Illinois’ income growth second-worst in the nation

Amid two record-breaking income tax hikes, growing property tax bills and population decline, the Land of Lincoln’s income growth is trailing the rest of the nation.

The end of 2007 brought economic distress nationwide with the painful arrival of the Great Recession. And more than a decade later, a recent study has found, personal income growth in Illinois continues to trail nearly every other state in the nation.

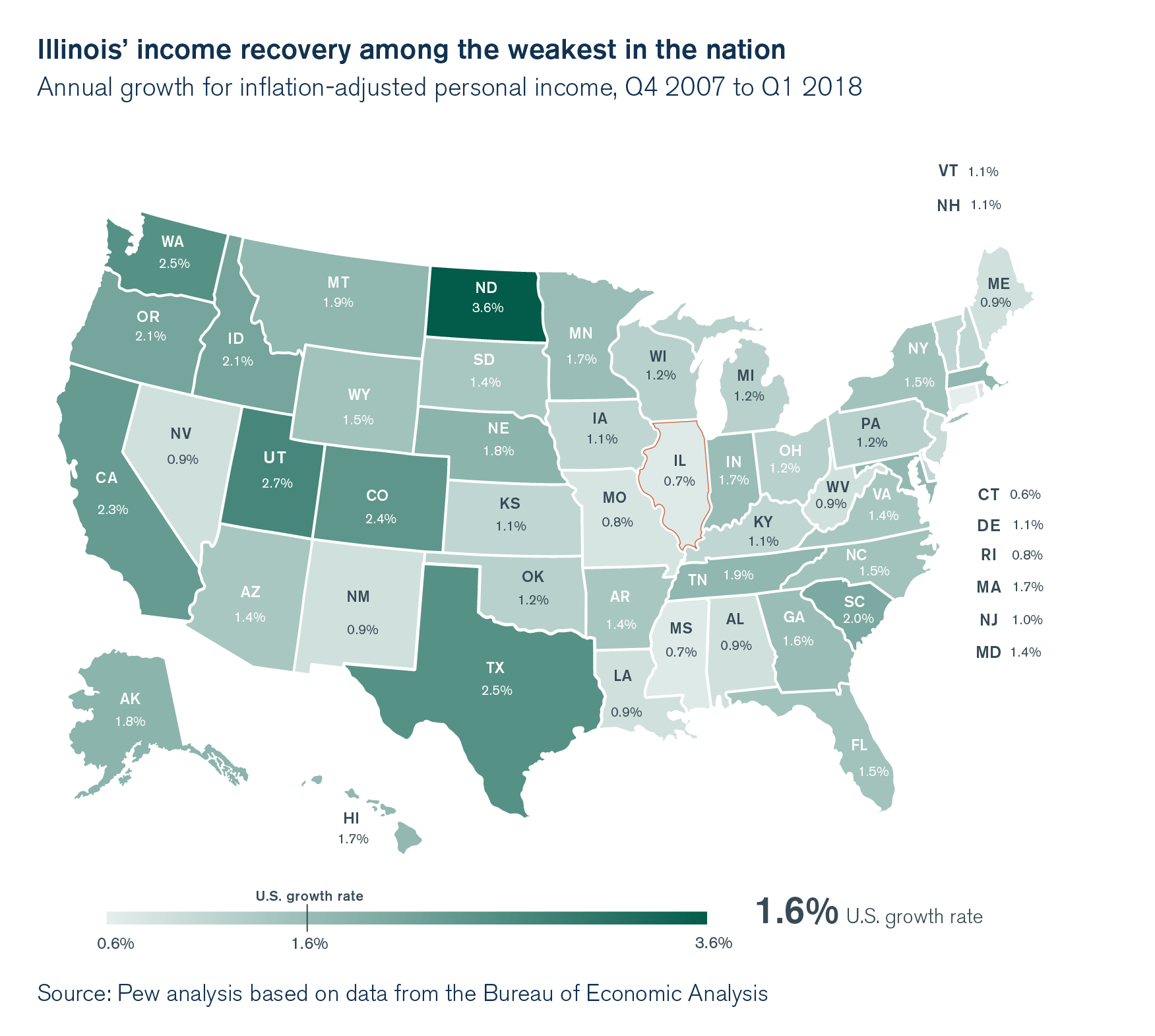

The study, released Sept. 10 by Pew Charitable Trusts, shows Illinois’ average annual income growth since late 2007 has been a meager 0.7 percent after adjusting for inflation – tied for second-slowest in the nation alongside Mississippi.

To put Illinois’ laggard income growth in perspective, the study recorded an average personal income growth rate of 1.6 percent for the nation as a whole – almost double Illinois’ personal income growth rate. Connecticut, with a 0.6 percent personal income growth rate over that period, is the only state that performed worse.

Illinoisans should wonder why their personal wealth has fallen behind that of their national peers. The answer can be attributed to a series of major policy failures at the state level.

Even compared with the nation’s tepid post-recession recovery, Illinois’ uphill economic climb had begun near the back of the pack. The state’s worst-in-the-nation pension debt coupled with its failure to control wasteful spending had fostered uncertainty, leading many to fear tax increases were on the horizon.

Those fears were vindicated when a pair of record income tax hikes – one in 2011 and another in 2017 – punished the state’s economy. An Illinois Policy Institute study found the 2011 income tax hike severely hampered job creation and wage growth in Illinois, ultimately costing the state economy $55.8 billion in real GDP. The subsequent income tax hike is expected to inflict similar harm.

Credit rating agencies have also taken note of Illinois’ policy failures. An Aug. 27 report by Moody’s Investors Service revealed that the state’s staggering 601 percent pension debt-to-revenue ratio is the highest on record for any U.S. state. Illinois’ credit rating remains the lowest in the nation.

Illinoisans must pressure their lawmakers to enact the reforms needed to reverse the state’s fiscal trajectory. When Springfield reconvenes next session, serious reforms such as a smart cap on state spending and changes to the Illinois Constitution’s pension clause need to be on the table.