “non-essential” business will be allowed to reopen, Illinoisans need certainty. A simple way for legislators to provide more certainty and improve chances of a strong labor market recovery would be to remove the progressive income tax amendment from the Nov. 3 ballot.

Prior to the coronavirus outbreak, Illinois was already shedding private sector jobs. Now, hundreds of thousands of Illinoisans are finding themselves out of work. In order to ensure as many of these jobs as possible can return, Illinois should work diligently to avoid increasing taxes.

The progressive income tax rate structure passed by the General Assembly would hike taxes on around 100,000 Illinois small business owners who file as S-corps or partnerships, also known as “pass-through” businesses. Small businesses are the economic engine of the state – responsible for roughly 60% of new job creation. Hiking their taxes would only serve to kneecap the economic recovery after the pandemic.

Instead of pursuing an expensive and contentious ballot fight that could end with tax hikes on Illinois small businesses at a terrible time, lawmakers should listen to local entrepreneurs and withdraw the question altogether.