Illinois lost 80,000 millennials between 2011-2015

Millennial out-migration from the Land of Lincoln is worse than all its neighboring states.

Illinois is losing more millennial taxpayers on net than all other states except New York. The state’s youth fleeing paints a bleak picture for the future, and it should sound the alarm for Illinois policymakers who need to make changes if they want to retain young Illinoisans.

The Internal Revenue Service, or IRS, releases yearly migration data based on individual income tax returns filed with the agency. In 2011, the IRS began including the age of primary taxpayers in these reports, which allows for analysis of interstate migration by age group.

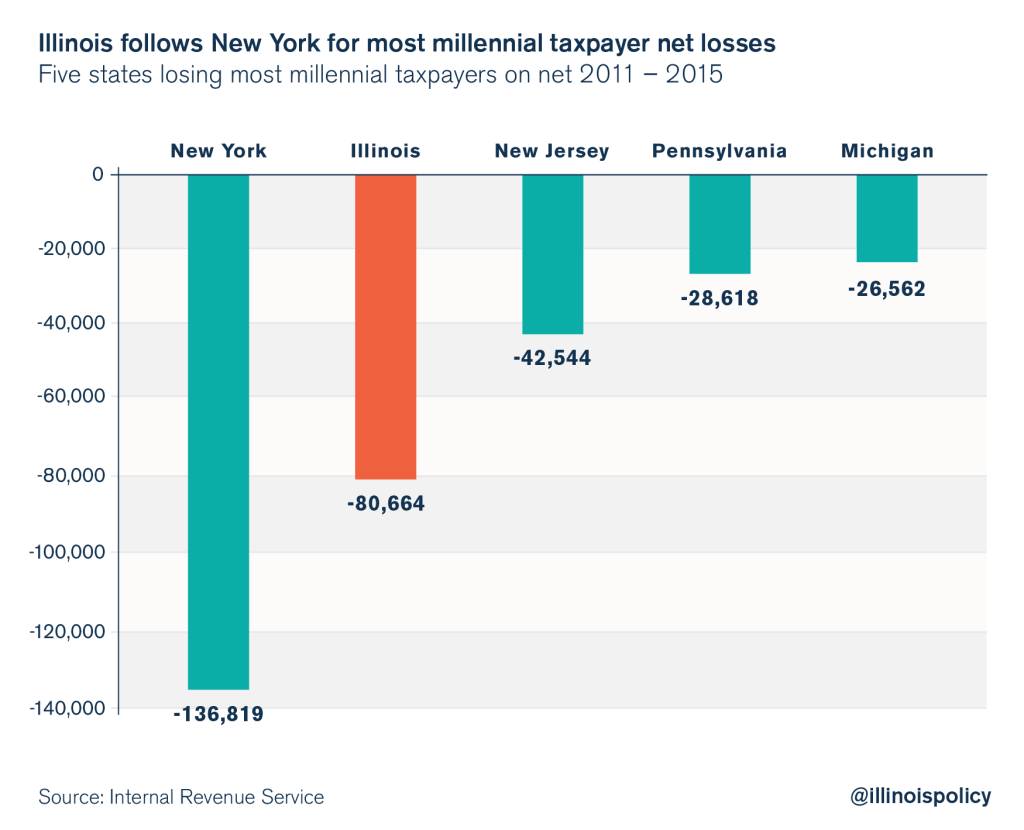

According to IRS data, Illinois lost more than 80,000 millennial taxpayers for the four tax years between 2011 and 2015. This is more than all other states aside from New York, which lost more than 136,000 during the same period. The top five losing states were New York, Illinois, New Jersey, Pennsylvania and Michigan.

