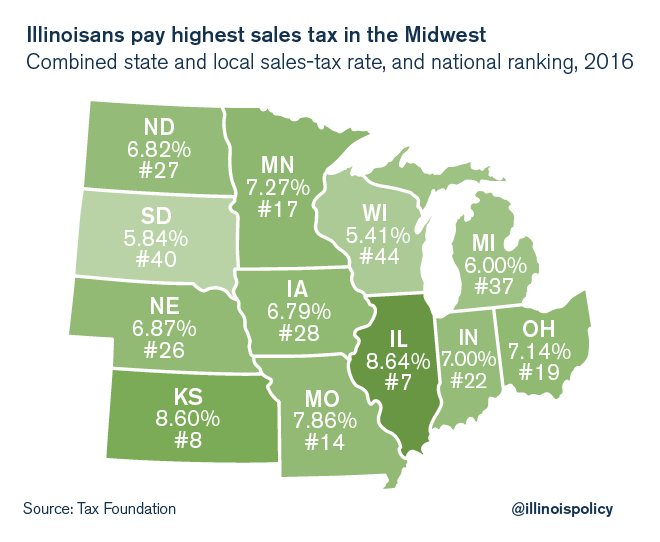

Illinois now home to the highest sales taxes in the Midwest

Combined sales taxes in Illinois have leaped past those of every other state in the region.

Whether buying diapers, drills or dungarees, the average Illinoisan pays higher sales taxes than any other Midwesterner, according to a March 9 report released by the nonpartisan Tax Foundation.

Illinois’ combined state and average local sales-tax rate of 8.64 percent surpasses that of every other Midwestern state.

Since 2015, Illinois jumped to No. 7 from No. 10 in the sales-tax rankings nationally. No other state saw such a large leap. This was due to Cook County’s 1 percent sales-tax increase that went into effect Jan. 1, 2016, which gave Chicago the distinction of having the highest sales tax of any major city – a whopping 10.25 percent.

This isn’t the only high tax Illinoisans bear.

Families also pay among the highest property taxes in the nation, which can be more expensive than a homeowner’s mortgage. They pay the fourth-highest wireless taxes in the nation and high gas taxes as well, and have politicians calling for the state to become the most heavily taxed in the Midwest overall.

These taxes, along with the record-setting 2011 income-tax hike, have led the Illinois state government to grow tax revenues at a rate higher than all but three states in the country when compared with revenues at each state’s pre-recession peak. State tax collections in Illinois have shot up by over 18 percent since before the Great Recession, after adjusting for inflation.

But as Illinois governments have seen their pockets bulge, citizens are scraping by.

Illinoisans’ incomes have grown at the second-worse pace in the nation since the Great Recession.

This disparity highlights the moral bankruptcy of another massive state income-tax hike without serious reform.