Illinois needs responsible Tier 2 pension reform

Illinois is at risk of getting in costly trouble with the federal government over its Tier 2 public employee retirement benefits. Here’s a solution that doesn’t make the state’s monstrous public pension debt even worse.

Illinois’ public pension problems are facing a new threat impacting the newer hires covered under the more modest “Tier 2” retirement benefits: the state can either add $280 million a year into their plans or face the feds demanding over $856 million a year.

State lawmakers introduced a couple bills during the fall veto session to address “Tier 2” pensions that they’ll likely move on in January. Here’s a quick review of how we got to this juncture and how to fix it.

Illinois faces a severe pension crisis with $142 billion in debt, mainly because of unrealistic benefits promised “Tier 1” pensioners. This crisis threatens public sector retirees’ benefits, crowds out spending for other important line items in the state’s budget, and contributes to high taxes, which stifle business and drive people out of the state.

To curb these unsustainable costs, the Illinois General Assembly introduced a set of reforms dubbed “Tier 2” in 2010. Inadvertently, the creation of Tier 2 has brought a new challenge: maintaining compliance with federal laws. There’s a growing gap between Tier 2’s benefits and the benefits required to avoid paying Social Security taxes.

The problem is growing quickly so the time for Tier 2 reform is now. In the past five years, the gap between the Tier 2 pensionable salary cap and the Social Security wage base has more than doubled.

On Nov. 13, state Sen. Robert Martwick and state Rep. Stephanie Kifowit introduced bills they said are geared toward addressing the problem, but their bills add a lot of unnecessary costs. What’s ultimately needed is much less expensive and less complicated: raise the Tier 2 maximum salary that earns additional pension benefits to an amount in line with Social Security.

Our proposed solution would cost the state about $280 million annually, or a single lump-sum payment of $2.1 billion. That’s better than the more than $856 million a year it would cost to pay Social Security taxes if Tier 2 goes unreformed, or the unknown sums the expansive reforms proposed by Springfield would bring.

Illinois’ pensions crisis has been brewing for decades

As of 2023, Illinois has the worst-funded pensions in the nation. Funding levels sit at 51% overall, but that number is closer to 45% for the five state-run pension systems. For context, experts consider less than 60% dangerous and less than 40% nearing the point of no return.

The state has accumulated an estimated $142 billion in pension debt, with some independent rating agencies estimating it to be over $300 billion. This means these funds don’t have enough money to cover all the benefits they’ve promised to pay out. In fact, for every dollar of promised benefits, the state only has about 45 cents on hand.

This pension crisis has been decades in the making, resulting from a long history of bad decisions from policymakers, such as devising schemes to get out of fully funding annual pension payments. Politicians have consistently failed to appropriate the necessary funding to keep the pension systems solvent, and it’s harming all Illinoisans.

With pension promises that grow at a faster rate than the state can reasonably fund, hundreds of thousands of public-sector retirees face the risk of drastic cuts to their promised benefits without reforms. The burden on Illinois taxpayers is immense: taxpayers’ contributions to state pension systems have grown nearly 20-fold from $614 million in fiscal year 1996 to $11.2 billion in fiscal year 2025 – and still those payments are $4.9 billion shy of what the state’s own experts estimate is required. It’s no wonder Illinois’ property taxes are second highest in the nation at 1.95% a year of a home’s value, more than double the nation’s median rate of 0.76%.

An increasing portion of the state budget is diverted from essential services to pay for pension obligations, adding to already challenging problems with the unbalanced budget. That leaves less money for things such as education, public safety and transportation.

The pension crisis is also unfair to private-sector workers, the median of whom earn less than $60,000 per year yet are asked to fund pensions for government retirees who receive an average of $82,000 annually in retirement. It’s an inequitable system that has stood for years.

The pension crisis needs urgent attention. Without constitutional pension reform, Illinois’ pension funds are at risk of insolvency, meaning they might not have the money required to pay what public-sector retirees are owed at a given time. The pattern of shifting the burden to future generations must end. The longer this issue remains unresolved, the more difficult and costly the eventual solutions will become.

Tier 2 reforms need adjustment

To address the growing pension crisis, the Illinois General Assembly created Tier 2 in 2010. This new set of pension benefits applies to state and local government employees hired after Jan. 1, 2011. Here are the key changes implemented with Tier 2:

- Increased retirement age: Full benefits are now available at age 67, up from 60 for most Tier 1 employees.

- Reduced final average salary calculation: Changed from the highest four of the last 10 years to the highest 8 of the last 10 years of service.

- Imposed limit on pensionable earnings: Initially set at $106,800 in 2011, with slower growth than the Social Security wage base.

