Illinois jobs growth spikes in June, double the growth of the rest of the U.S.

Illinois added 18,100 new jobs in June, the highest monthly increase since summer 2017, but the Prairie State still lags behind the rest of the nation for the post-recession period.

In June, Illinois had the strongest month of jobs growth yet in 2018, according to new payroll data released July 19 by the Illinois Department of Employment Security in conjunction with the Bureau of Labor Statistics. The preliminary data show that Illinois added 18,100 jobs over the month – a 0.30 percent increase in total employment from May. That increase was more than double the growth seen in the rest of the nation.

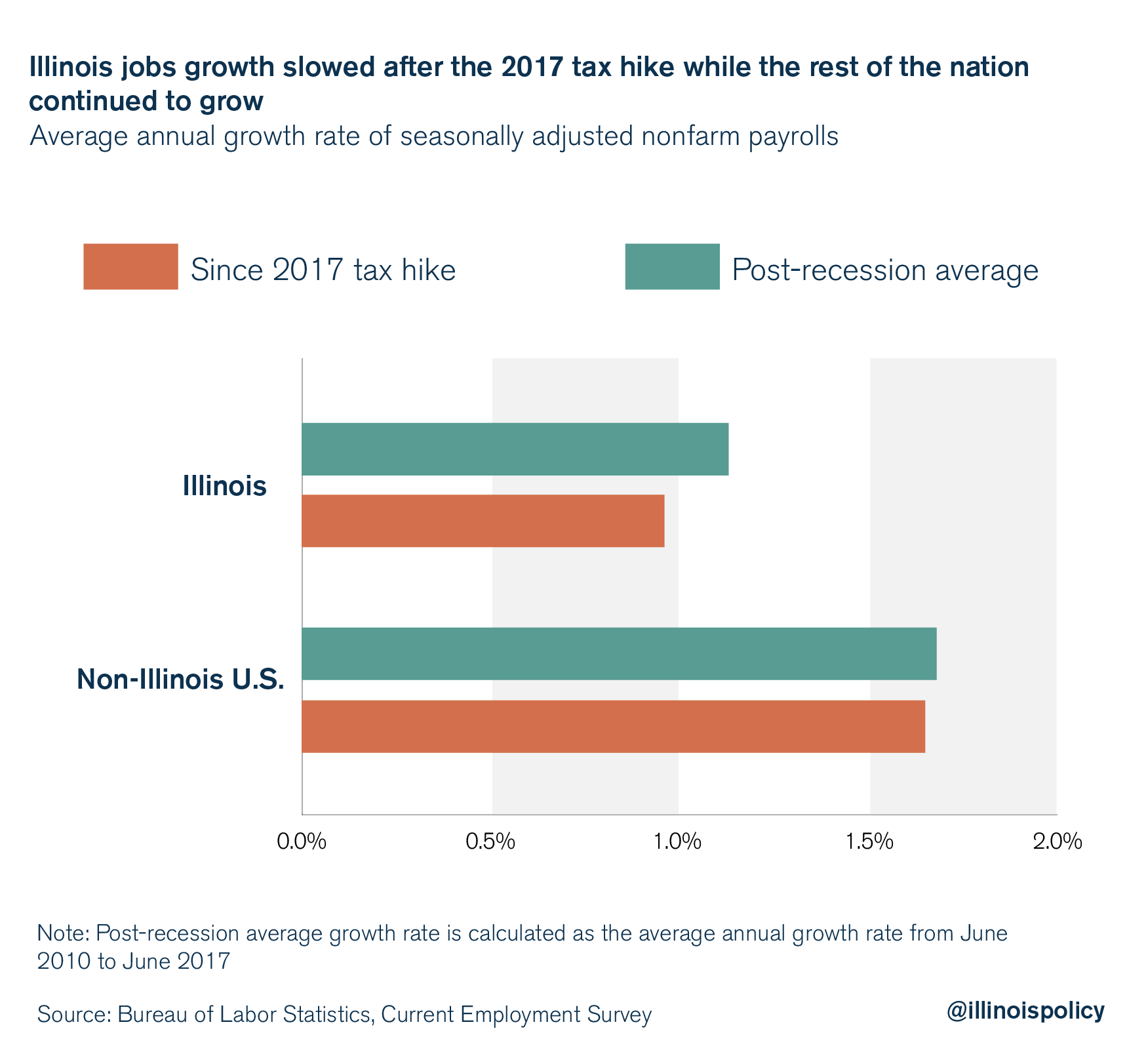

While good news for Illinoisans, June’s positive job numbers stand in stark contrast with the state’s lackluster economic performance for the post-recession period. Overall, Illinois still lags the nation in job gains for this time, a gap that widened in the wake of the state’s 2017 income tax hike.

