Illinois lawmakers hike 911 fees statewide, override Rauner’s veto

Gov. Bruce Rauner issued an amendatory veto nixing fee hikes from a 911 service reauthorization bill lawmakers sent to his desk, noting Illinoisans already pay some of the nation’s highest taxes on their cellphones. But those fee hikes will become law, as lawmakers have voted to override the governor’s veto.

Illinois House and Senate lawmakers voted July 1 to hike fees on wireless customers across the state, against the wishes of Gov. Bruce Rauner.

Rauner issued an amendatory veto July 1 stripping local and statewide fee hikes from a 911 funding reauthorization bill. But House and Senate lawmakers overrode Rauner’s veto with supermajority votes.

House Bill 1811 increases 911 fees for the state to $1.50 from $0.87 and will allow Chicago to increase its 911 fees to $5 per month per line from $3.90.

The House voted 90-22 to override Rauner’s veto. The Senate then passed the measure into law with a 43-1 override vote. State Rep. Brendon Phelps, D-Harrisburg, sponsored the bill.

“While the majority in the General Assembly has been unable to move forward with a balanced budget, it has found the time to inflict further abuse on Illinois taxpayers,” Rauner said in a press release. “Today the majority failed taxpayers by using the threat of canceling 911 services as leverage to force a tax hike on Illinois residents.”

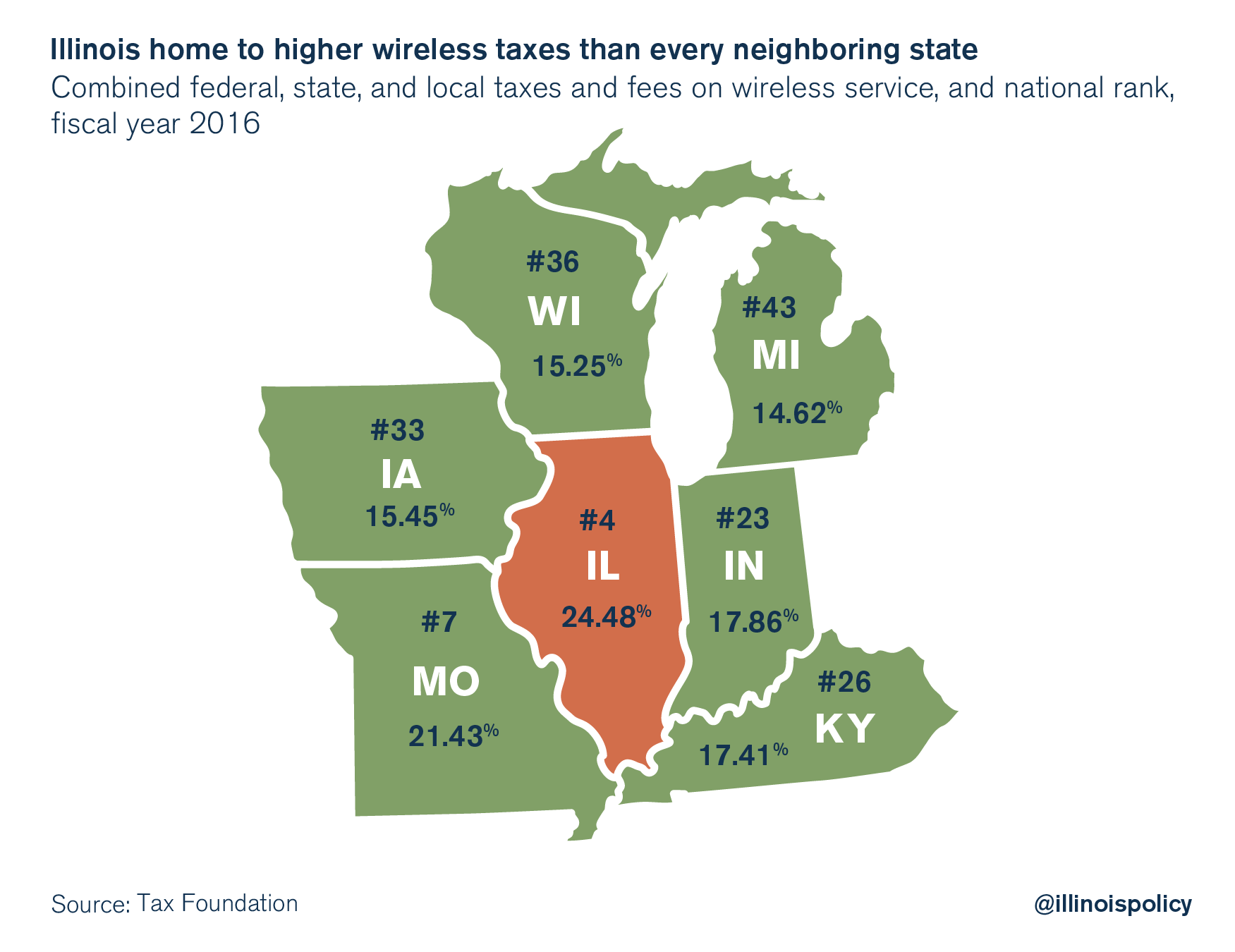

With the combination of federal, state and local wireless taxes and fees, Illinoisans shoulder a nearly 25 percent tax burden on their wireless bills. In addition to 911 fees, Illinois levies a state telecommunications tax of 7 percent, which municipalities other than Chicago can also levy at rates of up to 6 percent. Chicago tacks on an additional 7 percent telecommunications tax at the city level.