- Changed annual benefit increases: From 3% compounded for most Tier 1 employees to the lesser of 3% or one-half of the increase in Consumer Price Index, non-compounded for Tier 2.

These changes were projected to save the state billions of dollars over time by significantly slowing the growth of pension liabilities. While Tier 2 has mitigated the pension crisis by defraying some pension costs, two problems have surfaced. First, Tier 2 alone would not solve the state’s pension crisis. Second, it has created a new problem: a potential violation of federal “Safe Harbor” laws that guarantee pensions will not fall below the requirements for benefits that stand in place of Social Security.

Most public employees in Illinois don’t pay into Social Security because their pension plans are supposed to provide a defined benefit retirement. This allows the state to save significant money because the Social Security tax would be 6.2% of the employee’s income and 6.2% from the employer, totaling 12.4% in additional federal taxes overall. To remain exempt from paying into Social Security, pension plans must pass certain IRS tests known as the Safe Harbor tests. The primary test is whether the pensionable salary cap is equivalent to the Social Security wage base. This base is calculated as “the 1994 base of $60,600 multiplied by the ratio of the national average wage index for year (Y-2) to that for 1992, with the result rounded to the nearest multiple of $300” for year Y.

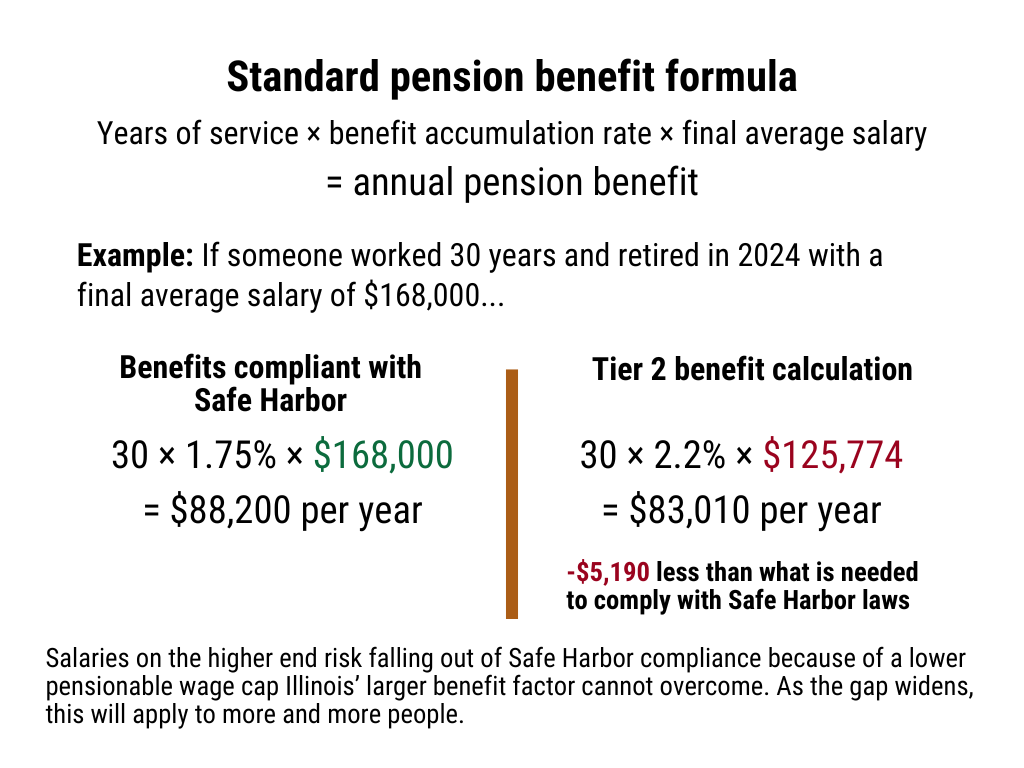

The concern arises because Tier 2’s maximum pensionable salary is growing more slowly than the Social Security wage base. In 2011, both were set at $106,800, but by 2024, the Social Security wage base has grown to $168,600 while the Tier 2 pensionable salary cap has only reached about $125,774. This gap is because the Social Security wage base increases with inflation, but the Tier 2 pensionable salary cap increases at half the rate of inflation, at most. This gap hasn’t already been flagged as a Safe Harbor violation likely because Illinois’ Tier 2 benefit accumulation rate is higher than the 1.75% mandated by the Social Security Administration. However, as the gap grows, the increased rate will not be able to compensate for the growing difference in income limits. Retirees at the highest income levels are already starting to feel these effects.