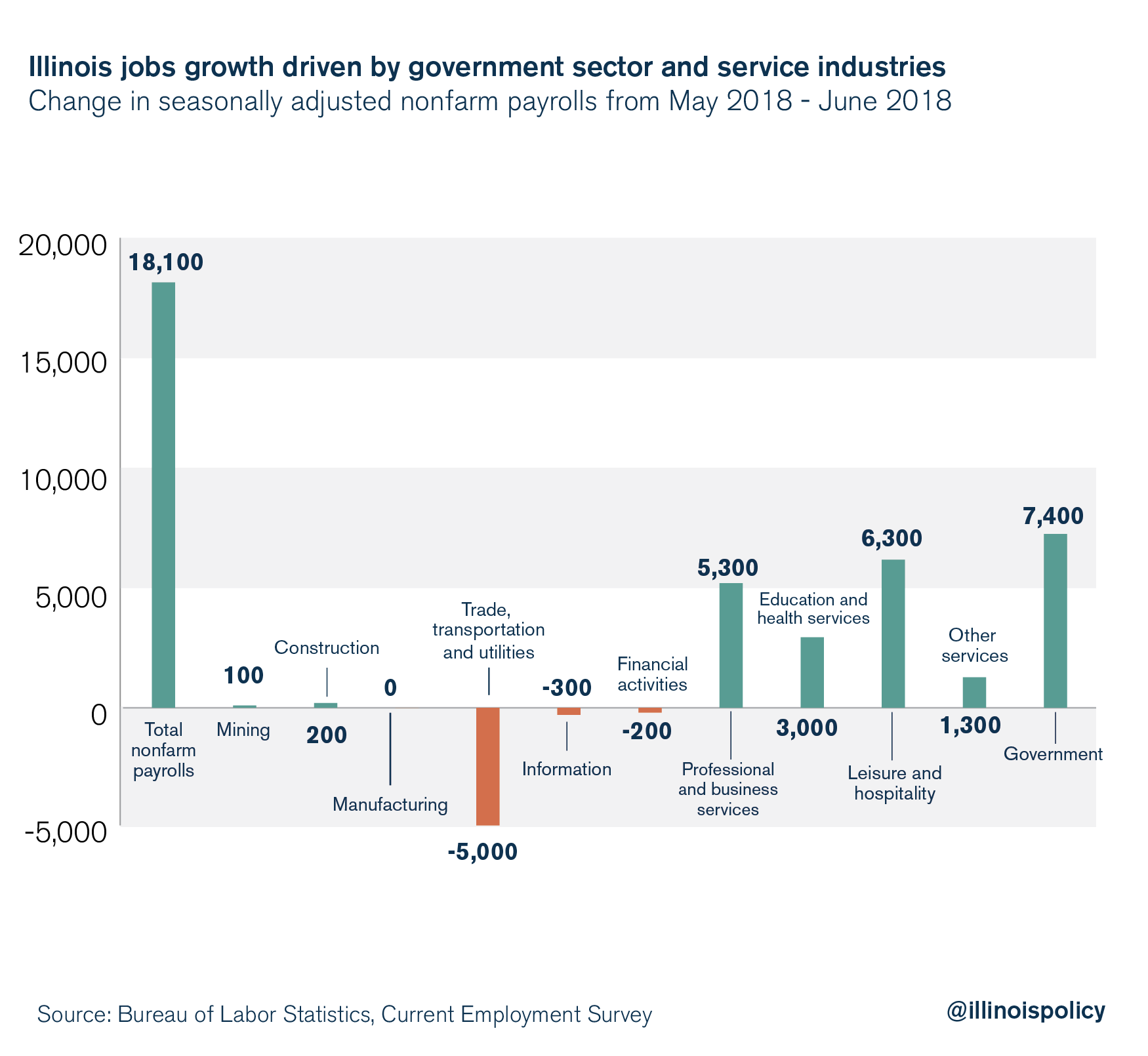

The largest portion of June’s gains was driven by expanding government payrolls, which contributed 7,400 of the new jobs. The private sector added 10,700 jobs.

Outside of the government sector, payroll increases occurred primarily in the service industries. The leisure and hospitality sector added 6,300 jobs, the professional and business services sector added 5,300 positions, and the education and health services sector expanded payrolls by 3,000.

There were some areas that saw a contraction in payrolls. Trade, transportation and utilities saw payrolls decline by 5,000, while the information sector lost 300 jobs, and the financial activities sector shed 200 jobs.

The state’s unemployment rate remained at 4.3 percent in June, 0.3 percentage points higher than the national rate of 4 percent.

While the June numbers are good news for Illinois today, large increases in the public sector can crowd out the private sector, diverting valuable resources from more productive areas of the economy and reducing overall productivity. The expansion of government payrolls combined with Illinois’ rigid public salary structure could crowd out private sector employment, and cause higher unemployment in the long run.

Out of the ordinary

Unfortunately for Illinois workers, growth rates like the one seen in June have become an anomaly. By comparison, other states often enjoy similarly robust jobs growth rates. For example, Illinois’ June growth rate matches the growth often observed in Texas – which also frequently surpasses that rate.

The last time Illinois experienced a greater rate of growth was in June 2017 – which was also largely driven by the government sector – the month before the General Assembly passed the largest permanent income tax hike in state history. In the time since the tax hike, Illinois has lagged the rest of the nation in jobs growth. Illinois’ jobs growth was already falling behind the rest of the country in the post-recession period – in no small part due to the “temporary” income tax hike in 2011. But since the 2017 tax hike, the gap between Illinois and the rest of the nation has widened.