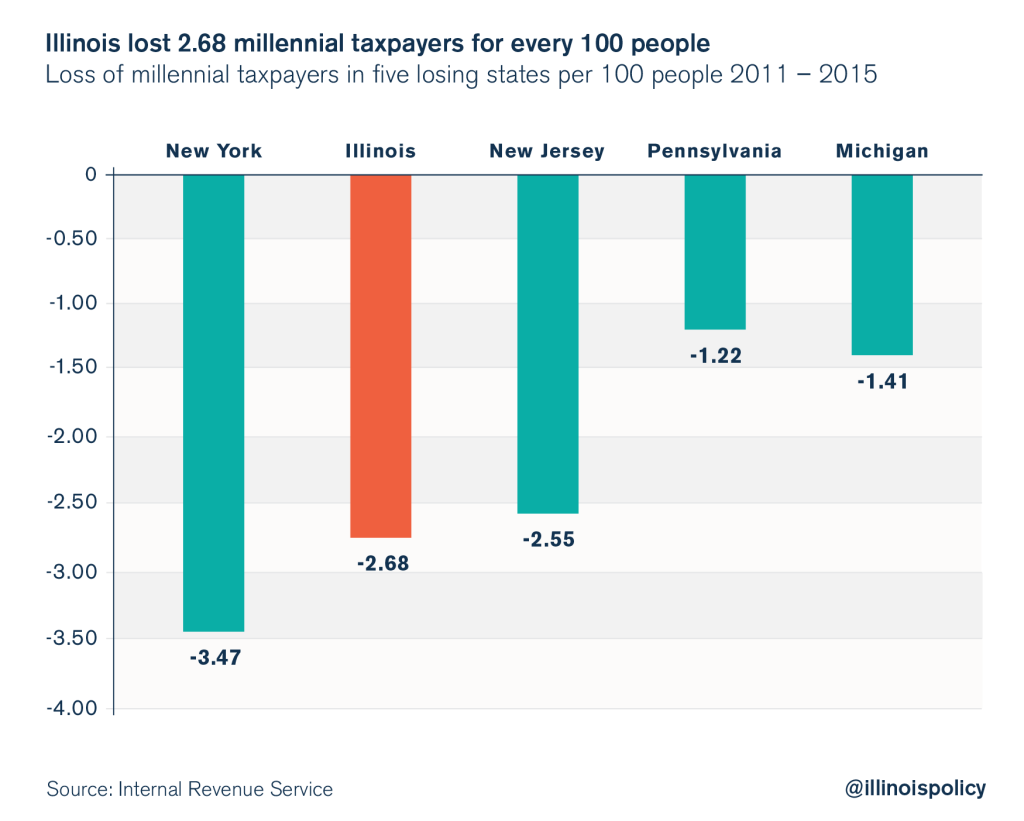

When adjusting for population size, Illinois still suffered the second worst net losses, behind New York, within these top five losing states. According to the data, from 2011 to 2015, Illinois had a net loss of 2.7 percent of its millennial taxpayers, meaning the state lost 2.7 millennial taxpayers to other states per every 100 Illinois millennial taxpayers. This is compared with New York’s 3.5 percent, New Jersey’s 2.6 percent, Pennsylvania’s 1.2 percent and Michigan’s 1.4 percent losses.

