Illinois has 43% of the country’s public pension plans

Illinois has 43 percent of the nation’s public pension plans, according to a 2012 study published by the Commission on Government Forecasting and Accountability, or COGFA, conducted by Marquette Associates on local police and fire pensions in Illinois. According to publicly available data, there are 1,511 public pension plans in the United States. With 657...

Illinois has 43 percent of the nation’s public pension plans, according to a 2012 study published by the Commission on Government Forecasting and Accountability, or COGFA, conducted by Marquette Associates on local police and fire pensions in Illinois.

According to publicly available data, there are 1,511 public pension plans in the United States. With 657 public pension plans, Illinois has the largest number of public pension funds in the country. The next largest is Pennsylvania with 137. These figures are a reflection of the local level structure in Illinois. There are 14 states that have adopted segregated statewide police and fire plans, combined statewide police and fire plans, or defined contribution/rollup plans.

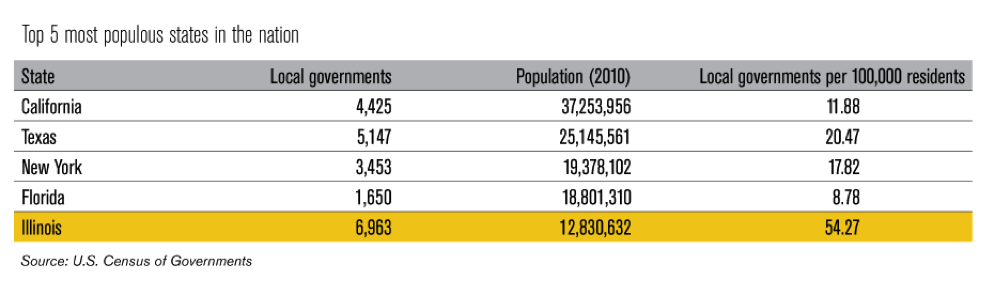

This latest pension revelation isn’t surprising, given that Illinois has 1,800 more units of local government than the next closest state of Texas, with half the population.

Many of those local taxing bodies have their own individual pension plans, primarily police and fire department pension plans. The COGFA study noted: “in 2009, there were 638 separate downstate pension funds, consisting of 288 firefighter pension funds and 350 police pension funds.”

The report also noted: “This report generally concludes that smaller police and fire pension funds (those with assets under $10 million) would benefit the most from a consolidation.”

According to Illinois Department of Insurance, there were 187 fire pension funds and 197 police pension funds in Illinois with less than $10 million in assets as of 2009.

In the recent report “Too much government: Illinois’ thousands of local governments,” we pointed out how Illinois’ record levels of local government created a problem for federal authorities fighting public corruption.

The sheer number of local governments in Illinois makes it harder for state and federal authorities to provide meaningful oversight of local governments. A study by the University of Illinois-Chicago that examined local government corruption in Illinois stated, “Since there are more than 1,200 separate units of government in the Chicago metropolitan region, there are too many jurisdictions and officials for the U.S. Attorney adequately to police.”

In addition to making it harder for authorities to police public corruption, too many layers of taxing authorities makes it harder for citizens and watchdog groups to play an active role in participating in the democratic process.

The vast number of Illinois’ local government pension plans hinders oversight and creates additional opportunities for fraud, mismanagement and abuse of public employee pensions and taxpayer resources.