Illinois home to higher ‘sin taxes’ than every neighboring state

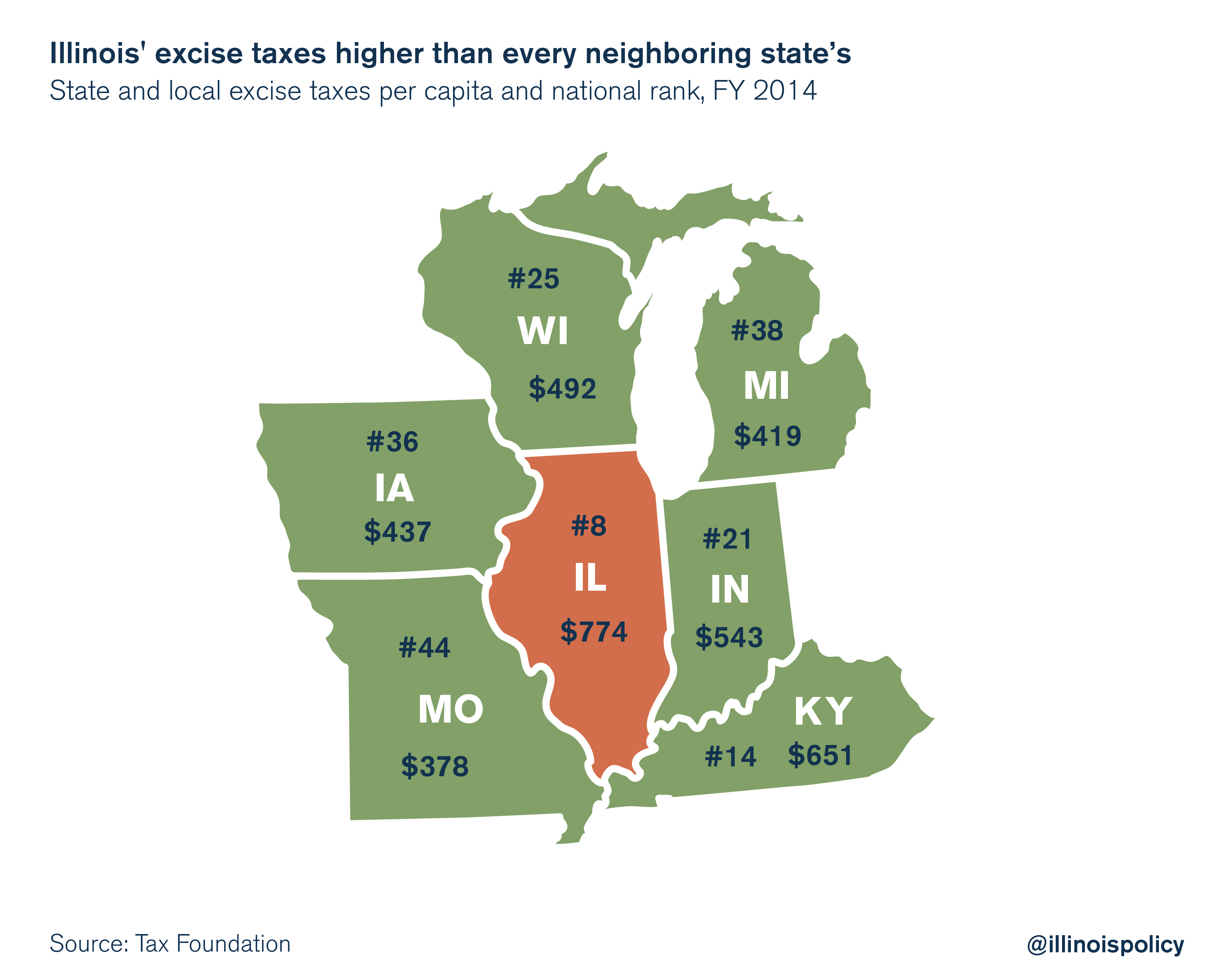

Illinois ranks eighth in the nation for state and local excise and selective sales tax collections.