If this gap continues to widen, Illinois pension funds may fail to meet the IRS standards for Social Security replacement plans. Failure to meet Safe Harbor requirements could force affected employees and their employers to start paying into Social Security (6.2% each) in addition to their existing pension contributions. That would have resulted in an additional $856 million in taxes in 2023 alone (based on the $6.9 billion in Tier 2 payrolls for fiscal year 2023). The Illinois Constitution’s “impaired or diminished” clause would prevent the state from ending its current pension obligations if this were to happen, meaning that $856 million would be piled on top of existing costs.

Tier 2 has created a complex situation. It reduced pension costs and liabilities for the state by an estimated $976.4 million in the year of its adoption and was projected to save over $71 billion by 2045. Any increase in Tier 2 benefits to address Safe Harbor compliance will mean increased costs for the state. On the other hand, the cost of Social Security taxes the state will have to pay if it falls out of compliance with Safe Harbor will be more costly. Therefore, it’s worth increasing Tier 2, but only by the minimum amount to meet the Safe Harbor requirements.

Illinois needs responsible Tier 2 reform

Given the severity of Illinois’ pension crisis and the unintended consequences of Tier 2 reforms, further action is necessary. This action must be carefully calibrated to address the Safe Harbor issue without undoing the financial benefits that Tier 2 has achieved.

The imperative for targeted reform:

- Preserving improved fiscal situation: Tier 2 has been effective in slowing the growth of pension liabilities, potentially saving the state billions of dollars. Any reform must preserve these crucial financial gains.

- Addressing Safe Harbor: The growing gap between the Tier 2 pensionable salary cap and the Social Security wage base threatens compliance with federal Safe Harbor laws. This issue must be resolved to avoid costly consequences for employees and the state.

- Balancing costs and benefits: Any reforms must carefully balance the need for compliance with the state’s fiscal constraints, being mindful of the dangerously low funding ratios state pensions currently face.

- Not increasing burdens on Illinoisans: Reform cannot include increasing the tax burden on Illinoisans because they already suffer under many of the highest tax burdens in the nation.

Recommendation: Adjust the pensionable salary cap and benefit accumulation rate for Tier 2

Illinois’ pension crisis can only be solved through constitutional pension reform. But the immediate Tier 2 crisis must be solved sooner, and the most straightforward and cost-effective solution is to adjust the Tier 2 pay cap to match the Social Security wage base and reduce the benefit accumulation rate from 2.2% to 1.75%. This targeted approach offers several advantages:

- Ensures compliance: By aligning the Tier 2 pensionable salary cap with the Social Security wage base, Illinois can ensure its pension plans continue to meet IRS standards for Social Security replacement plans.

- Minimizes cost increases: This change would only affect employees whose salaries approach or exceed the current Tier 2 pensionable salary cap, limiting the overall cost increase (about $280 million annually for the next 20 years).

- Preserves Tier 2 savings: The other cost-saving measures of Tier 2, such as increased retirement age and changes to benefit calculations, would remain intact.

- Avoids overcompensation: Unlike more extensive benefit increase proposals, this targeted change addresses the compliance issue without unnecessarily inflating pension obligations.

The Civic Federation has advocated for a similar reform.

Some stakeholders, such as the American Federation of State, County and Municipal Employees union, have advocated for more extensive benefit increases for Tier 2 employees. Such are the reforms present in the bills introduced by Sen. Robert Martwick and state Rep. Stephanie Kifowit this veto session. Their proposals come with significant risks of cost escalation, perpetuating the crisis and increasing taxpayer burdens. This puts pension benefits at risk for current and future pensioners. Given the already precarious state of Illinois’ finances, the safest and most responsible reform is one that minimizes additional spending while ensuring pension recipients are receiving what’s fair based on the Social Security Administration requirements.

To implement this targeted reform responsibly, the Illinois General Assembly should pass legislation that only adjusts the Tier 2 pay cap to match the current Social Security wage base and increase it at the same rate as Social Security each year. The benefits accumulation rate should also be decreased to match the Social Security rate of 1.75%. Because these changes result in either no change or an increase in benefits for all employees, it does not violate the “impaired or diminished” clause of the Illinois Constitution.

While addressing the Safe Harbor issue, Illinois must maintain focus on improving the overall funding status of Illinois’ pension systems through continued fiscal discipline and pushing for a constitutional amendment to remove the “contractual relationship” and “impaired or diminished” clauses. In the meantime, this balanced solution represents a responsible step toward ensuring the long-term sustainability of the state’s pension systems, protecting public employees’ retirement security and safeguarding the state’s fiscal health.