Illinois is losing its core income tax base

High-income earners provide the majority of Illinois’ income tax revenue, and IRS data show that Illinois is losing these taxpayers to out-migration.

Illinois’ income tax revenue comes primarily from the state’s highest earners. But these top-earning Illinoisans are fleeing the cash-strapped state, which puts the future income-tax revenue stream in jeopardy.

People earning $100,000 or more per year provide more than 60 percent of Illinois’ income tax revenue, for a total of $11 billion out of the state’s roughly $17 billion in total income tax revenue.

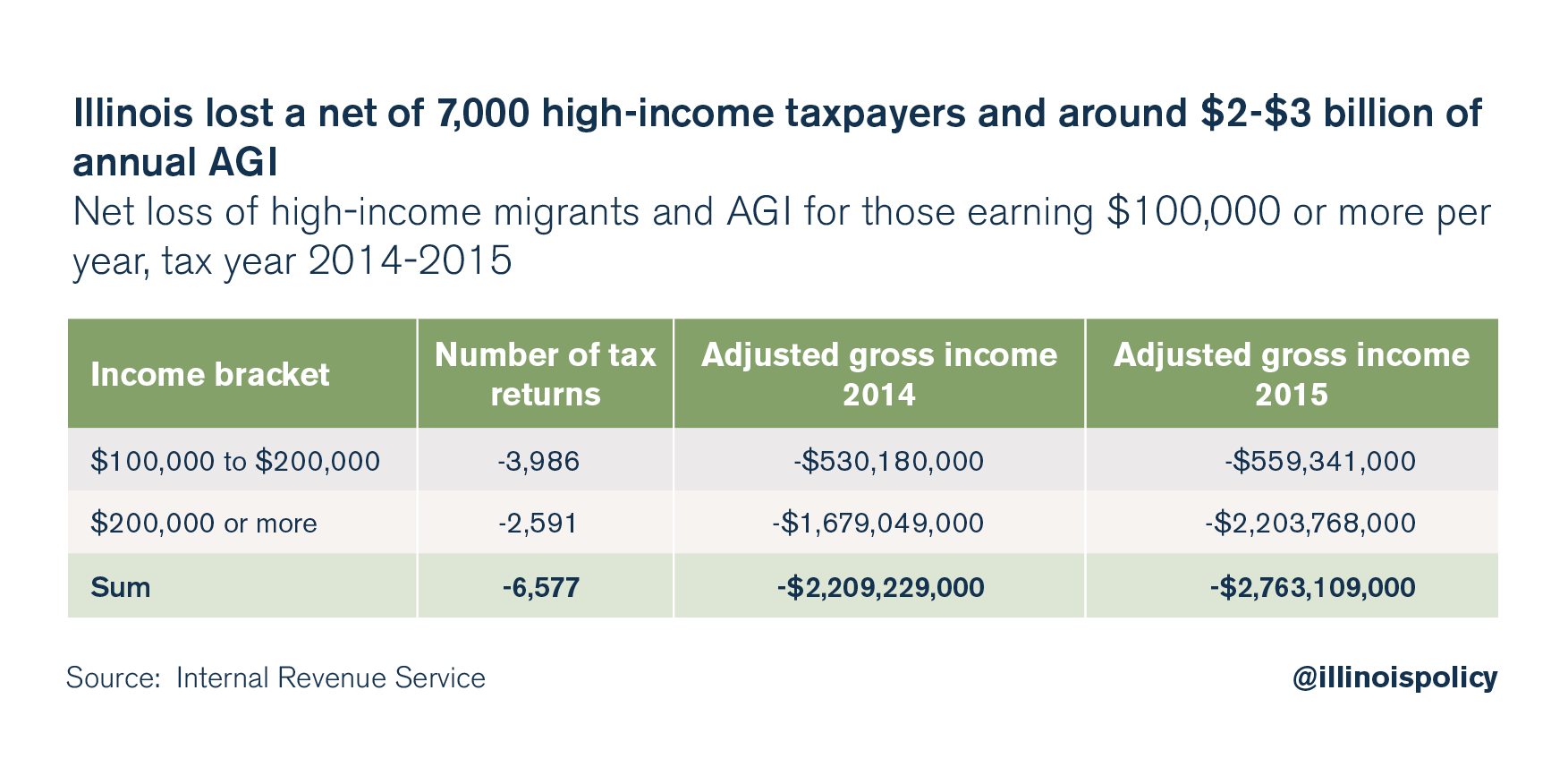

But IRS data show Illinois lost 7,000 high-income earners, on net, in tax year 2014-2015, with a net loss of between $2 and $3 billion of annual adjusted gross income, or AGI.