A new study from the Tax Foundation puts Illinois in the top 10 for the nation’s costliest excise tax burdens. The report ranks Illinois eighth in the nation for state and local excise and selective sales tax collections, as the state raked in $774 per capita in fiscal year 2014.

That’s higher than every one of Illinois’ border states by at least $100.

Unlike broad taxes such as those levied on general sales or income, excise taxes are used to collect revenue from sales of a specific good or type of service. Well-known excise taxes in Illinois include those on gas, beer and cigarettes. The Tax Foundation explains that such taxes can be unreliable and regressive, and that broad-based, stable taxes are superior for generating reliable revenue for important policy priorities.

Vermont is ranked No. 1 by the Tax Foundation, because as of fiscal year 2014, the Green Mountain State charged the most per capita in state and local excise and selective sales taxes.

Certain excise taxes, dubbed “sin taxes” – such as those on tobacco and alcohol – are justified as helping deter consumption of those products. Although there is evidence to show some such taxes do drive down the use of certain products, taxation can also encourage residents to cross county or state borders to buy the same product more cheaply. Excise taxes are notoriously unreliable revenue streams for local and state government.

Take Illinois’ cigarette tax, for example. Lawmakers doubled the state tax on cigarettes and raised taxes on other tobacco products in 2012, claiming that the tax hikes would raise an additional $350 million in revenue. Yet, the numbers tell a different story. In fiscal year 2013, the first year of the cigarette and tobacco tax hikes, total revenue from cigarette and other tobacco taxes totaled more than $856 million, up from $609 million raised in fiscal year 2012. This increase was far less than the extra $350 million the state said the new tax hikes would bring in, resulting in a shortfall of more than $100 million. Combined revenue from the tax hikes reached nearly $862 million in fiscal year 2015, but by fiscal year 2016, combined revenue fell to less than $845 million, still about $115 million short of the state’s original $350 million estimate.

This drop was driven by the sharp decline in cigarette tax revenue, which fell to about $807 million in fiscal year 2016 from around $825 million in fiscal year 2015.

While the cigarette tax hike might have played some role in lowering the state smoking rate, it ultimately failed to meet revenue projections, to the detriment of the programs it was meant to fund.

It is important to note that the Tax Foundation’s excise tax data and estimates are based on tax information from fiscal year 2014, which is before certain Illinois local governments raised new, product-specific excise taxes, such as Cook County’s controversial and wildly unpopular penny-per-ounce sweetened beverage tax.

And the Tax Foundation’s study of so-called “soda taxes” reveals they can have unintended consequences. The Tax Foundation found that Philadelphia’s sweetened beverage tax made soda and even certain sports drinks more expensive than beer, in effect making beer a more affordable choice for consumers. Currently, Cook County’s penny-per-ounce tax on sweetened beverages is more expensive than Illinois’ beer tax.

Despite the state’s high excise tax burden, some Illinois lawmakers are talking of raising it again, this time on gas. Lawmakers are proposing a new capital plan for state infrastructure projects, the first of its kind since 2009. However, in order to fund the measure, some are calling for an increase in the state’s gas tax.

While details remain sketchy, some have thrown out estimates. State Sen. Dave Syverson, R-Rockford, has stated the gas tax could be hiked by 5 cents per gallon. The Metropolitan Planning Council in 2016 called for a $43 billion capital plan, funded by increases of as much as 30 cents per gallon combined with a 50 percent price increase for vehicle registration fees.

Illinois’ fuel taxes are already multilayered and more expensive than most of its neighbors’. And unlike most states, Illinois charges sales tax on gasoline in addition to fuel excise taxes, making it even costlier for Illinois motorists.

Illinoisans have already had to swallow the massive income tax increase that passed in summer 2017. The last thing they need is yet another tax hike that will fall hardest on middle- and lower-income residents.

Sign the petition

Repeal the Cook County pop tax

Sign the petition today to tell your Cook County commissioner to repeal the sweetened beverage tax.

Learn More >