‘Illinois math’ in one tweet

The Land of Lincoln needs to end the phony math and restructure its debts and pensions. But legislative incompetence will keep the state in a death spiral.

The Illinois General Assembly is incompetent with numbers and finances.

The Statehouse is packed with lawmakers who either don’t understand the state’s financial problems or are unwilling to admit the insurmountable debts they’ve racked up.

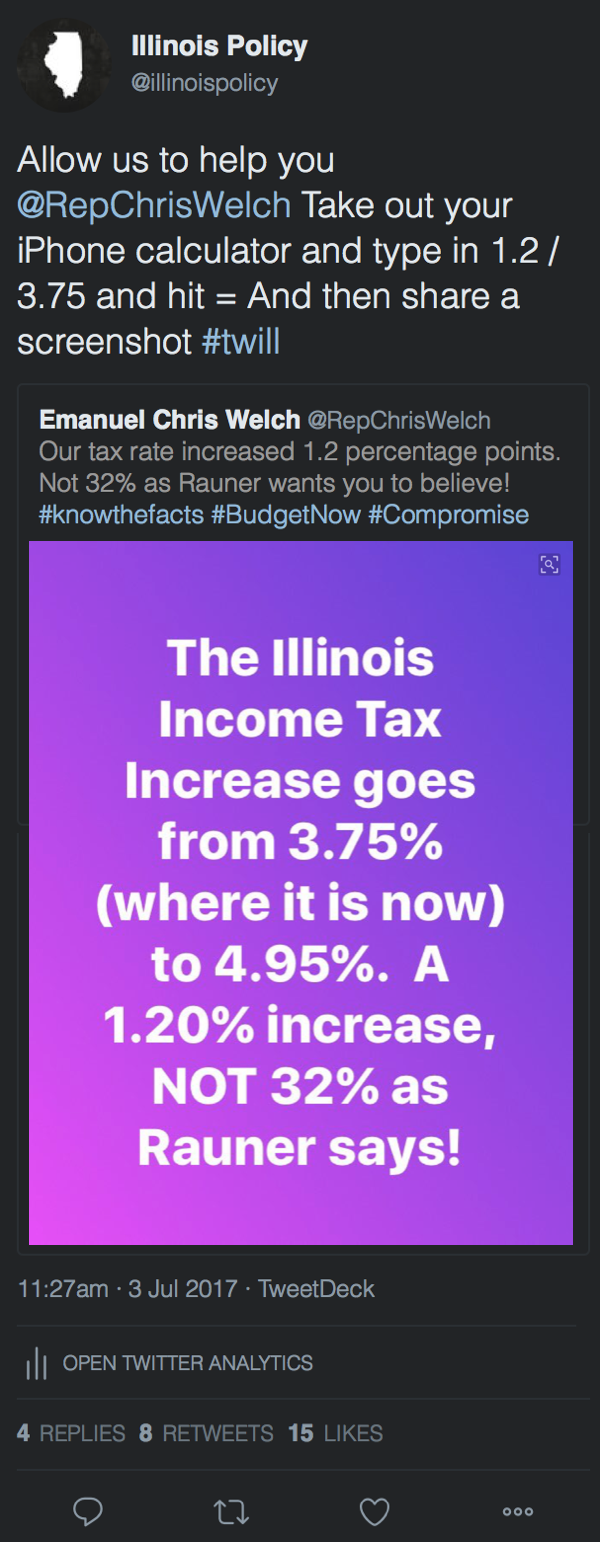

This truth came to light yet again after state lawmakers voted to pass a 32 percent income tax hike on taxpayers. Numerous lawmakers defended their position, including state Rep. Emanuel Chris Welch, D-Hillside. Welch took to Twitter July 3 to proclaim that raising the income tax to 4.95 percent from 3.75 percent was merely a 1.2 percent increase, not a 32 percent increase as Gov. Bruce Rauner said.

Welch’s tweet unleashed a firestorm of backlash. Illinoisans know their lawmakers can’t balance the books, but messing up the math is especially insulting coming from a lawmaker who is actively working to raise taxes.

Welch deleted the tweet.

And he was wrong on the math. A tax increase of 1.2 percentage points on a base rate of 3.75 percent is a 32 percent increase.(1.2/3.75 = 32 percent) Anyone paying $1,000 in taxes under the old regime would see their tax bill go up by $320 per year, which is exactly what families feel in their pocket books.

As the tax hike votes rolled in and were justified by lawmakers’ bad math, Illinoisans had to wonder to themselves: “How are these people running our state?”

Welch isn’t the only lawmaker confused about how taxes and finances work, and the state’s problems are much bigger than the calculation of a percentage increase.

In fact, Illinois politicians have used phony numbers in the past when dealing with pensions, and the phony numbers have been referred to by an actuary as “Illinois math.” It’s another sign of legislative incompetence, and another reason why the state’s finances are crippled.

Search for “Illinois math” in this pension report for the Teachers’ Retirement System and you’ll find it’s full of gems like:

- “Illinois Math.The term given to the various schemes in the Illinois Pension Code designed to systematically underfund public employee retirement systems in the state of Illinois. Refer to the executive summary for more details.”

- The derogatory term given to the funding provisions the Illinois General Assembly follows is “Illinois Math.” In contrast, the term we give for the prudent funding of TRS that we encourage stakeholders to adopt is “Actuarial Math.”

- By funding based on Illinois Math instead of Actuarial Math, the State has put the retirement security for the 390,000 current and former educators in the State of Illinois at risk.

- The State has systematically underfunded TRS using Illinois Math

- The funded ratio should trend to 100% over a reasonably short period of time – say 15 to 25 years. The 90% target and the 50 year period used by Illinois Math, while an improvement over funding before 1995, are inadequate. We recommend Illinois Math be replaced with Actuarial Math.

“Illinois math” and legislative incompetence explain why Illinois is so far along the road to insolvency.

Illinois needs leaders who understand the numbers and can come clean to the public about what they mean. The fact is Illinois has far too much debt, and taxes are already too high.

The Land of Lincoln needs to end the phony math and restructure its debts and pensions. But legislative incompetence will keep the state in a death spiral.