Who pays income taxes in Illinois?

Illinois Department of Revenue, or IDOR, data break down income tax returns and revenue by AGI. This allows for analysis of who pays income taxes, and how much they pay.

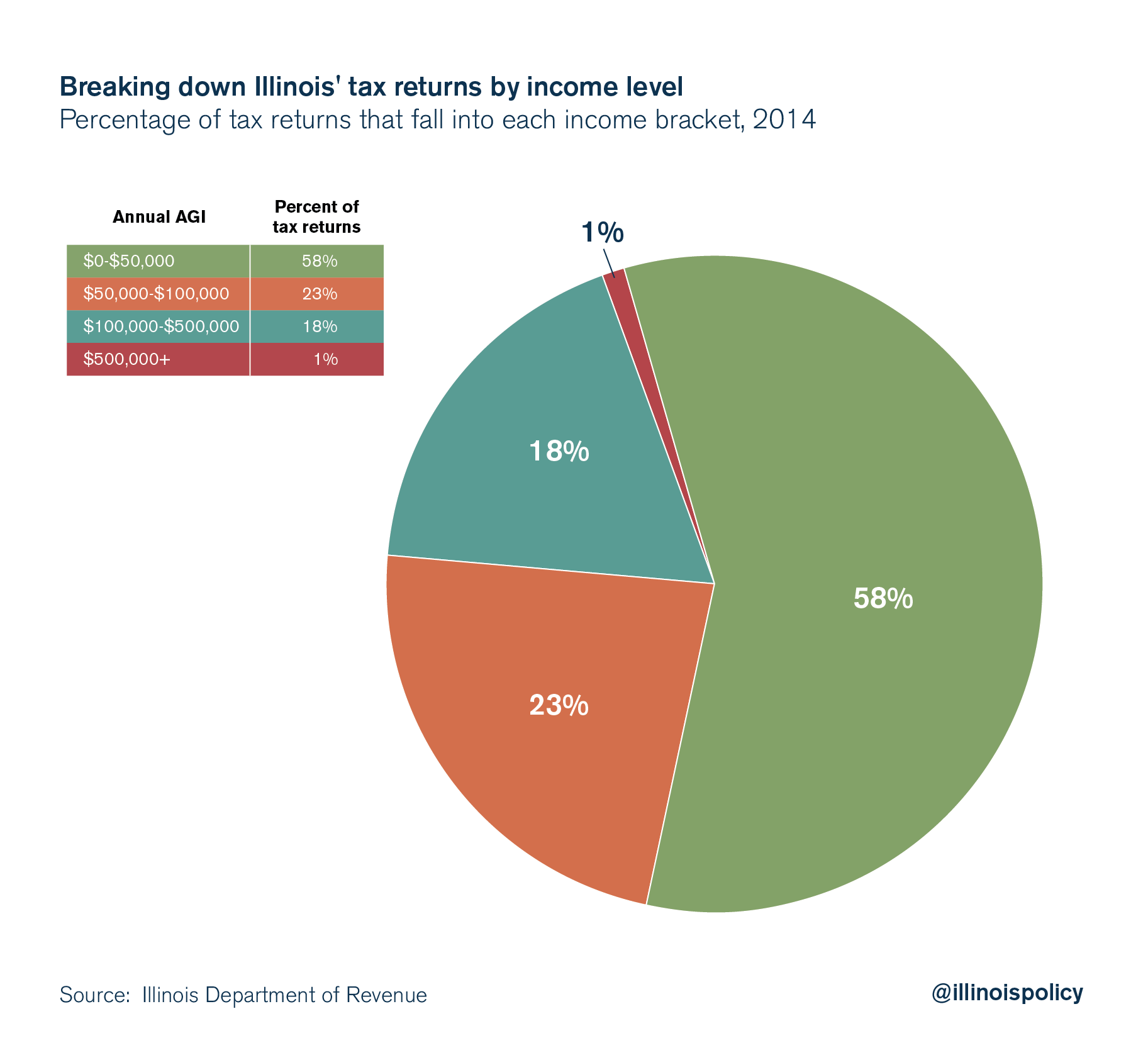

About 6 million tax returns were filed in 2014, with the majority filed by those earning less than $50,000 per year, according to the most recent data. The following is a breakdown of Illinois’ income tax returns by taxpayer AGI:

- Those with annual AGI of $50,000 per year or less make up 58 percent of all tax returns (3.3 million).

- Those with annual AGI of $50,000-$100,000 per year make up 23 percent of all tax returns (1.3 million).

- Those with annual AGI of $100,000-$500,000 per year make up 18 percent of all tax returns (1 million).

- Those with annual AGI of $500,000 or more per year make up 1 percent of all tax returns (55,000).

How much does each group pay?