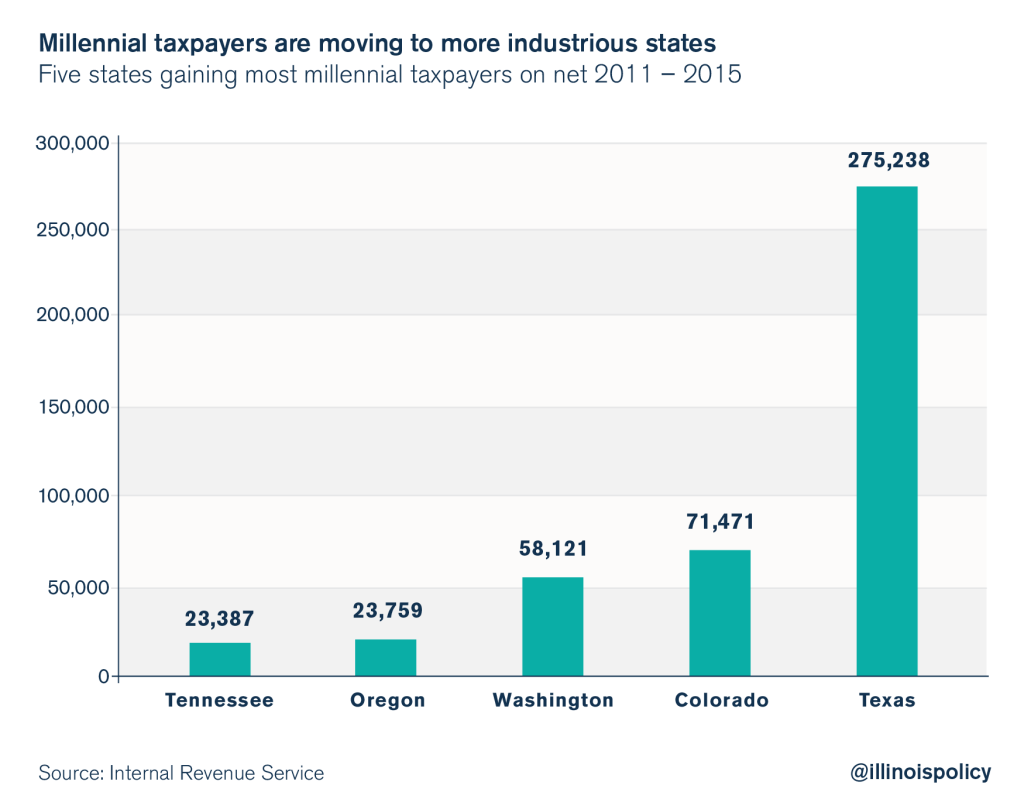

In contrast, some states gained millennials on net each year between 2011 and 2015. Texas gained the most millennials on net with 275,238, followed by Colorado at 71,471, Washington at 58,121, Oregon at 23,759 and Tennessee at 23,387.

