Illinois lawmakers file bill to save school choice program for low-income kids, families

Roughly half of the low-income students benefitting from Illinois’ tax credit scholarships are minorities, and about 26,000 students are waiting for a chance at a private school that better fits their needs. State lawmakers are working on a permanent fix.

Illinois’ low-income, Black and Hispanic students have suffered disproportionately from COVID-19 pandemic-related learning disruption, and these students and their families deserve education options that address their needs.

Bills introduced by state Sen. Antonio Muñoz, D-Chicago, state Rep. Angelica Guerrero-Cuellar, D-Chicago, and Rep. Mike Zalewski, D-Riverside, offer hope.

Senate Bill 3618, House Bill 5461 and House Bill 5391 would expand scholarship opportunities for low-income students and families of modest means of all demographic backgrounds, including thousands of Black and Hispanic students.

What would SB 3618, HB 5461 and HB 5391 do?

Invest in Kids Act’s current provisions

Illinois’ tax credit scholarship program, which passed in 2017, offers scholarships to attend qualified non-public schools to K-12 students whose family incomes do not exceed 300% of the federal poverty level. In Illinois, that was $78,600 for a family of four in 2021.

The program allows individuals and businesses to donate money to a scholarship granting organization and receive a tax credit of 75 cents for every $1 donated, up to a maximum credit of $1 million. The total amount of tax credits is capped at $75 million per year.

In Illinois, about 7,600 students rely on these scholarships every year, according to the Chicago Tribune. And 26,000 students were on the waitlist in May 2021, reported Empower Illinois, the largest scholarship granting organization in the state.

Invest in Kids scholarship opportunities are set to expire Dec. 31, 2023. If the program is allowed to die, thousands of Illinois students and their families would be left scrambling for other scholarship money to stay in their schools. Or they might have to leave their private schools, or never get the option.

SB 3618’s, HB 5461’s and HB 5391’s changes to Invest in Kids Act

SB 3618 and HB 5461 would strengthen the tax credit scholarship program in the following ways:

- Get rid of the 2023 sunset provision and make the program permanent

- Provide “superpriority” status for kids who are currently in the program so they have greater assurance of being able to continue in their current schools

- Provide 100% credit for donations against state income taxes, increased from the current 75% credit

- Allow businesses to designate particular schools as the recipients of their donations, as individuals can do under current law

- Expand the program to include pre-K students, in addition to students in K-12 who are currently eligible

HB 5461 would also give schools flexibility to offer more partial scholarships.

Similarly, HB 5391 also allows for more partial scholarships, and, like the other two bills, permits businesses to designate particular schools when donating scholarship money. This bill also expands the program to include pre-kindergarten students.

Illinois’ tax credit scholarship program provides needed options for low-income students

The families who benefit from the program are low-income or of modest means. Tuition at private schools that might be the best fit for their children is often out of reach. While $78,600 was the qualifying limit for an Illinois family of four in 2021, the average family household income was $38,403, 153% of the federal poverty level, for participants who received scholarship money in 2020 through Empower Illinois.

The scholarship program targets families who most need educational options at a time when many low-income students have fallen far behind their peers.

Researchers have noted that pandemic-related school closures have had the worst effects on the academic achievement of children in the lowest-income communities. A 2020 working paper co-authored by a Yale University economist found learning gaps between the poorest high school students and relatively higher income students grew as a result of remote learning, and can be expected to persist through high school and to threaten future prospects for those students.

Compared to public school students in other U.S. states, Illinois students were among the least likely to have been offered fully in-person schooling during the 2020-2021 school year.

Test results released by the Illinois State Board of Education in 2021 have revealed the learning loss that occurred among Illinois public school students since the start of the pandemic. And these scores show even more significant declines in academic performance among low-income students since 2019 compared to non-low-income students.

Tax credit scholarship program benefits thousands of Black, Hispanic students

Thousands of the children in the tax credit scholarship program are students of color. Of the students receiving scholarships through Empower Illinois in 2020, 17% of students identified as Black; 29% as Hispanic; 3.7% as multiracial; 3% as Asian; 0.8% as Native American, and 0.2% as Hawaiian or Pacific Islander.

Some of the problems associated with pandemic-era schooling have been especially acute for Black and Hispanic students. These students should have all the education options possible, including attending private schools under the tax credit scholarship program.