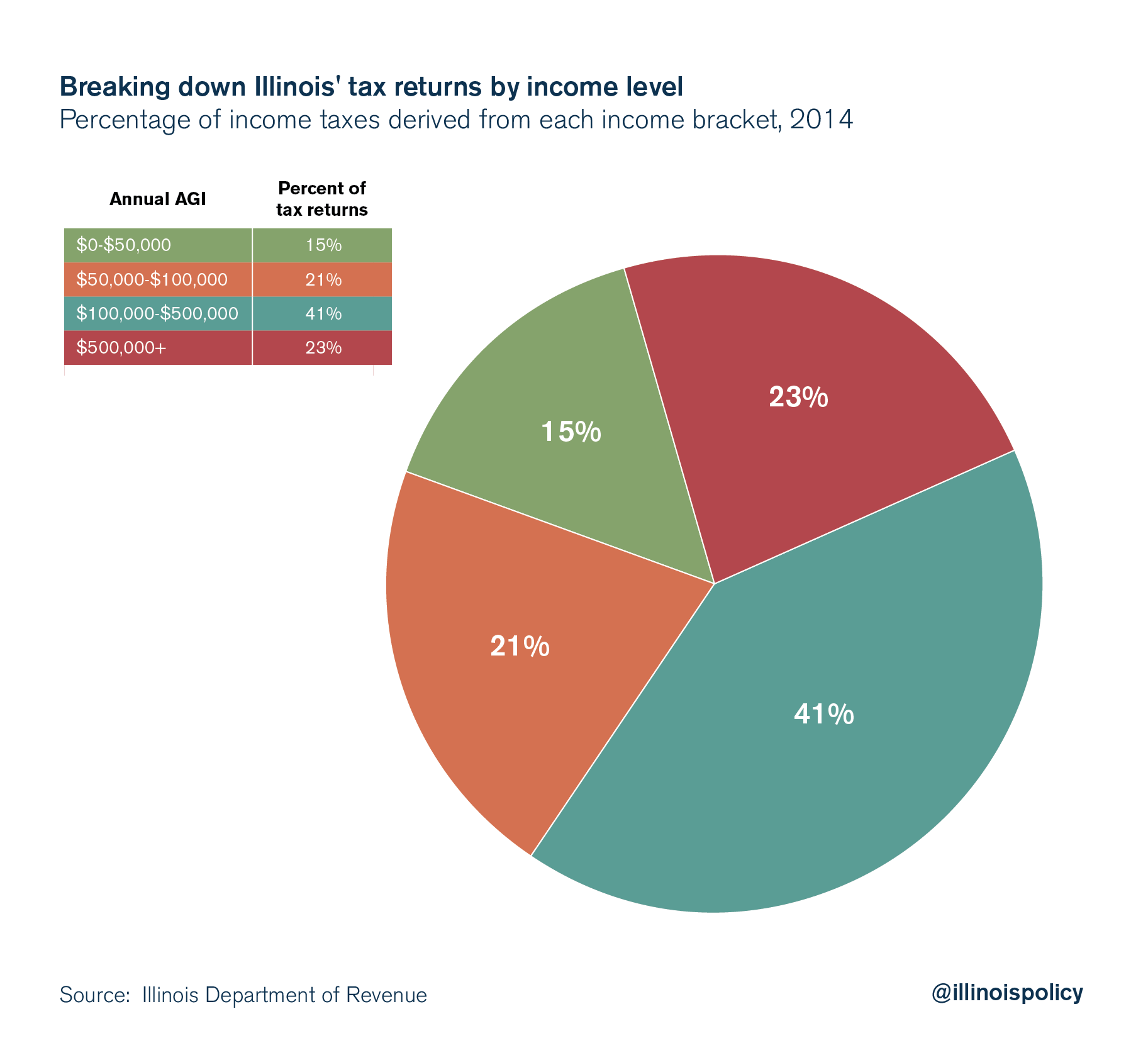

While those earning less than $50,000 per year made up the biggest portion of Illinois taxpayers, they also paid the smallest percentage of state income taxes. The following is a breakdown of the percentage of the state’s total income tax revenue paid by each income bracket:

- Those with annual AGI of $50,000 per year or less pay 15 percent of all income taxes ($2.5 billion).

- Those with annual AGI of $50,000-$100,000 per year pay 21 percent of all income taxes ($3.6 billion).

- Those with annual AGI of $100,000-$500,000 per year pay 41 percent of all income taxes ($6.9 billion).

- Those with annual AGI of $500,000 or more per year pay 23 percent of all income taxes ($4 billion).

The data show that the top 19 percent of Illinois taxpayers paid 64 percent of the state’s total income taxes in 2014.

Those in the top AGI bracket, or those earning $500,000 or more per year, made up 1 percent of the state’s income tax returns, but paid 23 percent of the state’s income taxes in 2014. Those in the second-highest income bracket, or those earning $100,000-$500,000 per year, made up 18 percent of Illinois’ total tax returns, but paid the greatest portion of the state’s income taxes, at 41 percent.

High-income earners fleeing Illinois

The state’s high-income earners, however, are among the masses of Illinoisans leaving the state, which could portend declining income tax revenue in the years to come.

Yearly IRS migration data reveal where people are moving based on their tax filings. Income brackets in the migration data allow for analysis of where the AGI and income-earning power are going.