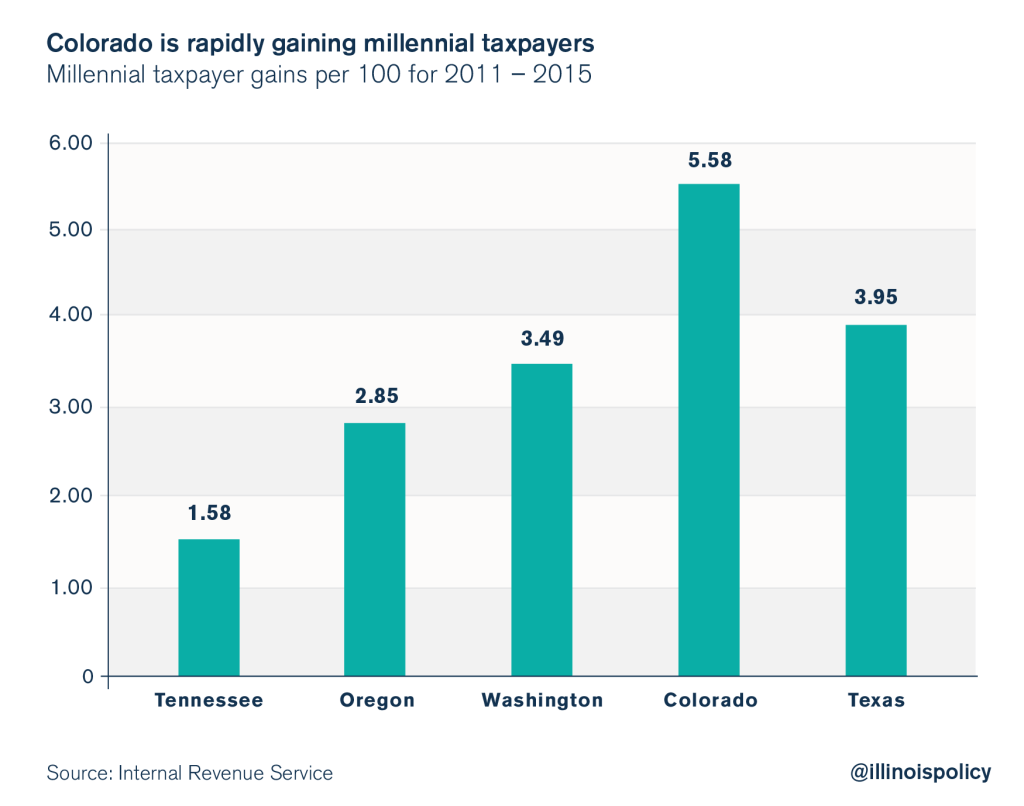

Colorado is gaining the most millennial taxpayers per capita. The data confirm that Colorado had a net gain of 5.6 percent to its millennial population between 2011 and 2015. Texas trails Colorado at 4 percent net gain, followed by Washington at 3.5 percent, Oregon at 2.9 percent and Tennessee at 1.6 percent.

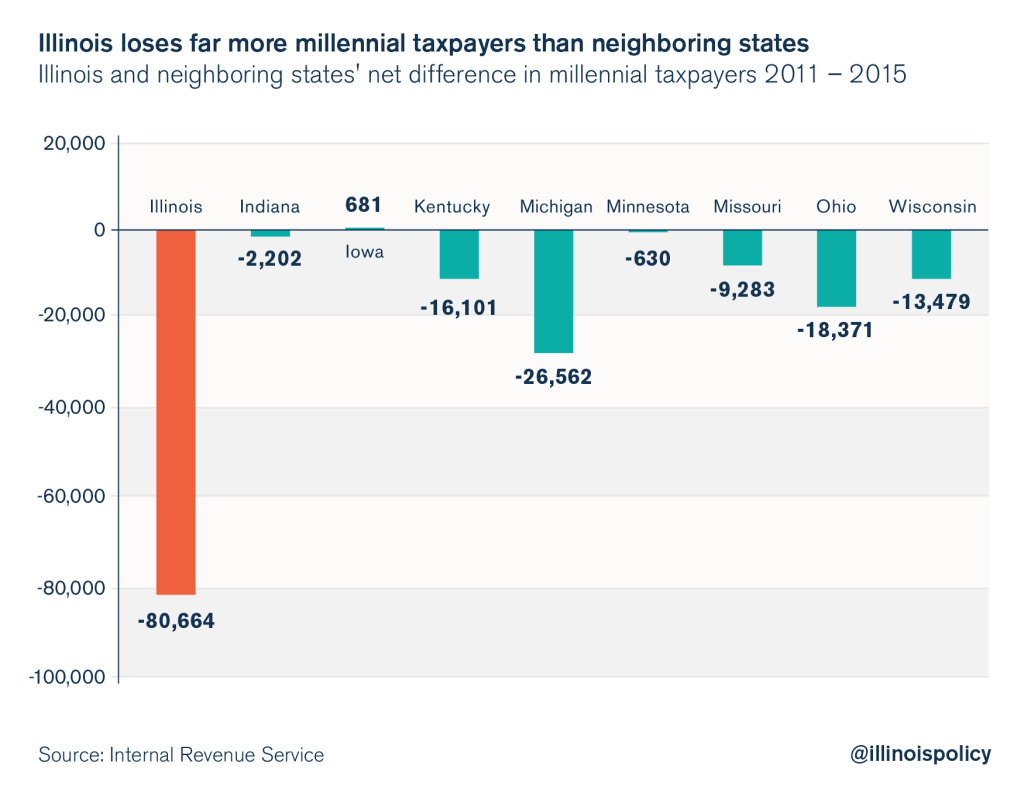

All neighboring states except Iowa experienced a net loss of millennial taxpayers, but Illinois was by far the biggest net loser of millennial taxpayers. Illinois lost more than 80,000 millennial taxpayers on net, followed by Michigan’s loss of more than 26,000. Iowa, which gained 681, and Minnesota, which lost 630, largely broke even.