Illinois is one of only three states and Washington, D.C., to levy taxes on wireless service at higher state tax rates in lieu of the broad sales taxes that apply to most other purchases. Only Illinois and Florida levy state-level telecommunications taxes with local add-ons.

Americans – especially those in low-income households – increasingly rely on wireless service as their sole means of communication and connectivity. More than 60 percent of Illinois households are wireless-only.

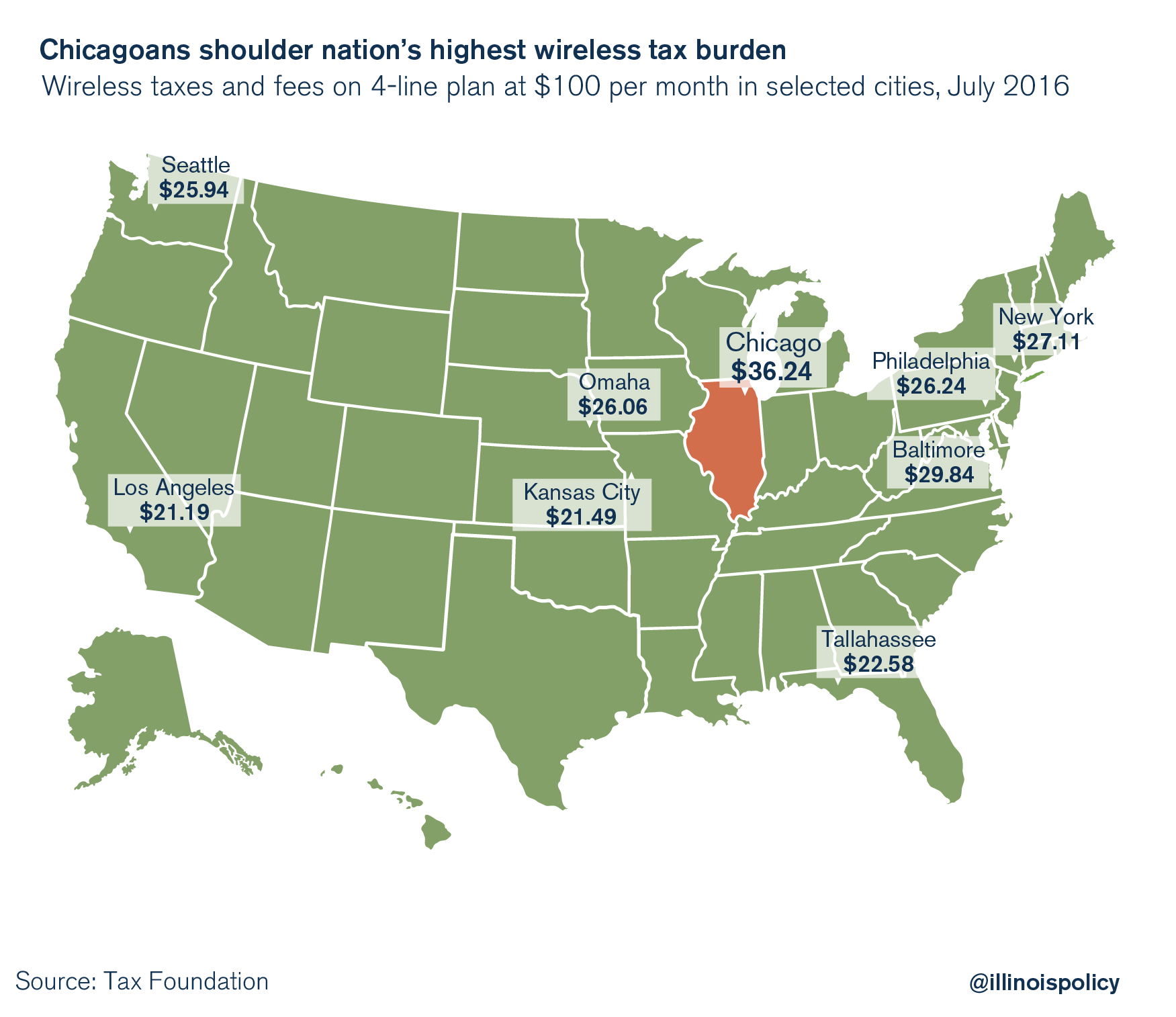

And while Illinois’ wireless taxes are high in general, Chicago’s are even higher. Chicago’s wireless taxes and fees were the highest of any city the Tax Foundation studied, by far. A typical Chicago household with four wireless phones paying $100 per month for wireless voice service pays nearly $435 each year in taxes and fees.

This amounts to a 36 percent tax burden on Chicagoans’ wireless bills. Under some payment plans, a Chicagoan can pay more in taxes on an additional line than on the line itself.

With the passage of HB 1811, Mayor Rahm Emanuel will likely push Chicago’s 911 fees even higher.

Illinois’ wireless taxes are already some of the highest in the nation. Instead of jacking up wireless bills even higher, lawmakers should find ways to cut costs while preserving public safety.