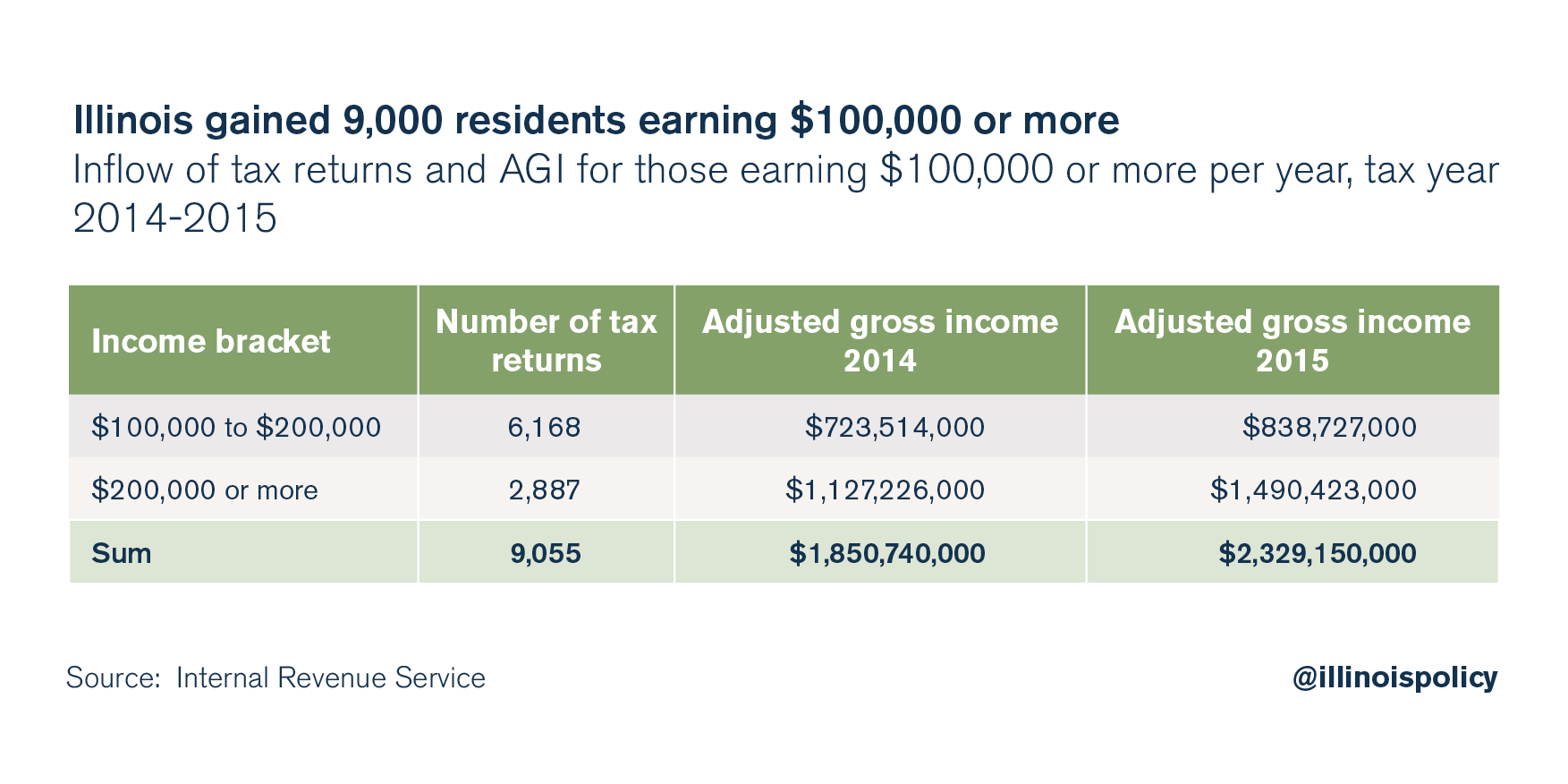

Illinois gained roughly 9,000 taxpayers earning $100,000 or more in tax year 2014-2015, based on the most recent IRS data. Those high earners brought in a combined $1.9 billion of AGI in 2014 and $2.3 billion in 2015.