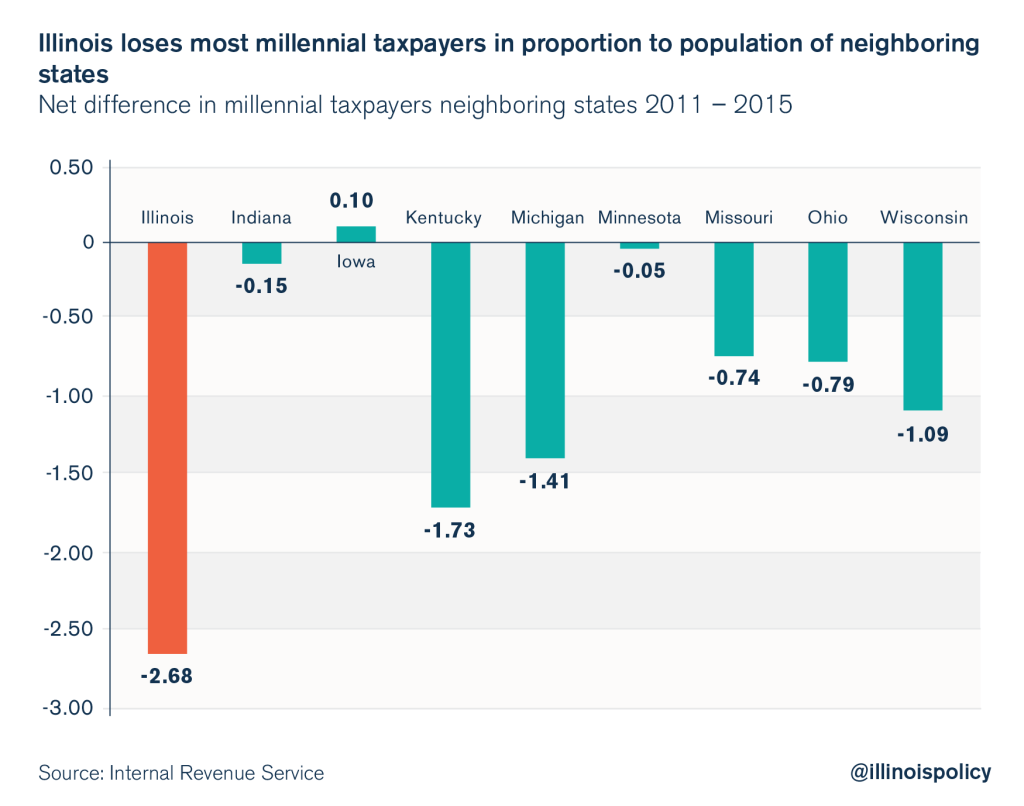

In proportion to the overall millennial taxpayer population, Illinois still lost far more millennial taxpayers than all neighboring states. Illinois’ 2.7 percent loss was followed most closely by Kentucky, with a 1.7 percent loss.

According to Paul Simon Public Policy Institute polling, a majority of millennials in Illinois want to leave, and the IRS data show that many are following through. Any out-migration crisis is disconcerting, but one in which millennials are leading the exodus has far-reaching implications for the state’s future. People aren’t building lives in Illinois. Millennials are leaving in masses, and Illinois needs young people to get its fiscal house in order.

While some factors influencing out-migration, such as weather, are out of the state’s control, Illinois policymakers must acknowledge that poor economic policies make the state unattractive. It’s not certain whether the highest property taxes in the nation, looming pension crisis and lack of jobs are unilaterally affecting mass departure, but they certainly don’t help. It’s also worth noting that the four years during which the loss of 80,000 millenials occurred line up with the 2011 income-tax hike.

State policymakers may be able to stop the bleeding and retain some young talent by adopting policies that make the state more attractive to young working-age adults. They can start by looking at the policies of the states actually gaining millennials. For example, of the five states gaining the most millennial taxpayers on net, Texas, Washington and Tennessee have no income tax, Colorado has among the lowest property taxes and a Taxpayer Bill of Rights, which restrains excessive government taxation and spending, and Texas and Tennessee both have pro-growth and entrepreneurial business environments that attract people from other states. All five states have substantially better economic growth than Illinois.

Illinois policymakers can’t ignore the data. They need to enact pro-growth policies that attract and retain talent and empower Illinoisans to prosper.