Illinois is more dependent on food stamps than any other neighboring state

Illinois has a higher percentage of its residents on food stamps than its neighboring states, and has seen a much slower decline in food stamp recipients following the recession.

Too many Illinoisans for too long have had to resort to government assistance to put food on the table.

Illinois has a higher percentage of its citizens enrolled in the Supplemental Nutritional Assistance Program, or SNAP, than any other state in the region. In April, 13.6% of Illinois residents received SNAP benefits, commonly known as food stamps, that are worth an average of $130 per person per month. That’s a higher share than any neighboring states.

Out of the 10 most populous states in the nation, Illinois is narrowly No. 2 in percentage of residents receiving SNAP benefits. Illinois’ 13.63% of the population on food stamps is edged out by 13.64% in Pennsylvania.

From 2010 to 2018, Illinois individual SNAP enrollment increased by 2.3 percent. During that same time, enrollment in Michigan, Indiana and Wisconsin decreased by significant amounts.

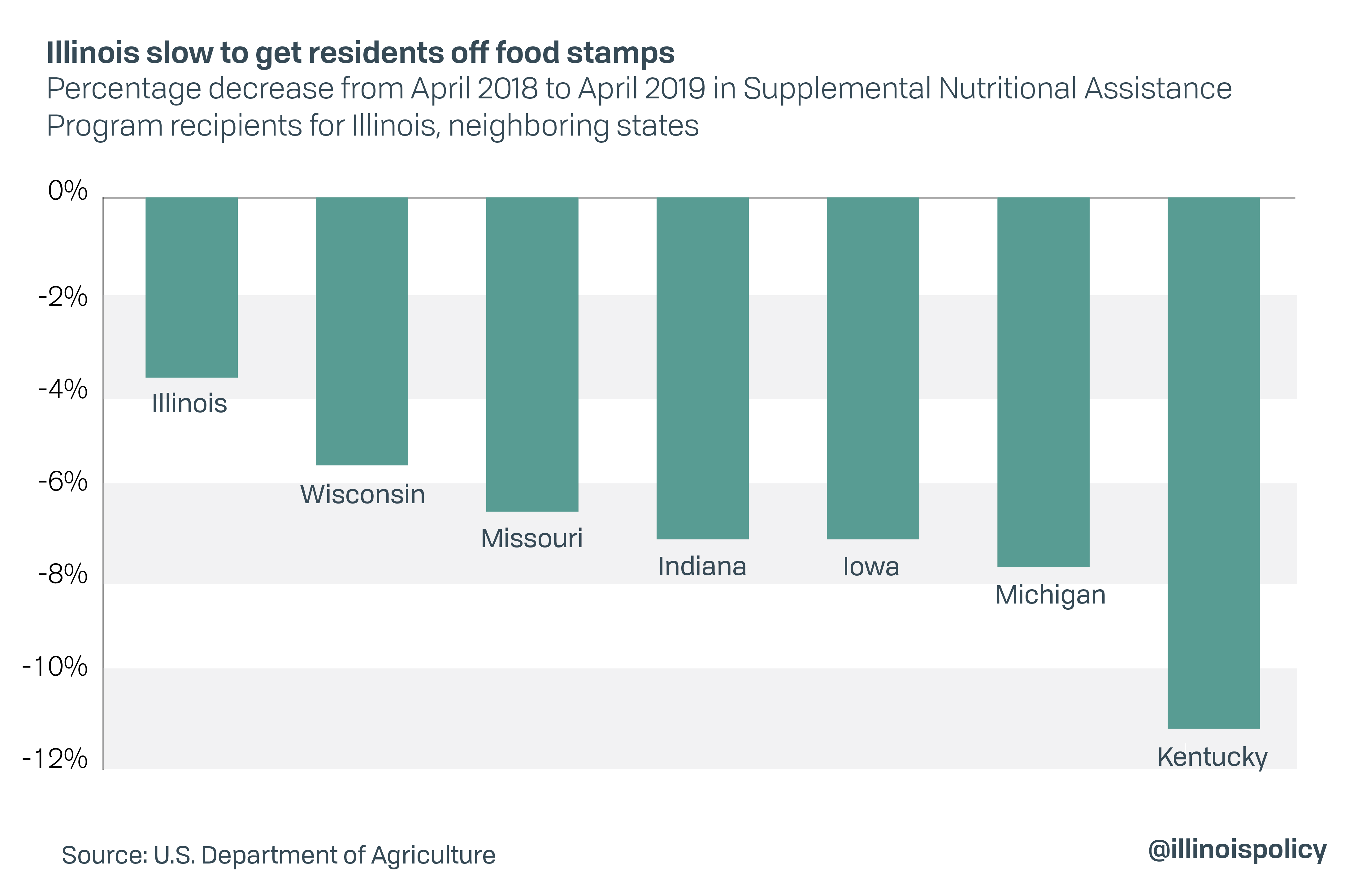

The number of citizens receiving food stamps has decreased for almost every state from a year ago, including Illinois. However, according to the same data, even this positive trend is weaker in Illinois compared to its neighbors.

From April 2018 to April 2019, Illinois saw 70,909 fewer people receiving SNAP benefits, or a 3.9% decrease. All neighboring states have seen much greater drops.

This small decrease also compares poorly to the rest of the U.S. Illinois ranked No. 9 in the nation for the percentage of residents getting off food stamps between April 2018 and April 2019, the most recent nationwide numbers.

Plus the trend may be reversing. Illinois SNAP enrollment was up in July compared to a year earlier, with 1,782,949 residents this July compared to 1,770,840 registered a year ago.

Under federal law, able-bodied adults between ages 18-49 and without children must work or take classes for 20 hours per week to receive food stamps. Individuals who do not work or go to school can only receive benefits three months out of every three years. Work requirements have been in place since 1996 and encourage able-bodied adults to get back in the work force and leave the public help for children and those who most need it.

Illinois, like most other states, was allowed to waive these requirements following the 2008 recession. However, in 2016 Illinois was still one of only eight states that continued to forgo work requirements.

Most Americans made their way back into the labor force during to the strongest jobs expansion in recorded history. However this wasn’t the case in Illinois. The high tax, high regulatory environment that punishes job creation combined with the continued waiving of work requirements have likely contributed to why labor force participation in Illinois lags that of many other states. Hoynes and Schanzenbach (2010) found that while many experts believed the food stamps program to have smaller disincentive effects on labor supply than other welfare programs, the policy resulted in modest reductions in employment and hours worked, perhaps because of the lack of substantial work requirements.

Illinois was approved for a partial work requirement waiver for 2019, meaning the policy would apply only in areas of the state with high unemployment. While the federal government also approved Michigan and Kentucky for limited waivers, Wisconsin, Indiana, Iowa and Missouri did not offer waivers.

Additionally, Illinois’ slow decline in SNAP recipients may be partially caused by the state overissuing food stamps. In 2018, the United States Department of Agriculture warned Illinois was issuing food stamps to individuals who did not qualify. This offense can carry hefty fines, with New Mexico fined $164 million for similar problems but over a longer time.

Illinois’ poor performance on SNAP benefits reflects the broader economic struggle Illinoisans have faced during the recovery from the Great Recession. Tax hikes have dragged down the economy, making opportunities scarce for many of the state’s residents.

Reforms such as property tax relief and real pension reform would help turn around the state’s struggling economy. These measures would put dollars back in Illinoisans’ pockets, improving business investment and reducing families’ dependence on public assistance.