Illinois metro areas yield slight jobs gain in January, but weak long-term trends persist

Combined jobs growth was slightly positive across Illinois’ metro areas in January. But only four metro areas have recovered the jobs they lost during the Great Recession.

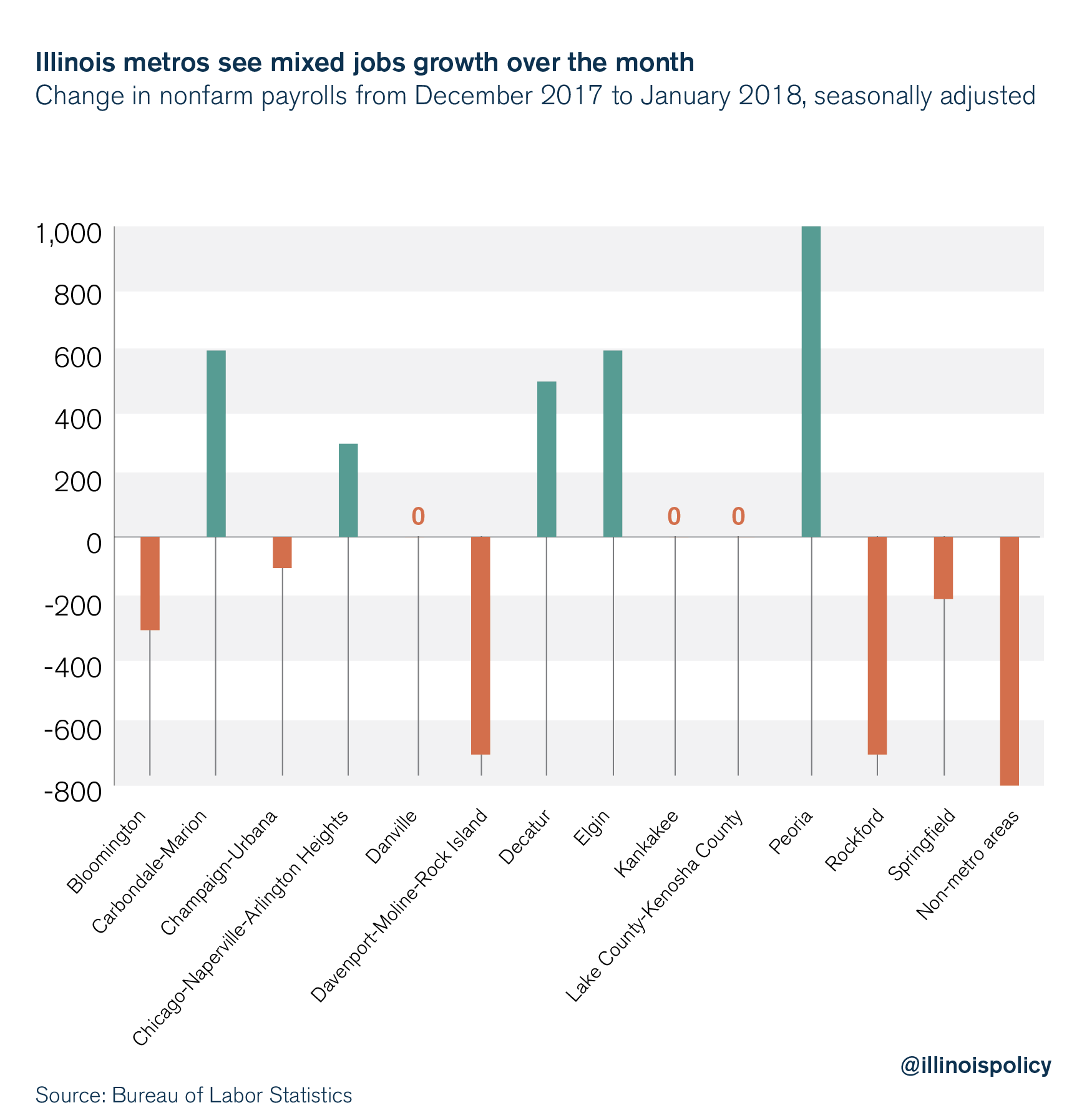

New jobs data reveal that over the month, Illinois’ largest metro areas saw a mixed bag in terms of jobs growth, yielding a 0.02 percent change in metro employment overall.

