Illinois on track to become first ‘junk’-rated state in nation

Credit rating agencies have warned Illinois’ credit could slide into junk territory if the legislative session ends in May without a budget deal to get the state’s finances back on track.

The state of Illinois’ financial condition is just one month shy of being designated “junk” by the nation’s credit agencies. The agencies have warned that if Illinois doesn’t resolve its budget issues by May 31 – the end of the state legislative session – it may be punished with more downgrades. It’s quite possible the agencies could downgrade Illinois bonds to junk status.

A junk rating of Illinois’ bonds isn’t just some wonky financial designation that only affects politicians. It has real consequences for the people of Illinois, from the most vulnerable to the wealthiest.

Illinois’ political class is to blame for the state’s financial collapse. Lawmakers have been unwilling to enact the spending reforms to stop the bleed and the economic reforms to grow the state’s tax base.

Falling to ‘junk’

Illinois, which already has the lowest credit rating of any state, will become the nation’s first junk-rated state if the rating agencies follow through on their downgrade warnings. The only remotely similar companion in this disgrace will be Puerto Rico, the junk-rated American territory that’s suffering a deep crisis of its own.

A junk rating would be another blow to Illinois’ already low reputation, further discouraging investment, job creators and the in-migration of new residents. It would also hurt Illinois financially and push up borrowing costs, taking even more funds away from core government programs and social service providers.

The state’s fall to junk credit status has been a long time coming. For decades, Illinois politicians have ignored important issues, passed fake reforms and papered over Illinois’ structural problems with tax hikes.

Lawmakers haven’t passed a real balanced budget since 2001. A lack of real pension reform has driven Illinois’ pension debt to $130 billion, up nearly $100 billion from a decade ago. And inadequate property tax reform and tax hikes have shrunk Illinois’ tax base, both in people and dollars.

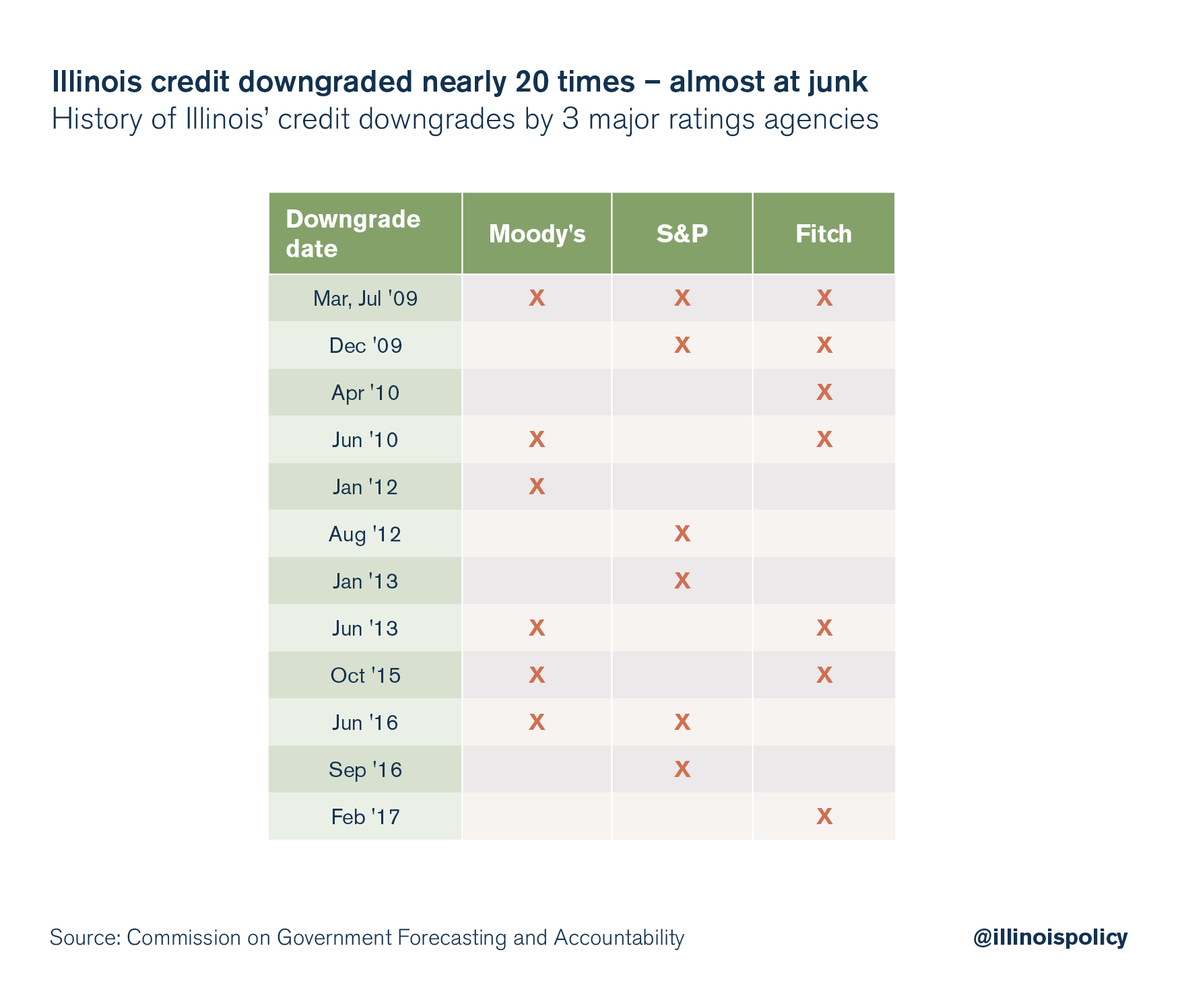

As a result, Illinois has been downgraded 19 times by the three major rating agencies since 2009 alone, according to the Commission on Government Forecasting and Accountability. Illinois’ drop to junk status would be its 20th downgrade, assuming a double-notch downgrade by just one agency.

The state’s decline is part of a larger story of financial collapse in Illinois. The city of Chicago is already junk-rated. Chicago Public Schools is even deeper in junk territory. And Illinois’ public universities are now facing additional credit downgrades as well. Northeastern Illinois University was recently downgraded further into junk status by the ratings agencies as part of a major review of all universities by Standard & Poor’s.

Without major reforms, such as moving state workers to 401(k)-style plans and comprehensive property tax reform, things will only get worse for both Illinoisans and the economy.

Illinois needs a real plan

Many politicians and pundits and those in the media think that Illinois needs a deal, any deal, to end the current crisis.

But Illinois’ past is littered with bad deals enacted in the midst of a crisis. They’re what got Illinois into its current crisis.

Former Gov. Jim Edgar’s 1996 pension ramp was a disaster that Illinoisans continue to pay for today. Former Gov. Rod Blagojevich’s $10 billion pension bond deliberately avoided addressing pension reform and simply left Illinoisans with more debt. And former Gov. Pat Quinn’s copycat deals borrowed another $7 billion. Then Quinn’s temporary income tax hike allowed politicians to raise spending, leaving Illinois on a budgetary cliff when that tax hike expired.

Every one of those deals had something in common – they all avoided fixing Illinois’ structural spending problems.

The Senate’s proposed “grand bargain” does the same. It will only perpetuate Illinois’ dysfunction, something that Illinoisans simply cannot afford.

A real plan – and a real balanced budget – must solve those structural problems. If not, Illinois won’t be able to avoid an eventual junk bond rating or get off the path to bankruptcy.