It is worth noting the June 2018 data are preliminary and will likely be revised next month. In fact, May’s numbers were revised down to 7,700 jobs gained from 8,600. Thus, Illinoisans won’t know for sure what June’s jobs numbers were until August. However, this is certain: Since the end of the recession and throughout the past year, Illinois has created fewer opportunities for workers than most of the nation.

Time for a change

Last year’s permanent income tax hike was the latest in a long line of poor public policies that have hurt the state’s economy. Despite the harm of increasing taxes, lawmakers in Springfield voted to increase income taxes $5 billion last year. Yet, notwithstanding the additional revenue, the 2018 budget ended the year with a deficit that could amount to as much as $1.2 billion, and the 2019 budget is up to $1.5 billion out of balance.

Furthermore, major credit rating agencies have agreed that neither budget since the tax hike has adequately addressed the largest drivers of the state’s poor credit rating: pensions and the bill backlog. Illinois’ credit rating remains the lowest in the nation.

Finally, despite having $5 billion in additional income tax revenues, the state took on more debt to pay some of its backlog of bills, kicking the can even further down the road on the $7 billion bill backlog that remains.

Moving in the right direction

June’s jobs growth should offer some hope to Illinoisans weary of anti-growth policies and the state’s seemingly endless fiscal problems.

The brighter job news comes on the heels of some encouraging signs from Springfield as well, such as the bipartisan support for a constitutional spending cap garnered this spring. Although the spending cap never made it to a vote, members of the Illinois House of Representatives and Senate have pledged to reintroduce the legislation next year. The spending cap would have tied the growth in state spending to the long-run average growth in the economy, avoiding the need for economically damaging future tax hikes.

And bipartisan opposition thwarted a harmful progressive tax constitutional amendment in the House.

Illinoisans should demand their lawmakers enact the pro-growth reforms that could help make good jobs numbers the norm moving forward, not an aberration.