But a long-term view reveals a much more concerning jobs trend in the Land of Lincoln, where residents are desperate for a healthier business climate.

Performance over the month

Jobs data released March 15 by the Bureau of Labor Statistics, or BLS, show Illinois metro areas combined for virtually no change in nonfarm payrolls over the month of January.

But this is not to say that all areas had stagnant payrolls.

Areas that gained jobs this month were Peoria (+1,000 jobs), Carbondale-Marion (+600 jobs), Elgin (+600 net jobs), Decatur (+500 jobs), Chicago-Naperville-Arlington Heights (+300 jobs). Areas that lost jobs in January were Davenport-Moline-Rock Island (-700 jobs), Rockford (-700 jobs), Springfield (-200 jobs), Bloomington (-300 jobs) and Champaign-Urbana (-100 jobs).

Performance over the year

Although many metro areas seem to have gotten off on the wrong foot in 2018, most areas saw slow employment growth in the past 12 months as well.

The Chicago-Naperville-Arlington Heights metro area gained 14,900 jobs over the year. But that constitutes only a 0.4 percent increase in employment.

Over the year, the biggest gains came from Rockford, with 4.4 percent growth over the year (+6,400 jobs). Employment also grew in Kankakee (2.4 percent, +1,100), Lake-Kenosha County (1.6 percent, +6,500), Peoria (1.4 percent, +2,400), Davenport-Moline-Rock Island (1.2 percent, +2,200), Champaign-Urbana (1.2 percent, +1,300), Bloomington (1.0 percent, +900), and Elgin (0.9 percent, +2,400).

There were a few areas that saw non-existent or even negative changes in payrolls over the last 12 months. There was no net employment growth in Decatur in the last 12 months. Employment fell in Carbondale-Marion (-0.9 percent, -500 jobs), Danville (-1.1 percent, -300) and Springfield (-2.2 percent, -2,500) over the last 12 months.

Weak economic recoveries

The slow growth in employment across Illinois is part of a much larger trend. Only four metro areas have recovered from the Great Recession. Compared with 2007, before the Great Recession, the winners were Kankakee (+6.1 percent), Lake-Kenosha County (+5.2 percent), Chicago-Naperville-Arlington Heights (+4.2 percent) and Springfield (+0.4 percent).

Those areas that have had a jobless “recovery” are Danville (-10.2 percent), Peoria (-7.2 percent), Rockford (-6.2 percent), Decatur (-6.2 percent), Bloomington (-2.7 percent), Carbondale-Marion (-2.1 percent), Champaign-Urbana (-1.3 percent), Davenport-Moline-Rock Island (-1.3 percent) and Elgin (-1.3 percent).

Although the current post-recession expansion is one of the longest in history, the recovery in Illinois has been lackluster, even in areas that have recouped their losses from the recession, when compared to the economic expansion seen from 1992-2000.

What happened?

What changed from the 1992-2000 expansion to now?

One key difference: Illinois has seen two of the largest income taxes in state history since the end of the Great Recession. The effects of the tax hikes, which are still being felt, have cost the economy thousands of jobs and billions of dollars. Furthermore, these tax hikes were used to fuel government spending that has outpaced the growth of personal income by 25 percent for the past decade, leading to immense uncertainty about the future of government finances.

What the state needs

Illinois needs to rid itself of the overwhelming tax burden that is crowding out private investment. A lower tax burden would stimulate investment and job creation.

However, the only way to get lower taxes is to rein in government spending both at the local and state levels. Illinois should look to places like Virginia for ways to cut spending without negatively affecting the delivery of core services.