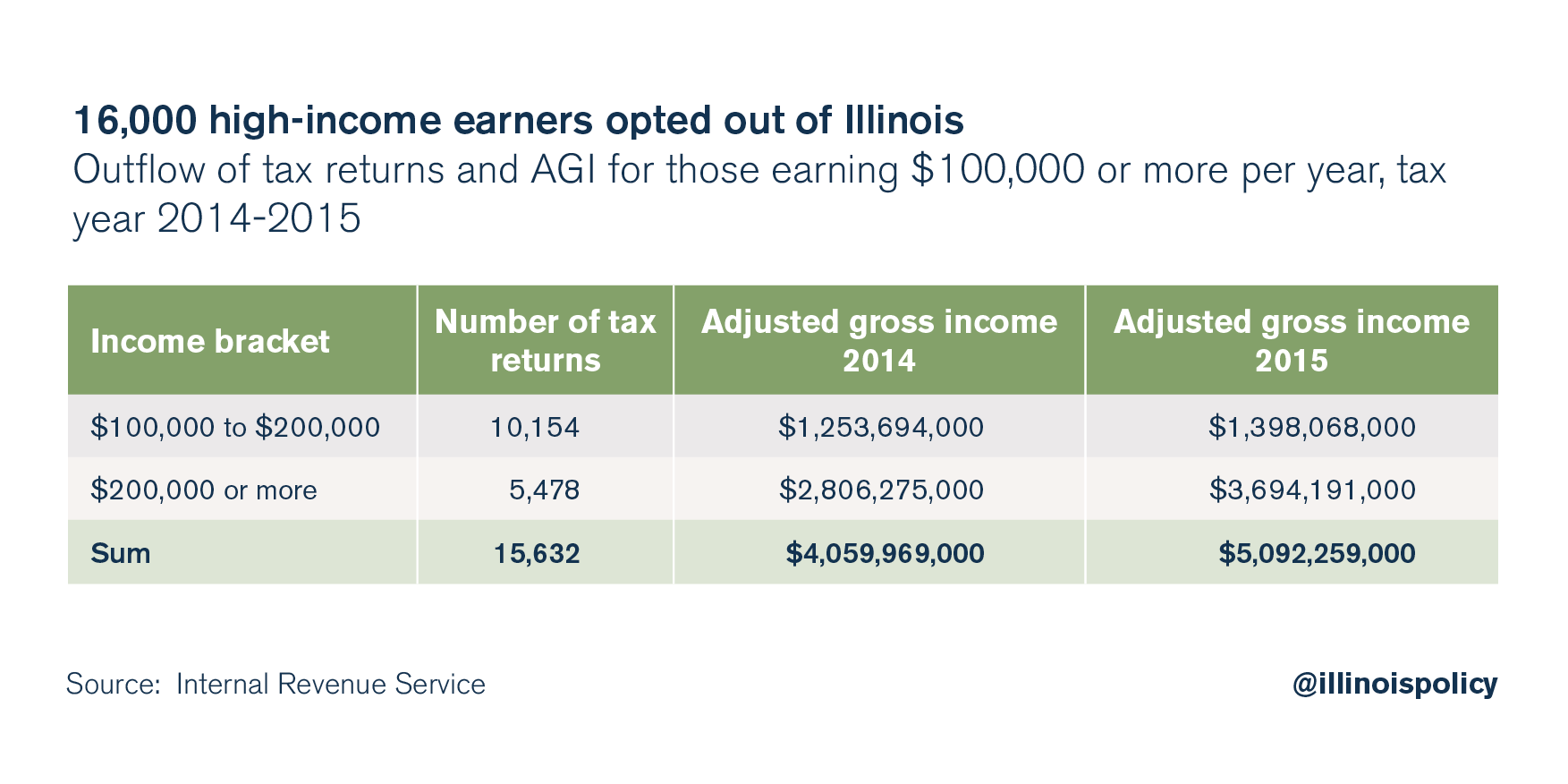

Unfortunately, Illinois’ gain was more than offset by the out-migration of 16,000 high-income earners who left Illinois over that same period, taking their combined $4.1 billion of AGI in 2014 and $5.1 billion in 2015 with them.

Illinois lost 7,000 high-income earners, on net, in tax year 2014-2015, resulting in a net loss of between $2 and $3 billion of annual AGI.

Illinois lost 7,000 high-income earners, on net, in tax year 2014-2015, resulting in a net loss of between $2 and $3 billion of annual AGI.

If Illinois had simply retained those 7,000 high-income earners in tax year 2014 ̶ 2015, the state would have raked in around $100 million in additional income tax revenue at the 3.75 percent income tax rate. And that’s just one year. That income is lost permanently, so the loss of tax revenue grows every year.

To be sure, taxes alone don’t fully explain Illinois’ out-migration. But layers upon layers of tax hikes add up. Eventually, the swelling tax burden has to reach a tipping point at which residents conclude it’s no longer financially logical to stay in Illinois.