The largest declines in test scores during the pandemic were in school districts that offered the least in-person schooling, according to a paper released by researchers from Brown University and other institutions in November 2021. Districts with higher shares of Black and Hispanic students were less likely to offer in-person learning. The researchers found the detrimental impact of the lack of in-person schooling on test scores was especially pronounced among Black and Hispanic students.

Illinois test results from 2021 and 2019 show in nearly every case, Black and Hispanic students experienced higher drops in performance than white students. One particularly startling number was a drop in the number of Black third graders proficient in math, which was nearly three times the drop in the number of white third graders who were proficient in math.

Black, Hispanic voters support Illinois’ tax credit scholarships

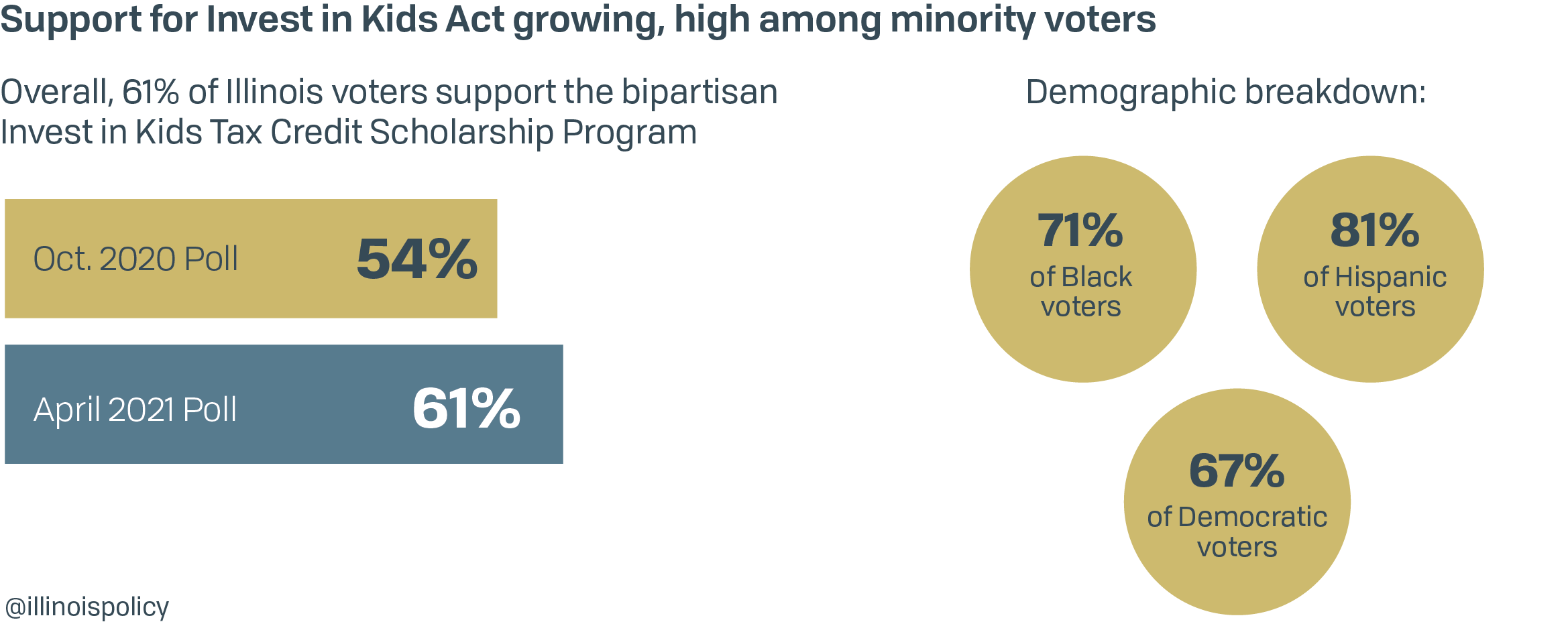

A poll of Illinois registered voters in April 2021 conducted by ARW Strategies on behalf of Empower Illinois showed 61% of voters support the Invest in Kids Tax Credit Scholarship Program, including: 71% of Black voters; 81% of Latino voters and 67% of Democratic voters.

Illinois support is in line with nationwide support for school choice programs. A June poll from RealClear Opinion Research showed 74% of registered voters – including 70% of Democrats – supported giving parents and kids access to education options.

Illinoisans should support the preservation and expansion of tax credit scholarships as ways to offer education lifelines to students and families who most need opportunities and choices.