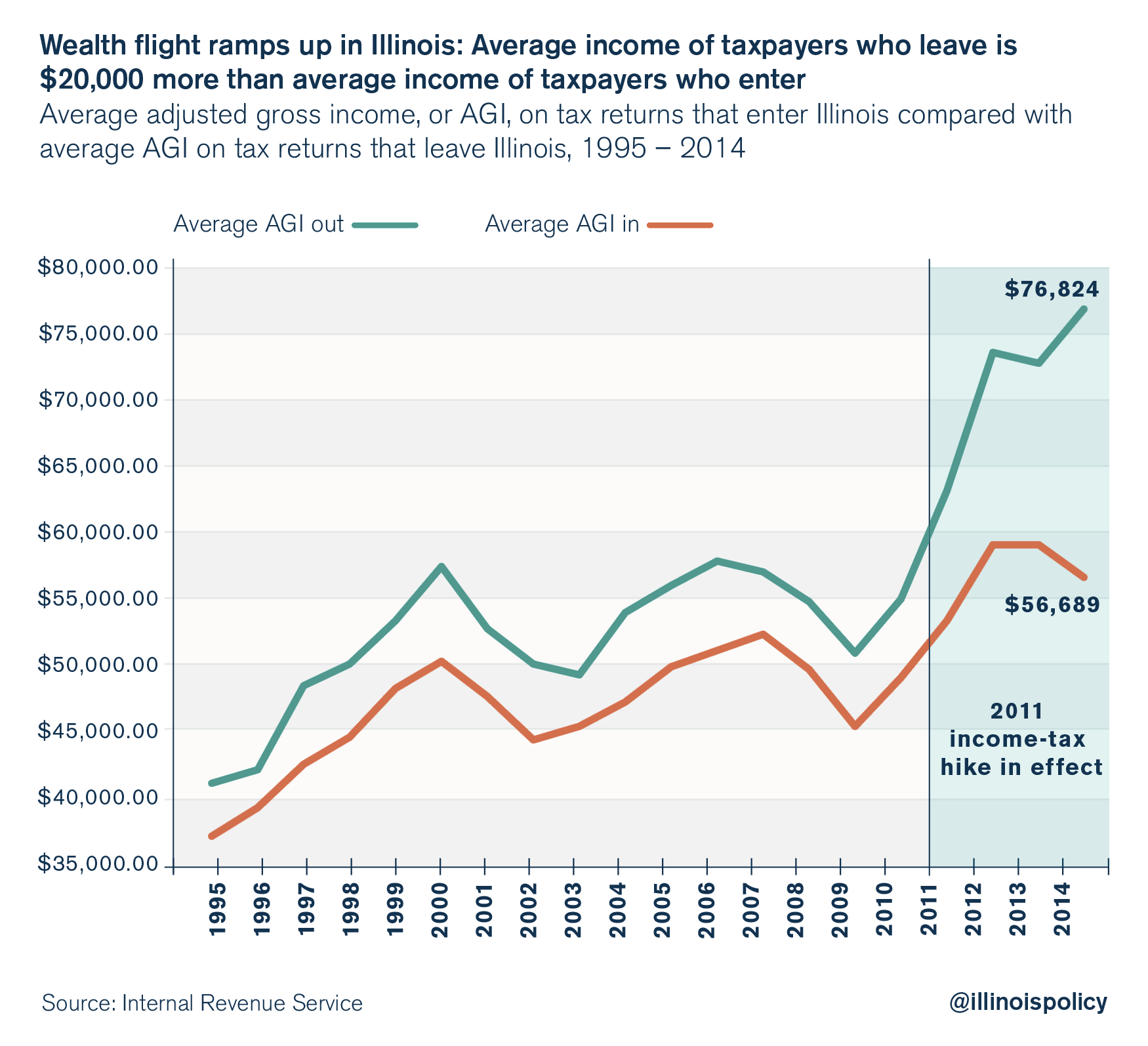

Illinois’ exodus has likely been aggravated by tax hikes. Following the 2011 income tax increases, the state’s out-migration problem only worsened. The rate of high-income Illinoisans leaving accelerated, and their departure wasn’t offset by high-income earners moving in from other states. In fact, the wage differential between Illinois’ in-migrants and out-migrants had skyrocketed by 2014, with those leaving Illinois earning, on average, $20,000 more annually than those moving in.

Illinois’ shrinking tax base will have long-term implications for state revenue, and as a result, for state services and spending. Considering Illinois’ dire economic standing, the state needs to keep as many residents as possible – especially those who pay the bulk of the income taxes.

Instead of perpetually reverting to damaging tax hikes, policymakers should adjust their focus to retaining Illinoisans: Simply hanging on to residents, especially those with higher incomes, can be a lucrative revenue strategy. Reducing the overall tax burden would help quell the state’s rampant out-migration to ultimately preserve the tax base and ensure future tax revenue.